Executive summary

The share of corporations earning profits above competitive levels has risen since the late 1970s. Large firms in many sectors—especially in communication services, health care, and information technology (IT)—now have market power that allows them to maintain prices above competitive levels.

This has important implications for the U.S. economy, which is largely governed through market competition. When firms are earning economic rents—returns to capital beyond what a competitive market would normally allow—income is redistributed upward to owners. The economic rents that flow to these owners function like a tax on everyone else, lowering real wages and shifting overall income shares away from workers.

Moreover, because firms earn rent when entry by competitors is inhibited, the economy becomes less dynamically efficient. When there are no entry barriers, high rates of profit attract new firms, increasing supply and eventually reducing price. When barriers exist, investment capital does not flow to its most profitable use, and potential gains in productivity can be squandered.

This report identifies several factors, apart from the development of technical superiority, that are creating entry barriers. These include the ability of firms to merge and increase market concentration; the increased importance of intellectual property rights; the development of businesses where network externalities are significant; and differential access to big sets of data on consumers.

This report also recommends a range of policy changes that can reduce these barriers to entry and support increased competition among firms. These policies include changes to antitrust policy and enforcement; changes to the rules thcat govern intellectual property; and measures to increase access to important types of data.

Recognizing that the implementation of some or all of these policies may provide incomplete solutions to competition problems, the authors also explain how a monopoly tax, levied on companies that earn profits in uncompetitive markets, could reduce the incentive to create market power and limit the revenues that can be used to sustain existing entry barriers.

Although there are many sources of competitive distortions, and any action taken to address them will require careful consideration, there is little doubt that changes to competition policy are in order and can substantially improve the operation of the U.S. economy.

Overview

- Entry barriers are raising many U.S. corporations’ profits.

Market economies rely on the entry of new firms to ensure competitive results. When profits in an industry are relatively high and markets are functioning effectively, new firms have an incentive to enter in order to capture some of those profits. This, in turn, increases supply, lowers prices, and reduces the rate of return.

Under competitive conditions, in which investment flows to the economic activity with the highest rate of return, the expectation is that rates of profit on invested capital will converge across firms and industries to a common, equilibrium value.

When there are barriers to entry—that is, when something prevents new firms from increasing supply in an industry where profits are high—this process is frustrated. Incumbent firms protected by entry barriers benefit from higher-than-normal profits, but these gains come at the expense of their customers. In addition, incumbent firms have a reduced incentive to innovate and have a strong incentive to defend their market power. Thus, some of the long-term benefits of competitive markets are lost.

There is now strong evidence that barriers to entry have a significant effect on many sectors of the U.S. economy. Measures to evaluate firm-level economic performance indicate that many firms have market power and are earning profits above competitive levels. For a significant number of firms, the ratio of a firm’s market value to the replacement cost of its capital has risen to well above 1. This indicates that firms are able to extract economic rent, meaning that they are able to net incomes exceed competitive levels. (see text box on Tobin’s Q below) The share of large firms earning rents has risen since the late 1970s, along with the share of rents in total corporate profits. This could not happen without the existence of powerful entry barriers.

- Several factors have created entry barriers.

Although some of the barriers to entry are the result of production techniques or organizational structures that cannot be replicated across firms, there are other important causes. Among them is ineffective antitrust enforcement, which has allowed concentration to rise through mergers and acquisitions. Evidence shows that increases in concentration are often accompanied by increased prices. Moreover, incumbent firms with market power have been allowed to use acquisitions to fend off potential competition.

Rules protecting intellectual property also create obvious entry barriers and play an important role in sectors such as communication services, pharmaceuticals, and IT.

Network externalities, which are increasingly important in software and IT-based business, also create barriers. They exist when the benefits that an individual derives from a good increase when others decide to use it, creating additional incentive for others to buy the good. Telephones, word processors, and social media platforms produce these externalities, as increased usage results in a positive feedback loop. When network effects are significant, individual users will be reluctant to switch to a competitor, even if it is superior. This creates a lock-in effect and a barrier to entry for new firms.

Differential access to big data on consumer behavior also appears to play an important role in reducing entry and competition. Data are crucial and valuable inputs to many digital businesses, many of which are constantly updating information based on the behaviors and interests of their users. Because these data are generated in part by the free or subsidized services that these firms provide to users, potential entrants are at a significant disadvantage. These entrants are less likely to become competitors if they lack crucial inputs for machine learning and the development of artificial intelligence (AI), which have become increasingly important to digital business.

- Changes in policy can reduce barriers to entry.

Changes to antitrust policy and enforcement

Rising market power is in part attributable to a decline in effective antitrust enforcement. Beginning in the 1980s, when the indicators of increased market power first emerged, antitrust regulators permitted many mergers, which has led to increased market concentration and price increases.

Antitrust agencies also appear to have missed the effects of allowing top firms to acquire potential competitors that could erode their dominance. Many of these dominant firms already benefit from entry barriers.

This report proposes a prohibition on mergers and acquisitions by firms already protected by entry barriers, as well as limits on operations by these firms in adjacent markets.

Changes to intellectual property protection

Because public investment in basic research is often the basis for patent-protected intellectual property, this report identifies a variety of potential measures to reduce the barriers created by patent rules. These include granting government entities the so-called golden shares, or decisive voting power, for products made possible by public investment; requiring licensing of patents with a public component; and introducing prizes to support innovation not accompanied by patent protection.

Open data standards where data are competitively significant

Building on a Consumer Financial Protection Bureau (CFPB) guideline that suggested banks share financial information with other institutions when their customers requested that they do so, the authors of this report propose similar rules: open data standards and data portability to allow users of digital platforms to switch easily when they wish. Additionally, the government should facilitate open data clearinghouses—analogous to weather data, which government sources provide to the public—to house publicly collected data that could be used in data-intensive areas such as AI. The report also advocates for a requirement that users be allowed to communicate across social media platforms, in much the same way that telephone subscribers can reach parties who are served by different telephone companies.

- When barriers remain, a monopoly tax can help level the competitive playing field.

Because it may not be possible to reduce barriers for all firms and across all industries—and because changes in fundamental policies, such as antitrust and intellectual property rules, may be difficult and time-consuming to implement—the report also proposes a monopoly tax to reduce the flow of rents to large firms.

Instituting a monopoly tax would have three effects. While such a tax would not directly aid new firm entry, it would reduce the flow of economic rents, making these revenues available for public purposes without harming efficiency. It would also discourage further efforts to enhance market power through actions such as mergers and acquisitions. Moreover, a monopoly tax would diminish the ability of firms with market power to use their outsize returns to influence political and regulatory outcomes.

Evidence of significant barriers to entry and rising corporate rents

There is now significant evidence that the competitive environment in the U.S. economy has changed dramatically since the late 1970s, with a significant share of corporations earning returns that exceed competitive levels.

Under competitive conditions—in which capital owners with funds to invest maximize their profits, and there are no barriers that prevent these funds from flowing to the projects with the highest rates of return—it is expected that rates of profit on invested capital will converge across firms and industries to a common, equilibrium value. The logic behind this expectation is simple: Supranormal rates of return in any line of business create the incentive for their own elimination, since profit-maximizing investors will have extra incentive to enter that business, replicate the productive process used by incumbent firms, and earn some of the higher profits for themselves. Entry should continue until the effects of increasing supply reduce prices and eliminate rents—that is to say, the difference between competitive and supranormal profits.1

The Q ratio: Using stock market valuations to determine when firms are earning monopoly profits

In a competitive stock market, the value of a firm will be equal to the present value of its net revenues. If the market value exceeds the replacement cost of a firm’s capital, there is an obvious way for a new entrant to make money: A new entrant would gain from purchasing an additional unit of capital and using it to produce the same good as the incumbent firm. This is because the new entrant would earn an immediate financial reward—the difference between the market value and replacement cost.

To put it another way, entry is encouraged by the existence of an arbitrage opportunity. Arbitrage opportunities exist when it is possible to buy a good in one market—in this case, the market for capital goods—and sell it for a higher price in another market. The arbitrage is between the capital goods market and the equity market—or buying a unit of capital goods at its current replacement cost and reselling it for more in the equity market by putting it to work in the appropriate line of business.

Of course, entry will increase the supply of goods. This should reduce the price of the firm’s output and therefore also reduce the net revenue from every unit of capital used in that line of business. This phenomenon makes entry a self-limiting process. Entry will continue until net revenue per unit falls to the level of replacement cost per unit of capital. At this point, no incentive for additional entry exists, and the incumbent firm is then earning the competitive rate of return on its capital.

Thus, when there are no barriers to entry, the stock market value of a firm, V, will be equal to the replacement cost of its capital, RC.

However, entry barriers can make it possible for a firm to earn more than the competitive rate of return on its capital. The existence of such barriers means that the ability of new firms to increase supply can be imperfect, and the return to capital for an incumbent firm can remain above the competitive level. When its rate of return exceeds the competitive level, a firm is said to be earning an economic rent.

When a firm’s net earnings include rent, those supranormal revenues will be included in the stock market valuation of the firm. After all, stock market participants do not care about the source of net revenues—only that they exist. This suggests a way to use stock market valuations and the replacement cost of capital stock to construct a measure that can signal when a firm is earning rent.

When there are no entry barriers, the market value of the firm will equal the replacement cost of its capital stock: V = RC. When Q = V/RC is greater than 1, the firm is earning returns that exceed competitive levels. The ratio Q is referred to as Tobin’s Q after the economist James Tobin who introduced its use in economics.

The excess of market valuation over replacement cost provides a quantitative measure of the rent component of net revenue. Conceptually, V = Vk + Vr, where Vk is the discounted value of the competitive return to capital and Vr is the discounted value of rents. Thus, it follows that Q = V/RC = Vk /RC + Vr /RC = 1 + Vr /RC. Hence, the excess of Q over 1 is then a measure of rents relative to replacement cost. If, for example, Q = 2, half of the earnings of the firm are from economic rent.2

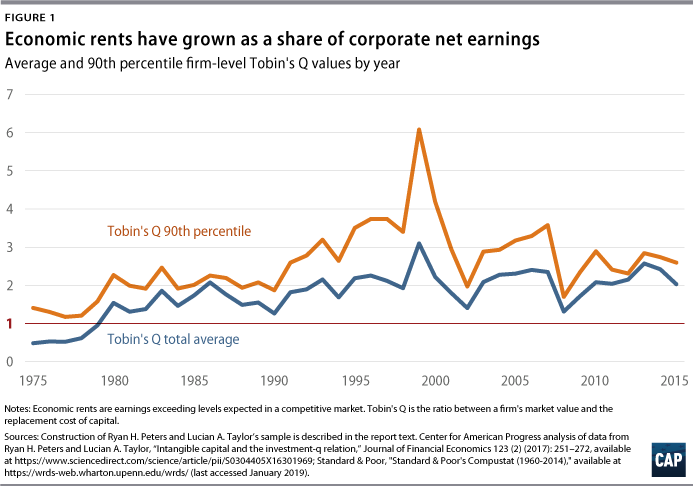

There is now evidence that in the aggregate, the share of rents in corporate income is positive and has trended upward since the late 1970s. To visualize this, consider the ratio of the equity market value of corporations to the replacement cost of the physical and intangible capital stock that they employ. This ratio, called Tobin’s Q, should be equal to 1 under competitive market conditions. However, Q values for many nonfinancial corporations have been trending upward since the late 1970s and are now significantly greater than 1. Using firm-level data from a large sample of publicly traded U.S. corporations for the period 1975–2015—excluding regulated utilities, financial firms, public service firms, and some others—economists Ryan H. Peters and Lucian A. Taylor construct measures of firm-level Q values. These measures include the replacement costs of both tangible and intangible capital.3 The average and 90th percentile values of the Peters-Taylor Q ratios are presented graphically in Figure 1.

Q values greater than 1 suggest that the rent component, or excess profit, of total U.S. corporate income is now quite large. Applying a model-based approach to national income accounts data, economist Simcha Barkai reaches a similar conclusion for the nonfinancial corporate sector as a whole.4

Without the presence of barriers to entry, this change in Q values is difficult to explain. The existence of rents should provide a strong incentive for the entry of new competitors, and rising rents should provide increasingly strong incentives as well. However, the expected competitive mechanism does not appear to be functioning.

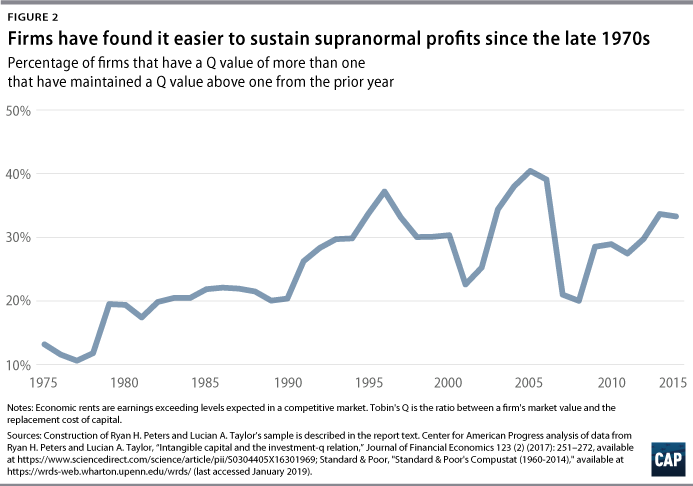

This interpretation of the data is supported by the fact that it has become easier for firms to earn rents in successive years. Figure 2 displays the share of firms in the Peters-Taylor sample with a Q greater than 1 in one year that maintained a Q greater than 1 in the next year. This number rises from around 10 percent of firms in 1980 to around 40 percent of firms in 2015, suggesting increased inertia around rent extraction. In other words, it has become more likely that a firm that earns measurable rent will be able to do so in a subsequent year. This is consistent with the expected effects of a decline in competition.

There are also various other data from across the economy that point to reduced competition. (see text box below)

A substantial set of indicators points to rising market power

- Firm markups—the ratio of price to the marginal cost of production—have risen substantially since the 1980s.5

- The 90-50 ratio for corporate returns—the accounting return on invested capital for the 90th percentile of firms to the 50th percentile—has increased from around 2 in 1980 to around 10 in 2014.6

- Corporate profits are concentrated in a declining number of firms.7

- Overall market concentration has increased over the past several decades.8

- The rate of entry of new firms across the economy has been declining since the late 1970s.9

- Rising concentration among employers is associated with job lock and weak wage growth.10

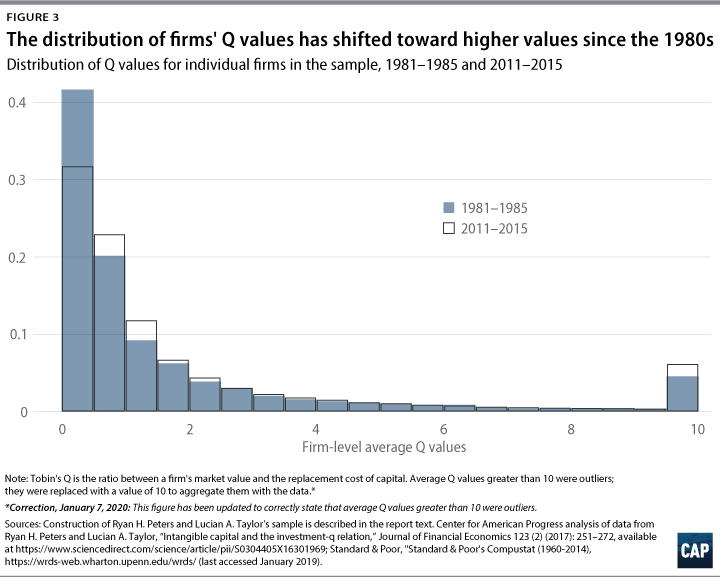

There is, of course, heterogeneity in the relative market power of firms. While the mean value of Q has trended upward, Q values for many firms reflect competitive returns. Figure 3 shows the distribution of Q values for individual firms in the Peters-Taylor sample averaged across 1981–1985 and 2011–2015. Both mean and median values have shifted right, and the right-hand tail of the distribution is more heavily populated, but many firms have Q values at or below 1.11

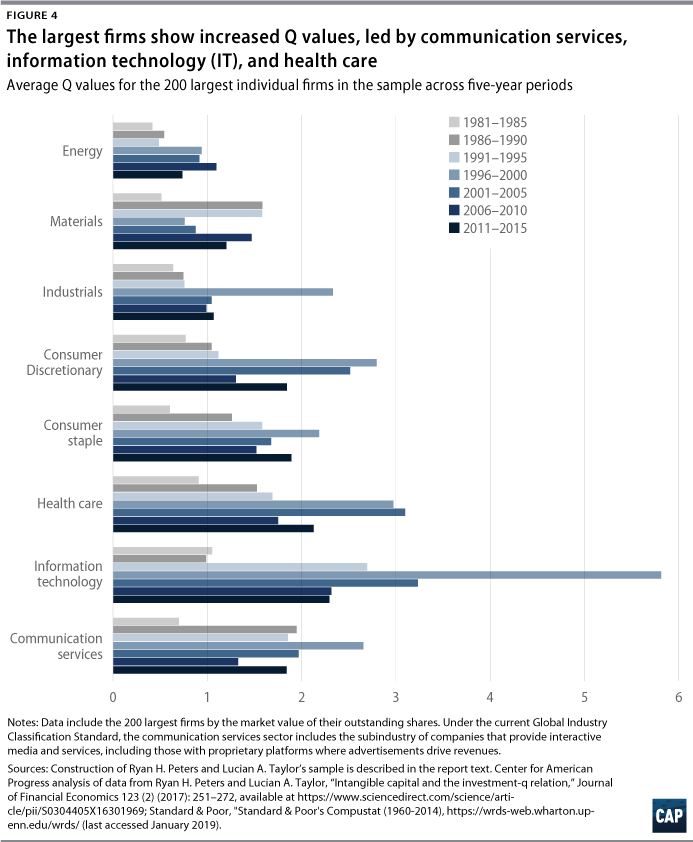

There is also evidence of differing degrees of market power across sectors of the economy. Figure 4 displays the average Q values for the 200 largest U.S. corporations by market capitalization in the Peters-Taylor sample, sorted into several broad Global Industry Classification Standard sectors.12 While there was a general upward trend in Q values across most sectors during the years 1981–1985 and 2011–2015, not all sectors ended the period with values significantly larger than 1.

It should be noted that a decline in competition is very likely not the sole explanation for the rise in observable corporate rent. Many economists have recognized that worker bargaining power has also diminished since the 1970s, a result of the decline in union representation, weakening of workforce protections, the decline in the real value of the minimum wage, and increased wage competition caused by expanding global competition—all of which have contributed to the rise in corporate rent. A recent paper by Economic Policy Institute economists Josh Bivens and Heidi Shierholz summarizes this case nicely:13 In an economy where competition is imperfect, the division of corporate net returns depends on how much power workers have to bargain for them.14 Therefore, the observable rise in corporate rent may well reflect the concurrent decline in worker bargaining power.15 The fact that these rents have not been competed away, however, even as they rise measurably, means that competitive entry is frustrated. But the authors do not attempt to estimate the quantitative contribution of each factor to the measured rise in economic rents.16

Moreover, persistent rents have dynamic implications. When rents are significant, incumbent firms have good reason to defend them. This can lead these firms to take economic, legal, or political steps to prevent the entry of new competitors, which, as a consequence, may prevent innovative products and processes from disrupting the marketplace.17 High rents can also deter incumbents from focusing their own efforts on developing and investing in innovation. The marked decline in nonfinancial corporate capital investment relative to corporate net income since 2000 is certainly consistent with rising market power.18

In the next section of the report, the authors identify potential barriers to competition that ought to be examined as sources of rising corporate rent. The report then discusses policy proposals that might reduce those barriers and explains why these policies should be augmented with a monopoly tax that will reduce corporate rent.

Sources of entry barriers

It is easy to think of ways in which normal competition can create barriers to entry that inhibit the equalization of profits, such as through the development of a significant new product or a more efficient production process for an existing product could certainly do it. As long as production techniques cannot be replicated, new entrants are either totally excluded or forced to earn lower rates of return. Some economists have pointed to technical superiority as a potential explanation for the rise in rents and increases in concentration.19

However, these types of barriers to entry should often be transient. Human beings are very good at imitation and reverse engineering; there is no good reason to believe that we have become less capable since 1980. It is implausible to attribute widespread rising rents exclusively to new products and new processes that cannot be replicated. Hence, we must look for other factors that can help explain why barriers appear to have increased over time.

Ineffective antitrust enforcement

Rising market power is in part attributable to the declining effectiveness of antitrust enforcement. Beginning in the 1980s, intentional policy decisions have hindered antitrust enforcement. Regulators largely abandoned challenges of mergers where market concentration was below the upper threshold of what is considered to be competitive.20 Similarly, they became increasingly reluctant to bring unilateral conduct cases, leading to an environment in which dominant firms could aggressively pursue anticompetitive conduct—such as foreclosure—without legal repercussions.21

A recent empirical study by economist John Kwoka presents convincing evidence that merger enforcement decisions allowing increased concentration have often led to price increases.22 A 2016 study by economist Robert Kulick, which looked at establishment-level data of cement producers from 1977 through 1992, also found “significant price increases due to horizontal mergers after a relaxation in antitrust enforcement standards in the mid-1980s, but no evidence of systematic price increases before.”23

Firms enjoying the gains created by entry barriers have every incentive to maintain and expand them. One excellent way to do so, made possible by large flows of rent, is to acquire potential competitors before they can fully establish themselves.24 There is evidence that pharmaceutical companies have used so-called killer acquisitions to discontinue innovations at target companies in order to pre-empt competition and preserve revenue from existing investments.25 This same motive, along with a desire to provide complements to goods and services that already produce network externalities, appears to generate some acquisitions in the software and IT services industries. There are signs that early-stage and startup companies and their venture capital funders do not mind being acquired by dominant firms. The number of companies that go public on an annual basis has dropped off considerably since peaking in the late 1990s.26

The acquisitions of Waze, YouTube, and DeepMind by Google27 and Instagram and WhatsApp by Facebook28 all appeared to be at a large premium to existing revenue and to strengthen the dominance of the acquiring firms.29 These and other acquisitions have not been subject to antitrust challenges.

The contributing role of weak antitrust enforcement to rising rents is further supported by the fact that rising market power is disproportionately prevalent in the United States. Returns on equity among U.S.-based firms dwarf those of corresponding non-U.S. firms.30 Similarly, since the mid-1990s, the United States has experienced highly irregular drops in the number of publicly listed firms—generally a country’s largest firms—relative to other developed countries, primarily driven by the United States’ unique and rapid increase in mergers and acquisitions.31 In contrast, due to improved antitrust enforcement in recent decades, European markets have less concentration, lower rents, and fewer barriers to entry, all without sacrificing innovation.32 Finally, as Thomas Piketty and Gabriel Zucman’s 2014 data show, Q values in the United States have risen more intensively than in many other developed countries starting in the 1980s.33

Strategic behavior to support entry barriers: Rent-seeking

Firms can use the regulatory and political system to protect their rents. As economist Luigi Zingales notes, “a firm’s size and the level of concentration within a market affect positively all the crucial factors that determine a firm’s ability to influence the political system.”34 As firms grow, they work to protect their advantages; this leads to further political investment, and, in turn, more political power. The benefits of this political influence can include a sustained ability to extract rents.

The U.S. telecommunications sector recently won several regulatory victories that are likely to aid in rent extraction.35 The Federal Communication Commission’s (FCC) rollback of net neutrality allows internet service providers (ISPs) to set up a previously prohibited price discrimination market.36 ISPs are now allowed to prioritize content providers that are willing to pay a fee. The likely result is higher consumer costs and greater rents for ISPs, who already have near-monopoly positions.37 In 2017, using the Congressional Review Act, congressional Republicans passed a resolution subsequently signed by President Donald Trump nullifying a rule that strictly limited the ability of ISPs to sell customers’ personal information.38

Other examples can be found in the pharmaceutical industry. For example, biologic therapies—drugs created using live cells—make up a significant share of pharmaceutical spending, in part due to a lack of competition. To combat these rapidly rising costs, the Obama administration created incentives within Medicare to entice hospitals to prescribe the cheapest biosimilar, or generic biologic drug.39 However, the Trump administration recently rescinded this rule after intense lobbying by biologic drug manufacturers, with the Wall Street Journal noting that the rollback “could drive up prices of certain biologic drugs.”40 It should come as no surprise to learn that the Pharmaceutical Research and Manufacturers of America set a new record for lobbying in 2018, with spending reaching $27.5 million.41

Economists German Gutiérrez and Thomas Philippon recently made the case that corporate capture of U.S. antitrust enforcement explains much of the state of U.S. competition. Comparing the markets of the United States with those of Europe, the authors find that the European economy is more competitive.42 They conclude that the most compelling culprit is not technology and efficient scale, but a form of corporate capture that is more prevalent in the United States than in Europe due to institutional choices.43 In a related study, authors Mihir Mehta, Suraj Srinivasan, and Wanli Zhao looked at a sample of U.S. mergers between 1998 and 2010, documenting how political connections affected antitrust outcomes,44 and found evidence of corporate influence on mergers policy. Even under increased public and political scrutiny, tech firms continue to spend significant amounts of money to lobby Congress and federal agencies. Facebook, Apple, Google, Amazon, and Microsoft spent a combined $64.3 million on political lobbying in 2018 alone.45

Increased use of intellectual property protection

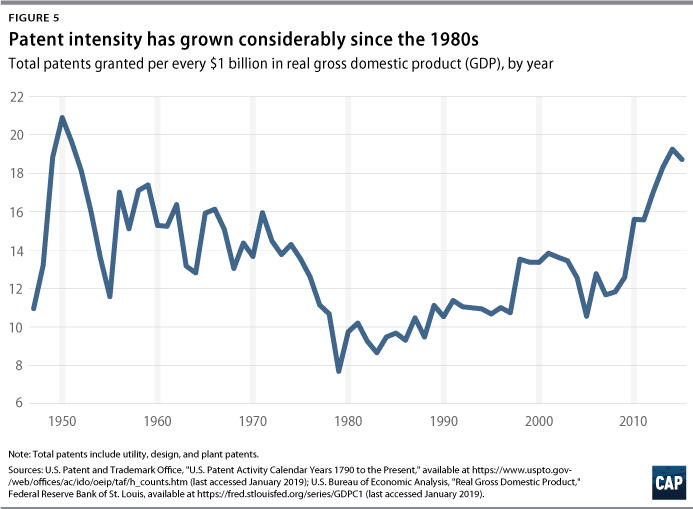

Intellectual property protection, a source of state-sanctioned monopoly power, is playing an increasingly important role in the U.S. economy. Because of changes to the patent system, since the 1980s, patents have become easier to obtain and enforce, and the rewards for enforcement claims have increased.46 Beginning around 1980, there has been a significant increase in patent awards, both in absolute numbers and relative to total output. (see Figure 5) In addition, as economist Dean Baker has emphasized, the Bayh-Dole Act of 1980 made it possible for private actors to obtain patent rights for publicly funded inventions such as medicines that are based on science funded by the National Institute of Health.47

Patents, of course, can be imperfect entry barriers. A potential entrant can invent around, license, or dispute patents legally. However, there is evidence that patents create effective barriers in important parts of the economy, such as in the pharmaceutical industry. Even though the production of drugs requires technical expertise and the ability to meet rigorous standards set by the U.S. Food and Drug Administration, brand-name drugs can be copied relatively quickly by generic drug manufacturers. When patents expire and generic drugs are brought to market, the price of drugs typically drops dramatically once there is more than one generic competitor.48

Patents are also crucial in complex technology areas, where so-called patent thickets—portfolios of patents with overlapping claims held by incumbent firms—create barriers to entry. For instance, in the U.S. software industry, as the number of patents held by incumbent firms rises, there is a statistically significant decline in the number of entrants.49 Data from the United Kingdom are consistent with this finding: An empirical study of firm decisions to patent for the first time in a given technology area shows a substantial and statistically significant negative relationship between the density of patent thickets and the likelihood of patenting in a new area.50

Network externalities

Some goods produce network externalities, which exist when the benefits that an individual derives from a good increase when others decide to use it, in turn creating additional incentive for others to buy it.51 A classic example is the telephone network: The more individuals join the network, the more valuable a telephone network becomes, and the more incentive others have to join.

However, network effects can create barriers to entry. When an existing good succeeds in generating very high levels of externalities and that good is incompatible with competing goods, individual users will be reluctant to switch to the competitor, even when it is superior. This is the so-called lock-in effect. This lock-in effect can be overcome with coordinated action by the network adopters, but coordination can be costly and imperfect.52 As Howard Shelanski, a former FCC chief economist, put it: “The network, feedback, and lock-in effects that can arise in platform markets might provide real benefits to consumers but also entrench market power in a platform that gains the lead in its relevant markets.”53

The sources of network effects can be quite varied. When there are economies of scale—when firms’ average costs fall as their output increases—and those cost decreases are reflected in the price of the good, then the pricing creates a network effect. Network effects can also be enhanced when there are complements to the network—for example, software that is compatible with an operating system or type of computer hardware—or when there are significant transactions costs to switching to an alternative.

Silicon Valley veterans have emphasized the importance of increasing returns to scale for software and IT services. Peter Thiel and Reid Hoffman, well-known IT investors, argued that the central idea to most Silicon Valley companies is to hit “escape velocity.” As Thiel said, “[T]he benefit is that you’re achieving escape velocity from the black hole that is … hyper competition.”54 This theory, said Hoffman, is the central idea that has driven “nearly every successful scale company.”55

Scale, for instance, appears to have been an important factor in Microsoft’s acquisition of LinkedIn. LinkedIn, a company with a $25 billion market capitalization, had been struggling with how to compete in light of what its CEO called “a redefinition of scale in the modern world.”56 As the entrepreneur and writer Tim O’Reilly later acknowledged, LinkedIn was not “big enough to be competitive as a standalone company in today’s market.”57

Potential entrants also recognize the importance of scale, as in the ad technology market with the rise of Google and Facebook. According to Mary Meeker, of the venture capital firm Kleiner Perkins, Google and Facebook made up three-quarters of all new ad spending in 2016 and more than half of the U.S. digital ad market in 2017.58 As venture capitalist Suranga Chandratillake noted, “Even if you manage to build a sustainable advantage for a few years, how do you scale to compete with Google or Facebook? That’s why traditional adtech does feel dead from a venture perspective.”59

The importance of having complements to the network good is also well-established. The U.S. Department of Justice’s successful case against Microsoft argued that by taking steps against Netscape—a browser designed to work across operating systems—the company was illegally acting to preserve the barrier to entry created by the willingness of programmers to make Windows-compatible applications its first priority.60

Access to data

Data are crucial and valuable inputs to many digital businesses. Firms such as Google, Facebook, and Amazon are constantly updating information based on the behaviors and interests of their users. Data are frequently locked up in closed systems or limited through intellectual property protections—and for good reason. As lawyers Maurice Stucke and Allen Grunes wrote, “If personal data were as freely available as sunshine, companies would not spend a considerable amount of money offering free services to acquire and analyze data to maintain a data-related competitive advantage.”61 A 2016 McKinsey & Company survey of U.S. auto industry executives found that firms prioritize “their R&D efforts and M&A [merger and acquisition] strategy on the basis of the expected growth in their data assets base.”62 Yet even when data can be purchased, it is not always the case that a sufficient repository can be built from third-party data sets.63 As economist Joshua Gans explains, “A firm’s monopolization of data could harm consumers if it confers an incumbency advantage—supported by barriers to entry—that reduces the incentives for competing platforms to enter a particular market.”64

One particularly valuable use of data is in machine learning and the development of AI. The continuous and growing complexity of tasks that AI has to master requires large repositories of data on which to train algorithms.65 Professors Eric Posner and Glen Weyl argue that “the vast data sets collected by Google, Facebook and others as a by-product of their core business functions became a crucial source of revenue and competitive advantage.”66 They make the case that data used for machine learning may have increasing returns to scale, in that more complex tasks that require deeper learning are often more valuable.67

Data access leads to material product improvements, including personalization and algorithm optimization,68 which result in efficiencies, increased productivity, and better customer targeting.69 Such outcomes often benefit consumers,70 but these dynamics can also make it harder for new entrants to compete.71 As firms scale and bring in more and better data, they become better performers. If it is hard to access the data or an equivalent source, replicating existing firms’ performance becomes exceedingly difficult.72 Because data are generated in part through the network effects of free services provided to users, other services are often unable to acquire the same information.73 Economists Di He and others provide empirical support for this theory, finding that having more historical data improves search engine performance, as measured by ranking quality and learning speeds.74 This data feedback effect ensures that incumbent firms extend their lead over new entrants over time.75

Data may also make it easier for dominant firms to enter adjacent markets.76 The European Commission has labeled this “concentric diversification,” wherein companies “expand their data collection & analytics into adjacent data areas where joint analysis of the existing and additional data gives them a comparative advantage over companies that separately analyze data in a particular area.”77 Amazon, for example, has unique knowledge about not just supply chains, but also customers and the marketplace for goods.78 Using its knowledge of customer locations from shipping addresses and purchasing patterns, the company is expanding its advertising business, now with an estimated worth of $125 billion.79 Amazon has also built a robust private label business using its proprietary sales and search data.80 A similar example can be found in the health care industry. Google, which dominates the search engine market, is now applying its machine learning algorithms to health care markets, seeing the sector as holding “commercial promise.”81

Recommendations: Policies to reduce entry barriers and increase competition

This section identifies a range of policies that have the potential to reduce entry barriers and make it less likely that corporations can extract rents over a prolonged period of time.

Increase antitrust enforcement

Some robust policy tools for encouraging competition already exist. The U.S. Department of Justice and the Federal Trade Commission have considerable authority to limit, and, in some cases, reverse, mergers.

Limits on acquisitions

Traditional merger review remains heavily focused on calculable price and efficiency effects. Hence, it may be difficult for antitrust authorities to view the acquisition of startups with small revenue streams and little or no market capitalization as anti-competitive.

However, when network effects or other factors already protect an incumbent firm from competition, a seemingly harmless acquisition may have a significant effect on protecting or expanding entry barriers. For digital companies, the size of the target firm’s user base, the speed at which the startup is growing, and the potential uses of its data are only a few of the indicators that may signal to the incumbent that the target is a potential competitive threat, or that incorporation of its product will help deter future competitors. An acquisition at what appears to be a very high financial premium reflects the present value of the company, as well as the future value of maintaining a barrier against competition.

Economists Timothy F. Bresnahan and Shane Greenstein argue, “We should not be surprised that an industry as inventive and important as computing throws up new challenges to the analysis of industry structure and of competition.”82 Antitrust authorities appear to have missed these strategic issues. Facebook, for example, acquired Instagram and WhatsApp without challenge from antitrust agencies.83 With both acquisitions, antitrust enforcers determined that there were sufficient substitutes for advertisers and user data.84 And yet, as others have noted, Facebook considered both companies to be existential threats to its business model.85 With the benefit of hindsight, permitting these acquisitions may have foreclosed the entry of potentially powerful competitors. Instagram and WhatsApp are doing remarkably well, even as they continue to function largely independently of Facebook.86 Instagram, for example, boasts 1 billion users, continues to experience rapid growth, and generates high revenue.87 Moreover, Instagram users spend a similar amount of time on the application as they do on Facebook.88

In light of the above example, it may make sense to challenge acquisitions by dominant firms already protected by significant entry barriers. This idea is not exactly novel: In a 1968 paper, Judge Richard Posner floated the concept of merger bans for natural monopolies.89 Considering the structure for how these firms gain market power,90 such a ban appears to be an effective way to prevent strategic anti-competitive behavior on the part of incumbents and would increase incentives for them to focus on internal innovation.91 Federal Trade Commission (FTC) Commissioner Rohit Chopra has recently argued that the FTC has broad rule-making authority to prohibit unfair competition under Section 5 of the Federal Trade Commission Act.92 This underused provision of the law might provide an avenue to implement such a ban.

Limits on operation in adjacent markets

When network externalities or other factors create barriers similar to those surrounding natural monopolies, expansion into related markets can sustain or increase those barriers. As economist Jean Tirole notes:

It is important to ensure that the existence of a natural monopoly at one point in the value chain does not turn the whole sector into a monopoly. If there is a danger of that happening, it may be desirable to further separate the service from the infrastructure to allow fair competition in the potentially competitive segments.93

There are at least two ways that this could be done: regulation of firm conduct in adjacent markets or structural separation between the dominant firm and adjacent markets.

The rules implementing the principle of net neutrality, which until recently governed all internet service providers, illustrate the operation of regulation.94 These rules prohibited discrimination against, or unfair prioritization of, any content by ISPs. The ISPs were permitted to own content but could not treat others’ content differently.

Such an approach could be applied to any market where a firm that functions as a market-maker or so-called platform also participates in the market it organizes or facilitates. While the market-maker would still be able to compete, its actions would be constrained to preserve competition in adjacent markets. For example, Google would be constrained in prioritizing adjacent sites—such as Google Shopping—within its search interface.95

The second approach is to prohibit the dominant firm in a particular market from operating in any adjacent market. The idea, recently advanced by lawyer Lina Khan, is to structurally separate the natural monopoly from complementary services or applications. Such a firewall would obviate the need for regulatory oversight of the platform’s conduct.96 As Khan notes, structural separations are not without precedent, having been used in both the banking and transportation sectors. One such example comes from the Bell Telephone System’s 1956 consent decree with the U.S. Department of Justice, which prohibited operation outside telecommunications.

Khan applies her approach to Amazon, arguing that the operator of a market should not also be allowed to compete against merchants that rely on that market. AmazonBasics, the firm’s store brand, does this by offering items that compete with goods offered by third parties on Amazon Marketplace. Another example is Google Shopping services. The European Commission’s case against Google argued that the search engine artificially prioritized its product ahead of other rival services that rely on fair ordering.97 In this sense, prioritization by Google may be seen as unfair use of its dominant position. Structural separations would restrict this conduct by not permitting the firm to operate adjacent services.

Limit intellectual property-generated monopoly power

In important sectors of the economy such as pharmaceuticals and IT, patent protection appears to contribute to high levels of rent extraction. The federal government could take several steps to reduce rents while also preserving incentives to innovate.

Leverage government expenditures

Across sectors, public funding heavily subsidizes private research and development (R&D). In her book The Entrepreneurial State, Mariana Mazzucato shows how companies from Apple to Google have benefited from public investment.98 She profiles the iPhone, making the case that the origins of its most critical innovations—including GPS, the internet, and touch-screen technologies—were born of publicly funded research. This is also true in the pharmaceutical sector. From 2008 to 2014, the industry received $28 billion in public funding, access to public research institutions, and R&D and orphan drug tax credits.99 One study by economists Bhaven N. Sampat and Frank R. Lichtenberg found that between 1988 and 2005, 40 percent of groundbreaking therapies, called “priority-review” drugs, cited at least one public sector patent, and nearly one-fifth had a public sector patent.100 The federal government could leverage the value of its contributions to either reduce or recoup some of this rent.

One approach would be to prevent rents from being accrued in the first place. Health policy expert Ezekiel Emanuel, for example, has proposed replicating the Swedish government’s practice of setting a value-based price ceiling on drugs. This would permit buyers “to negotiate with drug companies over prices as they do now, but there would be a ceiling to prevent prices from becoming unsustainable.”101

Another ex ante approach would be for the government to shorten the duration of patent protection. While firms might respond by increasing prices during their government-issued monopoly, a shorter period of exclusivity granted under patent protection could limit much of the pernicious effects seen today, including reduced innovation, slower entry of new firms, and high rental income.

The government could also recoup the rent after it has been made. Mazzucato argues that the public should receive golden shares or royalties in cases where public investment has been used.102 These returns would go back to the U.S. Department of the Treasury to fund further innovation.103 Alternatively, drug companies in particular could adopt a version of a medical loss ratio. In the case that firms raise prices substantially above “fair value”—such as a drug with minimal time left under patent—the ratio would require the firm to reinvest that revenue to fund further research.104 Finally, the government could reform current royalty frameworks to ensure that the public receives a larger return when innovation that relied on government funding is commercialized. In such cases, this may deter price increases or ensure that society is benefiting.

A tougher lever has been floated by professors Amy Kapczynski and Aaron S. Kesselheim. They call for the novel use of a longtime statutory provision in 28 U.S.C. Section 1498, which covers patent and copyright cases. This provision enables the federal government to procure a patented innovation based on a reasonable rate of return—the equivalent of eminent domain.105 Kapczynski and Kesselheim suggest applying this lever to pharmaceuticals, where the price of the drug far exceeds a fair profit and where greater access to the drug is paramount.106 Importantly, this lever can be used regardless of whether the government played any role in the innovation to develop the drug.

Require compulsory licensing

Another promising approach is compulsory licensing combined with rules governing access to an incumbent firm’s essential infrastructure.107 A form of compulsory licensing has been used before: In 1956, Bell Labs, which had a monopoly over telecommunications, agreed to a consent decree with the U.S. Department of Justice following an antitrust case premised on monopolization. As part of the remedy, Bell, which had the most advanced private research lab in America, was forced to license patents without royalties.108 A 2017 study by Martin Watzinger found that the decree led to a large and “long-lasting” increase in the number of citations to Bell patents, especially by small and young firms.109

In this same spirit, in sectors with persistently high Q values owing to patent protections, remedies could include required patent licensing. This could precede a patent’s designation. Regulators could establish a fair, reasonable, and nondiscriminatory term or a ceiling as a condition for receiving a patent.110 This could also occur after the fact, much as it did in the Bell case.

Finally, the government presently has what are termed “march-in rights” as part of the 1980 Bayh-Dole Act. March-in rights can compel the licensing of a private patent that has benefited from public research. To date, such rights have never been used.111 Yet, as Sampat and Lichtenberg point out, “[T]he government could theoretically exercise march-in authority or use a recoupment policy” for as much as 20 percent of the high-priority drugs developed through the 1990s.112 Several have called for reforms to Bayh-Dole to make sure such authorities become more administrable.113 Others have called for further pro-competitive changes such as making sure publicly funded innovation is not exclusively licensed.114

Increase public investment

The U.S. government needs to substantially increase basic research in high-value, high-growth sectors. Whereas private funding understandably rarely goes to long-term bets, public R&D have a rich track record of positive spillovers that enhance private sector competition and enable the United States to stay competitive with rival countries of growing innovative capacity.115 Since 2010, there has been a declining level of public investment in R&D. Funding levels dropped by nearly 15 percent over the past decade, totaling about $143 billion in fiscal year 2018.116

A related approach is to consider awarding prizes, rather than monopoly power, for innovations. The idea of prizes has a long legacy. Economist Joseph Stiglitz, for instance, has called for the creation of a prize fund in tandem with a patent system.117 When a prize is awarded, the innovator makes an immediate and large return but has little ability to dictate price or access. Prizes could preserve incentives to invent without the promise of monopoly power. As an example, Stiglitz discusses “pill prizes” awarded to pharmaceutical companies that invent a drug to cure a disease. The challenge with prizes is defining the objective and certifying it has been met. Similarly, there would need to be a process for commercializing the findings—not a trivial task.118

Increase data-sharing

Access to large quantities of relevant data has important competitive effects. Data access allows for deeper understanding of customer preferences and behaviors; creates network effects; and can ease entry into new markets.119 The centralization of data ownership among a few companies makes it harder for smaller firms and startups to compete. The authors of this report propose three policy approaches to increase data-sharing: improve policymakers’ understanding of the resource; reduce consumer switching costs; and require data-sharing through application programming interfaces, clearinghouses, or open standards.

Conduct data retrospectives

Enforcement agencies have periodically performed retrospective reviews to assess merger policy effectiveness, with the most recent review published in 2017.120 A similar review should occur for mergers where data are a strategic asset—an increasingly frequent occurrence. This idea was first proposed by Allen Stucke and Maurice Grunes, who made clear that “agencies, while predicting a proposed merger’s likely competitive effects, seldom revisit the merger several years later to see whether they predicted accurately.”121

A data retrospective would enable enforcement agencies to evaluate their assumptions and identify new competitive effects.122 A more ambitious goal would be to establish a structural presumption for data-intensive mergers.123 One could imagine a presumption, triggered by the resulting data advantages of a merging entity, that would force the firms to explain why the data asset is not a competitive concern.124 This would be particularly valuable in data-intensive industries where defining a market has proven difficult.

Finally, enforcement agencies need to be proactive in learning how new technologies are interacting with industries “beyond the sectors most closely associated with the digital economy,” as noted by economists Dominique Guellec and Caroline Paunov.125 There should be a research team thinking holistically about how market structures and business models are changing. These findings should affect how the federal government enforces competition policy. Enforcement agencies across the world are now trying to address whether and how data are a competitive advantage.126 The European Commission has created an academic advisory council to research the issue,127 as has the United Kingdom’s Competition and Markets Authority,128 and the United States’ FTC has held hearings on the topic.129

Establish data-sharing requirements

In October 2017, the CFPB released a set of principles “to help foster the development of innovative financial products and services, increase competition in financial markets, and empower consumers to take greater control of their financial lives.”130 The guidelines, although nonbinding, laid out a clear expectation that banks should share financial information with financial applications when requested by bank customers. Previously, large financial institutions had resisted such efforts, worried that, powered by these data, startups could enter more easily banks’ business lines. As The New York Times reported, “Both sides see big money to be made from the reams of highly personal information created by financial transactions.”131

Similar interventions could be applied beyond finance.132 Where appropriate, agencies should look to draft sector-specific data-sharing provisions to mandate that firms open application programming interfaces and enable access to useful data feeds.

Another approach is to facilitate open data standards in sectors where data are competitively significant. Inconsistent data standards can stymie startups while giving incumbent firms an advantage by making it harder to access information. Consistent and open data standards reduce the friction of data-sharing and lower entry barriers.133 Several sectors have already taken this step. For example, public-private partnerships were established in the health care and energy sectors to make it easier for consumers to access and share information with other applications through consistent data frameworks.134

A third approach to enhance competition, especially in emerging high-growth fields such as AI, is to have the government establish data clearinghouses. Weather data, for instance, are collected through various agencies with public infrastructure and now support a burgeoning market of private apps and services. The Obama administration called for “releasing a significant number of government data sets” for training AI as part of an “Open Data for AI” initiative.135 A similar concept could be applied to real-time mapping infrastructure for autonomous vehicles. Not only would this improve safety, but it would also create a baseline platform for new entrants to be trained.136

A final approach that is gaining prominence is data portability.137 Fueled by enormous amounts of data collected on individual consumers, applications can personalize people’s experiences. This level of personalization increases switching costs for consumers and creates higher entry barriers for startups. The premise behind data portability is to enable users to carry data with them from application to application. More than just empowering consumers, it would also lower barriers to entry in data-intensive markets, allowing startups to more ably compete with dominant incumbents.138 Already, some of the largest platforms allow users to port their data.139 It is also required under Europe’s new data protection law.140

A new proposal by Joshua Gans goes beyond user-generated data and includes interoperability of user content. By enabling users to communicate across platforms without necessarily being on a platform, it eliminates the need for “a coordinated move among users to recreate network effects on a new platform.”141 As Gans notes, incumbents may still come out on top as they may be able to offer a better service, but true interoperability of data, permissions, and content would remove powerful entry barriers.

Tax monopoly rents

The aforementioned policies aim to reduce barriers to entry. However, even if all of these policies were implemented successfully, there are large firms currently earning large rents that would likely remain untouched. Firms with significant economies of scale, for example, may be able to defend against new firm entry for sustained periods.

To complement entry-related policies, the authors propose implementing a higher marginal tax on the profits of firms that have accrued high rents over an extended period. Such a tax would have three effects. While it would not break up a firm, it would reduce the flow of economic rents, making these revenues available for public purposes with no harm to efficiency.142 It would also discourage further efforts to enhance market power through actions such as mergers and acquisitions. Moreover, it would diminish the ability of these firms to use their outsize returns to influence political and regulatory outcomes.

The origins of this idea go as far back as to Supreme Court Justice Louis Brandeis, who, in the 1930s, called for “an annual excise tax rapidly progressing in the rate as the total capitalization of the Corporation rises” as a mechanism to restrain the growth of firms.143 Similarly, Judge Richard Posner floated an “excess profits tax” as one of several approaches to rein in natural monopolies. Such a tax, he wrote, “would require the regulated firm to divide its monopoly profits with the public.”144

Firms’ Q values, along with other data, could be used to identify those that are earning measurably sustained rents and set a higher corporate tax rate for these firms.145 For example, when a firm’s Q value is persistently greater than 2, markets are signaling that more than half of the firm’s earnings are from rents. Taxing away such rents would not affect competitive efficiency, and the revenue generated could be used to support public sector projects, which would in turn reduce income inequality.146

Conclusion

This report presents the case for an enhanced competition policy. On the basis of the empirical evidence reviewed, there is good reason to conclude that market competition is not delivering the expected results in the U.S. economy. The competitive response to high profits—the entry of new firms that want to earn a share of those higher returns—has not materialized. As a result, firm owners are earning more, consumers are paying more, workers are earning less, and incumbent firms have less incentive to innovate on their own.

This report also identifies a set of policy measures that could be used to address these problems. They include steps to reduce barriers to entry, such as restrictions on acquisitions by firms protected by barriers; limits on the ability of such firms to enter into adjacent markets; requirements to standardize and share important data; and a requirement to allow users to communicate across digital platforms. It also proposes a monopoly tax, which could complement other proposed pro-competition policies.

There are, however, many open issues. For example, this report has not touched on competition in finance, a sector that has expanded significantly as a share of the economy in recent decades, while market concentration, at least in the banking industry, has increased. Nor has this report fully explored issues presented by intellectual property protection or the rise of new technologies such as artificial intelligence. These and other matters will be the subject of future work.

About the authors

Marc Jarsulic is the senior vice president for Economic Policy at the Center for American Progress.

Ethan Gurwitz is a student at Harvard Law School and a former policy analyst for Economic Policy at the Center.

Andrew Schwartz is a senior policy analyst for Economic Policy at the Center.

Acknowledgements

The authors wish to thank Professor Ryan Peters for providing Q values data. They also thank Charles Duan and Professors Mark Glick, John Kwoka, and Christian Weller for their helpful comments on earlier versions of this report. The authors are exclusively responsible for the contents of this report.

* Correction, January 7, 2020: Figure 3 of this report has been updated to correctly state that average Q values greater than 10 were outliers.