This column contains a correction.

New Census Bureau data released today illustrate once again the extent to which America’s middle class is struggling to recover from both the Great Recession and the decades of unequal economic growth that preceded it. Household incomes remained essentially flat in 2013—far below their pre-recession levels—and the share of the national economic pie that goes to the middle class continued to stagnate close to record lows. At the same time, those at the very top claimed the majority of the income growth seen since the recession’s end.

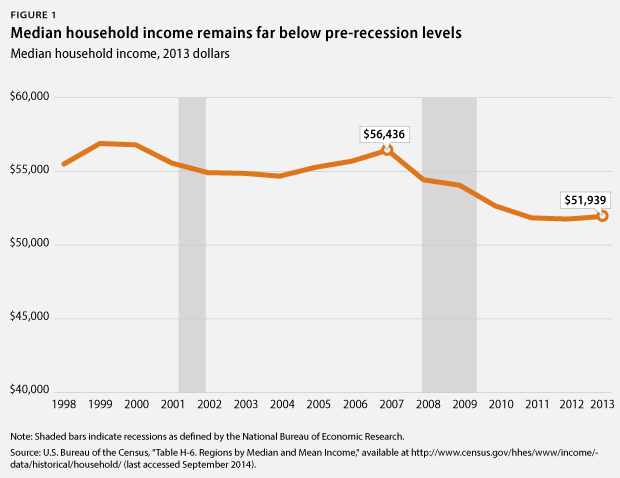

The clearest indicator of the continuing struggles of the middle class has been the failure of the national median income to rebound to pre-recession levels and its overall decline over the past 14 years. In 2013, the typical middle-class household earned an income of $51,939, which was a statistically insignificant $181* above their inflation-adjusted 2012 income level but still nearly $4,500 below what they earned before the start of the Great Recession in 2007. Of greater concern, however, is that middle-class incomes have been either stagnant or declining since peaking in 1999. As a result, the median household in the United States is now actually earning less than it did in 1989—nearly a quarter of a century ago.

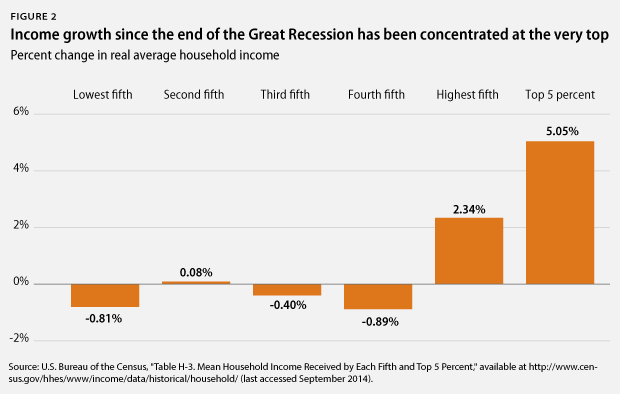

The fact that the majority of the income gains seen since the Great Recession ended in 2009 have been concentrated at the very top is partially responsible for the median income’s stalled recovery. While families across the entirety of the income distribution suffered greatly during the recession, the wealthiest households have bounced back the fastest. Between 2010 and 2013, the average income of households in the top 5 percent increased more than 5 percent, while average incomes of those in the middle 60 percent actually declined overall. Such disproportionate growth only further exacerbates economic inequality as the middle class fall further and further behind the rich.

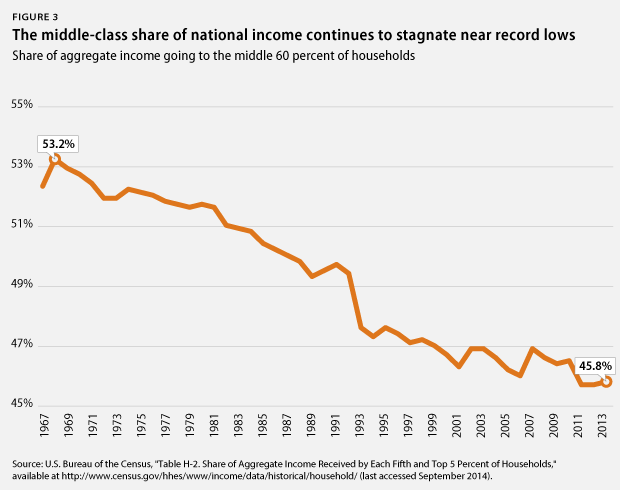

This concentration of post-recession income growth among the wealthiest households should come as no surprise given that those at the top of the income distribution have seen their share of the national economic pie expand for decades at the expense of the middle class. In 2013, the middle 60 percent of households took home only 45.8 percent of total national income—essentially unchanged from the record-low 45.7 percent they took home in 2011 and 2012 and down 7.4 percentage points from the record-high share they took home in 1968. To put this figure in perspective, 7.4 percent of the aggregate national income in 2013 was approximately $661 billion dollars, or $9,000 per middle-class household. Over that same time period, the top 20 percent of households expanded their share of total national income from 42.6 percent to 51.0 percent, with the top 5 percent of households alone increasing from 16.3 percent to 22.2 percent.

The United States requires a prosperous middle class to spur economic growth. But as the Census Bureau data released today make clear, America’s middle class is still struggling to reverse the trends of the past several decades and overcome the economic trauma of the Great Recession. Policymakers must take action to help the middle class by enacting policies that help more Americans get back to work and ensure that those who do have jobs can earn enough to support themselves and their families. Without such action, America’s middle class will continue to be squeezed more and more, sacrificing both their well-being and overall U.S. economic growth.

Keith Miller is a Research Associate with the Economic Policy team at the Center. David Madland is the Managing Director of the Economic Policy team at the Center for American Progress.

*Correction, September 16, 2014: This article has been updated to clarify that the change in household income in 2013 was not statistically significant.