A billion here, a billion there, and pretty soon you’re talking about real money.

— Sen. Everett Dirksen

Former Sen. Everett Dirksen (R-IL) could not have been more right—especially when it comes to transportation. Since fiscal year 2008, Congress has transferred $54 billion in general fund revenues into the Highway Trust Fund, or HTF, to stave off insolvency. Real money, indeed.

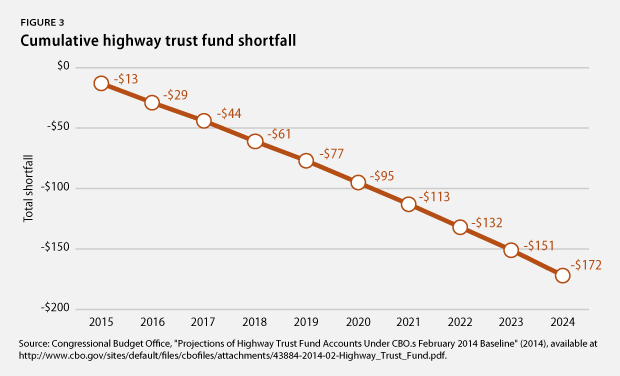

The most recent infusion came as part of the surface transportation authorization bill, Moving Ahead for Progress in the 21st Century, or MAP-21, which was intended to keep programs running through September 30, 2014. Yet the most recent estimates by the U.S. Department of Transportation, or USDOT, show the highway account within the fund will run out of money as early as July, with the mass transit account not far behind. Without new revenues or another general fund infusion, federal funding for surface transportation infrastructure will grind to a halt. This sudden stop will be especially disruptive and will arrive during the heart of summer construction season. The Congressional Budget Office estimates that over the next 10 years, the HTF—which supports highway and public transportation programs—will need $172 billion in additional revenue to remain solvent. In the absence of congressional action, states will receive no new contract authority in FY 2015, leading to an immediate drop in trust fund outlay of approximately $15 billion.5 The shortfall results from the way in which the federal government raises revenue to fund surface transportation infrastructure.

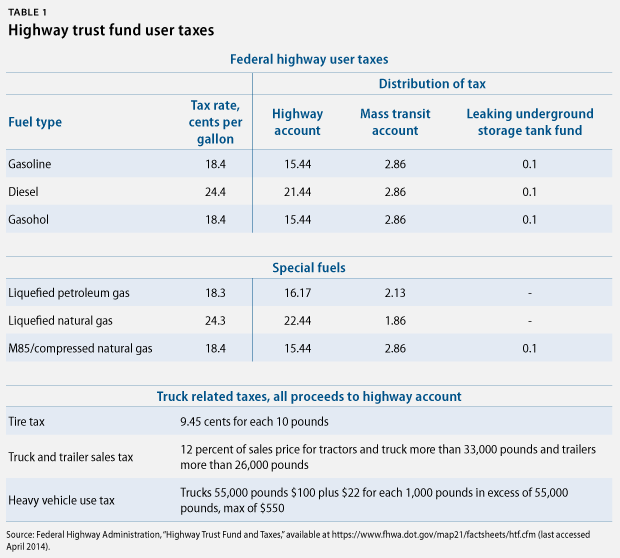

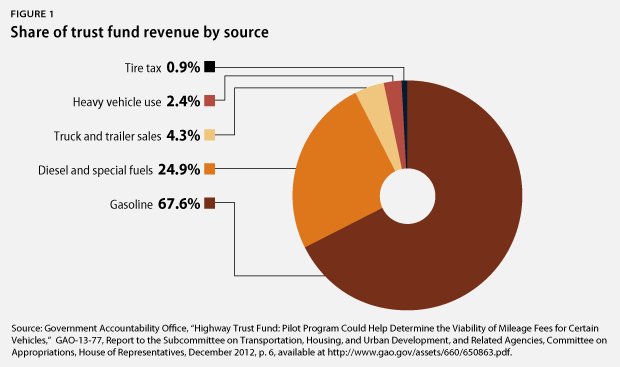

The current approach traces its origins to the passage of the Federal-Aid Highway Act of 1956. This landmark legislation established the HTF and ensured its continued capitalization by depositing federal gasoline and diesel fuel taxes within the fund. Currently, the federal government levies a tax of 18.4 cents per gallon on gasoline and 24.4 cents per gallon on diesel. These taxes were last raised in 1993.

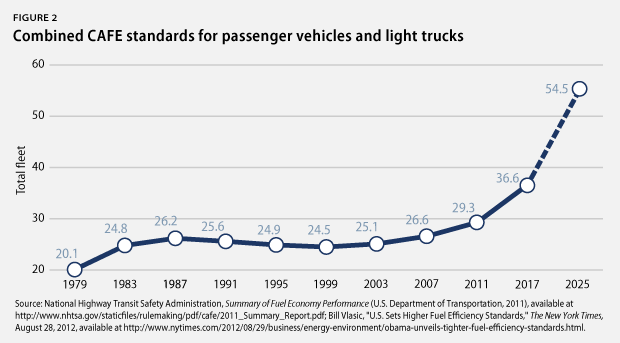

For more than five decades, gas tax revenues have been sufficient to fund highway and transit programs. However, dramatic improvements in vehicle fuel efficiency have significantly reduced the amount of revenue flowing into the fund. This situation will only get worse in the coming years. In 2012, the Obama administration finalized a rule that requires corporate average fuel economy, or CAFE, standards to increase from the current level of 29 miles per gallon to 54.5 miles per gallon by model year 2025. This will approximately double vehicle fuel efficiency, thus cutting gas tax revenues in half and decimating the HTF in the process.

Inflation has also eroded the purchasing power of gas tax revenues. In inflation-adjusted terms, the current gas tax is worth only 11.5 cents per gallon. If gas and diesel taxes had been indexed to keep pace with inflation, they would be 29 cents and 38 cents per gallon, respectively. In effect, states and metropolitan regions face a growing demand for more transportation investments at the same time the real value of federal dollars is falling.

The need for additional revenue is clear. Without more funding, the federal government cannot serve as a strong partner to states and local governments or effectively set national transportation policy. However, funding is only part of the picture. Congestion, especially within metropolitan regions, remains the largest transportation cost, followed by fatalities and injuries, system maintenance, and environmental externalities.

According to research conducted by Texas A&M University, congestion added 5.5 billion hours of additional driving last year and wasted 2.9 billion gallons of fuel, for a total economic cost of $121 billion. The Centers for Disease Control and Prevention reports that every 10 seconds, someone is involved in a vehicle accident and taken to the emergency room. Even more sobering, every 12 minutes someone dies as a result of a vehicle accident. The total economic cost of these losses tops $90 billion. System maintenance, which dominates the discussion of transportation costs, is the third-largest expense at a combined $62 billion for all government levels. Finally, environmental costs—while less straightforward and therefore difficult to calculate—are also significant. Research shows that each year, transportation-related pollution—mostly smog—costs the economy $50 billion. As these numbers show, the policy challenges facing Congress are larger and more complex than the narrow issue of trust fund solvency and asset management.

How we pay for transportation infrastructure affects not only how much we build but also how well the system performs over time. In short, system finance and performance are intimately linked. Transportation financing options exist on a spectrum with some taxes and fees completely disconnected from system use while others are directly tied to use. The more closely the tax or fee is tied to system use, the greater its ability to reduce travel demand and improve system performance.

For example, take three of the most common forms of transportation tax: vehicle fees, gas taxes, and tolls. Vehicle fees levied by states function like a property tax and are not connected to use. Vehicle owners pay an annual fee regardless of how much, when, or where they drive. These fees are attractive to many states because they provide predictable and stable revenue. After all, the total number of registered vehicles does not change significantly from year to year and tends to rise over time.

Gas taxes—both state and federal—fall in the middle of the spectrum, as they are tied to use, but only loosely. Significant differences in fuel-efficiency rates mean some light-duty vehicles can travel as many as 50 miles per gallon while others can only travel 15. Moreover, gas taxes are collected not at the point of use but instead at the wholesale level, with most of the cost passed along to consumers. The resulting tax revenue supports a number of different highway and public transportation programs, with states determining how to allocate funds based on competing needs. Gas taxes provide a macro-level indicator of overall travel demand and fuel consumption, but they do not capture use by day, time, direction, or facility.

Tolls, by comparison, are directly tied to use and levied on drivers when they enter a specific facility. Tolls finance the construction and maintenance of specific roadways rather than surface transportation programs more broadly. Moreover, toll rates may be adjusted in real time to manage travel demand and ensure conditions remain free flowing. Unlike vehicle fees and gas taxes, tolling only works on highways with strictly controlled access and cannot be scaled up to finance federal surface transportation programs.

As Congress considers alternative mechanisms, four criteria should inform its final choice. First, the funding source must generate sufficient revenue to cover current needs and grow in the future to support an expanding economy and population. Second, the source should connect as directly as possible to system use. Third, the funding source should allow for active system management to provide the best system performance at the lowest cost. Fourth, the funding mechanism must be able to be implemented nationwide.

Simply raising additional revenue is not enough. In order to meaningfully address the growing costs of congestion, Congress must adopt a funding mechanism that not only raises new money but also ties closely to system use and allows state and local officials to effectively manage travel demand. The most promising, efficient, and fair alternative is a fee based on the number of miles a person drives in a year—often referred to as either a mileage-based user fee, or MBUF, or a vehicle miles traveled, or VMT, fee. These two terms will be used interchangeably throughout this report.

An MBUF meets all four criteria. First, it would raise substantial revenue and allow for growth over time. A mileage fee of 1.3 cents per mile would raise the same amount of revenue as the current gas tax. A mileage fee of 2 cents per mile would raise the same revenue as a gas tax increase of 15 cents.

Second, a mileage fee connects directly with system use by charging drivers based on the number of miles they travel each year. Gas taxes are only a loose approximation of system use, given the substantial differences in vehicle fuel efficiency. A mileage fee would address this shortcoming by accurately capturing how much each driver uses the system.

Third, the underlying technology used to assess the mileage fee could also allow the application of congestion pricing to help manage travel demand. States and metropolitan regions would have the option of adding a congestion charge in addition to the federal flat mileage fee to help manage travel demand. States and regions could also tailor their mileage charges to address important social and regional equity concerns unique to their regions.

Fourth, a mileage fee system could be implemented on a national scale over a number of years without expensive retrofitting of existing vehicles or other transportation infrastructure. For mileage-fee-participating drivers, state departments of transportation would use fuel-efficiency ratings based on the make and model year from the Environmental Protection Agency, or EPA, to estimate total fuel consumption. Using this figure, states would credit participating drivers for the gas taxes they have already paid at the pump, issuing a refund or bill depending on the balance of mileage charges. Once the entire vehicle fleet has adopted the new technology, gas taxes would be removed. Unlike tolling, a mileage system would not require the construction, maintenance, or staffing involved with expensive toll facilities.

A VMT fee also removes the incentive for states to penalize drivers of advanced technology vehicles with additional taxes since all users would pay the same per-mile rate regardless of vehicle technology. If we decouple system finance from fuel consumption, technology advances that promote a clean environment will no longer undermine infrastructure programs.

A mileage-based fee presents significant policy advantages over other potential revenue options, all of which fail to meet one or more of the four criteria listed above. Some advocates have called for raising revenue through nontransportation sources such as customs duties, energy royalties, and/or allowing multinational corporations to repatriate a share of their earnings at reduced tax rates. These potential revenue sources are disconnected from system use and would not allow for active system management. Moreover, their revenue generating potential is questionable.

Policy recommendations for MAP-21 reauthorization

In 1956, the gas tax was an attractive financing mechanism because it generated robust revenues and conformed to the principals of sound tax policy—namely, that a tax should be feasible, enforceable, user friendly, and affordable to administer. In short, the gas tax produced needed revenues and conformed to the technological limitations of its time.

However, the same technology constraints do not apply today. In fact, one of the biggest differences between then and now is the development of advanced telecommunication and information technologies that enable the collection of alternative revenues that were unimaginable even a few years ago. Specifically, new technologies allow for drivers to be charged based on the number of miles they drive rather than on how much fuel they burn.

Transitioning to a mileage fee will require time. However, the fiscal cliff facing transportation is only a few months away. The trust fund needs immediate revenue to provide stability while a mileage system scales up. As discussed above, the current authorization measure will expire on September 30, 2014. Congress should therefore take the following steps:

- Raise the gas tax by 15 cents per gallon with an equivalent percentage increase on diesel in order to provide time for a transition to an MBUF.

- Authorize $100 million to fund state-based demonstration projects in 10 to 15 states to test different VMT technology platforms, administrative approaches, and privacy protocols.

- Establish a surface transportation revenue office within the Office of the Secretary of Transportation to facilitate demonstration projects, provide technical assistance, share best practices, and fund independent research on privacy standards for vehicle data.

Dramatic improvements in vehicle fuel efficiency have eroded the long-term viability of the gas tax as a primary source of transportation revenue. Raising the gas tax will stabilize the trust fund and provide transitional revenue to serve as a bridge to an MBUF system. Each penny in gas tax generates approximately $1.7 billion in annual revenue. Current gas and diesel taxes produce approximately $37 billion in revenue—roughly $15 billion less than what is needed to sustain federal surface transportation programs at their current levels. A 15-cent increase would generate $25.5 billion in new revenue. This increase would not only cover the shortfall but would also allow for some programmatic growth in future years as the system changes over to a mileage fee.

The one thing Congress cannot afford to do is wait. The shortcomings of the gas tax are clear, and they will only get worse over time. Similarly, the challenges and economic costs of congestion will increase as our country continues to grow. States and metropolitan regions need a strong federal partner that provides predictable funding over many years in order to implement big, complex projects. A mileage fee would provide the funding certainty to build critical projects and the technological platform needed to effectively manage travel demand. Importantly, a federal MBUF would not involve any congestion pricing. Rather, states and metropolitan regions with the worst congestion could choose to levy additional charges separate from the flat federal fee.

Kevin DeGood is the Director of Infrastructure Policy at the Center for American Progress. Michael Madowitz is an Economist at the Center.