This issue brief contains corrections.

The Powder River Basin, stretching across southeast Montana and northeast Wyoming, produces more coal than any other region in the United States. It is also home to the single-richest coal reserves in the country, containing an estimated 162 billion short tons of coal that are recoverable under the U.S. Geological Survey’s projections for future mining technology and coal prices.* By and large, the vast majority of this coal belongs to U.S. taxpayers and is managed on their behalf by the Department of the Interior’s Bureau of Land Management, or BLM. Approximately 40 percent of all coal produced in the United States comes from BLM-managed lands, with a staggering 87 percent of it mined in the Powder River Basin.

While the open-pit mines that stretch across the Powder River Basin have long been a source of cheap fuel, they are also one of the nation’s largest sources of carbon pollution. In fact, 13 percent of all U.S. fossil-fuel emissions stem from Powder River Basin coal, which is burned in more than 200 power plants across 35 states. This is equivalent to the annual emissions of 70 percent of all cars registered in the United States, or 1.5 times the annual emissions of Saudi Arabia. In fact, the Powder River Basin alone ranks globally as the seventh-largest emitter of carbon pollution annually, trailing six countries—China, the rest of the United States, India, Russia, Japan, and Germany.

While it is evident that Powder River Basin coal is a major contributor to U.S. climate change and carbon pollution, what is less apparent are the real economic and social costs of burning this coal—and the true cost borne by U.S. taxpayers, which has long been overlooked by policymakers.

Undervaluing Powder River Basin coal

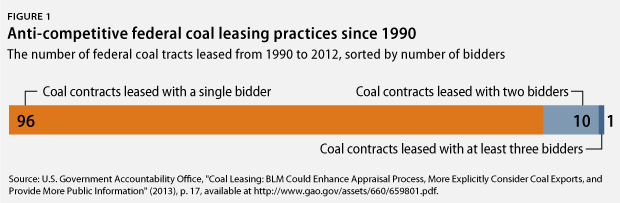

For decades, the BLM has run a fundamentally noncompetitive leasing program, which has been a boon to industry. Since 1990, 96 of the 107 coal-lease sales held by the BLM have had only one bidder, despite a clear mandate under the Mineral Leasing Act of 1920 that federal coal leases be offered “competitively.” (see Figure 1) This means that almost 90 percent of all federal coal-lease sales over the past 25 years have been noncompetitive.**

Coal companies that operate in the Powder River Basin benefit from the BLM’s coal program because, in large measure, they have dictated the terms of federal coal leasing for decades. Although the BLM is obligated to hold competitive lease sales and conduct rigorous environmental reviews in coal-producing regions, the BLM in 1990 officially decertified the Powder River Basin as a “historic coal production region.” Decertification has effectively given coal companies control over the federal leasing process, allowing them to select which tracts to lease, rather than having to follow a regional leasing plan where the secretary of the interior controls the process—as was envisioned by the Federal Coal Leasing Amendments Act of 1976. This long-overlooked policy exemption, made by former President George H.W. Bush’s secretary of the interior, Manuel Luján Jr., has resulted in diminished competition, reduced environmental review of proposed coal leases, and lax oversight.

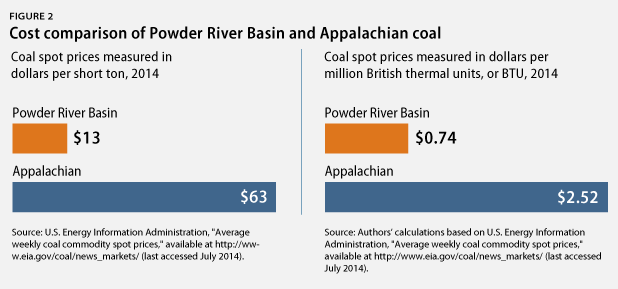

Consequently, Powder River Basin coal is significantly undervalued and sells at a fraction of the cost of coal produced in other regions of the United States. Coal produced in the Appalachian region, for example, sells for $63 per short ton, but Powder River Basin coal sells for a shockingly low $13 per short ton—$50 less per short ton. (see Figure 2) Even when accounting for the higher energy content of Appalachian coal, Powder River Basin coal is still drastically cheaper, costing just $0.74 per million British thermal units, or BTUs, versus $2.46 per million BTUs for Appalachian coal. (see Figure 2)

The domestic price of Powder River Basin coal is even more startling when viewed in the context of the global market. Internationally, Power River Basin coal sells for five times more than it does domestically. In China, for example, Powder River Basin coal fetches $69 per short ton. And demand for domestic coal on the global market continues to rise. In 2012 alone, the United States exported more than 125 million short tons of domestic coal. Moreover, the demand for exports continues to grow, with U.S. coal companies that operate in the Powder River Basin, such as Arch Coal, Inc., pursuing ports in Oregon and Washington to export as much as 150 million short tons of coal per year to Asia.

The noncompetitive practices of the BLM coal-leasing program and the agency’s undervaluation of Powder River Basin coal are well documented. In 2013, the Government Accountability Office, or GAO, and the U.S. Department of the Interior’s Office of Inspector General issued separate reports in which they each found major deficiencies in the coal-leasing program and concluded that it lacks rigor and oversight. In particular, both noted that the BLM employs a deeply flawed process to assess the fair market value of federal coal.

The artificially low market price of Powder River Basin coal costs U.S. taxpayers in several ways. Although the GAO and the Office of Inspector General refrained from assessing the full loss to taxpayers from the noncompetitive nature of BLM’s coal-leasing program, a third-party review estimated that over the past 30 years, the government’s undervaluation of coal may have cost taxpayers upward of $30 billion in lost revenue. What’s more, taxpayers are missing out on royalty payments that would accrue if the coal were sold at a higher price on the market. A short ton of coal sold at $60 per short ton, for example, provides a 12.5 percent royalty payment of $7.50 per short ton for taxpayers. However, a short ton of coal sold at $13 per short ton returns a 12.5 percent royalty payment of just $1.63 per short ton. With hundreds of millions of tons of federal coal sold annually from the Powder River Basin, these losses to American taxpayers add up quickly.

Social cost of carbon from burning Powder River Basin coal

The true cost of Powder River Basin coal is much more than the billions of dollars in lost revenue that the federal government fails to collect on behalf of U.S. taxpayers; that is only half the story. The cost to society for mining and burning Powder River Basin coal—its social cost—is the other half. The “social cost of carbon,” as defined in the 2013 Economic Report of the President, is the monetized estimate of damage caused by emitting an additional ton of carbon dioxide in one year. Damage can include immediate and future impacts to health, property, agriculture, the value of ecosystem services, and other welfare costs of climate change.

Burning coal emits significant pollutants with significant social cost—principally carbon pollution, smog-forming pollutants, and heavy metals. These pollutants degrade our air and our health and accelerate climate change, adversely affecting the environment now and well into the future. Because the social cost of carbon for extracting and combusting coal captures these various effects, not to mention the added climate effects, the true price of Powder River Basin coal is much higher than the revenue generated from its sale.

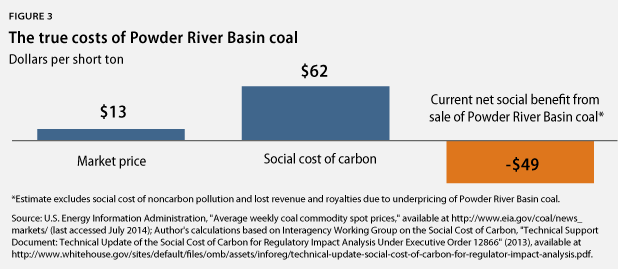

By our estimates, based on just carbon pollution, the social cost of Powder River Basin coal, no matter where it is burned, is currently $62 per short ton—4.5 times the current domestic market price for this coal. This estimate will rise to more than $70 per short ton by 2020. Including other social and health costs, as well as foregone tax revenue, would lead to a much higher figure.

Health costs to society reflect premature deaths, lost days of work, and medical treatment costs. These costs to society fall heavily on people closest to where coal is burned and can vary based on the technology installed at a power plant, population density near plants, and a variety of other factors.

It is noteworthy that the applicability of the social cost of carbon to Powder River Basin coal is not merely speculative. The BLM and federal courts have determined that the costs of carbon emissions from the mining and combustion of coal result in impacts that must be accounted for as the social cost of carbon.

All in all, depressed market valuations, an anti-competitive leasing program, low royalty rates that have not changed in decades, and unaccounted for social and environmental costs all mean that U.S. taxpayers are paying heavily to sell, mine, and burn Powder River Basin coal. When the social cost of carbon for burning this coal at $62 per short ton is taken into account, the federal government is not only foregoing billions of dollars in lost revenue but is also selling publicly owned coal at a net social loss of at least $49 per short ton. (see Figure 3)

Even using BLM’s lower estimate of 388 million tons of federal coal sold from the Powder River Basin in 2012, the total net social loss that year was more than $19 billion dollars. These losses will continue to reach into the hundreds of billions of dollars if Powder River Basin coal remains so highly undervalued and production continues at similar levels to today.

The bottom line is that the government is selling federal coal at a huge loss, subsidizing an industry to produce carbon pollution, and seemingly has no meaningful plan to change course. In its current form, the federal coal-leasing program in the Powder River Basin is—from top to bottom—a bad deal for U.S. taxpayers.

Nidhi Thakar is Deputy Director of the Public Lands Project at the Center for American Progress. Michael Madowitz is an Economist at the Center. Nathan Joo, an intern at the Center, also contributed to this column.

* Correction, July 29, 2014: This issue brief has been corrected to clarify under what circumstances coal in the Powder River Basin is recoverable.

** Correction, July 30, 2014: This issue brief has been corrected to reflect that the referenced coal sales are national.