The Earned Income Tax Credit, or EITC, can be modified to specifically help lesbian, gay, bisexual, and transgender, or LGBT, people, a disproportionate number of whom are living in poverty. The EITC is one of the nation’s most effective tools for reducing poverty. In 2013, the EITC lifted 6.5 million people out of poverty by providing an average credit of around $2,400. This fact sheet explains the EITC and discusses how proposed modifications to improve its effectiveness can help the LGBT community.

What is the Earned Income Tax Credit?

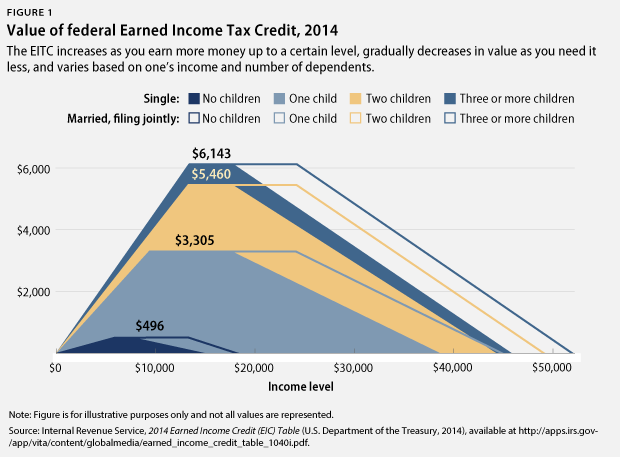

- The EITC is a tax credit that benefits workers with low to moderate incomes.

- The income limit varies by filing status and number of qualifying children.

- It is a credit, not a deduction, meaning that if a person is eligible, the EITC will reduce the amount of federal income tax they would otherwise owe on a dollar for dollar basis.

- The EITC is refundable, meaning that those who qualify will receive the full value of the credit even if they do not owe any federal income tax.

EITC eligibility and benefits

- Same-sex couples who are legally married can file jointly and claim EITC benefits. However, unmarried couples who are domestic partners, in a civil union, or in other formal legal relationships may not file as married couples.

- In some cases, workers who were eligible for the EITC during the past two to three tax years but failed to file for it can still claim benefits.

Improvements to the EITC that can reduce poverty rates among LGBT communities

Did you know?

- Around 80 percent of EITC recipients use the tax credit to pay bills and reduce debt.

- Children in families that receive additional income from refundable tax credits such as the EITC are more likely to attend college.

- 61 percent of recipients only receive the EITC for one or two years in order to overcome income disruptions such as unexpectedly losing a job.

- Congress should pass bipartisan proposals that would lift the current restriction that make young adults under the age 25 ineligible for the EITC unless they have children. More than 20 percent of same-sex couples under the age of 25 are living in poverty.

- Congress should pass a bipartisan proposal to increase the modest value of the EITC for workers who do not have qualifying children. Eighty percent of same-sex couples are not raising children, but the current EITC does very little to benefit childless workers.

Find out if you are eligible

The IRS has an online tool that allows you to determine if you are eligible for the EITC and estimate the amount of your credit.

If you need help filing for the EITC, the Volunteer Income Tax Assistance program and other community-based programs offer free tax return preparation for most low- and moderate-income people. The IRS has a tool to find a site near you.

- Congress should make the funding provided in the American Recovery and Reinvestment Act of 2009 for the EITC and Child Tax Credit, or CTC, permanent. In 2017, provisions that increase the value of both the CTC and the EITC for certain married couples and families with three or more children will expire. These improvements are important for same-sex couples who are raising children, a greater number of whom are living in poverty compared to both same- and different-sex couples without children.

- Congress should enhance the EITC’s effectiveness as a tool for promoting economic mobility, including allowing workers to access a portion of their EITC ahead of tax time.