Additional tables available in the appendix of the PDF and Scribd versions.

It has been well documented that the nation’s public colleges, universities, community colleges, and career training centers significantly boost the economic mobility of students who pursue and complete degrees and credentials after high school. The skills students acquire at these higher-education institutions lead to jobs that pay a wage premium in a modern economy. However, for many students, families, and society as a whole, decreasing state investments and increasing student-loan debt is threatening the value of a public postsecondary education—that is to say, the idea that a degree or credential beyond high school will deliver on the promise of a higher standard of living. To make sure that higher education attainment leads to improved outcomes for graduates, it is crucial that national policy choices ensure that public colleges remain affordable for low- and moderate-income Americans and student-loan debt does not overly burdened graduates as they prepare for the workforce.

As the Center for American Progress recently detailed in its report “A Great Recession, a Great Retreat,” in the mid-20th century, the United States had success in making significant investments in postsecondary education—particularly in public institutions. These efforts boosted the college-attendance rate and solidified the nation’s commitment to ensuring that students had access to an affordable education after high school. However, the Great Recession led to policy choices that curtailed progress in many areas, including higher education, which set back America as a result. The report found that in response to the fiscal crisis, the majority of state governments charted a budgetary course that reduced direct support to public colleges and universities, which, not surprisingly, coincided with the increasing unaffordability of these institutions. To make up for the funding cuts, public colleges increased their reliance on tuition revenue, which unduly burdened low- and moderate-income families. Those students and families living in states with the greatest disinvestment in public colleges and universities paid the highest net price for a postsecondary education relative to students in the same income groups in states where funding cuts were not as deep.

It is particularly important that the United States increases its investment in postsecondary education in the face of rising competition from its international peers. As recently as 1996, the United States had the second highest share of adults who had earned postsecondary education credentials and the highest share of adults with university degrees, according to the Organisation for Economic Cooperation and Development’s, or OECD’s, measurements of educational attainment levels across developed nations. More recently, however, America’s level of achievement has fallen behind other nations. In 2012, the most recent year measured, the United States ranked fifth in the percentage of adults who had earned postsecondary education credentials.Even more worrisome, the share of young Americans—those between the ages of 25 and 34—with postsecondary credentials has dropped to 12th relative to other nations, while those possessing university degrees fell to 14th.

Earning a college degree or credential can be life changing and economically sustaining. That is why it is critically important that America’s system of public colleges remain affordable for all Americans. However, CAP analysis estimates that annual student-loan borrowing increased by $17 billion in the five years since the beginning of the Great Recession.Moreover, annual borrowing per student increased by a median of $1,285 during that same time span.

An affordable, quality college education must remain a central pillar of the nation’s policy agenda. CAP recommends the creation of a Public College Quality Compact—an investment from the federal government matched with state reinvestment—that would prompt a resurgence of postsecondary education degree attainment and, at the same time, ensure that this education is affordable for low- and moderate-income Americans.

This issue brief examines the increased reliance on loans by students attending public institutions and presents state-by-state data on the spike in federal student-loan borrowing since the onset of the Great Recession. Further, this brief details the proposed Public College Quality Compact, which CAP believes is the best solution to address affordability and ensure that public colleges continue to be an engine for economic mobility.

In response to the Great Recession, states have disinvested in public colleges

The onset of the Great Recession in 2008 prompted a fiscal crisis within state governments, which in turn ushered in a variety of budget tightening measures. When it came to higher education, the majority of states cut back their direct investment in public universities, colleges, and training centers. Unfortunately, these cuts affected the affordability of public colleges for low- and moderate-income American families as institutions relied more on tuition revenue to fill their budget shortfalls. As a consequence, students and families in states with the highest disinvestment pay a higher net price relative to similar students and families in other states.

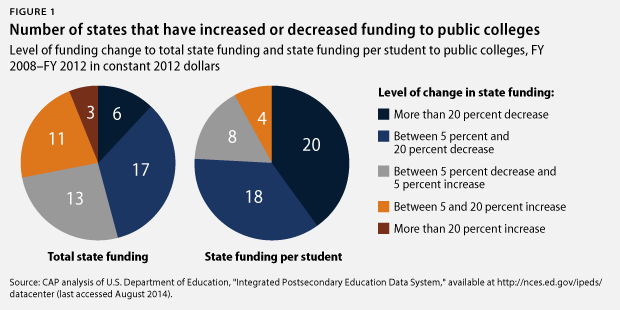

CAP analyzed data that higher-education institutions reported to the U.S. Department of Education and found that 29 of 50 state governments decreased their total level of direct support to public institutions between fiscal years 2008 and 2012 after adjusting for inflation in constant 2012 dollars. The Great Recession coincided with a 13.7 percent increase in enrollment at public colleges as Americans who lost their jobs pursued degrees and credentials in order to acquire skills and remain competitive in the economy.These cuts were more pronounced when measured on a per-student basis, with 44 of 50 state governments decreasing their direct support of public colleges between FY 2008 and FY 2012.

The decreases in state funding after the Great Recession also coincided with institutions’ increased reliance on tuition revenue, with students and families carrying those costs. All 50 states decreased the share of revenue going to public colleges from state coffers,while 47 states increased the share of public college revenue from tuition dollars.

Finally, the cost of the state cuts was passed on to the nation’s most vulnerable students. In the states that decreased funding of public colleges by the greatest amount, low- and middle-income families pay a greater net price for their education than students from the same income group across the country.

Student-loan debt at public colleges

The nation’s postsecondary education system is increasingly reliant on student-loan debt. According to the most recent accounting by the Department of Education, there are more than $1 trillion in federal student loans outstanding.As states have disinvested in post-secondary education and family budgets were strained by the recession, students who attend public institutions have increasingly relied on student loans to finance their education. The share of students borrowing to attend public institutions and the amount of money borrowed has increased sharply in recent years.

Department of Education data released every four years are some of the most detailed on postsecondary education and how American families finance college. During the 2007–08 school year, 24 percent of undergraduate students at public institutions borrowed federal

student loans to pay for their education—the same level of borrowing recorded during the 2003–04 school year.However, the share of students borrowing at public colleges jumped sharply after the onset of the Great Recession to 30 percent during the 2011–12 school year. (see Figure 2)

In addition to the increase in the share of students borrowing to pay for school, the amount of money borrowed has increased. Looking just at the students who borrowed federal student loans, the average amount borrowed each year increased by 42 percent over the period examined. The average amount borrowed at all public institutions jumped by $2,095, increasing from $4,967 borrowed during the 2003–04 school year to $7,063 during the 2011–12 school year. (see Figure 2) At public two-year institutions, the average amount borrowed during the 2011–12 school year was $4,718 while at public four-year institutions, the average amount borrowed during 2011–12 was $8,163.These figures measure just one academic year of borrowing by students. The cumulative student-loan levels required to complete a degree are significantly higher.

Student-loan borrowing at public colleges by state

After carefully documenting the trend of state disinvestment and increased reliance on tuition funds at public colleges, it is important to examine the corresponding changes in the volume of student-loan borrowing each year at public colleges by state. The Department of Education releases information on the volume of student loans issued by institution and loan program. These reports were organized to examine public institutions by state and calculate the change in overall and per-student borrowing since the Great Recession.

The total amount of federal student loans borrowed at public colleges increased by $17.1 billion, from $31.3 billion during the 2007–08 school year to $48.4 billion during the 2011–12 school year. This change represents a 54.6 percent increase in yearly borrowing.

Yearly federal student-loan borrowing at public colleges increased in all 50 states since the onset of the Great Recession, but the magnitude of the increases varied by state. Yearly borrowing in North Dakota, for example, increased 19.6 percent, which was the lowest increase of the 50 states. In contrast, yearly borrowing in Utah increased 102 percent, which was the highest increase among the 50 states. In total, 9 states saw yearly borrowing increase by less than 40 percent; 26 states saw yearly borrowing increase between 41 percent and 60 percent; 7 states saw yearly borrowing increase between 61 percent and 80 percent; and 8 states saw yearly borrowing increases by more than 80 percent. (see Table A1)

As discussed above, between the 2007–08 and 2011–12 school years, enrollment at public colleges increased by 13.7 percent, so it is important to examine the changes in yearly borrowing on a per-student basis.After controlling for increases in enrollment, yearly borrowing per student increased at public institutions in all 50 states between the 2007–08 school year and the 2011–12 school year.The median increase was $1,285 per student. In Indiana, for example, yearly borrowing increased by $92 per student, the lowest percentage increase of the 50 states. On the other hand, yearly borrowing in Oregon increased by $2,273 per student, making it the state with the highest increase. In total, 4 states saw an average yearly borrowing increase of less than $500 per student; 9 states saw a yearly borrowing increase of between $500 and $1,000 per student; 21 states saw a yearly borrowing increase of between $1,000 and $1,500 per student; 13 states saw a yearly borrowing increase of between $1,500 and $2,000 per student; and 3 states saw a yearly borrowing increase of $2,000 or more per student.(see Table A2)

Borrowing per student was measured as a share of the estimated full-time undergraduate enrollment. While not all undergraduate students at public colleges borrow federal student loans to finance their education and many graduate students also borrow, the estimate in borrowing per student and the change in borrowing per student was calculated to produce a measure that was comparable to the analyses presented in the CAP report “A Great Recession, a Great Retreat.” If only students that borrowed were included, the loan burden would be larger; if graduate students were included in the enrollment, the amount borrowed per student would be smaller. Ideally, only borrowing for undergraduates would be included in this analysis. However, those data are not consistently available across the years examined in this issue brief.

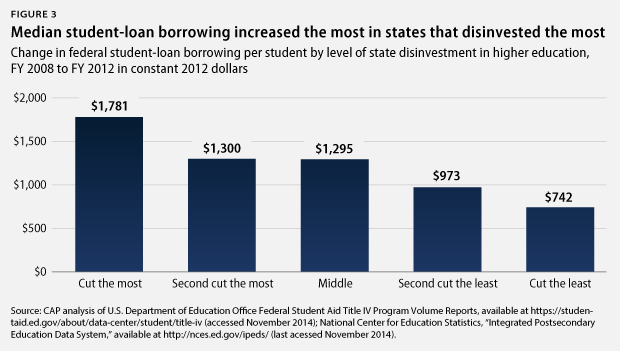

Student-loan borrowing increased the most in states that disinvested the most

The increase in federal student-loan borrowing at public institutions since the Great Recession is notable because states that disinvested the most also saw the greatest increase in federal student-loan borrowing. In response to the economic downturn, 44 of 50 state governments decreased their direct support per student.In the states that decreased state funding the most—by 30 percent or more—student-loan borrowing increased more in terms of number of students borrowing and the loan amount borrowed than it did in states with less disinvestment. At each level of disinvestment, student-loan borrowing increased in line with the change in state support for public colleges.

Public College Quality Compact calls for renewed investment in higher education

To ensure that American postsecondary education remains affordable for the next generation of students, it is time for the federal government to make an investment similar to the investments that transformed American higher education in the post-World War II era. The Public College Quality Compact, as envisioned, would aim to significantly boost degree attainment in the same way that post-World War II investments did. Increased degree attainment would be accomplished through the creation of a federal grant program, or fund, that directly ties federal and state investments in postsecondary education and encourages states to reinvest. This new fund will spur states and institutions to more effectively meet the needs of low- and middle-income students. As designed, the program would require states to match federal grants. To be eligible to participate in the compact, states would be required to agree to implement reforms and innovations that would increase the value proposition for students attending public colleges, universities, and training centers. Specifically, a Public College Quality Compact would require states to do the following:

- Create reliable new streams of college funding. These new streams would need to provide at least as much as the maximum Pell Grant per student in indirect and direct support to public colleges and universities. Doing so would ensure that students and prospective students can prepare for and enroll in postsecondary education with certainty.

- Make college affordable.States should guarantee grant aid to cover enrollment at public institutions earmarked for low-income students who pursue an associate’s or bachelor’s degree.

- Improve institution and student performance.States must set outcome goals for institutions, such as increased graduation rates and the implementation of proven, successful strategies that improve student performance. Some of these proven strategies include learning communities that promote student engagement or summer bridge programs to put students on a path to academic success.

- Remove barriers to degree attainment.State and institutional practices and policies that stand in the way of college completion should be eliminated. This can be accomplished in part by standardizing transfer-credit and admissions requirements and by raising K-12 learning standards to align with readiness for postsecondary entry-level courses.

Affordability is key element of Public College Quality Compact

In light of recent increases in student-loan borrowing at public colleges, it is particularly important to outline what level of borrowing is affordable in the context of public colleges. The Public College Quality Compact formula would award funds to states by measuring the affordability of the education they offer.

The majority of funds would be allocated to states based on the enrollment of low-income students and military veterans, measured by the share of Pell Grant and GI Bill beneficiaries. Eligible states would receive funding from the compact based on these students having access to an affordable education and earning a credential or a degree. The federal government would also reserve some program funds for states or groups of institutions working across state lines that wish to experiment with reforms that are effective in improving higher-education quality and outcomes.

Under the terms of the compact, a student should not be required to borrow more than the federal loan limit to cover the cost of attending school, which today stands at $27,000 for four years of college education.However, the aim of the compact is to allow students to borrow far less than that amount to finance their education.

The measure of college affordability should be related to what level of borrowing a student can reasonably expect to repay based on the median salary earned by people holding a specific level of degree. For example, in 2012, the median salary for a young worker with an associate’s degree was $35,720 and was $49,950 for a young worker with a bachelor’s degree.Under the compact, the maximum amount of subsidized student loans that a student could borrow would be $19,000 over a four-year period and $8,000 over a two-year time span.Therefore, with $19,000 in student-loan debt, a person with a bachelor’s degree would be able to repay their loans under the government’s standard repayment plan, paying $199 per month over 10 years at current interest rates.If a student with an associate’s degree’s borrowed $8,000, he or she would owe $84 per month over 10 years at current interest rates.These levels of borrowing are affordable for student borrowers when taking into account their respective median salary.

Conclusion

To keep postsecondary education affordable, CAP proposes the Public College Quality Compact aimed at boosting access to and degree attainment at America’s system of public universities, colleges, and training centers. This proposal is essential to address our national crisis of more than $1 trillion in outstanding student-loan debt. An investment from the federal government, matched with reinvestment by states, would translate into lower prices for American families and ensure that a college education remains within reach for all without saddling students with burdensome levels of debt. Improving the affordability of postsecondary education will increase the share of Americans with postsecondary credentials and degrees and ensure that the American workforce and economy remain competitive globally. Importantly, it will improve the situation of students from moderate- and low-income families, promoting economic and social mobility within our society.

Elizabeth Baylor is Associate Director of Postsecondary Education at the Center for American Progress.