For the full issue brief, click here.

Washington, D.C. — Congressional leaders promised to address tax credit extensions in the first quarter of 2012 and today the Center for American Progress released “Good Government Investments in Renewable Energy,” by Richard Caperton, examining current government investments in renewable energy and how they should work in the future to foster a healthy and stable business environment that creates jobs and keeps America competitive in the global economy.

This issue brief specifically calls on Congress to take action on extending the production tax credit, or PTC, investment tax credit, or ITC, and the Treasury Cash Grant Program, focusing on a comprehensive investment package that creates paths for all technologies so that American businesses will invest in the technologies that make the most sense for our country. For many years the technologies eligible for the PTC and ITC have remained unchanged, but Congress should consider placing technologies within the PTC and ITC (or both) depending on the unique characteristics of each technology and their specific capital investment needs.

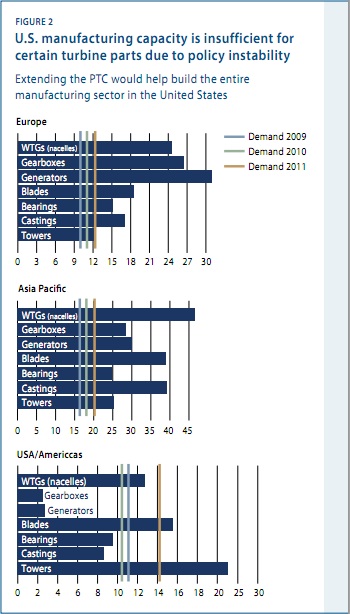

The production tax credit, which has real benefits for at least 85,000 American workers in the wind industry, has only been extended for two years at a time since its creation. When it’s not in effect, there’s virtually zero investment. Since manufacturers know that this on-again, off-again cycle for the industry would leave them with virtually no business every other year, and because demand for certain turbine parts exceeds our manufacturing capacity, American wind farms use some imported parts. The lack of consistent policy is clearly contributing to U.S. underinvestment in domestic production of these strategic technologies, while our economic competitors have simultaneously developed robust manufacturing capacity to serve their growing domestic demand while meeting global demand through technology imports.

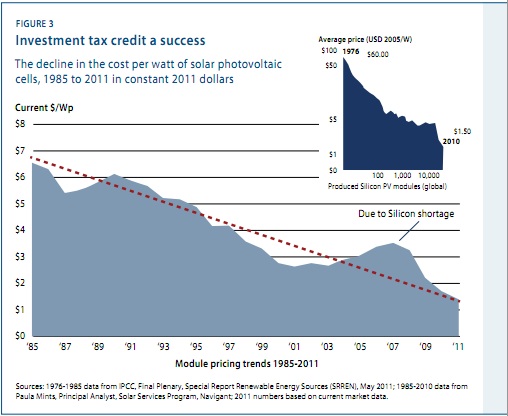

The upfront, one-time nature of the investment tax credit has some real benefits for solar power. It has facilitated extremely impressive cost improvements within the solar industry, despite the fact that solar is a more expensive technology to initially install, it is a younger industry than wind, and the technology isn’t quite as proven over the long term. Not surprisingly, as costs fall and demand rises, the solar industry now employs more than 100,000 people, up from 20,000 just five years ago. Offshore wind farms are generating a lot of interest and projects that are moving forward could be made temporarily eligible for the ITC, with a shift back to the PTC as the industry grows and more closely resembles onshore wind.

The Treasury Cash Grant Program, also known as the Section 1603, makes the PTC-eligible technologies also eligible for the ITC and allows developers to get a cash grant instead of the ITC. This means that all renewable developers are able to get a cash grant from the Treasury Department for 30 percent of the initial investment in their project. This solved the tax equity market shortfall problem, and allowed renewable investments to continue. Instead of shrinking, the wind and solar industries grew during the recent recession, largely because the Section 1603 program helped with financing. The cash grant program makes the PTC and ITC more effective, more efficient, and more transparent. If Congress does choose to extend the cash grant program to always match the PTC and ITC extensions, thus making public spending more efficient for taxpayers, they should also evaluate the size of the tax credits as evidence seems to indicate that the ITC could be made smaller if it were always offered as a cash grant.

For the full issue brief, click here.

To speak with Richard Caperton, please contact Christina DiPasquale at 202.481.8181 or [email protected].

###