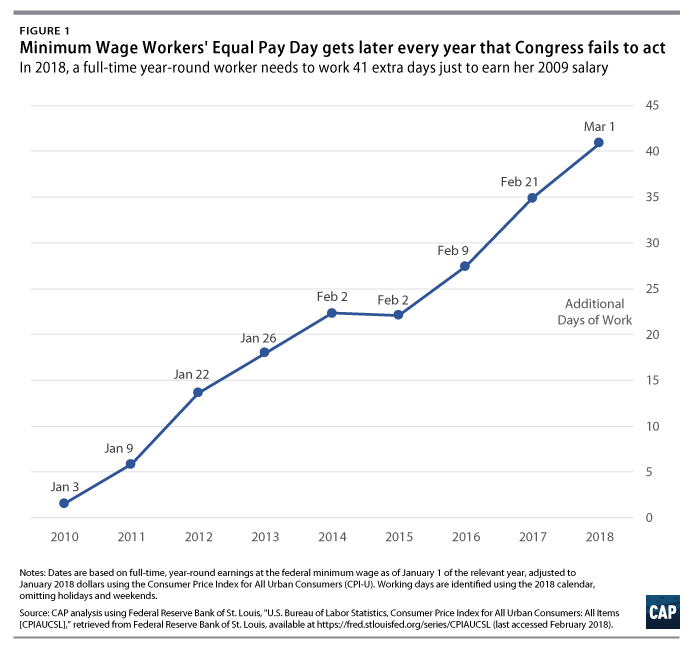

Today, Minimum Wage Workers’ Equal Pay Day, marks how many extra days into the new year a minimum-wage worker must work just to earn the same amount she did in 2009. In 2018, a worker earning $7.25 per hour needs an extra 41 working days—more than eight weeks—just to take home the same pay as she did in a single year when the federal minimum wage was last increased. (see Methodology)

As a result, a full-time minimum-wage earner will lose nearly $2,370 in purchasing power this year. That’s more than 47 times the average tax cut this same worker can expect from Republicans’ tax law. (see Methodology) And it’s 30 times the $1.50 per week “raise” a Pennsylvania school secretary reported getting thanks to the tax law, as House Speaker Paul Ryan (R-WI) proudly tweeted—and then quickly deleted.

Instead of directly benefitting workers by raising the federal minimum wage, President Donald Trump and congressional Republicans passed a tax plan skewed heavily toward the wealthy and large corporations. In their rush to ram through the bill, Trump and congressional Republicans repeatedly vowed the bill’s benefits would trickle down to everyday American workers through higher wages. In the three months since the bill’s passage, that promise has proven empty. Rather than raising wages, corporations have deposited their gains squarely back into the pockets of wealthy shareholders by issuing nearly $200 billion in stock buybacks—more than 30 times what workers have received in bonuses or wage increases.

Meanwhile, in contrast to their hard work on behalf of America’s richest, Congress and President Trump are refusing to consider commonsense policies to help the nation’s lowest-paid workers. For nearly nine years, congressional Republicans have blocked efforts to raise the nation’s federal minimum wage above the poverty wage of $7.25 an hour. As a consequence, inflation has been eating away at low-wage workers’ pay since July 2009.

Every year that Congress fails to act, Minimum Wage Workers’ Equal Pay Day slips later and later into the year. (see Figure 1) The burden of a low and eroding minimum wage falls much more heavily on women and workers of color, who are disproportionately likely to work in low-wage jobs, exacerbating the already-wide pay gaps by gender and race. But despite extensive research showing that minimum-wage increases substantially boost workers’ incomes—at virtually no cost to government and with no discernable effect on employment—conservative leaders in Congress have repeatedly voted against change.

Fortunately, many states, cities, and counties have forged ahead amid congressional obstructionism. As of early 2018, 29 states and the District of Columbia, as well as at least 41 localities, had adopted minimum wages above $7.25—thanks in large part to the efforts of groups like Fight for $15. In fact, much of the January wage bump that President Trump bragged about was fueled by states’ minimum wage increases that went into effect on January 1. Low-paid workers these areas will lose less than $2,370 compared to 2009—and in 22 states, the lowest-wage workers are better off than they were under the 2009 federal minimum wage.

Despite significant state and local progress, federal action is more urgently needed than ever—and not just due to the widening gap separating workers in $7.25 states from their peers in higher-wage states. Half of states have also adopted so-called minimum wage preemption laws, preventing local communities from acting to raise wages for their lowest-paid workers.

But merely raising workers’ pay back to 2009 levels is far too low a bar for a low-wage workforce that is older, better educated, and more productive than ever—especially as our nation’s wealth is greater than ever. Yet today’s minimum-wage workers earn nearly 30 percent less in inflation-adjusted terms than their counterparts earned half a century ago, in 1968.

In overwhelming numbers and across party lines, Americans want their lawmakers to take bold action on minimum wage. Legislation introduced last April, the Raise the Wage Act of 2017, would gradually increase the federal minimum wage to $15 per hour by 2024 and tie its value to inflation—a move that nearly two-thirds of American voters support.* The bill would also phase out the discriminatory subminimum wages for tipped workers and workers with disabilities.

But rather than raising wages like a majority of Americans want, Republicans leaders—in a tax-cut hangover—are instead preparing to slash programs that help millions of working families afford the basics. But taking away people’s food, housing, and medical care won’t help them find work any faster, nor will it suddenly make their low wages enough to make ends meet. If Ryan and his fellow conservatives were sincere about helping working families, they would champion a higher minimum wage as a win-win solution—a way to improve low-income families’ wellbeing while also reducing their need to turn to social assistance programs. Indeed, raising the minimum wage to $12 by 2020 would save an estimated $53 billion over 10 years in spending on food assistance benefits alone.

Thanks to the Trump tax law, rich Americans making more than $1 million will see an average tax cut of $70,000 this year—nearly five times what a full-time minimum-wage worker will earn in the entire year. (By 2027, the majority of taxpayers—especially lower-income taxpayers—would see a tax increase under the law.) If policymakers can muster the will to act on behalf of millionaires, surely they will not let another Minimum Wage Workers’ Equal Pay Day go by without giving America’s lowest-paid workers a raise.

Methodology

Author’s calculations of Minimum Wage Workers’ Equal Pay Day and changes in purchasing power are based on earnings from working 40 hours per week for 52 weeks per year at the federal minimum wage, with 1968 and 2009 values adjusted to current dollars as of January 2018 using the Consumer Price Index for All Urban Consumers (CPI-U) and Consumer Price Index Research Series Using Current Methods (CPI-U-RS) produced by the Bureau of Labor Statistics. Dates are identified as the number of working days into the year on the 2018 calendar, omitting holidays and weekends. Expected changes in purchasing power under a $15 minimum wage by 2024 (see Table 1) are calculated using inflation projections from the Congressional Budget Office released in June 2017.

The average tax cut a minimum-wage earner can expect to receive from the Tax Cuts and Jobs Act is based on Tax Policy Center analysis for households with income between $10,000 and $20,000 per year, which will see an average tax reduction of $50 in 2018. (A household with one full-time minimum-wage worker has annual earnings of about $15,100.)

Rachel West is the director of poverty research at the Center for American Progress.

*Author’s note: Center for American Progress and GBA Strategies forthcoming poll data on file with author.