When Superstorm Sandy struck the eastern seaboard at the end of October 2012, two of the primary consequences of global warming amplified its destructive impacts. First, artificially warmer sea-surface temperatures—the highest ever recorded for the waters of the Northeastern United States—almost certainly increased the intensity of the storm’s rainfall.

Second, elevated sea levels resulted in broader and more-severe flooding as the massive weather system’s wind and waves pushed the storm surge inland. As a direct result of global warming, sea levels along the eastern seaboard are significantly higher today than at any point in the past 2,000 years. Today’s sea levels are the result of the dramatic acceleration of ocean rise, which began around the beginning of the 20th century and in close correlation with the increase of global average temperatures.

Evidence shows that after many centuries of relative stability, sea level along the eastern seaboard is around one foot higher today than it was 100 years ago. Tide measurements taken by the National Oceanic and Atmospheric Administration, or NOAA, show 11 inches of rise in New York, 10 inches in Massachusetts, and more than 15 inches in New Jersey over the past century. What’s more, the situation is not going to get any better. Climate scientists warn that even if we cease all emissions of fossil-fuel-based greenhouse gases today, sea levels will continue to rise for the next several centuries. One geologist points out that the last time the atmosphere was as carbon rich as we have made it today, seas were 20 meters higher.

So what are the consequences of having more ocean at our back doors? According to Princeton University earth scientist Michael Oppenheimer, who was interviewed in October by the Associated Press, 50,000 people experienced flooding from Superstorm Sandy who would have otherwise been spared in the absence of global warming. By the time the storm dissipated, it had exacted an economic cost of more than $68 billion, resulted in the deaths of 117 Americans, and taken the lives of 69 more people throughout the Caribbean and Canada.

Blunting the intensity and reducing the rise in frequency of storms like Sandy is one of the most pressing reasons to reduce global greenhouse gas emissions. According to a September 2013 report from the American Meteorological Society, global-warming-caused sea-level rise is significantly reducing the time between major coastal flood events. The town of Sandy Hook, New Jersey, provides a daunting example: Storm surge from Superstorm Sandy destroyed the town’s flood gauges after rising past 8 feet. In 1950, a flood of that magnitude would have been considered a once-in-435-years event. But given the rapidly increasing likelihood of storm-surge flooding, scientists now predict that by 2100, Sandy-scale flooding will occur every 20 years.

This skyrocketing risk of flooding puts a huge portion of the U.S. population and economy in jeopardy. Coastal counties are already the most populous in America, and they generate a disproportionately large share of our nation’s economic output. According to NOAA and the U.S. Census Bureau, 39 percent of the U.S. population lives in counties with coastline, and these counties contributed 45 percent of the country’s entire gross domestic product, or GDP, in 2011. Yet these counties account for less than 10 percent of U.S. land area—excluding Alaska. Furthermore, these counties continue to grow, having expanded by nearly 40 percent in population since 1970.

Unfortunately, this concentration of people and economic activity is beginning to resemble the metaphorical eggs being gathered in a single, increasingly vulnerable basket. In June, the consulting firm AECOM published a report for the Federal Emergency Management Agency, or FEMA, comprehensively analyzing the change in America’s flood risks due to climate change. Its study found that sea-level rise is projected to increase the flood-hazard area in our nation’s coastal floodplain by 55 percent by 2100. Moreover, if the United States fails to adapt to rising seas, the study projects that the number of coastal flood-insurance policies will increase by an astounding 130 percent over the same time period, due largely to growth in the coastal flood-hazard area.

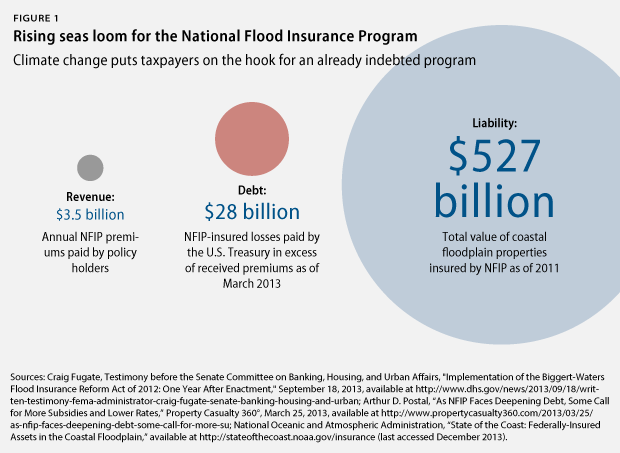

The dramatic increase in flood-insurance policies would be one thing if the risk were borne exclusively by property owners. But the reality is not so simple. In fact, U.S. taxpayers underwrite flood insurance for the $527 billion in properties in the coastal floodplain as part of the $1.2 trillion in assets insured overall under the federal National Flood Insurance Program. And the devastation caused by coastal storms from Katrina in 2005 to Sandy in 2012 has not only exhausted the premium-funded resources of the National Flood Insurance Program, or NFIP, but it has also required around $28 billion in taxpayer-funded bailouts to pay for insured losses. As coastal populations continue to swell, so too will this already underfunded liability.

Fortunately, there are proven solutions at hand that can reduce the risk and the public liability for flood damages while simultaneously enhancing the resilience of our coastal communities to sea-level rise. The deceptively simple concept of publicly funded buyouts of flood-prone coastal properties, in which the lands are restored to their natural states and then turned over to state ownership, may be the foremost such option. Evidence from completed buyout programs across the country shows that these investments pay for themselves in avoided federal recovery costs from future floods, usually within about 10 years. They also continue to provide savings through cost avoidance in perpetuity, since flood risk, response, and recovery costs are permanently avoided. Buyouts also provide additional public benefits, including physical buffering against future floods, public recreational space, and enhancement of wildlife habitat. Finally, buyout programs help physically adapt our coastlines to the inevitability of sea-level rise. Such adaptation is an unavoidable task that we can either chose to undertake in an orderly fashion or wait to have imposed on us through emergency response to the next extreme weather disasters we know are coming to our coasts.

In order to realize these benefits at a larger scale across America’s coastal floodplain and to help adapt the U.S. coastline to the dramatic rise in sea level predicted for the century ahead, this issue brief recommends the following actions:

- Congress should preserve the NFIP reforms of 2012 so price signals from premiums accurately reflect worsening flood risks. New legislative effort on the NFIP should be focused on mitigating the reforms’ immediate and short-term costs to low-income coastal residents, rather than on modifying the important 2012 reforms.

- State and federal decision makers should implement policy that increases voluntary buyouts of coastal properties in the most flood-prone areas by, for example, authorizing and investing in buyouts of high-risk properties in advance of flood disasters and, when appropriate, allowing states to use federal aid to complete buyouts above the existing 75 percent cap on federal contributions.

- Lawmakers, regulators, and program managers should collaborate to develop, evaluate and, as appropriate, institutionalize innovations in property buyouts—such as New York state’s buyout price bonuses—to address specific social and land-use challenges and to maximize their fiscal and environmental benefits.

With rising seas comes rising taxpayer liability

Flooding already constitutes the most common natural disaster in the United States. Between 1991 and 2010, hurricanes and tropical storms were the biggest cause of property losses among all natural catastrophes, causing 44 percent of all disaster-related property destruction in the United States. Just how did federal taxpayers end up on the hook for the security of more than half a trillion dollars worth of coastal property?

Following what was then unprecedented destruction in the wake of Hurricane Betsy, legislation was passed in 1968 to create the National Flood Insurance Program, or NFIP, because very few private insurers were willing to tolerate the risk of widespread catastrophic losses associated with large flood events. Policymakers realized that in the absence of insurance against flood risk, the social, fiscal, and economic costs of hurricanes and other flood disasters could spiral out of control. As summarized by University of Pennsylvania economist Erwann Michel-Kerjan and his colleagues:

It was thought that a government program could potentially be successful because it would have funds to initiate the program, pool risks more broadly, subsidize existing homeowners while charging actuarial rates to new construction, and tie insurance to land-use changes that might lower risks.

Unfortunately, lawmakers have struggled to achieve a fiscally sound balance among these objectives or impose building codes or land-use policies to slow development of flood-prone coastal areas. Despite periodic efforts by Congress to improve the solvency of the NFIP, the damages from flooding events over the past decade—including Hurricanes Katrina, Rita, Wilma, Irene, and Sandy—have left the program approximately $28 billion in debt to U.S. taxpayers.

This liability became costly enough to spark a rare bout of bipartisan agreement last year, when Congress passed the Biggert-Waters Flood Insurance Reform Act of 2012, or BW-12 as the bill became known, to reduce the NFIP’s billions of dollars of debt to taxpayers and rapidly curtail the subsidies it provides in the form of below-market-rate premiums for approximately 715,000 federal flood-insurance policyholders—around one-fifth of all NFIP policies. Among its provisions, BW-12 required the NFIP to raise premiums to reflect true flood risks and complete updates to flood-risk maps that in some cases had not been revised in decades.

These adjustments make fiscal and economic sense. Put simply, before BW-12, taxpayers had been paying ballooning amounts of money to keep many coastal homeowners in known floodplains, even properties that had been repeatedly flooded and rebuilt. For other hazards faced by homeowners, the only option to manage risk when opting to live in harm’s way is to purchase private, unsubsidized insurance from the open market.

But some painful short-run consequences accompany the reforms mandated by BW-12, which are scheduled to be phased-in over a five-year period. As flood-map revisions expand hazard zones to more accurately reflect the new reality of rising seas and the law terminates longstanding subsidies, many coastal homeowners will face spikes in their annual premiums—reportedly from hundreds of dollars to as much as $10,000. For lower-income households, these new rates may not only be onerous, but they could also affect resale values as potential buyers balk at the increased cost of ownership.

As Nicholas Pinter, a flood expert from Southern Illinois University, concluded:

The reforms passed by Congress are taken from the best textbooks on floodplain management, but too much of the burden is being forced on flood-zone residents. If harsh medicine is in order—and the programs’ $25 billion debt says it is—then the cure should be effective and permanent, but not kill the patient in the process.

Fortunately, real cures exist to significantly reduce flood risks and provide fiscal, economic, and environmental benefits.

Investments that save money

In 2005, FEMA commissioned a congressionally mandated, independent study to quantify the costs and benefits from the projects it has funded through grant making to states and municipalities, for the purpose of reducing the risk of property loss from floods, earthquakes, and wind damage. Its findings were unequivocal: For every $1 invested in these “hazard- mitigation activities,” the U.S. economy saves $4 in societal losses from future disasters and an additional $3.65 in costs to the U.S. Treasury from avoided federal disaster-recovery expenditures and lost tax revenues.

While policy development, education of state and local authorities, and vulnerability assessments are among the hazard-mitigation activities assessed by the independent study, the grants FEMA awards to state governments to implement physical measures that help avoid or reduce damages from disasters—primarily floods—made up the largest proportion of total investments. Specifically, activities to acquire, relocate, elevate, or flood-proof properties made up 47 percent of the total costs studied. By comparison, only 13 percent of costs were for retrofitting and rehabilitating earthquake-affected structures, and grants for structural wind retrofitting made up only 3 percent of studied investments.

For the coastal properties facing the inexorable onslaught of sea-level rise, evidence indicates that one specific mitigation measure—voluntary public buyouts of flood-prone coastal properties—may become the most important and cost-effective step that the federal government can take to help coastal residents move out of harm’s way.

The Columbia University Law School’s Center for Climate Change Law, summarizing relevant federal statutes, defines voluntary buyout programs as a specific type of property acquisition in which the government uses public funds to purchase privately held lands from willing sellers, demolishes existing structures, and then maintains the land in an undeveloped state in perpetuity for public use.

FEMA has long supported flood-stricken states and municipalities with voluntary buyouts of properties damaged or destroyed by inundation. Under its current program, when a city or state government determines that buyouts would be appropriate for a flooded area, it may apply to FEMA for the allocation of federal recovery aid for this purpose. If FEMA approves, the agency then provides funding for 75 percent of the full pre-flood market value of each of the flooded—and flood-prone—properties. The state or municipal government must fund the remainder. If the property owner has already received money for losses from the NFIP, FEMA and the state or local government subtract that settlement amount from the pre-storm market price value to determine what they will pay.

After purchase, the state or local government takes title for the land and must demolish the remaining buildings. Under federal law, the acquired property cannot be resold or built on and must be maintained for public use, such as parklands, wildlife refuges, or public beaches.

To some, buyouts may seem like the antithesis of post-flood recovery and reconstruction. Evidence from flood-prone areas nationwide, however, shows that voluntary buyouts often make sense for severely stricken neighborhoods and the communities of which they are a part. In addition, follow-up studies of specific buyout programs have shown repeatedly that these buyouts are highly cost effective for taxpayers.

During and after historic flooding along the Mississippi River from 1993 through 1995, for instance, the state of Missouri launched a program to buy out “repetitive-loss” buildings in the river’s floodplain—homes in flood-prone areas that had been known to draw repeated flood-insurance payouts. Between 1995 and 2008, FEMA and the state of Missouri invested roughly $75 million to purchase 4,045 repetitive-loss properties across eight eastern counties.

The initiative was tested frequently over the ensuing decade. From 1999 to 2008, Missouri faced 14 presidential disaster declarations due to flooding. Analyzing the performance of buyouts in 2009, FEMA and Missouri found that for the 885 properties for which there were adequate data, nearly $97 million in losses was avoided during those 14 flood disasters, representing a 212 percent return on investment for the $44 million of public funds that had been invested in those particular buyouts. As the state’s hazard-mitigation officer put it in a 2010 interview, “In Missouri, it seems that buyouts have worked the best and been the most cost-effective approach.”

Similar cases exist from around the country—cases in which FEMA and flood-stricken states jointly completed buyouts targeting repetitive-loss properties and quickly earned cost-covering returns. Consider the following examples:

- In Shepherdsville, Kentucky, FEMA and the state government’s $1.3 million investment in property buyouts yielded a 245 percent return in avoided losses after four so-called 100-year floods and one 500-year flood repeatedly inundated the region between 1999 and 2011.

- Many residents of Baker County, Georgia, decided to take buyouts after Tropical Storm Alberto devastated their town in 1994, causing $4.5 million in damages. In 1998, when a massive storm again flooded the town, nearly $2 million in damage was prevented thanks to the $754,000 invested in buyouts by FEMA and the state, representing a return of approximately 265 percent in less than five years.

- In a detailed study, Iowa determined that the buyout of 703 floodplain properties in 12 of the state’s communities between 1988 and 2008 yielded a 219 percent return on investment following the floods of 2008 alone, representing an average of $140,408—in 2008 dollars—in total losses avoided for each property.

In a multistate study on buyouts following the catastrophic 1993 Midwest floods, the National Wildlife Federation, or NWF, reported a broader summary statistic: a $2 return to taxpayers for every $1 invested in buyouts of repetitive-flood-loss properties within five years, demonstrating that the cost effectiveness of FEMA-managed buyouts holds up over large areas, even within short time horizons.

Yet NWF also pointed out that its estimate was inherently conservative because it did not capture an array of additional costs that are permanently avoided because of buyouts, such as local flood fighting, evacuation, rescue and recovery expenses, and the social costs of human suffering and the loss of life.

In addition, buyouts—because they involve restoration of floodplain lands back to their natural environmental conditions—provide ongoing benefits beyond the elimination of future disaster-response and recovery costs. As Columbia University’s Center for Climate Change Law summarizes, restored coastal wetlands absorb and hold floodwaters, buffering the surrounding communities from inundation; filter pollutants from runoff; and provide public recreational space that enhances property values and public health for the surrounding community. Furthermore, recent studies from around the world have revealed that some coastal ecosystems capture and store immense quantities of atmospheric carbon dioxide, which means that they help mitigate climate change in addition to enhancing local resilience to its destructive effects.

In other words, buyouts turn coastal floodplain lands from a massive federal liability into a valuable community asset.

Buyouts today: Sandy’s aftermath as prelude to the coasts’ future

Between 1993 and 2011, FEMA spent more than $2 billion to buy 37,707 properties nationwide. Reflecting how the U.S. government was initially motivated to pursue buyouts following the broadly catastrophic Great Flood of the Missouri and Mississippi rivers in 1993, Missouri was the most active state in terms of buyouts during that time period, completing 4,950 buyouts of the nationwide total.

Yet the scale of liabilities growing along our nation’s coasts dwarfs those figures. As of 2012, the NFIP had written 2,409,526 flood-insurance policies for properties in America’s coastal floodplain, the area within coastal and Great Lakes counties where the NFIP flood-planning regulations are enforced, and flood insurance is mandatory. Between 1978 and 2011, about $24 billion in losses was paid to NFIP policyholders in the coastal floodplain, and even though Midwest floods dominated flood-damage-mitigation discussions in the 1990s, 9 of the top 10 most destructive flood events since 1999 were along America’s coasts.

Continued emissions of climate-change-related pollutants from fossil-fuel burning, deforestation, and other activities is bringing this monstrous liability to life: Florida, home to nearly half of the 2.4 million current coastal flood-insurance policies, is now projected to face two feet of sea-level rise in the next 50 years. By the end of the century, New York City is likely to see 2.3 feet of sea-level rise, and Galveston, Texas, is likely to see 3.5 feet.

As discussed, the global-warming-enhanced destruction of Superstorm Sandy and the $50.7 billion price tag for federal assistance in its aftermath represent a preview of these looming coastal flooding challenges.

But ambitious new buyout initiatives from the governors of New York and New Jersey, as components of their Sandy recovery strategies, provide templates—and lessons—for the type of governmental responses that will be needed along the rest of America’s coastal floodplain.

In New Jersey, Republican Gov. Chris Christie’s administration is targeting the buyout of 1,000 properties from willing sellers in coastal floodplain areas that were affected by Sandy—along with another 300 repetitive-loss properties in the inland Passaic River Basin—using $300 million of the federal aid appropriated by Congress to the state for recovery. FEMA is currently approving small blocs of buyout-eligible properties on an incremental basis. As of late October, the agency had awarded New Jersey $55 million for the purchase of 272 homes in Sayreville and South River, two communities particularly hard hit by Sandy’s flood.

On one hand, New Jersey’s buyout program represents a significant investment: Should the Christie administration achieve its goal, the state will have completed around 3 percent of all buyouts nationwide since the inception of the modern program. On the other hand, as of 2011, New Jersey had 188,141 NFIP policies for properties in the state’s coastal floodplain. To put it another way, while the state’s post-Sandy initiative is a strong step toward securing the most vulnerable coastal lands relative to past efforts, the huge public liability from these policies—collectively worth more than $40 billion in publicly underwritten coverage in 2011—will probably continue to worsen in risk as sea-level rise continues.

Meanwhile, in New York, of the $663 million in federal aid that Democratic Gov. Andrew Cuomo’s administration allocated for housing recovery following Superstorm Sandy, the state designated $171 million for buyouts of properties in the coastal floodplain subject to repetitive loss. According to reports, the state identified 10,000 qualifying homes and expects the owners of roughly 15 percent of them—1,500 qualifying homes—to accept a buyout.

While the scale of New York’s buyout targets parallels that of New Jersey, the Cuomo administration’s program includes notable differences and innovations. Perhaps foremost among these is the explicit establishment of improved resilience to climate change as a strategic objective to overall Sandy recovery. According to New York’s official post-Sandy action plan, its efforts aim to comprise recovery that will “protect [homeowners] from future extreme weather events and climate change” in a manner that is “informed by a post disaster evaluation of hazard risk, especially land use decisions that reflect responsible flood plain management and take into account possible sea level rise.”

Second, as is the case in New Jersey, the standard offer to owners of flood-damaged property is full, pre-storm market price. Unlike New Jersey, however, New York is offering modest payout bonuses above that market price as incentives to improve the performance of its program. With this price flexibility, New York is aiming to address key challenges that have plagued buyout programs in other states. For instance, coastal properties in the areas of highest flood risk, as well as those on lands identified in consultation with local government officials as having high potential to serve as buffers following ecosystem restoration, are eligible for 5 percent to 15 percent bonuses above the pre-storm price. Next, to prevent the erosion of local government tax bases, a common complaint of property buyouts, New York provides a 5 percent bonus to property owners that relocate within their same county, a measure that also helps preserve community cohesion. Finally, in certain high-risk areas, New York offers 10 percent bonuses for each member of a group of adjoining property owners that collectively opt for buyouts, in order to maximize the public benefits from the associated restoration of coastal lands. To prevent abuse, New York caps incentives at 15 percent per property.

As of late October, about 400 homes in the Staten Island town of Oakwood Beach have been approved for buyouts and demolition under the auspices of New York’s program, with scores of others on the island pending. The Oakwood Beach community was particularly hard hit by Sandy: In addition to severe property damage, three residents drowned in the floodwaters. The trauma of the death and destruction caused by the storm continues to exact a toll from residents and has cumulatively motivated many to sell.

“The heartache of losing my home, the heartache of losing my memories, the blood and sweat and tears that I put into this home, is going to be healed by seeing trees and nature come back to that spot right there … I don’t want to remember Sandy. I don’t want to remember my neighbors dying in a storm. I want to remember the good times. They’ve got to level this whole area. Get it over with, get it done.” – Joe Monte, former resident of Oakwood Beach, New York

Recommendations: Strategic action for coastal resilience

The findings in FEMA’s comprehensive June 2013 study on the increase in U.S. flood hazard due to climate change crystallized the need for a multifront attack on the nation’s coastal flood-insurance liability. Although the NFIP is already in debt to U.S. taxpayers for around $28 billion, losses per policy nationwide are projected to increase by 50 percent by 2100. Meanwhile, the total number of policies in coastal floodplains could rise by as much as 130 percent if we fail to adapt our coastlines to the sea-level rise that’s already locked in due to past greenhouse gas emissions. In other words, efforts must be made to improve the financial soundness of the NFIP and control the growth in assets in America’s threatened coastal floodplains. The following recommendations aim to spur progress on both of these fronts.

Preserve the 2012 Biggert-Waters reforms to the National Flood Insurance Program

The bipartisan Biggert-Waters Flood Insurance Reform Act of 2012 initiated badly needed reforms for the NFIP, aimed primarily at reducing the program’s severe strain on the federal budget. Three major components of BW-12 serve this purpose:

- Curtailing of subsidies—often called premium discounts—for second homes, business properties, and certain other previously eligible structures

- Mandating adjustment of all NFIP premiums to reflect actuarial flood risk, including consideration of catastrophic loss years—such as major hurricanes—in the calculation of the average historical loss

- Establishing within FEMA an ongoing mapping program to review, update, and maintain flood-insurance rate maps, including all areas within the 100-year and 500-year floodplains. BW-12 also authorized $400 million annually to support FEMA’s new mapping requirements.

In sum, BW-12 takes major steps to align the NFIP’s premiums with its losses, an imminently reasonable expectation for taxpayers underwriting policyholders in floodplains.

These reforms, however, will not be painless, and by mandating their implementation over short four- and five-year timeframes, complaints about affordability among NFIP ratepayers have grown. As Congress re-evaluates BW-12 reforms at the behest of constituents facing premium increases, it should focus strictly on alleviating short-run pain among low- and middle-income coastal residents by, for example, lengthening the phase-in period for the higher rates while preserving the substance of the law’s vital reforms. BW-12 not only alleviates the NFIP’s fiscal toll on taxpayers, but—by requiring that flood-insurance price signals accurately reflect the real and worsening flood risks in the coastal floodplain—the law can also help reduce any artificially inflated demand for development of coastal assets.

Prioritize expansion of coastal floodplain buyouts in federal disaster policy

Securing the nation’s coastal communities against sea-level rise will also require proactive efforts to physically adapt our coastal communities to the reality of a changing climate. Implementing hazard-mitigation policy that increases voluntary buyouts of coastal properties in the most flood-prone areas, such as the ideas proposed below, supports this strategic objective. More buyouts also mean helping more Americans voluntarily move out of harm’s way, in a safe, equitable manner.

First, state and federal decision makers must recognize that coastal floodplain buyouts are a multibenefit policy tool

Buyouts alleviate suffering in the aftermath of coastal catastrophes. By facilitating the reinvestment of value that property owners have accrued, they permanently reduce future disaster-recovery costs and taxpayer liability, usually paying for themselves within 10 years; help communities strategically respond to sea-level rise; and enhance the resilience, quality of life, and environmental health of coastal communities.

Second, two policy changes can help increase uptake of coastal property buyouts, which will help save taxpayer dollars and reduce future NFIP liability

- Programs for voluntary buyouts of coastal properties generally launch with federal aid following flood disasters such as hurricanes. Federal and state emergency managers could save money—and lives—if they had resources and direction to initiate such programs for high-hazard flood zones before the next storm events strike. Pre-hazard buyouts for select, highly vulnerable communities could also provide recourse for low- income coastal property owners facing burdensome increases in flood-insurance premiums as rates are adjusted to more accurately reflect flood risk under the BW-12 reforms.

- Federal law limits FEMA to a maximum contribution of 75 percent of the pre-storm purchase price of each coastal property to be publicly acquired, necessitating that state and local governments contribute the additional funds required to complete the buyout. Following large-enough flood disasters, this limitation may impede fulfilling existing demand for buyouts if local and state governments are incapable of mustering their required contribution. Reducing this minimum 25 percent contribution for properties in coastal floodplains may help more willing sellers receive a buyout after a major storm, an outcome of higher value to federal taxpayers than a few additional percentage points of upfront cost. Since federal taxpayers will benefit from reduced NFIP liability, it is appropriate that they shoulder more of the burden of the upfront cost.

Develop and institutionalize new innovations in coastal floodplain buyout programs

The post-Sandy buyout programs underway in New Jersey and New York represent some of the largest such efforts in the U.S. coastal floodplain since FEMA initiated its contemporary property-acquisition framework in 1993. These efforts are in response to a coastal disaster that, while having little precedent, is projected to become a much more common occurrence for coastal cities, especially those along the Atlantic and Gulf of Mexico coastlines. Accordingly, these buyout programs provide an important learning opportunity for FEMA and other coastal states, which should carefully monitor their performance and study their outcomes upon completion to capture all available lessons.

Of particular note, New York state’s innovative system to provide up to 15 percent bonuses as a way to address specific social, fiscal, and land-use challenges that can accompany property buyouts warrants close attention. If the performance of New York’s program achieves the state’s goals—an increase in the number of willing sellers and more buyouts of high-risk properties—the increased price flexibility and higher buyout prices of the program should be institutionalized.

The remarkable cost effectiveness of buyouts shows that incentives, even those well above the 15 percent bonus cap maintained in New York, will likely still be fully “paid back” through cost avoidance within a relatively short time horizon. Moreover, restored coastal ecosystems provide valuable public services in addition to flood buffering, such as wildlife habitat, erosion control, water-quality enhancement, and public recreational opportunities, further justifying targeted bonuses for coastal property sellers.

Conclusion: Congress must act to make cost-effective investments in coastal resilience

On November 1, President Barack Obama signed an executive order titled “Preparing the United States for the Impacts of Climate Change,” which directs federal agencies to take several steps to help prepare the federal government and the nation for the effects of climate change. Its measures include the identification and removal of bureaucratic barriers in federal permitting of municipal investments in climate resilience, the formation of a task force on resilience planning, and improvement of public access to relevant data housed by federal agencies. In addition, the executive order directs federal agencies to recognize the “many benefits” provided by the “natural infrastructure” of the nation’s ecosystems, and—in language well aligned with the coastal wetlands discussed earlier—manage the nation’s lands and waters in ways that “promote the dual goals of greater climate resilience and carbon sequestration.”

The president’s executive order will surely contribute new momentum and institutional resources to building resilience to climate change in the United States and has obvious bearing on future management of the nation’s dangerously expanding coastal floodplains. But as a unilateral act by the executive branch, its potential to meaningfully reduce the immense and growing risks from inundation in America’s coastal floodplain is minimal. What are urgently needed, and what have repeatedly been proven to be cost effective many times over in states across the country, are federal investments in pre-hazard mitigation measures such as coastal property buyouts. As discussed earlier, such investments usually pay for themselves, often quickly returning more than 200 percent in avoided disaster-recovery costs within a decade or less.

Previous analysis from the Center for American Progress showed that between fiscal years 2011 and 2013, the federal government spent about $22 billion on general resilience-enhancement efforts nationwide, including both coastal and inland states, plus an additional $13 billion on post-Sandy recovery efforts, much of which included pre-disaster mitigation activities. As past FEMA research has shown, those investments will save the United States as much as four times that amount in economic losses and save taxpayers more than double that amount in post-disaster expenditures from the U.S. Treasury.

Over that same two-year time period, however, Congress was forced to spend $136 billion— nearly $400 per U.S. household—on relief and recovery after disasters struck. Based on what we know about the return on federal investments in resilience to flooding and other catastrophes—namely, the avoidance of $3.65 in U.S. Treasury spending for every $1 invested—that extraordinary sum could have been significantly reduced with a comparatively small investment in hazard-mitigation measures such as coastal floodplain buyouts, perhaps even saving expenditures from the Treasury and precluding unquantifiable pain and suffering within disaster-stricken communities.

Of course, appropriation of new discretionary spending of any kind is a near impossibility in today’s polarized political climate—in large part due to a bloc of House Republicans who favor fiscal austerity as an economic remedy. Yet even Tea Party champions who opposed the relief and recovery bill for Superstorm Sandy have realized the importance of federal spending once a weather-related disaster such as an Oklahoma tornado or a South Dakota blizzard strikes their home states.

Proactive, problem-solving policy has not been one of Congress’s strengths in recent years, but we must not ignore the fact that proven, highly cost-effective, and readily deployable measures exist to head off climate change’s threats to our physical and fiscal well-being. The resilience of our nation’s coastal areas is contingent on significant, dedicated investments, irrespective of Congress’s current willingness to make them.

While coastal floodplain buyouts are not a panacea for the effects of sea-level rise, they are an essential and complementary policy tool among the array of other hazard-mitigation measures available, such as elevating buildings and constructing levees, breakwaters, and seawalls. Buyouts and environmental restoration of the most vulnerable coastal properties, for example, reduce the extent to which this expensive “grey,” or concrete and steel-based, flood-protection infrastructure must be built, saving money and limiting the negative impacts on coastal habitats. This saves capital for coastal hardening in areas where buyouts are not appropriate, such as major urban centers, seaports, and coastal airports.

As sea-level rise accelerates along our nation’s coastlines, the United States stands at a juncture. One option: We can begin to make the smart investments necessary to respond to this reality and move our citizens and assets out of the crosshairs of climate change. FEMA and its partners in state and local governments have shown that floodplain residents can and will move out of harm’s way when given a fair opportunity to do so and that those properties can rapidly turn from being public liabilities to serving as valuable community assets that provide numerous public benefits. Expanding this effort to adapt our shorelines to sea-level rise will require political discipline to preserve existing reforms, compassion to aid families trying to relocate, and vision to effectively scale up coastal floodplain buyouts ahead of the pace of rising seas. This being the case, tremendous opportunities exist.

Alternatively, we can continue to ignore the root causes of sea-level rise and coastal flooding, as well as its available solutions. In so doing, we will squander precious time on further partisan bickering about which states deserve federal relief as we continue to lurch from one multibillion dollar catastrophe to the next, even as our collective liability for coastal floodplain properties mounts.

The latter path represents both an extension of the status quo and a dangerous gamble against an overwhelming body of scientific understanding that global warming is well underway. The stakes could hardly be higher: more than half a trillion dollars of taxpayer liability and the security of America’s economic powerhouses—its coastal counties.

Shiva Polefka is a Research Associate for the Ocean Policy program at the Center for American Progress. Mark Dennin, Michael Conathan, and Kristan Uhlenbrock contributed to this report.