See also: Achieving Middle-Class Economic Security Through Raising Wages and Rebuilding Wealth

Report chapters

The American middle class is finally seeing economic gains after more than a decade of declining economic security. Yet millions of Americans are still feeling the effects of a painful economic period.

Middle-class wages and incomes grew rapidly during the 1990s, but that growth came to an end around 2001. Seven years of stagnant middle-class income growth were followed by the financial crisis of 2008 and the Great Recession, which ravaged middle-class jobs and savings. And in recent years, ill-advised austerity policies have slowed the recovery of jobs and wages while income inequality has reached new heights. Add to this the growing costs of child care, health care, higher education, and housing, and families are feeling squeezed. On top of that, saving for retirement has become a monumental challenge, since far too many middle-class families are barely able to get by.

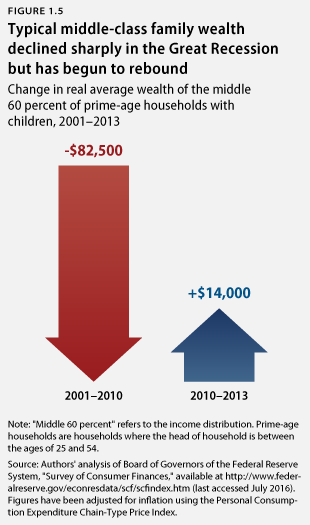

The precarious state of middle-class finances emerges clearly in the trends for household wealth: The average middle-class household’s net worth—the difference between the savings it owns and the debt it owes—fell an astonishing 49 percent, or $82,500, between 2001 and the aftermath of the financial crisis in 2010. Not only has this left families more exposed to the ordinary ups and downs of the economy and regular life, but it has also placed the basic tenets of middle-class life—such as paying for college and retiring comfortably—frustratingly and increasingly out of reach.

But there are signs of hope. The unemployment rate has fallen from a high of 10 percent in October 2009 to 4.9 percent in July 2016. Real median household income in 2016 has recovered to its 2000 levels. And real wage growth—the heretofore missing element of the recovery—made its first appearance in the recovery last year. And middle-class wealth too has begun to recover, growing $14,000, or 16 percent, between 2010 and 2013.

Nevertheless, public policy can and must deliver better results for the middle class and those who seek to enter it. Despite largely stagnant middle-class household incomes, real gross domestic product, or GDP, per capita grew 16 percent and the share of income going to the top 10 percent rose between 2000 and 2016. Middle-class wealth remains $68,000 below its 2001 level. This is unacceptable and demonstrates the need for policies that will help all Americans share in the fruits of economic growth.

Much progress has been made in the past eight years. A stimulus bill helped prevent another Great Depression, a health care reform bill expanded health insurance coverage to millions of Americans, and far-reaching Wall Street reform significantly improved financial stability and consumer financial protection. Unfortunately, additional measures that would support job creation, raise middle-class wages, and rebuild wealth have been repeatedly blocked. No wonder many Americans feel that the system is rigged against them.

In January 2017, the next president and the U.S. Congress will have the opportunity to generate policies that grow and support the middle class. A policy agenda that raises wages and reduces the burdens of major expenses would help families rebuild their wealth and afford the pillars that make up a secure, middle-class life. This report provides a roadmap for doing just that.

At the same time, an economic agenda that helps the middle class would simultaneously give a boost to low-income families trying to enter it. Raising wages by returning the economy to full employment and restoring worker bargaining power are two of the most effective ways to increase economic mobility. Indeed, recent Center for American Progress research shows that children of fathers without a college education who grow up in union households earn 28 percent more as adults than children of fathers without a college education who do not. Similarly, reducing the price of key human-capital investments such as child care and higher education would make it easier for low-income families—and their children—to enter the middle class.

The course of the past 15 years demonstrates that addressing genuine problems is never easy. And while Americans have made progress, much more remains to be done. In this report, we* outline the squeeze that middle-class families have been feeling and summarize the policy prescriptions to relieve it. We provide analyses of the causes behind—and solutions to—these middle-class challenges.

The challenge to middle-class wages and wealth

To capture the financial state of middle-class households, income and wealth are two critical starting points. Income, which includes wages, reflects the amount of money households receive each year, while wealth is the value of families’ assets—such as savings and houses—minus their debts, such as mortgages and credit cards. Together, income and wealth help determine the ability of households to consume. Wealth also reflects the ability of a household to weather economic shocks such as job loss and to provide for long-term needs such as education for children and retirement. Thus, examining the trends for real incomes and real wealth—that is, their levels after adjusting for inflation—reflects how well both have kept up with the cost of living.

For the purposes of our analysis, we focus on households with children in which the head of household is between the ages of 25 and 54. We focus on this group since it is in this life stage that families need to make important investments such as child care and college. We define middle class as the middle three income quintiles of this group, or the middle 60 percent of households ranked by income. Defining the middle class is a difficult concept, but this group is both broad enough to calculate meaningful statistics on the financial state of the middle class and narrow enough to allow for a distinction to be made between wealthy, middle-class, and low-income households.

Most of the analysis ends in 2013 since that is the last year for which our primary data source—the Federal Reserve’s Survey of Consumer Finances—provides data, but we provide more updated statistics for context when they are available from other sources.

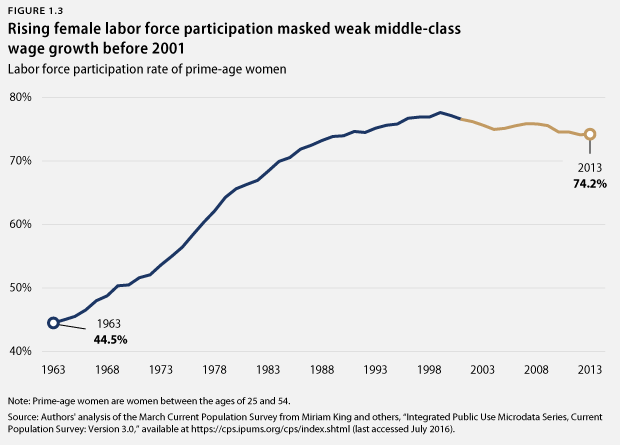

Incomes and wages

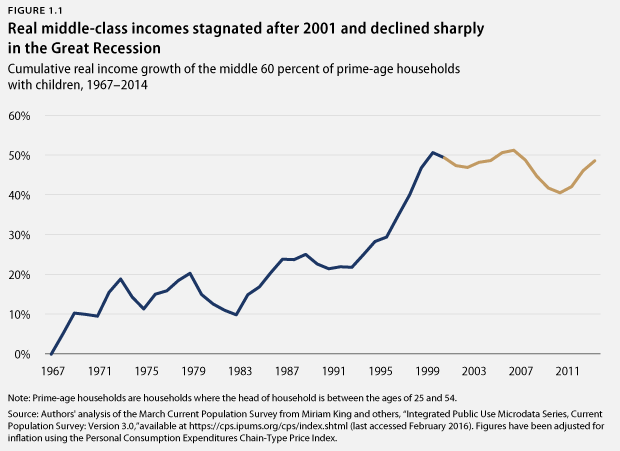

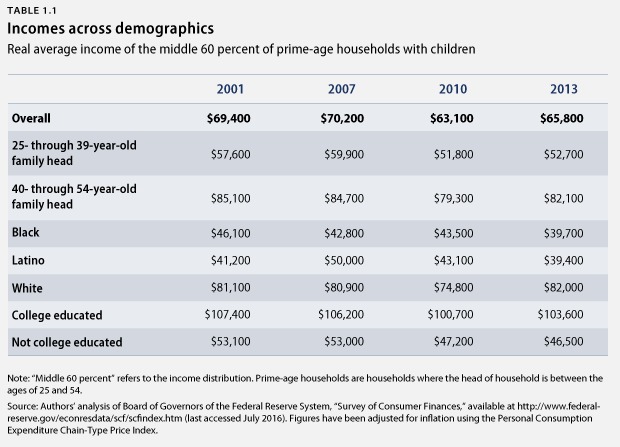

Incomes grew rapidly—if somewhat unevenly—over the second half of the 20th century, enabling middle-class households to pay for college, purchase homes, and build nest eggs for retirement. Beginning around 2001, however, 40 years of growth came to an end. Middle-class incomes were not growing before the 2007–2009 Great Recession and, as of 2013, were still 5 percent below their 2001 levels. This trend held across families regardless of the head of household’s age, race, and level of education and developed despite a 10.8 percent increase in real GDP per capita. In other words, the middle class did not share in the period’s economic gains. More recent data suggest that middle-class incomes in 2016 have finally reached their 2000 levels—a fact that still amounts to more than a lost decade for middle-class income growth.

The main reason middle-class incomes stagnated after 2001 is that their most important component—wages—has also been stagnant. But wage stagnation began long before: Real middle-class wages fell between 1973 and 1990. Indeed, the 1990s have been the only business cycle since 1973 during which real middle-class wages grew faster than 1 percent per year. (see Figure 1.2) Real middle-class incomes, on the other hand, continued to grow between business cycle peaks during the 1970s and 1980s.

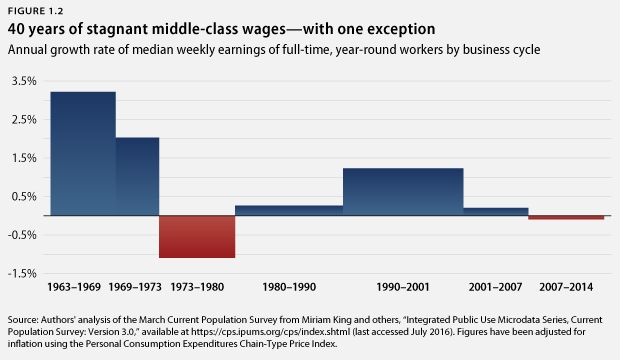

How do we reconcile the negative wage growth for workers between 1973 and 1990 with families’ continued income growth during that period? Families’ incomes mostly reflect their hourly wages multiplied by the number of hours they work per year. When wages do not rise, families can raise their incomes by working more hours. The surge in female labor force participation during this period shows that they did just that, as shown in Figure 1.3.

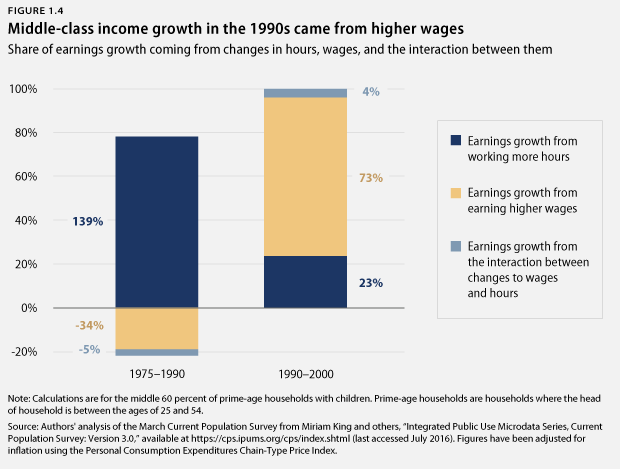

Middle-class families thus offset stagnant wages for each worker by working more hours, many of them transitioning from one- to two-earner households. The entire inflation-adjusted increase in middle-class incomes from 1975 to 1990 came from increased workforce participation and hours rather than higher wages, as shown in Figure 1.4.

In the 1990s, a unique period of productivity growth and a tightened labor market forced employers to compete for workers by raising wages. Almost three-quarters of middle-class earnings growth between 1990 and 2001 came from higher wages rather than workers putting in more hours, reversing the trend of the previous 15 years. At the same time, female labor force participation reached its peak. The confluence of these factors drove middle-class incomes to reach their peak around 2001.

The 2000s, however, marked a return to stagnant middle-class wage growth, but families could no longer simply rely on working more hours. Middle-class women, who drove the previous growth in hours, had already dramatically increased their labor supply, working 558 more hours per year in 2007 than in 1975—the equivalent of almost 14 additional 40-hour work weeks. Raising female labor force participation even further was certainly possible, but it would have required either higher wages to draw more women into the labor force or the type of family-friendly policies that the United States lacks, such as paid leave. And after the Great Recession, both men and women have struggled to find work in an economy that, for most of the past several years, has remained far from full employment.

The above analysis of incomes focuses on the trend for pretax income and does not include the effects of noncash transfers from the government, such as Medicaid, and from employers, such as employer-sponsored health insurance. Some analyses that include these transfers show stronger middle-class income growth than described above. However, close examination of these analyses shows that the income gains come almost entirely from tax cuts and transfers, rather than the ability of families to get ahead through work. Moreover, the gains are likely to be overstated because of their treatment of health care inflation. (see Textbox on p.52)

Wealth

Most analyses of the financial state of the middle class focus on income, but wealth is also important. Indeed, 86 percent of Americans view the ability to save money as a requirement for a middle-class lifestyle. In this section, we analyze the trend for household wealth using the above definition of middle-class—the middle three income quintiles of families with children whose head of household is between the ages of 25 and 54.

Wealth primarily serves two main economic functions. First, it serves as insurance against economic hardship in the event of layoffs and other financial emergencies when families need to spend more than their incomes. Second, it allows families to make the most important and largest expenditures—everything from paying for higher education to buying a house to saving for a comfortable retirement.

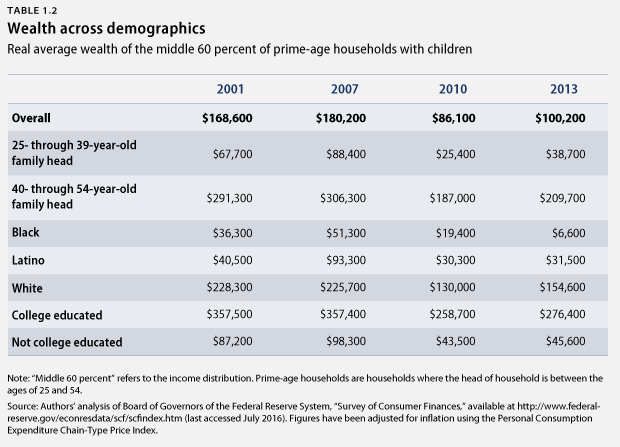

Unfortunately, the wealth that has traditionally formed the economic and political foundation for the middle class has undergone an even more disturbing convulsion than the corresponding trend for income. While the average middle-class household’s wealth grew slightly between 2001 and 2007, it collapsed beginning in 2007 with the onset of the financial crisis and the Great Recession. The result was a $82,500, or 49 percent, decline in average middle-class household wealth, comparing 2001 to 2010, and an even starker decline compared to 2007. The collapse in wealth from the financial crisis occurred regardless of the head of household’s age, race, and education. (see Table 1.2)

2013, the most recent year in which these data are available, showed a modest recovery for household wealth: growing $14,000, or 16 percent, from its low point in 2010. However, average middle-class household wealth is still $68,000, or 41 percent down from 2001. More recently, housing and stock market prices have finally recovered to their pre-crash levels nationally. Many communities, though, still struggle to fully recover from the crisis. Overall, the wealth effects of the financial crisis and Great Recession have been tangible and long-lasting, harming families’ feelings of economic security, their ability to pay for college, and confidence that they will enjoy a secure retirement.

A particularly disturbing phenomenon is that the wealth of African American households—which was always far below that of white households—has essentially disappeared, falling from $36,000 in 2001 to just $7,000 in 2013. A likely reason for this enormous loss is that African Americans suffered a disproportionate loss of housing wealth, made worse by the fact that housing represents a far larger portion of black families’ assets than of white families’ assets. Subprime lending and particularly aggressive predatory lending practices were far more prevalent in communities of color leading up to the housing crisis: African American and Latino borrowers were 30 percent more likely to receive the highest-cost subprime loans than white subprime borrowers with similar risk profiles. It should then be no surprise that the foreclosure crisis hit black homeowners disproportionately. African Americans were 47 percent more likely to face foreclosure than non-Hispanic whites in 2010, and there is a strong relationship between metropolitan areas’ degree of racial segregation and the number of foreclosures they experience.

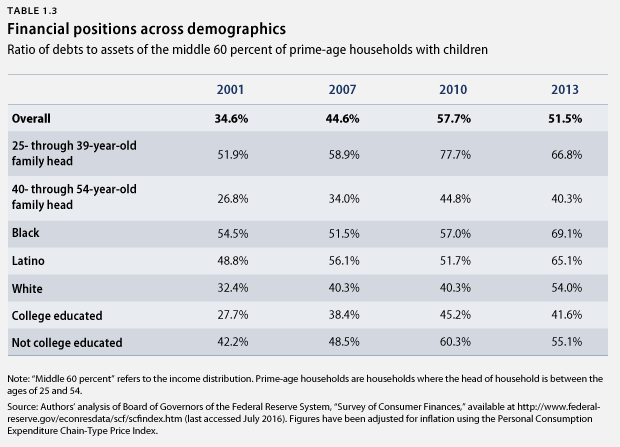

It is no coincidence that middle-class wealth declined during a period in which incomes stagnated and middle-class costs rose. Unable to cope with stagnant wages by increasing female labor force participation, middle-class families responded by reducing their savings and—in some cases—actually reduced their savings by borrowing. The middle-class savings rate declined during this period, and the rise in borrowing was concentrated in areas where real incomes were declining.

The housing bubble in the mid-2000s masked and even exacerbated the decline in middle-class savings rates. Thus, although middle-class wealth ostensibly grew between 2001 and 2007 due to a 46 percent real increase in home prices that caused middle-class residential assets to rise in value, households also took on more debt. Higher housing prices meant that families had to take out larger mortgages to purchase a home, and many existing homeowners responded to the increase in their house’s value and the stagnation of their wages by borrowing against their home to finance consumption. This increase in debt left middle-class wealth extremely vulnerable: Housing prices could decline, but the debt would remain. Fueled by consumer protection failures, that is exactly what happened in 2007 and 2008, with long-lasting consequences.

The arrival of the financial crisis and Great Recession destroyed trillions of dollars in middle-class wealth. The decline in real housing prices and the rise in foreclosures left middle-class residential assets at around their 2001 levels but with substantially more debt. (see Table 1.3) Middle-class nonresidential assets—especially financial assets—had actually been declining between 2001 and 2007, consistent with the decline of the middle-class savings rate during that period. But they then fell sharply during the financial crisis and the Great Recession as a result of the stock market crash, declining small business ownership rates and value, the tendency of many investors to buy high and sell low, and the need to make up for the real decline in earnings.

Recently, real home values have returned to their pre-crisis levels nationally and the stock market has reached all-time highs. Middle-class wealth has begun to recover as well, rising 16 percent above 2010 lows. Rebuilding middle-class wealth will require solutions that solve the problem that caused it to decline in the first place: stagnant wages and incomes, as well as the rising costs of child care, higher education, housing, and retirement. It also requires policies that protect against financial crises and ensure a quick and robust return to full employment should recessions hit.

Under pressure: Middle-class costs

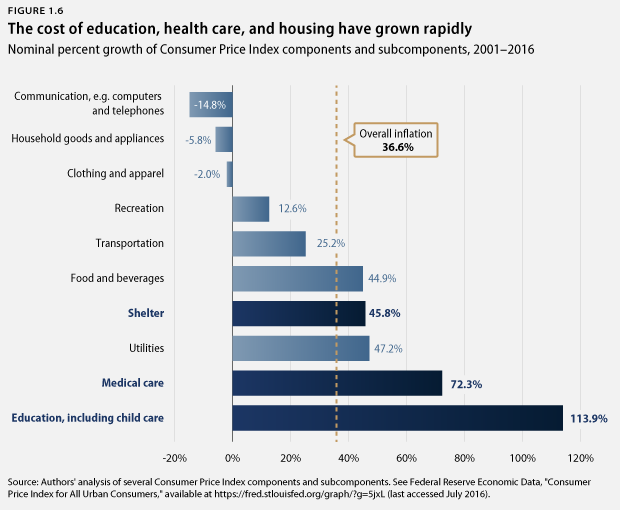

The other part of the story is the high cost of several middle-class necessities. Even as inflation across a wide variety of goods and services has been relatively modest for many years, big-ticket necessities such as housing and education have increased much faster. The price of education—which includes higher education and child care—rose more than three times faster than overall inflation between 2001 and 2016, as shown in Figure 1.6. The goods that have seen their prices fall the farthest, on the other hand, have been durable consumer goods such as communications technology—cell phones and computers, for example—whose price has actually fallen in nominal terms.

It is noteworthy that necessities and human capital investments have gone up the most in price. This places families at risk should their incomes suddenly decline. Normally, when a family member loses a job or faces a medical emergency, the family can save money by forgoing purchases of discretionary consumer items, such as televisions, in order to continue to pay their mortgage or pay for child care. Yet because the prices of these durables have declined relative to the prices of necessities and human capital investments, the savings from delayed discretionary purchases are smaller than ever.

While each of these costs—child care, higher education, health care, and housing—require their own story, a common thread that weaves them together is how inequality affects both the cost and affordability structures of these big-ticket items. Whether it is growth of expensive technologies in health care or the inability to save for a down payment on a home, low-income and middle-class families are buffeted by expenses that challenge their budgets and balance sheets.

Important policy advances, such as the Affordable Care Act, along with the broader slowdown in health spending growth, have helped cool the growth of some costs. Lower health cost growth, however, has been disproportionately captured by employers, who have not passed along savings to their employees. Progress in other areas has been imperfect, often stymied by backsliding, austerity-driven policies at the federal and state levels. A stark example is in higher education. Although the 2009 stimulus package provided much-needed support to states hamstrung by state balanced-budget rules, it was not sufficient to prevent many states from cutting their support to higher education. Congress has since refused repeatedly to help states avoid higher education cuts, which too often result in families paying more in tuition.

More generally, reducing the prices of critical goods and services such as child care, health care, and housing is an effective way to boost real middle-class economic security. An added benefit is that even as inflation has hovered at quite a low level for most of the past decade, reducing the cost of these more expensive services would raise productivity, giving the Federal Reserve additional space to boost employment and wages without worrying about generating excessive inflation.

Policy response and recommendations

Economic insecurity is not an inevitable condition; the right policy choices can have a tremendous impact. Much of the devastation that was wrought on household incomes and wealth, as well as the major growth trends in high cost services, occurred prior to and immediately following the global financial crisis. In many ways, the past eight years have been spent cleaning up that economic mess. And from health care to consumer financial protection to student debt, we have achieved important progress in addressing the middle-class squeeze.

Yet much more remains to be done in addressing the wage, wealth, and cost challenges that the middle class faces today to ensure that the economy works for everyone and not just the powerful few.

This report offers a package of policy solutions that can help restore economic security to the middle class and grow the economy for those at all income levels. The American people clearly want the federal government to act. This report offers a roadmap for how to do so.

More specifically, it looks at ways to boost middle-class economic security in six crucial areas: jobs and wages, early childhood education, higher education, health care, housing, and retirement. Together, they make up the pillars of a middle-class life. Policies that improve Americans’ ability to obtain each of these will make it easier for families to rebuild their financial foundations and restore the social contract that has made a vibrant middle class the heart of America’s ongoing effort to build a more perfect union.

Listed below are some of the recommendations that the subsequent chapters explore more fully. The impact and implications of the overall trend outlined in this report are also explored for a range of groups and topics, including immigrants; lesbian, gay, bisexual, and transgender, or LGBT, individuals; the disabled; and African American and Latino communities.

Jobs and wages

- Use fiscal policy to support growth, for example, by investing in infrastructure. An investment in infrastructure would generate jobs in the short run while raising productivity in the long run. Policymakers should make a $500 billion investment in infrastructure over the next 10 years while adopting measures to ensure that infrastructure investments deliver the highest economic, environmental, and social returns.

- Promote business investment by orienting corporate incentives toward the long term. Aligning the incentives of the corporate sector could foster a long-term approach that boosts productive investments, which drives economic growth and helps workers and firms both get ahead.

- Make employment more resilient. Policies that make it easier for workers to reenter the workforce would raise demand in the short term while increasing productivity in the long term. Temporary national service positions during periods of high unemployment, a national subsidized jobs program, reform to unemployment insurance, and a jobseeker’s allowance would all help the unemployed remain in or reenter the labor market.

- Ensure monetary policy targets full employment. Full employment promotes higher wages and quality jobs for Americans. Given persistently low inflation, monetary policy should be targeted at generating a high-pressure economy with robust wage and employment growth.

- Protect wage growth by preventing financial crises. Financial crises and their aftermaths can devastate middle-class wages and wealth. The reforms enacted after the 2008 financial crisis and recession, including the Dodd-Frank Act, must be maintained. Policymakers should take additional steps to mitigate emerging systemic risks.

- Restore worker bargaining power. Unions are one of the most important vehicles for raising middle-class wages. Worker bargaining power should be restored by changing labor market rules to encourage industry-wide collective bargaining.

- Deploy profit-sharing. Broad-based profit-sharing plans can raise middle-class incomes by enabling workers to share in the benefits of productivity growth.

- Address the labor market effects of globalization. Trade policy should promote greater automaticity in enforcement and higher standards for labor and the environment, among other changes to level the playing field.

- Rebuild labor standards. Government should provide a baseline set of employment standards for all working Americans. This means raising the minimum wage and enacting protections against job-scheduling volatility.

- Reinvigorate competition policy. The active enforcement of antitrust policy would ensure that business profits are shared more widely by, for example, reducing the growth in consumer prices, enabling workers to compete for higher wages, and providing more opportunities for small- and medium-sized businesses to grow.

- Support consumer financial protections. Consumer financial protections prevent unfair reductions in take-home earnings and level the playing field for high-road companies that do the right thing.

- Enact family-friendly policies to protect human capital. Workers who take extended absences from the labor market to take care of children or an elderly parent suffer lifelong earnings losses. Family-friendly policies such as paid family and medical leave and paid sick days—as well as the child care and early education policies spelled out below—would raise both labor force participation and wages.

- Raise wages by expanding opportunity. A suite of policies should be deployed to help maximize the value of American workers and their incomes, including investing in workforce training, expanding and diversifying entrepreneurship, and eliminating unfair barriers to formal employment.

- Use tax policy to promote fairness. The U.S. tax code, while progressive, would benefit from changes that support middle- and low-income Americans while ensuring that financial gains are taxed fairly. The federal government should collect enough revenue to fully fund much-needed public investments.

Child care

- Enact the High-Quality Child Care Tax Credit. This new tax credit would put quality, affordable child care within reach for working families. It would provide low-income and middle-class families with up to $14,000 per child, with eligibility limited to families earning up to four times the poverty level, or $97,000 for a family of four.

- Create a federal-state partnership to provide universal preschool. Congress should authorize a universal preschool program to prepare 3- and 4-year-old children for school. The federal government should partner with states and share the cost of expanding preschool to low- and middle-income children.

Higher education

- Reshape the financial aid system through College for All. Policymakers should overhaul the federal student financial aid program to provide greater guarantees that college will be affordable for low- and middle-income students. This includes additional federal aid as well as requirements for states to maintain postsecondary education funding.

- Simplify the federal financial aid application to make it easier to apply for grants and loans from the U.S. Department of Education. Paperwork should not be a barrier to college affordability. The Department of Education should allow students to apply for financial aid while still in high school and limit how often they must reapply.

- Simplify student loan repayment to support affordability. The federal government should make it easier for federal loan borrowers to make payments equal to an affordable share of their income. This includes allowing borrowers to sign up for income-based repayment plans for multiple years at once and experimenting with automatic enrollment into these plans.

- Ensure that students have high-quality options. Congress should create accountability measures to monitor and reduce student loan default.

Health care

- Address cost shifting with increased transparency and shared savings. Policymakers should require employers to increase transparency on annual costs to illuminate and discourage cost-shifting. As a further safeguard, employers should have to share savings in particularly egregious cases. In addition, Congress should require health plans to include three free primary care visits per enrollee per year.

- Combat excessive drug prices. The federal government should categorize new drugs by their comparative effectiveness and develop value-based payment recommendations. Drug companies should be required to justify prices outside of the recommended payment range and to invest more in research and development. In addition to these steps to address the overall price of drugs, out-of-pocket prescription drug costs for individuals should be capped.

Housing

- Reform mortgage credit practices to boost affordability and access. The federal government should ensure that creditworthy families have a fair shot at getting a mortgage. The Federal Housing Finance Agency, or FHFA, should finalize a strong Duty to Serve rule and modify fees that mortgage financers Fannie Mae and Freddie Mac charge for borrowers with suitable credit. Policymakers should also support and expand low down payment lending, help prospective borrowers save for a down payment, and support shared equity programs run by local governments and nonprofits.

- Promote neighborhood stabilization and reduce costs on the struggling middle class. Policymakers should commit to helping stabilize distressed communities, which includes supporting access to affordable housing for middle-class families. Federal agencies should prioritize home retention and tighten reporting standards for purchasers of nonperforming loans. Congress should work with federal agencies to implement a progressive agenda for rural housing finance; expand the Low-Income Housing Tax Credit, or LIHTC, program; ensure funding for the HOME Investment Partnerships Program and the National Housing Trust Fund; and strengthen the Section 8 housing choice voucher program. In addition, local governments should confront restrictive zoning policies in order to boost the supply of affordable housing.

Retirement

- Update Social Security provisions to support the vulnerable. Congress should increase the Social Security special minimum benefit and modernize survivorship and divorce benefits, as well as institute a caregiver credit.

- Innovate to make private retirement savings safer and more convenient. Congress should create a National Savings Plan to ensure that all workers are able to save at work; help states and the federal government provide collective defined-contribution plans; and reform retirement tax incentives to help those who need it most. Policymakers should also implement and defend the conflict of interest rule to protect savers from hidden, unfair costs that drain retirement savings.

Implemented together, the above policies will raise middle-class wages, reduce critical costs, and make it easier for families to accumulate wealth. In 2017, a new president and Congress will have the opportunity to demonstrate that they work for all Americans, not just the wealthy few, and all Americans should hope that they seize it.

*All instances of “we” and “our” in this section refer to the authors of this report.

Carmel Martin is the Executive Vice President for Policy at the Center for American Progress. Andy Green is the Managing Director of Economic Policy at the Center. Brendan V. Duke is the Associate Director for Economic Policy at the Center.