See also: Interactive: Where Will BP’s $18.7 Billion Deepwater Horizon Settlement Go? by Michael Conathan and Andrew Lomax

On July 2, the U.S. Department of Justice and BP—one of the world’s largest oil and gas companies—announced that they had come to terms on a historic $18.7* billion settlement over damages from the 2010 Deepwater Horizon oil disaster. By any metric, this is an enormous sum of cash; for example, it is more than the gross domestic product of 83 countries, according to the World Bank. U.S. Attorney General Loretta Lynch announced in a statement that, if ultimately approved, this restitution “would be the largest settlement with a single entity in American history”—appropriate considering that the spill was one of the worst environmental disasters to ever occur in the United States.

But what does this amount—$18.7 billion—mean to one of the wealthiest, most profitable corporations on the planet? A couple of clues came soon after the settlement was announced: That afternoon, BP’s stock price jumped 4.2 percent. The Financial Times, meanwhile, quoted an unnamed BP source who detailed the wave of relief that swept over his colleagues as they learned of the agreement: “I could see it in the eyes of the executive team. [The settlement] liberates us.”

Yet, is almost $19 billion enough to liberate the Gulf of Mexico’s economy and environment after BP’s “gross negligence” led to the dumping of more than 3 million barrels of oil into its waters and onto its shores? Where will the money go? And, at the end of the day, is it a good deal for Gulf Coast residents and American taxpayers? The answer is not simple. However, this brief provides a breakdown of the key points of the settlement: the good, the bad, and the convoluted.

The good news for BP

Long payout schedule means cost savings

When does $18.7 billion actually equal $9.16 billion? When it’s paid over 15 to 17 years. While the exact present day value of the total payout is subject to some interpretation, it will certainly equal less than $18.7 billion in 2015 dollars by the time all the checks are written. As any economics student will tell you, money loses value over time. One way economists measure this depreciation is by using what’s known as a discount rate, which allows them to calculate the value of future income and expenses in terms of present day dollars.

The economic policy team at the Center for American Progress examined the settlement’s payout structure and applied a variety of discount rates. When using a very conservative discount rate of 3.1 percent—the same rate used by the White House Office of Management and Budget for public sector projects—offset by accrued interest, the net present value of BP’s financial restitution will equate to approximately $15.43 billion. Meanwhile, in BP’s own annual report, it uses a discount rate of as much as 12 percent—indicative of the rate of return the company estimates it can earn on money invested in its business today. Applying this rate to the settlement’s payment plan puts the cumulative toll on BP at just $9.16 billion. That discounted total is still a lot of money for economic and environmental restoration in the Gulf, but an amount BP could cover while still remaining in the black considering the $12 billion in profits the company pocketed in 2014 alone.

BP will pay interest at well below market rates

Even a company as profitable as BP would not be able to simply write a check to cover a 10-figure settlement; the company was always going to have to figure out a payment plan. As previously mentioned, this deal includes a payout structure that will last 15 to 17 years. As a result, BP will have to finance what amounts to a 15 to 17 year mortgage.

Because the damage had already been done in this case, the U.S. government would have been within its rights to demand payment upfront, forcing BP to borrow money from markets by taking a loan from a bank or issuing stocks or bonds. Instead, the parties agreed to an extended payment plan at an annual interest rate of slightly less than 1 percent over the life of the settlement. By comparison, in BP’s most recent long-term bond sale, markets demanded an interest rate of just more than 3.5 percent for $1 billion in bonds that come due in 10 years. An $18.7 billion settlement, which would require a much larger loan with a longer payback time, would almost certainly have demanded a higher interest rate. Thus, as structured, the settlement results in massive savings for BP relative to the cost of being forced to pay the settlement upfront. Conservatively, these savings are equivalent to the difference between the less than 1 percent interest BP is paying out and the 3.5 percent or more that the market would have demanded. CAP’s economists have calculated that in sum, this amounts to a savings of more than $2 billion. That may be one reason the overall settlement number is so large: BP may have been willing to settle for a slightly larger amount since the terms of the deal included a lower interest rate.

Tax write-offs could save BP—and cost taxpayers—$4.6 billion

Furthermore, BP may be able to ease the financial burden of the settlement by simply deducting a huge portion of it on their corporate tax returns. According to the U.S. Public Interest Research Group, or U.S. PIRG, it is possible that when the ink dries on a final settlement, all of it except the $5.5 billion in Clean Water Act penalties could become a tax write-off, unless the terms of the final settlement expressly forbid it. Absent such a prohibition, U.S. PIRG estimates that the deduction will save BP—and cost the U.S. Treasury— roughly $4.6 billion in tax revenue.

The good news for the Gulf of Mexico

A quick end to Gulf Coast residents’ waiting game

Arguably the biggest benefit of this settlement is not the total amount of money BP will have to pay, but the fact that the company will start paying as soon as the settlement is finalized, avoiding what could have become a lengthy waiting game. Until the Macondo well blew out in 2010, the highest profile U.S. oil spill had been the 1989 Exxon Valdez spill in Alaska’s Prince William Sound. While that 11-million gallon disaster spawned numerous strict regulatory changes and led to the passage of the Oil Pollution Act of 1990, the judicial proceedings over Exxon’s financial restitution dragged on for more than two decades. In 2008, the U.S. Supreme Court remanded a $2.5 billion punitive damages award back to a lower court for reconsideration, resulting in a final payment of just more than half a billion dollars.

In the intervening two decades, at least 6,000 of the 32,000 original plaintiffs in the case died prior to its resolution, including native Alaskans who had relied on the sound for their livelihoods and to sustain their culture for centuries. Gulf Coast residents will avoid potentially decades of waiting before their claims can be resolved and appear to be guaranteed a significant proportion of the amount needed to restore the region’s coast and ocean.

BP agrees to pay for as yet unknown damages

For all the clear ramifications of this massive spill, we may not yet understand all the negative effects of such a large and far-reaching disaster. To address additional damages that may come to light long after the settlement is signed, the deal includes a groundbreaking clause that sets aside $232 million, plus interest accrued, for future natural resource damages payments. This money will go into a fund dedicated to addressing harmful results from the spill that may not be known until years down the road.

For example, in the case of Exxon Valdez, the herring fishery in Prince William Sound collapsed in 1993, two years after the initial settlement was reached. Only later did scientists discover that crude oil exposure makes herring highly vulnerable to disease and causes major embryonic deformities. Even today, the Exxon Valdez Oil Spill Trustee Council lists this herring fishery as “not recovered.”

The Exxon settlement did include a so-called reopener window, which allowed the government to file additional claims of as much as $100 million for 15 years after the spill. Yet it set a very high bar for meeting the burden of proof and required additional litigation to access any of this money. By contrast, the BP settlement includes its future damages fund as an upfront commitment with no additional litigation required.

The convoluted: Where will all this money go?

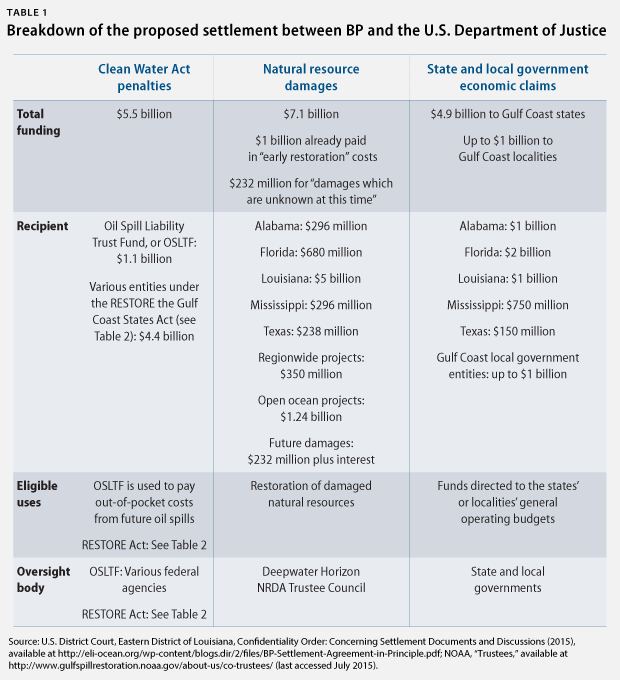

There are basically three pots of money that comprise the $18.7 billion settlement: $7.3 billion is for natural resource damages, including the future damages fund; as much as $5.9 billion will go to states and Gulf Coast localities to settle claims for economic damages, primarily lost tax revenue; and the remaining $5.5 billion will be used to pay penalties under the Clean Water Act. The first two pots of money are for relatively straightforward purposes. Natural resource damages are funds that states and federal entities will use to restore natural resources to as close to their pre-spill state as possible, including $1.24 billion that is specifically targeted for deep ocean restoration. The economic damages money, meanwhile, will be paid to state, county or parish, and local entities to compensate them for economic losses during the spill—primarily lost tax revenue. States will receive $4.9 billion; “up to” $1 billion will go to municipal government entities.

The Clean Water Act penalties, as alluded to in the table above, are a unique case. In 2012, Congress enacted the Resources and Ecosystem Sustainability, Tourism Opportunities, and Revived Economies of the Gulf Coast States Act—a mouthful of a title designed to be truncated as the RESTORE Act. The law, which was a key recommendation of the Center for American Progress’ 2011 “Beyond Recovery” report, requires 80 percent of BP’s punitive Clean Water Act penalties to be returned to the Gulf Coast states for ecosystem and economic restitution. Under the current settlement, those penalties will total $5.5 billion, meaning the Gulf Coast region’s 80 percent share will equal $4.4 billion. (see Table 2 in PDF)

The RESTORE Act money will provide states and localities with a one-time opportunity to address some of the lingering environmental effects of decades of oil and gas development and set an economically depressed region on a path to a more vibrant, sustainable future. The question of how much will be spent on ecosystem-related initiatives, however, remains unsettled. Eligible uses for the states’ money include environmental restoration and resiliency, but also initiatives to promote tourism and fisheries and to either build or rebuild coastal infrastructure.

Restoration of the Gulf’s rapidly degrading wetlands should be a priority for RESTORE Act funding. For decades, the oil and gas industry has contributed to the landscape-scale loss of marshes and wetlands throughout the region. This industrial activity, combined with sea level rise due to climate change, results in 75 square kilometers of Louisiana wetlands eroding into the Gulf of Mexico annually. Lost along with this acreage are the social and economic benefits they provide to society, including buffering storm surge, filtering pollution, and serving as nursery habitats for fisheries.

One might assume that environmental restoration projects would be a tough sell in the Republican-dominated Gulf Coast states. However, a new poll of Gulf Coast residents commissioned by the Theodore Roosevelt Conservation Partnership and The Nature Conservancy found that 68 percent of respondents prefer that RESTORE Act money be used “mainly for restoration of our beaches, wildlife habitat, coastal areas, rivers and other waters that affect the Gulf Coast,” while just 17 percent prefer funds be “mainly” used for infrastructure projects. That figure is actually higher among Republicans, at 71 percent, and independents, at 75 percent, than among Democrats, at 60 percent. Furthermore, the conservative think tank R Street supported this bipartisan approach in a 2013 report, calling wetlands restoration “an excellent example of a public good that the RESTORE Act can and should fund.”

Conclusion

Even if all goes smoothly, the settlement will not be finalized until sometime in 2016—possibly around the time the Mark Wahlberg action-drama “Deepwater Horizon” is set to be released on September 30. At least now the federal, state, and local entities that will be faced with managing this massive payout know how big their pieces of BP’s pie are likely to be. It will then be up to them to ensure that all Gulf Coast stakeholders make the most of this opportunity to do what then BP CEO Tony Hayward promised to do in the immediate aftermath of the spill: “Make this right.”

Michael Conathan is the Director of Ocean Policy at the Center for American Progress. CAP policy analyst Shiva Polefka, economist Michael Madowitz, and intern Elise Pi contributed to this brief.

* Author’s note, April 5, 2016: The final settlement approved by Judge Carl Barbier on April 4, 2016 was for $20.8 billion. According to a statement from BP as reported in The New York Times, this amount will not require the company to spend more than the $18.7 billion initially agreed to but “included amounts previously spent or disclosed by the company.”