President Barack Obama’s budget proposal for fiscal year 2014 would eliminate $39 billion of special tax breaks for Big Oil companies over the next decade as part of comprehensive business tax reform. These companies earned billions of dollars in recent years due to high oil and gasoline prices and do not need additional support from taxpayers. These tax breaks emerged over the past 100 years to help the then-nascent industry develop, and they relieved the oil and gas industry of $466 billion in tax payments to the federal treasury between 1918 through 2009, according to DBL Investors. Now that the oil and gas industry is fully developed and mature, President Obama’s budget would end this century of largesse.

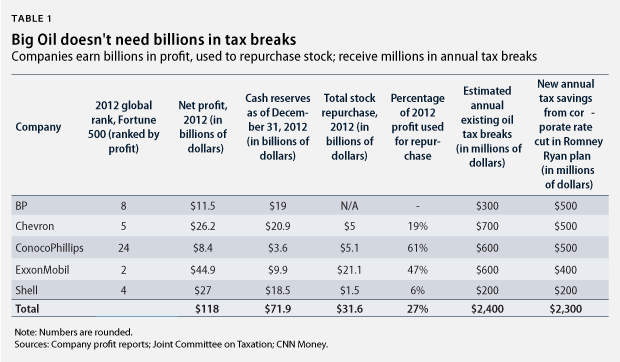

The five largest oil companies—BP, Chevron, ConocoPhillips, ExxonMobil, and Shell—earned a combined total of $255 billion in 2011 and 2012, largely a result of higher oil prices. Meanwhile, these companies are producing less oil, have $72 billion in cash reserves, and are using one-quarter of their profits to buy back their own stock to enrich their largest shareholders. (see Table 1) Reuters reported last year that Chevron, ConocoPhillips, and ExxonMobil—the three largest American oil companies—paid half or less of the standard corporate tax rate. President Obama’s budget recognizes that oil companies no longer need tax relief.

In contrast, the House of Representatives would continue to provide tax subsidies for one of the richest industries in the world. It passed an FY 2014 budget authored by Rep. Paul Ryan (R-WI) that retains these existing special tax preferences and provides yet another tax break on top of them. What’s more, the House budget cuts the corporate tax rate by nearly one-third, which would provide more than $2 billion annually in additional tax relief to the five largest oil companies.

The American Petroleum Institute, or API, serves as Big Oil’s lobbying arm and is spending tens of millions of dollars on ads and lobbying to pressure Congress to retain these special tax breaks. API equates eliminating special tax breaks with tax increases, when in actuality such legislation would simply make Big Oil pay its fair share of taxes. Economists recognize that tax breaks are simply federal government spending through the tax code, which also contributes to the budget deficit.

Donald Marron, the director of the independent nonpartisan Washington research group Tax Policy Center, explains that “a great deal of government spending is hidden in the federal tax code in the form of deductions, credits, and other preferences—preferences that seem like they let taxpayers keep their own money, but are actually spending in disguise.”

Many influential conservatives also understand that tax expenditures have the same budgetary impact as direct government expenditures. Martin Feldstein, for instance, who chaired the Council of Economic Advisers under President Ronald Reagan, notes that tax expenditures are “those features of the tax code that are a substitute for direct government spending.” And in 2010 Rep. Dave Camp (R-MI), the current chair of the House Ways and Means Committee, observed that:

… we must admit that not all of that spending has been through increased appropriations or expanded entitlements; much of it has been through the back-door proliferation of “tax expenditures”—provisions that technically reduce someone’s tax liability, but that in reality amount to spending through the tax code.

The House-passed Ryan budget would keep existing special tax breaks and give Big Oil additional tax cuts, while also slicing vital middle-class programs, including education, science, and infrastructure. Meanwhile, President Obama’s proposal to eliminate $40 billion of special tax breaks for Big Oil as part of comprehensive business tax reform would make the tax code more fair.

Daniel J. Weiss is a Senior Fellow and the Director of Climate Strategy at the Center for American Progress.