By Karen Davenport, Isabel Perera | February 15, 2011

Download this brief (pdf)

While conservatives garner public attention with their effort to repeal the Affordable Care Act, other conservative proposals to undermine our nation’s health care system are receiving less attention. Most notably, Rep. Paul Ryan (R-WI), the chairman of the Budget Committee in the House of Representatives, advocates in his “Roadmap to America’s Future” replacing today’s Medicare program with a federal voucher that future Medicareeligible seniors could use to purchase health coverage. This proposal will force Medicare beneficiaries to spend significantly more than they do today to maintain coverage equivalent to today’s Medicare program.

This issue brief estimates the new costs that Americans with Medicare coverage will bear under Ryan’s budget proposal—costs that will be largely borne by everyone under the age of 56.

The proposal

Rep. Ryan proposes to give new Medicare enrollees an annual voucher they could use to purchase health insurance beginning in 2021. Individuals who join Medicare in this year— largely individuals turning age 65—would receive this voucher, which would initially be worth an average of $5,900 (in 2010 dollars). Rep. Ryan further specifies that when all age groups are fully phased-in, the voucher would be worth, on average, $11,000 in 2010 dollars.

The voucher would grow at a slower rate than projected increases in health care costs, and would replace Medicare’s current benefits. Medicare would no longer pay for services as enrollees see their doctors, use hospital care, or fill a prescription. Nor would Medicare pay Medicare Advantage plans a monthly premium to finance and arrange care for their Medicare enrollees.

Traditional Medicare would continue for individuals who enrolled in coverage prior to 2021, but would eventually disappear completely as this older generation of Medicare enrollees passes away. That means anyone who today is under 56 years of age will be paying more, perhaps much more, for health coverage when they qualify for Medicare.

What does this mean for tomorrow’s seniors?

Ending Medicare as we know it would leave seniors facing significantly higher health care premiums. With a voucher that fails to keep up with increases in health care costs, Medicare beneficiaries would not be able to purchase coverage equivalent to today’s Medicare benefit. Their new premium—the amount above the voucher they would have to pay to purchase that coverage—would far exceed their expected Medicare premiums under current law.

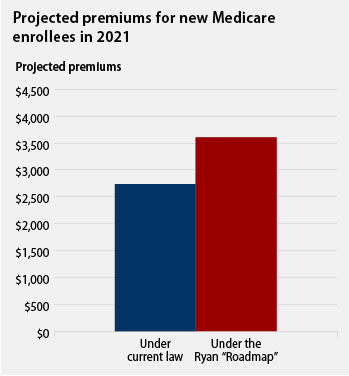

Under current law, people with Medicare coverage can expect to pay $2,730 per year ($228 a month) in 2021 for total Part B and Part D premiums, which will provide them with full Medicare benefits. Under Rep. Ryan’s proposal, new Medicare enrollees will pay an average of $3,579 for equivalent coverage—a 31 percent increase in their premium for this year. This “Roadmap” premium increase will grow over time, as the voucher’s value fails to keep up with increases in health care costs.

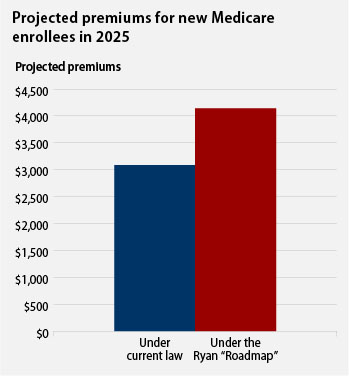

Indeed, the Ryan plan will mean that seniors and people with disabilities who receive the “Roadmap” voucher would face an average increase in premiums of almost $850 in 2021, which will grow to nearly $1,060 in 2025, to purchase a benefit package equivalent to today’s Medicare program.

Methodology

The Center for American Progress relied on a multistep calculation to compare Medicare beneficiaries’ premiums under Rep. Ryan’s “Roadmap” proposal and under current law. Here are those calculations.

Average beneficiary premium under the Ryan Roadmap: $3,579 in 2021; $4,132 in 2025

In his proposal, Rep. Ryan specifies that the initial Medicare voucher would average $5,900 (in 2010 dollars) per beneficiary, and that the average voucher at full implementation would equal $11,000 (in 2010 dollars). In their analysis, the Congressional Budget Office grows this amount by 2.7 percent annually, which represents their estimate of the growth factor specified by Rep. Ryan—the average of the growth of consumer price index for all urban consumers, or CPI-U, and the growth of the price index for medical care, or CPI-M.1 Using this 2.7 percent annual growth rate, we grow the value of the Medicare voucher to the first year of the voucher program and beyond, which gives us initial voucher values of $7,910 in 2021 and $8,800 in 2025 for the first cohort of enrollees.

To develop projections of average per beneficiary spending, we first grew per capita Medicare expenditures on personal health care spending for 65-to-74 year olds from 2004 to 2010 by historical growth rates found in the 2010 Medicare Trustees Report. We adjusted for the addition of the Part D benefit in 2006 and assumed that spending for this cohort grew at the same rate as the general Medicare population.2, 3 For comparison, we applied demographic adjustment factors for Medicare Advantage contracts to average 2010 per beneficiary costs and obtained similar results. We then grew average per beneficiary spending for this cohort to 2019 using the trustees’ projections, and used the trustees’ projected average annual growth rate for 2010 through 2019 to estimate per beneficiary expenditures through 2025. These calculations yield average per beneficiary spending of $11,488 in 2021 and $12,930 in 2025.

We then calculate the difference between the projected value of the Medicare voucher under the “Roadmap” proposal and projected average per-beneficiary Medicare spending to estimate the average beneficiary premium under the Ryan “Roadmap.”

Medicare premiums under current law: $2,737 in 2021; $3,094 in 2025

The 2010 Medicare Trustees Report estimates the Part B standard monthly premium and the Part D base beneficiary premium through 2019. Together, these values equal the monthly baseline beneficiary premium, under current law.

Using the trustees’ projected average annual growth in Part B and Part D premiums for 2010-2019, we project the monthly baseline beneficiary premium through 2025. This value, multiplied by 12, equals the annual beneficiary premium under current law for individuals who pay the standard Medicare premium.

Download this brief (pdf)

Click here to read full brief.

Karen Davenport is Director of Health Policy at the Center for American Progress. Isabel Perera is a Special Assistant for Health Policy at the Center.

###