Introduction and summary

As of 2017, nearly 26 million acres of federal land1 were under lease to oil and gas developers in the United States.2 But according to the Bureau of Land Management (BLM), which oversees the federal government’s onshore subsurface mineral estate, not all of these leases are poised for future production. In fact, in 2017, less than half of the nearly 26 million acres were producing any oil and gas.3 But why would developers invest in acquiring these leases if only to sit idly on reserves and stall production? Companies point to a variety of possible factors that contribute to this stay in production on federal land: uncertainty in subsurface mineral deposits, shifts in commodity prices, high exploration costs, and the perception of endless government red tape that the industry blames for delays in development.4

But some public land advocates and lawmakers have suggested there might exist a more perverse incentive for companies to sit on undeveloped federal land.5 Once a company acquires a lease, it then carries those subsurface reserves as assets on its balance sheet. By doing this, a company can immediately improve its overall financial health, boost its attractiveness to shareholders and investors, and even increase its ability to borrow on favorable terms. While industry leaders have suggested it was “absurd” to think companies would continue to shell out millions of dollars in rental fees and lease acquisitions solely to pad their balance sheets,6 the relatively low cost of federal land nonetheless provides a strong incentive for companies to do just that. Because of this, companies have the potential to directly benefit from amassing these undeveloped reserves through federal land leases, while the U.S. taxpayer loses out on revenue that could—and should—be generated from wells actually producing oil and gas products. Meanwhile, these undeveloped leases tie up land that the federal government would otherwise manage for conservation, recreation, or other beneficial uses as required under the BLM’s multiple-use mandate.

This report explores these possible financial motivations for oil and gas companies to acquire and hold undeveloped federal leases as a means to bolster their bottom line and improve their financial health. By analyzing financial reports for publicly traded oil and gas companies from 2006 through 2017, the author determined that changes in Securities and Exchange Commission (SEC) reporting policies have allowed oil and gas companies to increase their booked reserves over time. This is thanks to an expansion of acceptable reporting standards for proved undeveloped (PUD) reserves—assets that have yet to be drilled for production. While the impact of acquiring PUD reserves on a company’s valuation or stock returns has been downplayed by some industry analysts who point to the high exploration and development costs for moving these undeveloped reserves to market,7 this report shows that booked undeveloped reserves do serve as a statistically reliable indicator of a company’s overall market value. In fact, immediately following the 2008 change in SEC reporting standards, the companies included in this study saw a marked increase in their booked PUD reserve levels and yet another increase in the correlation between these PUD reserves and overall market value. Though the global drop in oil prices in 2014 saw this trend reverse temporarily, the recent market rebound has resulted in a return to these high correlation measures between undeveloped reserves and market valuation. Overall, the author’s results suggest that this link provides adequate incentive for oil and gas companies to acquire federal leases with the purpose of increasing their booked reserves and bolstering their overall financial health, rather than bringing those leases into production.

Researching oil and gas financial reporting

While there has been no shortage of research and studies from the federal perspective examining the current trends in oil and gas leasing practices, little understanding or analysis exists that explores the industry side of this equation. This gap in current oil and gas analysis is almost certainly due to two major research obstacles: the lack of financial data available for companies that are not publicly traded and the wide diversity of businesses within the oil and gas industry. Financial accounting in the commodities market is a complex system that must account for a wide variety of external variables, including different valuation methods and guidance for companies depending on their business models and risk management strategies. All of this is to say that reporting on the financial incentives at play in acquiring federal land leases presents an array of challenges—not all of which are addressed within this report. Importantly, this report does not distinguish between upstream, or exploration and production (E&P), companies and fully integrated conglomerates. While reserve levels and reporting play an integral role in determining the fair market valuation of companies that fall into both these categories, integrated companies have far more external variables that could affect their total market capitalization or share price. This report does not include midstream and downstream companies, though reserve levels could potentially affect their business practices as well.

What is explored here are three primary scenarios under which a company may have sufficient financial incentives to acquire federal land leases as a means to increase reserves on their balance sheet. The first scenario is when a company benefits financially—either in the form of a rise in stock price value or market capitalization8—by increasing their booked undeveloped reserves, or those reserves reported on annually either publicly or to a company’s shareholders and investors. The second scenario is when companies pursue potential acquisition or merger options with another company. In this situation, the theory suggests that companies could obtain a higher acquisition price by demonstrating a high value of undeveloped reserves on their balance sheet. Finally, the author explores the practice of reserves-based lending to understand the degree to which undeveloped acreage can better position companies to ensure more favorable lending terms on long-term loans.

Not all of these scenarios apply to companies equally—each depends on the size, financial health, and business model of a particular entity. That said, all of these possible outcomes could provide companies—regardless of size—with sufficient incentive to acquire federal land in the hopes of bolstering their bottom line and pulling in additional investment.

An overview of the oil and gas leasing process on U.S. federal lands

The process by which federal lands and oil and gas reserves are managed by the federal government has long been criticized for the outdated and imbalanced incentive structure. The Mineral Leasing Act—which authorized the U.S. Department of the Interior (DOI) to lease federal lands for extractive purposes—has undergone few changes since it passed through Congress back in 1920.9 Royalty rates, bid minimums, and lease development terms have largely remained stagnant, resulting in a system heavily favored to the interests of oil and gas companies rather than to the American taxpayer. By one estimate, as a result of the federal government’s failure to modernize its oil and gas program, U.S. taxpayers are now losing out on more than $730 million in revenue every year.10 According to the Congressional Budget Office (CBO), between 2003 and 2012, the federal government leased about 25,000 parcels averaging 1,000 acres each in size. It leased half of these for less than $10 per acre, and about 4,000 parcels received no bids and were leased noncompetitively.11 Because federal leases are priced well below the market rate of both private and state-owned parcels,12 federal leases are an attractive option for companies looking to augment their reserves at minimal cost. But the same CBO report showed that these reserves often never even make it to market. In fact, for parcels leased between 1996 and 2003, all of which have reached the end of their 10-year exploration period, only about 10 percent of onshore leases issued competitively, and 3 percent issued noncompetitively, entered production.13 But why are companies acquiring these lands if not to develop them for sale? While shifts in commodity prices and questionable speculative practices are likely at play, another incentive traces back to the valuation practices within the oil and gas industry and the reporting standards established by the SEC in 2008.

Reporting requirements for oil and gas companies

According to the Oil and Gas Financial Journal, the primary determinants in assessing the value of an oil and gas company are its reserves, level of production, and commodity price at the time of valuation.14 While the latter two variables are relatively straightforward, the question of how best to measure a company’s reserve stocks has evolved over the years. For publicly traded companies in the United States, the SEC is the primary regulatory body that provides companies with guidelines on how to report resource classifications and reserve listings on their stock exchanges.

Overview of oil and gas reserve classification

In estimating reserves, oil and gas analysts classify reserves into three categories: proved, probable, and possible. SEC guidelines require oil and gas companies to report only on proved reserves—considered to be the most valuable with the lowest risk—on an annual basis as a way to standardize reserve volumes across the industry. Generally, proved reserves are broken down into three subcategories:

- Proved developed producing (PDP): These reserves can be expected to be recovered through existing wells with existing equipment and operating methods that are currently open and producing.

- Proved developed nonproducing (PDNP): These reserves can be expected to be recovered through existing wells with existing equipment and operating methods that are open at the time of estimate but are not yet producing due to situations including unfavorable market conditions, minor completion problems, or other setbacks.

- Proved undeveloped (PUD): These reserves are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for increased recovery. Reserves in undeveloped locations may be classified as proved undeveloped, provided the locations are within a defined proximity to commercially producing wells, and/or geological and engineering data from wells indicate there is a “reasonable certainty”15 that commercial recoverability can be met.

However, in 2008, the SEC published a rule called Modernization of Oil and Gas Reporting, or 17 CFR § 210.16 These revised rules for oil and gas reserve disclosures further defined the requirements for “proved reserves” in the hopes of giving investors and shareholders a more accurate understanding of a company’s current assets. According to the SEC, proved reserves are defined as the estimated quantities of oil and gas anticipated to be economically producible, as of a given date, under existing economic and operating conditions.17 Proved reserves can be defined as both developed or undeveloped and are classified into proved developed producing (PDP), proved developed nonproducing (PDNP), and proved undeveloped (PUD) categories. (see text box above)18 While oil and gas companies historically included PUD quantities within their annual financial disclosures, the 2008 rule goes a step further by broadening the terms under which a company could list undeveloped reserves as “proved” for both shareholders and potential investors.19

Within the classification of reserves, PDP is viewed as the least risky reserve class, while conversely, PUD is the riskiest and least certain reserve class for proved assets. While the new SEC regulations do not change this risk structure, they do give companies larger leeway in booking PUD reserves than they had in the past. The finalized definition of PUD reserves removed the previous “certainty” test that was required for reserves to be considered PUD reserves and replaced it with a “reasonable certainty” test.20 What does this slight shift in language mean in practice? In simplest terms, companies that would previously be required to invest capital in exploration drilling to meet PUD standards now can rely on both deterministic—involving actual drilling—and probabilistic methods to estimate PUD reserves. Importantly, this shift also allows the use of evidence—economic data, drilling statistics, and geoscience—gathered from reliable technology to meet the reasonable certainty test of economic producibility for lease parcels further removed from currently productive units, rather than just those units immediately adjacent to productive wells.21 Essentially, the area from which companies can estimate and book proved reserves was drastically increased as a result of the new rules. 22

As a result, the revised 2008 SEC guidelines have provided the oil and gas industry with what could be considered a regulatory windfall. Thanks to the loosened requirements on PUD estimates, companies now have both an opportunity to report on these risky reserves while also increasing the levels booked on their annual reports to shareholders and investors. This is not to say that the SEC ruling was not warranted—in fact, due to advances in technology, costly exploratory drilling is largely being replaced with probabilistic methods of assessment.23 That said, it was no secret that the Bush-era regulation was adopted in acquiescence to industry pressure as the oil and gas industry looked to rebound from the financial collapse of 2008.24 Industry analysts, both then and now, anticipated that the new rule would likely result in an increase—or overestimation—in PUD reserve volumes.25 Some even suggested that the new policies could result in a rise in correlation between transaction values, or the amount paid by one company to acquire the assets or shares of another company, and booked reserves26 as investors increasingly looked to reserve reports as a proxy for financial health. If these trends are, in fact, taking place, then a clear financial motive exists for oil and gas companies to acquire new federal leases on adjacent and nearby parcels, with little incentive in place to actually develop this acreage for market or for the BLM to consider land management options other than oil and gas development.

But if the revised SEC regulations now provide companies with added flexibility to report on these distinct reserve classes, the degree to which these assets affect the broader financial health of a company remains unclear. To explore this, the author considers the three scenarios listed above and examines to what degree reserve levels—both developed and, more importantly, undeveloped—affect a company’s total valuation and its leasing practices.

The impact of oil and gas reserves on total company valuation

Booked reserves are the most important assets to oil and gas companies. For publicly traded U.S. companies, reserves are classified according to their probability of recovery and are reported on annually in accordance with the revised 2008 SEC regulations. While reserve levels can undoubtedly affect the total valuation of a particular company, the degree of variance between these different reserve classes and their effect on a company’s total market value is not as clearly understood. Low-risk PDP reserves are typically understood to have a more direct impact on market valuations of oil and gas companies, but there is less certainty on how investors interpret and value less mature reserves.

In particular, determining the valuation of PUD reserves to investors and financial analysts could help establish whether boosting PUD reserves would have a significant impact on a company’s year-end share price or market capitalization. The author suggests that if a trend exists wherein a company’s undeveloped reserves show a direct correlation with its year-end market value, then companies may have a reasonable incentive to bolster their booked PUD reserves through large-scale acquisitions of new leases, regardless of whether these lands are intended for production. Similarly, the author explores whether the 2008 shift in SEC disclosure requirements resulted in an overall increase in reported PUD reserves, as well as whether the industry more broadly saw an increase in the correlation between PUD reserves and total market valuation as a result of the policy and its changes to PUD classification standards.

Methodology

To answer the question of how and whether different oil reserve classes affect market valuation of a company, the author synthesized and evaluated insights from current industry literature and previous research. To compliment this work, additional primary data were gathered in hopes of adding some contemporary statistical analysis in support of the literature review. The author collected data both prior to and following the enactment of the 2008 SEC regulation to determine whether any shifts in industry behavior or market conditions could be attributed to the change in policy.

Primary data were sourced directly from the Bloomberg Terminal database, which contains financial and operational data for thousands of energy companies worldwide. From this, only companies that conduct either exploration and/or production (E&P) within their business operations, as well as provided data on both proved developed—both producing and nonproducing—and PUD reserves were included.27 Finally, the author filtered this initial data set using a secondary data set collected from the DOI Office of Natural Resources Revenue tracker.28 This data set provides Natural Resources Revenue Office data collected by DOI for individual companies for calendar years 2013 through 2016. The author used this list solely to identify companies that currently hold or recently held federal leases for oil and gas extraction purposes.29 Such a proxy is needed, because companies do not consistently report on the breakdown of land ownership within their overall lease portfolio. For the purposes of this study, only companies that have current or recent federal leases as part of their asset holdings were included. This final data set consists of a total of 63 oil and gas companies, with annual SEC data from fiscal years 2006 through 2017 collected via Bloomberg for the following variables:

- Total market value of company shares

- Last security price

- Total short- and long-term assets

- Worldwide proved reserves, including U.S. reserves

- Worldwide proved developed reserves

- Percentage of reserves developed

- U.S. proved reserves

- U.S. proved developed reserves

- U.S. PUD reserves

- U.S. percentage of undeveloped reserves

- U.S. percentage of total reserves

- Year-over-year revisions in proved reserves

- Percentage of total acreage developed

- U.S. daily production totals

- Reserve replacement rate

From there, these data were analyzed using R programming and a simple regression analysis was run to determine the degree to which each variable affects total market valuation. Spot prices for both oil and natural gas were included as control variables to remove the outstanding impact that commodity prices might have on company valuation.

To understand the impact of the 2008 SEC policy change, total PUD volumes for all 63 companies were measured across 2006 through 2017 to assess both pre- and post-policy trends. From there, total PUD reserves for each year were measured against total market valuation at year-end for all companies to determine the correlation coefficient for a given fiscal year. This coefficient was then measured across the 2006-through-2017 time frame to understand how trends in correlation between these two factors were moving in response to the change in policy.

Existing research

Company valuation and stock price returns can be affected by a multitude of factors, including profitability, systematic risk factors, fluctuations in commodity prices, and even global geopolitical events. But there is little research examining the impact that different classifications of booked reserves have on the market value of a company. This is partially due to the difficulty in valuing booked reserves that inherently carry substantial risk, either due to economic changes or other external factors that could prevent future development. That said, a recent 2017 study from Bård Misund and Petter Osmundsen, researchers from the University of Stavanger in Norway, looked into the effects on market valuation of various classifications of reserves.30 Using data from 1993 through 2013, the study compared the relationship between three classifications of reserves—proved developed, PUD, and probable reserves—and their respective impact on returns for 94 oil and gas companies across the globe.31

While their research showed information that probable reserves do not have an impact on stock returns, they did find a significant positive relation between changes in proved developed reserves and oil company returns.32 Moreover, their results suggested that PUD reserves do, in fact, affect returns—though only at a 10 percent level, indicating a weaker correlation to valuation than for proved developed reserves.33 Importantly, however, their study does see a significant shift in the valuation of less mature gas reserves from 2008 onward. In particular, probable reserves appear to have a positive correlation with stock returns for gas companies after, but not prior to, 2008. Because this shift appears to only apply to gas reserves and not oil reserves, Misund and Osmundsen posit that the change is a result of the “shale gas revolution,” which began around this time. They suggest that modernized technology in unconventional shale plays has resulted in a decreased emphasis on proved developed reserves and an increased focus on the cost of well development, production, and decline curve.34 For these reasons, the researchers suggest that less mature reserves, including PUD reserves, are now valued higher and play an increasingly large role in the total valuation of a company.35

While the shale revolution in 2008 undoubtedly played a role in the valuation of gas reserves, 2008 also marked the year in which the SEC shifted its reporting standards as part of 17 CFR § 210. To understand how oil and gas companies responded to both these changes in policy and the market conditions, the author expands upon Misund and Osmundsen’s work analyzing global data from 1993 to through 2013 by first analyzing the impact of PUD reserves on market valuation from 2013 onward for just United States-based companies, or those companies that hold federal leases. Then, the author measures both pre- and post-2008 PUD levels and their correlation over time to market valuation across the industry.

Analysis and findings

Through primary research and data collection, the author looks to answer three questions. The first is whether PUD reserves are a reliable indicator of how a company is valued. The second is, if PUD reserves are a useful indicator of total market value of a company, was there an incentive for companies to inflate increase their annually reported PUD volumes after the introduction of 17 CFR § 210? And finally, how has this link between PUD reserves and market value evolved over time? Or rather, has it become a stronger or weaker indicator over the last several years?

Determining whether PUD reserves are a statistically significant indicator for a company’s market value

With the Misund and Osmundsen study as a starting point, the author looks to determine whether their analysis holds true for United States-based companies beyond 2013. Using the data set of 63 U.S. companies, a select group of explanatory variables were included in a regression analysis to determine their correlation with three response variables: measure of theoretical takeover price, total market value of company shares, and last security price. These variables include:

- Total short- and long-term assets

- Percentage of reserves developed

- Total U.S. proved reserves

- U.S. proved developed reserves

- U.S. PUD reserves

- U.S. percentage of undeveloped reserves

- Percentage of total acreage developed

The author focuses primarily on United States-based variables as the research question of this report is specific to the leasing practices of United States-based companies on federal lands. Given the high multicollinearity between the developed and undeveloped reserves variables, the author conducted separate regressions, swapping out each variable as needed. To determine whether Misund and Osmundsen’s findings apply for fiscal years 2013 through 2017, regression analyses were run for each year across this time period.

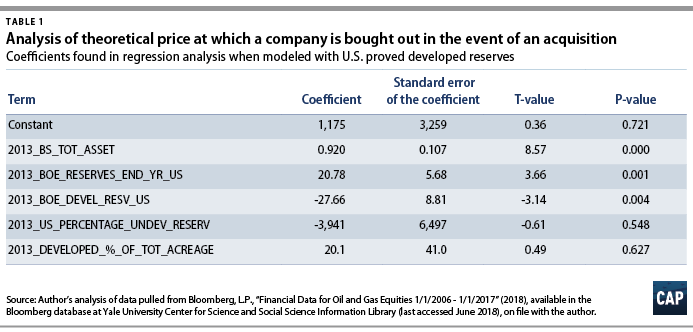

Beginning with fiscal year 2013 and using “measure of theoretical takeover price” as the response variable, the author’s initial regression model reveals that while “U.S. percentage of undeveloped reserves” and “percentage of total acreage developed” are not statistically significant, “total short- and long-term assets,” “total U.S. proved reserves,” and “total U.S. proved developed reserves” are all statistically valid based on an alpha limit of 0.05. The regression analysis was redone after removing the statistically insignificant variables and confirmed these findings. (see Table 1)

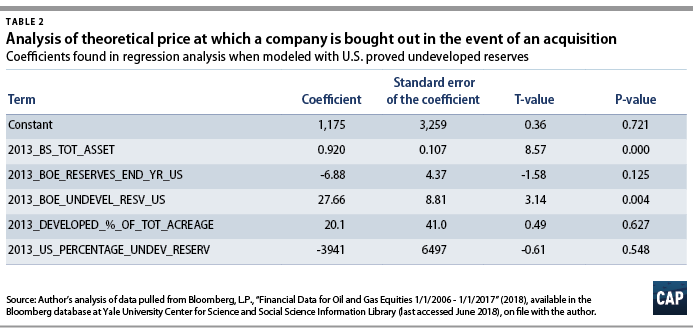

When the regression model is rerun with “U.S. PUD reserves” swapped in for “U.S. proved developed reserves,” there is a similar pattern—only now, “total U.S. proved reserves” is removed from the model. (see Table 2)

This process was repeated for fiscal year 2013 using response variables “total market value of company shares” and “last security price.” The analysis yielded similar results for the “total market value of company shares,” but none of the explanatory variables seemed to be statistically significant in explaining “last security price.”

From there, the regression model was repeated for the three explanatory variables for each subsequent year: 2014, 2015, 2016, and 2017. In each of these models, “U.S. PUD reserves” resulted in a p-value of less than 0.05 for both “total market value of company shares” and “measure of theoretical takeover price.” No statistical indicators were identified for the response variable of “last security price” for any of the years included in this study.

From this analysis, the author can tentatively conclude that both proved developed reserves and PUD reserves continue to be statistically significant indicators of a company’s market value and theoretical takeover price. These findings largely mimic those of Misund and Osmundsen for their global sample of oil and gas companies. This analysis of just United States-based companies with current or recent federal lease holdings, however, indicates that undeveloped reserves appear to be more statistically significant than previously thought.

Understanding trends in PUD reporting prior to and following the 2008 SEC regulation change

Following the enactment of the revised 2008 SEC guidelines, some analysts predicted there would likely be an increase in booked PUD reserves across the industry. Because the new regulation loosened the requirements around establishing reserves as proved to include probabilistic methods, companies no longer needed to sink large amounts of upfront capital into exploration and drilling in order to book new PUD reserves.

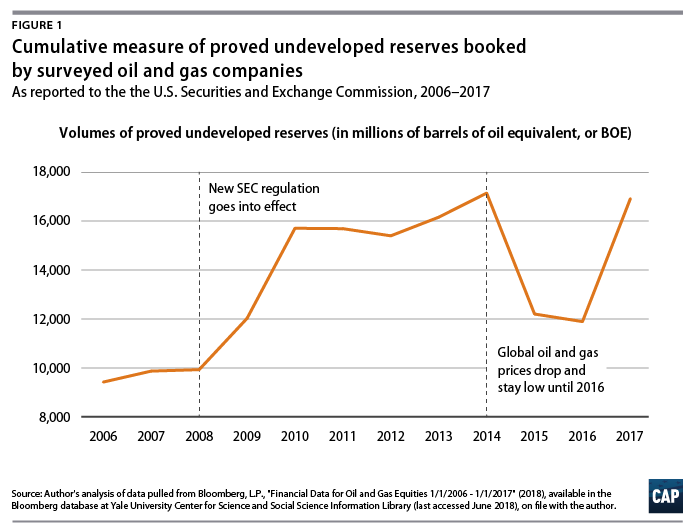

To determine whether this assumption rang true, the author accumulated and measured PUD reserves for all 63 companies included in this sample across the 2006-through-2017 time frame. This analysis reveals that total reported PUD reserves did, in fact, increase dramatically in the six years following the 2008 SEC regulation. (see Figure 1) Booked reserves steadily increase from 2008 through 2014, with total reserve levels nearly doubling over the course of this period. This trend reversed from 2015 through 2016, likely the result of the precipitous drop in worldwide oil and gas prices which resulted in most companies removing large amounts of reserves from their balance sheets.36 With the recent rebound of global spot prices, however, PUD reserves have rebounded to 2014 levels, with upward trends likely to continue for the foreseeable future, barring a significant and sustained drop in global oil and gas prices.

Identifying shifts in the correlation between PUD reserves and company valuation prior to and following the 2008 SEC regulation change

With PUD reserves established as a significant indicator of a company’s market value, the author looked to determine whether this relationship has increased or shifted in recent years. The higher the correlation between PUD reserves and a company’s total value, the larger the incentive a company may have to find creative ways to boost its booked PUD reserves. Since the new SEC regulations were expected to have some effect on this relationship thanks to the improved probabilistic techniques by which companies can now prove reserves with lower risk for failure, the author looks to see whether such a shift, in fact, took place.

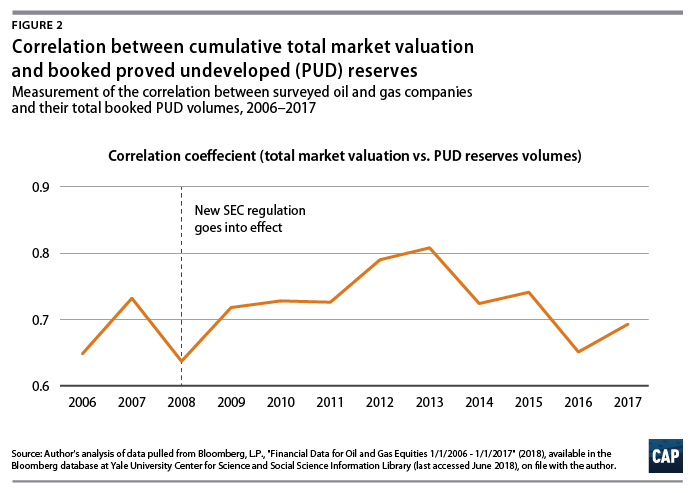

To determine whether the correlation between total market valuation at year-end—for all companies collectively—and total booked PUD volumes has increased since 2008, the correlation coefficient between both variables is measured over the course of 2006 through 2017. In analyzing these data, there emerges an uptick in correlation following 2008, which steadily rose through 2013 before reversing by 2014. (see Figure 2) However, given that the correlation coefficient had fluctuated similarly prior to 2008, it appears as though this shift may not be entirely attributable to the 2008 policy change. Overall, while these findings do show there was a slight rise in correlation between market value of a company and its booked PUD reserves in the years following 2008, it remains to be seen whether this shift was only temporary or at all a result of the change in SEC reporting standards. In other words, this analysis indicates that the 2008 SEC rule contributed to companies’ increasing their booked PUD reserves and that this increase correlated, for a time, to an increase in overall total market capitalization for the sample companies included.

Reserve trends in merger/acquisition market

Given that reserve levels for both proved developed and PUD reserves show an impact on overall company valuation for United States-based equities, it is helpful to understand whether or not this factors into how oil and gas companies conduct business. In particular, this report is interested in understanding the degree to which undeveloped reserves affect the acquisition price following a company buyout. While it would be expected that any acquisition price would increase with reserve size, as that often serves as a proxy for company size and/or production potential, the degree to which companies are incentivized to purchase undeveloped acreage is still unknown.

Methodology

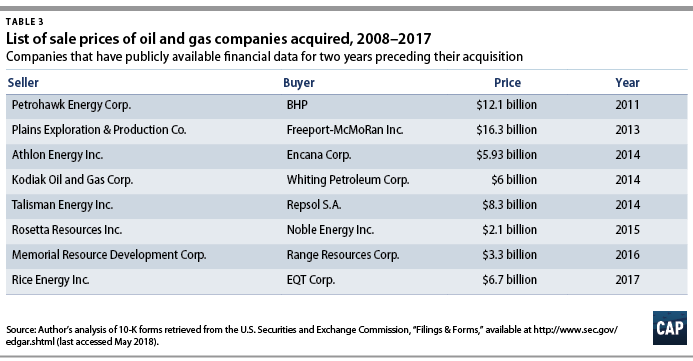

Mergers and acquisitions are commonplace in the oil and gas industry, with new deals taking place every year. Unfortunately, the terms of these transactions are not always available to the public, depending on the companies involved. To simplify this research, this report focuses solely on total acquisitions that took place between companies who have financial data available for the two years preceding the actual transaction deal. The decision to remove partial mergers or lease transfers from these data was made given the various contributing variables that could confound or complicate any assumptions made. The authors also selected case studies that took place following the 2008 SEC reporting rule, to ensure that any transaction included disclosures of PUD reserves. Given these parameters, this report includes eight transactions. (see Table 3)

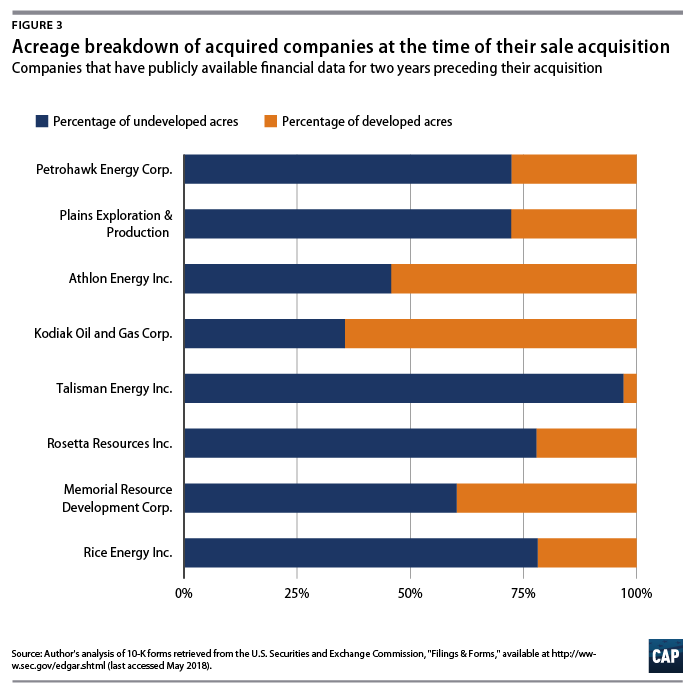

Once this sample was compiled, data were pulled individually for each newly acquired company through the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) database, which files energy company 10-K reports on an annual basis. Since reporting on total PUD quantities varied in structure and unit measurement for each company based on its size and energy portfolio, “total undeveloped acreage” was instead used as a proxy for determining whether companies were sitting on undeveloped land, rather than undeveloped reserves, in advance of a buyout to demand a higher acquisition price.37

Findings

With a small sample size of only eight companies, no statistical analysis would yield results feasible for comparison. That said, a general overview of the case studies presented here indicated that acquired companies were carrying a higher percentage of undeveloped land than the average company. The data collected for this report’s initial data set of 63 companies with current or recent federal leases show a year-over-year average acreage ratio of 60 percent undeveloped-to-40 percent developed. But for newly acquired companies—including those with and without federal leases—over the same 2009-through-2017 time period, the average ratio of undeveloped to developed acreage jumped to 68 percent-to-32 percent. More revealing, however, is that of the eight companies acquired in recent years included here, five carried substantially higher percentages of undeveloped land, ranging from 72 percent undeveloped (Petrohawk Energy Corp. and Plains Exploration and Production Co.) to up to a staggering 97 percent undeveloped acreage—Talisman Energy Inc. (see Figure 3)

Not only do these findings suggest that companies looking to secure buyouts are sitting on undeveloped land at a disproportionately higher rate, but on average, these companies are also increasing this undeveloped acreage at a rate of 13 percent in the two years immediately preceding acquisition. Moreover, the companies that increased their undeveloped acreage in advance of acquisition saw their final takeover price increase by an average of 64 percent from the previous year. Meanwhile, the companies that instead reduced or sold off their undeveloped acreage prior to acquisition saw their takeover price fall by 23 percent on average.38 This trend points to a larger problem: By increasing their hold on undeveloped parcels in advance of possible buyouts—rather than looking to offload what would normally be considered a liability based on rental costs or management fees—companies can see their market value and theoretical takeover price skyrocket. It appears that for companies seeking an increased buyout price, the cost to sit idly on undeveloped acreage does not outweigh the incentive of posting these lands and their subsurface reserves on their balance sheet and demanding a higher acquisition fee to potential buyers.

While this analysis is limited to a small sample of recent acquisitions in the oil and gas industry, the results herein suggest that further research is needed to understand the business decisions of companies in the immediate lead-up to their takeover. Because acquisitions often take years to negotiate, companies may have the opportunity to adjust their market standing through various means in order to obtain more favorable buyout terms. To determine whether this is, in fact, a tactic used within the industry would require additional research and analysis. Similarly, partial acquisitions and asset transfers—which are far more common transactions within the industry—could reveal an entirely different set of market practices currently underway. Understanding how and why acreage and assets are bought and sold between companies would be immeasurably helpful to understanding whether undeveloped acreage and reserves can provide liquidity to companies when balance sheets are stressed.

Trends in unproved property acquisition

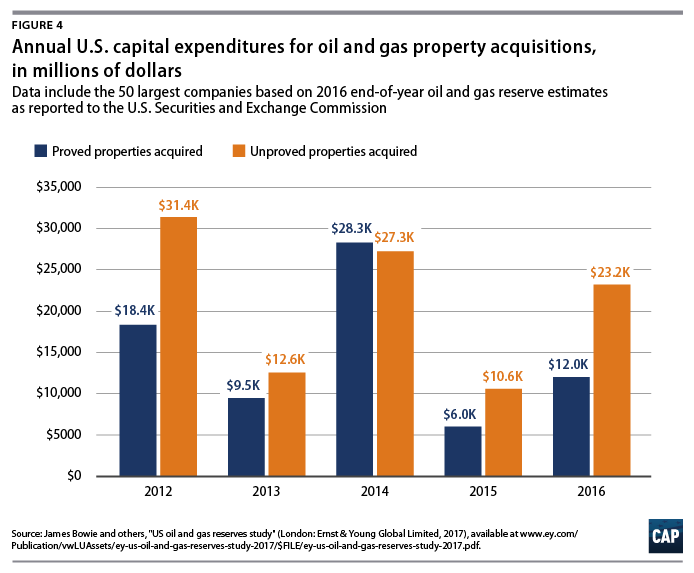

From this research and analysis, this report now can assume both that PUD reserves have a direct effect on the overall market value of a company, and that this effect is at least tangentially incentivizing companies to acquire additional acreage in advance of possible buyouts to demand a higher acquisition price. But to what degree are companies prioritizing these acquisitions in their broader business strategies? Taking data from Ernst & Young’s (EY) annual U.S. Oil and Gas Reserves Study, one can identify how industry spending is tracking across the past several fiscal years. This EY report is a compilation and analysis of select oil and gas reserve disclosure information as reported by publicly traded companies in their annual reports filed with the SEC. The 2017 report presents the U.S. E&P results for the five-year period from 2012 through 2016 for the largest 50 companies based on U.S. oil and gas reserve estimates.39

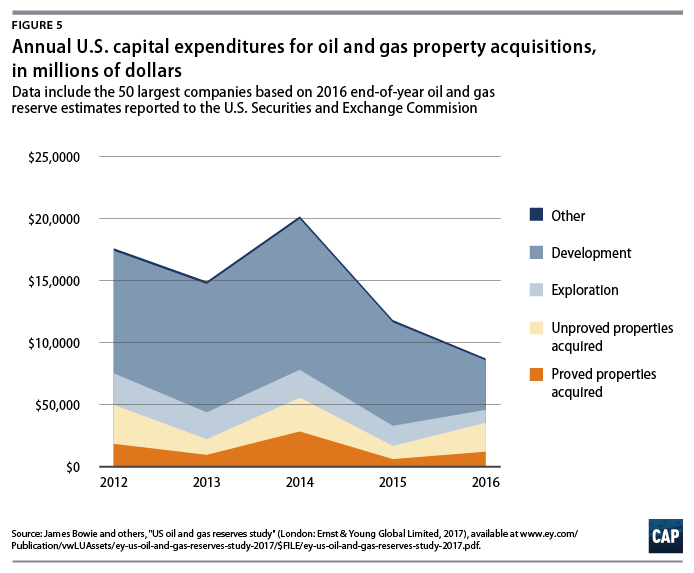

These data show that oil and gas companies spent more money on unproved property acquisitions than they did on proved properties for four of the past five years.40 (see Figure 4) In 2016 alone, the companies included in the study saw a surge of more than 119 percent in unproved property acquisition from the previous year.41 This includes any unproved properties obtained through company acquisitions described in the previous section. But more striking perhaps than the discrepancy between costs in proved and unproved properties, is that during this same time period, exploration and development expenditures declined precipitously by 35 percent and 52 percent, respectively.42 (see Figure 5)

While the oil and gas industry appear to be prioritizing the acquisition of new properties—and by extension, future reported assets—it does not seem to be placing as high a premium on actually developing these lands. Instead, development and exploration seem to be taking a back seat to what could be considered a land grab by the industry and its leaders.

PUD valuation in reserve-based lending

Oil and gas E&P companies require substantial amounts of capital to finance their operations. For decades, E&P companies have relied on various debt products to provide this much-needed capital, including what is known in the industry as a reserve-based loan (RBL).

Reserve reports, such as those provided to the SEC, are central to negotiating the lending terms of an RBL, with a producer’s reserves serving as the primary collateral. As previously mentioned, determining the value of these reserves can be difficult due to changes in market conditions and commodity pricing. That said, the contractual nature of RBLs makes them slow to adapt to these market changes. During the recent downturn in crude oil prices, E&P companies’ balance sheets became highly stressed, since the value of existing reserves dropped substantially, and access to low-cost reserves to provide liquidity should have been highly valuable. However, determining the degree to which undeveloped or nonproducing reserves serve as valuable collateral to lenders would help the public understand whether an incentive exists for E&P companies to acquire and book these assets.

According to industry reports, banks that provide RBLs typically lend against SEC PDP and PDNP classified reserves. This makes sense, given the low risk and higher degree of confidence that comes with these reserve classes. However, some lenders may give a small percentage of value to PUD reserves, meaning high levels of these reserves could be a benefit to companies looking for more capital. In general, though, the high level of uncertainty around whether PUD reserves will be developed has led most banks to place limits on the degree to which these levels can be valued in loan calculations.43 This uncertainty was partly behind the SEC decision to finalize their 2008 rule, which aimed to codify production commitments and curtail extended development plans.44 While the rule did, as previously mentioned, provide broader parameters around what could constitute a PUD based on the reasonable certainty test, it also stipulated that PUD classification must carry with it a commitment to develop those reserves within a five-year time frame.45 The SEC wrote this revision to give lenders and investors increased certainty that PUD reserves would be developed and that their investment would result in profitable returns. It should be noted, however, that exceptions to this five-year development timeline do exist, and the companies can appeal to have this reserve structure if “specific circumstances”46 are present that justify a longer interval before development will be initiated. Reports in the years following the passage of the SEC rule suggest that companies have continued to struggle in converting PUD reserves within this five-year timeline, leaving the effectiveness of the revised SEC regulations in question.47

Overall, the degree to which PUD reserves are valued in U.S. RBL structures appears to be minimal, thanks to lenders’ acute awareness of the tendency for these reserves to idle and remain undeveloped. While the SEC guidelines were intended to address this high level of uncertainty, little progress has been made in moving the RBL industry to place higher value in PUD futures. This trend does appear to be somewhat United States-specific, as U.K. banks in the North Sea market historically have been comfortable lending against undeveloped reserves.48 These loans benefited from the provision of a guarantee put forth by a large corporate sponsor to ensure a given project would meet production goals within a given time period. But here in the United States, banks remain hesitant to make this shift. The contractual nature of RBLs makes them slow to adapt to market changes. However, with the recent shift in valuation of traditionally high-risk reserves—particularly gas reserves that stem from unconventional plays—lenders could be tempted to change their ways. As the industry continues to adapt to the sweeping modernization occurring in extraction and production practices, PUD and high-risk reserves could become increasingly valuable for the purposes of RBL capital.49

Overview of findings

Through this analysis and research, this report looked to identify current market scenarios that might provide oil and gas companies with sufficient financial incentive to acquire—but not develop—federal land. Because of the relatively low rental rates, minimum bids, and royalty rates applied to federal leases, these parcels of land are typically an attractive option for E&P companies looking to bolster their balance sheet and increase their total assets. But the assumption behind these acquisitions is that eventually, these lands will be developed, and the reserves will come to market for the benefit of U.S. taxpayers. It appears, however, that this is not always the case. Either way, such leases tie up land that would otherwise be managed for conservation, recreation, or other use as the BLM’s directive requires.

As a result of the shift in SEC reporting guidelines, developments in predictive technology, and a highly unstable commodity market, companies are increasingly sitting on undeveloped acres of land with little risk of financial harm. In fact, it appears there is a substantial financial gain to be met by delaying future development—and instead maintaining these otherwise depleting assets on their balance sheets for future use.

Overall, this research suggests the following:

- The 2008 revised SEC regulations broadened the requirements for companies to book PUD reserves, now allowing probabilistic methods to confirm reserve quantities over deterministic methods—drilling, for instance.

- In the aftermath of the 2008 regulations, total reported PUD volumes nearly doubled between 2008 and 2014 for the 63 oil and gas companies included in this study that hold federal leases, herein referred to as “sample companies.” This trend only reversed in 2015 with the global drop in oil prices before rebounding again in 2017 to previously high reporting levels.

- For each of the five years following the 2008 regulations, sample companies saw an increase in the correlation between reported PUD volumes and total market valuation.

- Both total proved developed reserves and PUD reserves can affect and predict the market valuation and theoretical takeover price of a company, meaning companies have a clear incentive to increase their booked undeveloped reserves.

- Based on total acquisitions since 2008, newly acquired companies appear to have a higher percentage of undeveloped acreage than the average E&P company, regardless of size.

- These newly acquired companies on average increased their rate of undeveloped acreage in the years immediately preceding buyout.

- E&P companies have spent more on unproved property acquisition than they have on proved properties in four of the past five years.

- Unproved property acquisition expenditures increased by 119 percent from 2015 to 2016, while exploration and development costs dropped 35 percent and 52 percent, respectively, during the same time period.

- While PUD reserves can be factored into RBL terms, most U.S. banks place little value in these, thanks to the high level of uncertainty that companies will develop these within the five-year period established by the SEC. This could change—particularly in the natural gas industry—as unconventional well development has reduced the danger of traditionally high-risk reserves not coming to market.

Policy implications

The purpose of this report is not to provide specific policy prescriptions but rather to explore what market mechanisms and regulations exist that incentivize oil and gas companies to sit on vast amounts of undeveloped leased acreage. That said, based on the contemporary research underway and the research presented herein, there is a clear need for further exploration into how the current U.S. regulatory model promotes the financial well-being of oil and gas companies to the detriment of American taxpayers. If these leases are to be offered up to oil and gas companies for their own use, there is at least an expectation that Americans will somehow benefit from private enterprise on public land—either in the form of energy access or through royalty revenues. Instead, companies get to use these lands to pad their own bottom line, ignoring the social and legal contract they made with the American people. While advocates and lawmakers in favor of reforming the current leasing system have tried to address some of these perverse incentives at various times in the past few years, their efforts have seen little success.

In 2011, then-Rep. Ed Markey (D-MA) and then-Rep. Rush Holt (D-NJ) introduced the Utilizing Significant Emissions with Innovative Technologies (USE IT) Act to compel oil companies to produce on the drilling leases they already own by imposing an escalating fee after the first few years on undeveloped land.50 On the Senate side, a similar piece of legislation was introduced that would apply a new $4-per-acre annual fee to new leases while forcing oil companies to report their plans for using their leased lands and waters.51 But given that the SEC regulations already have a similar reporting structure in place, it is clear more needs to be done.

In order to address the current loopholes in the leasing system, further research and consideration should be given to the following areas:

- Stronger enforcement of the SEC’s five-year development standards: While SEC regulations do require oil and gas companies to develop booked PUD reserves within a five-year time frame, it is clear from industry reports and public comments that these parameters are not strictly enforced. The current regulations allow for exemptions based on “special circumstances,” and it appears that companies regularly use this loophole to apply for extensions on their PUD reserves. To its credit, the SEC has worked hard to enforce these regulations more strictly, often requiring companies to respond directly to charges that booked reserves have remained undeveloped for a longer period than permitted. In fact, according to the SEC, in the first year following the passage of the final rule, 12 of the top 50 10-K filers issued revisions reducing their total PUD reserves due to the five-year rule enforcement.52 That resulted in a total revision of approximately 0.5 billion net barrels of oil equivalent. Despite these gains, however, enforcement of this provision has lagged, as evidenced by the lending market’s unwillingness to consider PUD values in their RBL negotiations.

- Increase rental fees on undeveloped acreage: As it stands, the current cost to oil and gas companies to rent and hold on to undeveloped acreage is insufficient to force development of PUD reserves or not acquire them in the first place. It appears as though companies are willing to shell out the nominal rental fee because the benefits to doing so—in the form of increased reserves and market value—outweigh the annual cost to hold on to undeveloped land. To address this market failure, the rental fee on undeveloped acreage should be increased to ensure that the cost to lease holders is sufficient enough to force development of these properties or to hand them back to the federal government for future oil and gas development or other land management goals.

- Increase minimum bid prices for both competitive and noncompetitive leases: Like the current rental fee structure on undeveloped acreage, the bidding process for federal leases must be reformed to ensure fair market pricing of federal land. Because federal leases can be acquired far below the rate of private or state leases, companies can incur minimal acquisition costs in hopes of securing vast amounts of subsurface assets through the federal leasing process. By increasing the minimum bid price set by the BLM for both competitive and noncompetitive leases sold after auction, companies will be dissuaded from acquiring cheap federal leases solely as a means to bolster their reserve bookings for future investment and market share.

- Prioritize leasing parcels with reasonable certainty of production: Thanks to advancements in technology and geoscience over the past few years, the high level of uncertainty that often accompanied lease sales is dwindling. Now companies—and the federal government—can more accurately predict where and to what degree land parcels might reasonably yield developable assets without invasive and costly exploration methods. Because of this, priority should be placed on leasing lands that have a reasonable expectation of producing economically viable products. In establishing the predictive value of a given lease, the BLM and other leasing agencies would be able to require additional assurances from bidding companies that a lease would be developed within the required time frame or surrendered without the need for a lease extension.

- Require development plans at bid sale for consideration: Currently, SEC regulations require companies to establish and report on development plans for their leased property to meet the five-year PUD development guidelines. Similarly, the BLM has permitting standards that require companies to report on their short- and long-term plans for developing a given lease. But both standards require development plans to be submitted after a given lease is secured at bid. While this would historically make sense given the uncertainty around land viability and the existence of subsurface reserves, by limiting bid sales to those leases that already have been deemed to have a reasonable certainty of production, this exploration delay could be avoided. In doing so, the BLM could then require any potential bidder to submit a development plan at bid to ensure these leases would not remain undeveloped for the purposes of a company’s own financial gain.

Conclusion

This report looks to explore the potential financial incentives that exist for oil and gas companies to acquire federal land, while delaying development of resources on those same properties. By highlighting a variety of market scenarios, this research suggests that E&P companies do, in fact, seek to gain financially from both the increase in proved developed reserves—those that are produced and sold to market—as well as PUD reserves that may never make it out of the ground. Through this research, the author suggests that sufficient evidence exists to show that the current regulatory model for oil and gas leasing is inadequate; it allows private companies to benefit from the undeveloped resources they are purportedly required to develop and bring to market for the benefit of everyday citizens—and at the expense of the public lands that are being managed poorly for future generations.

About the author

Mark K. DeSantis is an analyst and researcher focusing on the intersection of public land management and climate policy. DeSantis previously served as director of Community Partnerships at the National Park Foundation, where he worked directly with the U.S. National Park Service to engage nonprofits in partnering with the agency on place-based programming and education. Most recently, DeSantis was a Berkeley conservation fellow at the National Parks Conservation Association, where he helped craft the organization’s climate advocacy strategy. He received his Master of Environmental Management from the Yale School of Forestry and Environmental Studies where he studied land conservation and environmental policy. He is a graduate of the American University School of Communication.

Acknowledgments

Thank you to the Center for American Progress and the entire staff there, who generously offered their time, resources, and expertise throughout this entire process. In particular, the guidance and patience of Mary Ellen Kustin and Matt Lee-Ashley was invaluable as this research came to fruition.

A special thanks should also be extended to Yale University and the staff at the Center for Science and Social Science Information for their time in fielding research requests as well as graciously offering their resources throughout this process. Finally, this project would not have been possible had it not been for Jim Lyons, who was instrumental in laying the conceptual framework and vision this project needed to succeed from the start.