On September 14, 2017, Ingrid Henlon, a teacher at the Mount Olive Child Development Center in Hartford, Connecticut, stood in the U.S. Capitol alongside Sen. Minority Leader Chuck Schumer (D-NY) and House Minority Leader Nancy Pelosi (D-CA) to unveil legislation aimed at making child care more affordable and improving conditions for child care workers.1 Henlon is a passionate teacher who describes her work as “educating our nation’s future leaders.” She has worked in early childhood education for her entire career and now supervises other teachers who work with toddlers.

Despite 26 years of experience in early childhood education and a bachelor’s degree, Henlon earns $11 per hour and has not received a pay raise in 10 years. After working a full day in child care, she goes to her evening part-time job as a home health care provider. That means a six-day work week that can exceed 12 hours per day. She has seen colleagues who are talented early childhood educators move on to other professions because they cannot afford to stay in child care.

In Henlon’s home state of Connecticut, the child care assistance program ran out of funds and only recently began accepting applications from parents who need help paying for child care after the program froze intake in August 2016. About 5,000 families are on a waiting list. Like Henlon, the parents who have children at the child care center where she teaches are working two jobs to afford tuition. She sees parents pick up their children in the afternoon and take them to another child care provider so they can go to their second job. Henlon worries about how this affects children’s socio-emotional development.

For working families across the country and child care workers such as Henlon, this new legislation, the Child Care for Working Families Act, offers a path forward.2 The bill would give low-income and middle-class families access to affordable child care by limiting payments to 7 percent of their income; make much-needed quality improvements; and increase wages and provide a living wage to child care teachers. (see text box)

The Child Care for Working Families Act

Sen. Patty Murray (D-WA) and Rep. Bobby Scott (D-VA) introduced legislation that, if enacted, would reform child care by mandating several new policies.3 These include:

- Guaranteeing child care assistance to low-income and middle-class families earning up to 150 percent of the median income in their state, which will more than double the number of children eligible

- Limiting child care payments to 7 percent of a family’s income to align with the U.S. Department of Health and Human Services’ definition of affordable child care

- Ensuring that people who work in child care earn a living wage and are compensated at the same level as elementary school teachers if they have the same credentials and experience

- Making investments to improve quality in child care programs and build the supply of child care in underserved areas

This brief presents an analysis of the employment and workforce effects of a broad child care expansion. If enacted, the Child Care for Working Families Act would create 2.3 million new jobs, which accounts for an increase in employed parents and new jobs in the child care and early education sector. Most of these new jobs would result in higher employment rates among low- and moderate-income families.4 (see Appendix)

Once fully phased in, this legislation would result in an additional 1.6 million parents joining the labor force as a direct result of the availability of new child care subsidies and the reduced child care costs. In addition, many parents who are already employed would be able to work more, increasing their family’s available resources.

The child care and early education workforce would expand by an estimated 700,000 new jobs. In addition, pay would increase by 26 percent among teachers and caregivers working in these new jobs and those already in the sector. Those working in child care centers would see their average annual income go from $26,000 to $33,000.

Increased employment among parents

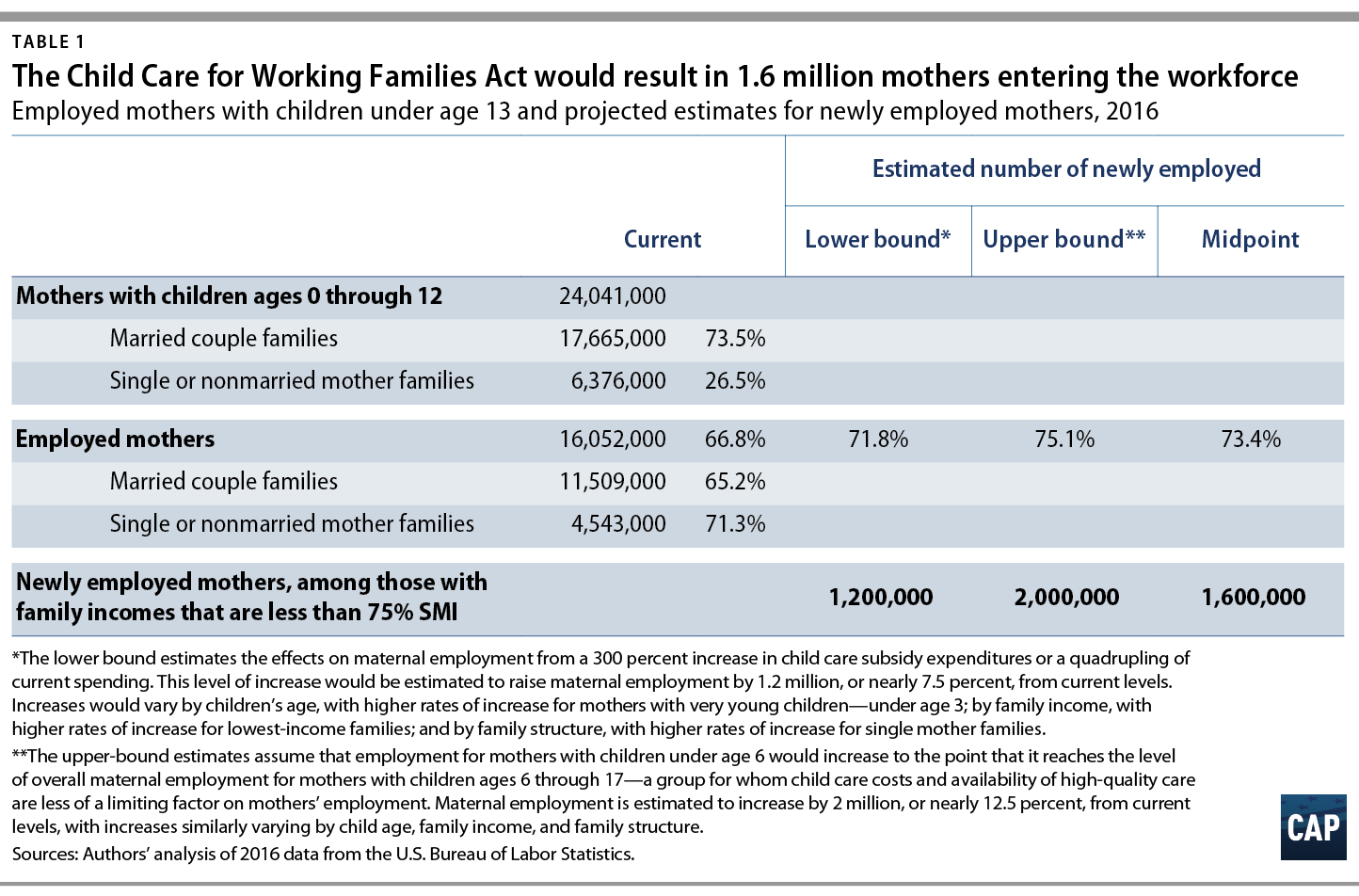

A proposal to guarantee all low- and middle-income families affordable, high-quality child care would directly lead to many more parents becoming employed. There is a substantial and wide-ranging body of previous economic research that demonstrates a clear relationship between employment levels and changes to the price of child care or reductions in costs to families through child care assistance.5 Reduced child care costs and increased child care availability increases parental employment, primarily among mothers and those from low-income families. Based on the most consistent range of findings among these studies, the authors estimate that an additional 1.6 million parents,6 primarily mothers, would be newly employed. (see Table 1) The total number of employed mothers with children under age 13 would increase from 16.1 million to between 17.3 million to 18.1 million, and the percentage of employed mothers increasing from 67 percent to between 72 percent and 75 percent.

The substantial increase in access to high-quality care for young children would allow many parents to increase their employment and earnings, especially those with lower incomes. Eighty percent of the increased employment would be among mothers in families who earn less than half of the median income in their state.7 Thus, an investment in child care supports for families will likely lift 1 million or more families out of poverty due to increased earnings from employment and reductions in child care costs. Beyond the direct impacts on family income, decreasing rates of family and child poverty can substantially improve child outcomes, particularly children’s cognitive developmental and education outcomes.8

Given that labor force participation rates have been falling over the past 17 years—mostly due to an aging population as the baby boomer generation retires—the employment boost from more working parents could help counter this steady decline.9 In the United States, women’s labor force participation peaked at 67 percent in early 2000 and has declined to 63 percent in August 2017.10 The long rise in women’s labor force participation over the past four decades of the 20th century that fueled the overall increases in U.S. employment halted by 2000, and it has plateaued and even retreated since then.11 The influx of more working mothers spurred by a large national investment in child care could recapture that progress and restore women’s labor force participation to its pre-2000 levels. The projected increase in employment of 1.6 million mothers with children ages birth to 12 due to child care expansions would increase prime-age women’s employment to its highest level of close to 77 percent reached in 1999.12

A large-scale expansion of child care assistance to all working low-income and middle-class families, as proposed in the Child Care for Working Families Act, would reduce child care costs for parents who are currently working and for those who may enter the workforce because of access to child care assistance. Parents who are already working would see reduced child care costs, allowing them to keep more of their paycheck to support their families and place children in a higher-quality program of their choice.

Expansion and improvements in the child care and education workforce

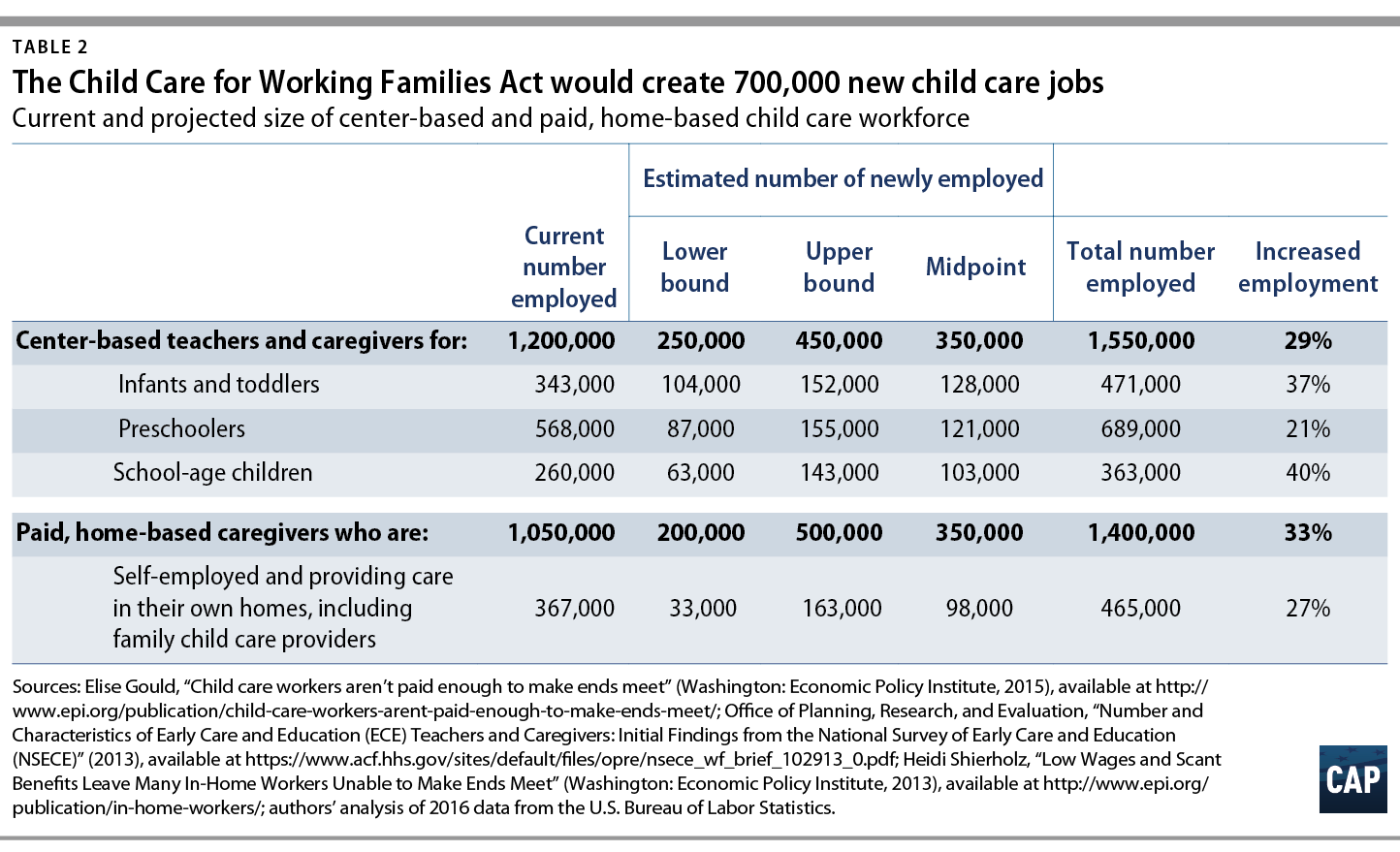

Broad-based expansions in child care assistance for most working families—including those currently and those who would be newly working—is projected to lead to very significant expansions in the overall size and composition of the child care and education workforce. When this legislation is fully implemented, the child care workforce would increase by 700,000 new jobs.13 (see Table 2) The number of center-based teachers and caregivers would increase by nearly 30 percent, or 350,00014 more individuals employed above the 1.2 million currently in the child care and education workforce.15

The number of paid, home-based child care providers would also likely increase by an estimated 350,00016 individuals or more than 30 percent above than the current estimates of paid home-based care providers. This includes an increase of as many as 100,000 new family child care providers, who are typically self-employed, licensed child care providers who serve multiple unrelated children in their homes. In addition, 250,000 or more of the increase in home-based providers could be for relatives or other informal care for individual children, which is often used by families with infants and very young children as well as for more limited after-school care arrangements.

The Child Care for Working Families Act includes provisions to significantly improve the compensation and training of teachers and caregivers. The legislation requires that child care payment rates reflect the costs of a better compensated workforce and incentivizes teachers and providers to increase their qualifications. This is essential to professionalize one of the nation’s most underpaid workforces and to better recruit and retain the more skilled and stable labor force needed to improve the quality and outcomes for children’s early care and education.

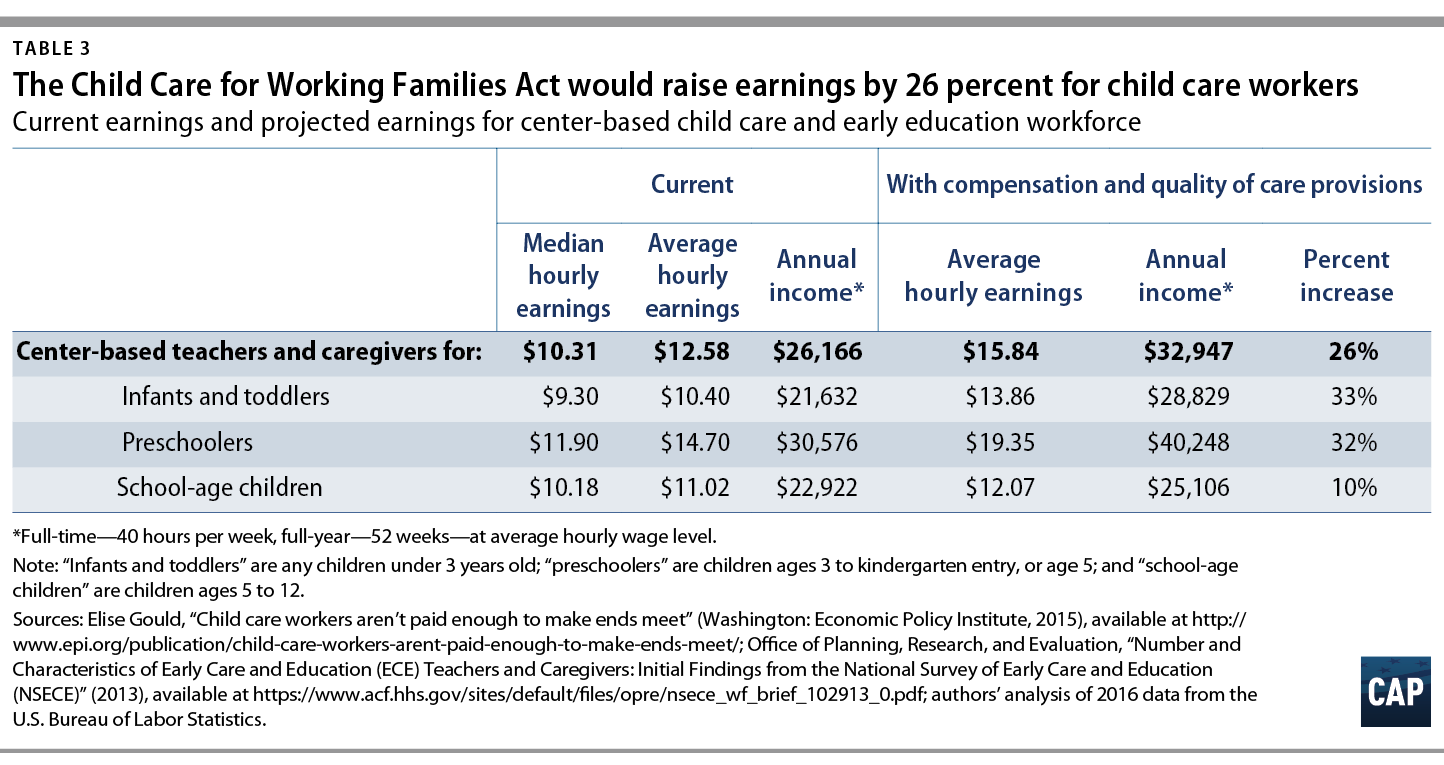

The proposed legislation calls for increasing workforce compensation levels to ensure child care workers are paid a living wage and that center-based early childhood educators are provided parity with elementary school teachers with similar credentials and experience. The median hourly wage in the child care workforce was $10.31 in 2013,17 which is nearly 40 percent below the median for all workers in the U.S. labor force, making the pay for work in this critical sector among the bottom 10 percent of all occupations.18

Analysis of the impact of the compensation provisions would raise wages for people who work in child care to the earnings level needed to meet their basic needs, such as housing, food, and utilities.19 Compensation levels would increase to new levels across most states, though the amount of increase would vary based on the variations in local costs of meeting basic needs. Still, the overall compensation levels for center-based child care workers nationally would increase by 26 percent to an average hourly wage of $15.86 or $33,000 annually for a full-time, full-year worker. (see Table 3) Teachers and caregivers who work with children birth to age 5 will see an increase that amounts to about one-third of their current earnings. Payment rates for family child care providers would similarly be increased to assure that providers would be able to earn incomes at wage levels above the minimum self-sufficiency standards for their state.

With both new and significantly improved jobs, the earnings, credentials, training, and tenure of both existing and new employees in the early care and education service sector would all be dramatically raised. This professionalizing of this sector of the workforce will have a rippling affect for the economy. Not only will the workers benefit, but the work they do can build the longer-term human capital of tens of millions of children needed to support the capacity and growth of the economy.

See also

Conclusion

Many American families are caught in a child care conundrum. They cannot afford child care, but need it so that they can work. When parents are forced to leave the workforce, cut back on hours, or piece together a haphazard web of child care providers, families can find themselves stressed both economically and emotionally. Families cannot afford to pay more for child care, and yet the price for child care—even as it stands now—means that people who work in child care are paid low wages, leading to further instability in this sector of the labor market. An investment in child care as proposed in the Child Care for Working Families Act will put America on a path to meeting crucial economic and societal goals now and into the future by putting more people in the workforce, raising wages, and helping families make ends meet, all while making sure that children—right from the start—get the safe, stable, and high-quality care and learning experiences they will need to thrive and succeed.

Appendix

Findings presented in this brief build upon Ajay Chaudry’s analysis of the range of estimates for participation levels and costs for the proposed the Child Care for Working Families Act legislation for families at different income levels with children in different age groups. His model integrates data from a wide range of data sources, including the U.S. Census Bureau, Bureau of Labor Statistics (BLS), the U.S. Department of Health and Human Services, and other relevant data sources.20

Analysis for this report utilized additional data from the BLS Employment Characteristics of Families Data for 2016 along with elasticity data from Maria Enchautegui and others for the range of estimates for increased parental employment. For the analysis of increases in employment and earning levels in the child care and early education sectors of the labor market, additional analysis of data from the May 2016 BLS Statistics State Occupational Employment and Wage Estimates applied to baseline data on workforce and earning levels gained from Elise Gould, the National Survey of Early Care and Education (NSECE), and Heidi Shierholz.21

Estimations of increased employment among parents

There is a significant body of empirical research base that shows the positive employment effects of lowering child care costs through subsidized provision or what economists refer to as the elasticity or amount of change in overall employment as a result of change the reduction in the price of child care families face.22

A recent analysis by Enchautegui and others examined the relationship between the amount of public spending on child care subsidies and how responsive mothers’ employment levels would be to higher levels of child care spending. They found an employment elasticity for likely eligible parents (mostly mothers) with children under age 3 was 0.068.23 This elasticity is consistent with research literature examining the effects of child care costs and subsidies on parental employment. The research also consistently reports that increases in subsidies or reduced child care costs leads to much more positive employment effects for single-parent families, families with younger children, and those at the lowest levels of family income.24

For the lower-bound estimate of the effects on maternal employment, we estimated what would be the increase for a 300 percent increase in child care subsidy expenditures or a quadrupling of current spending. While projected spending is estimated to increase by much more, for a lower-bound estimate, we took this conservative approach. It is not clear if at much higher levels of increases how much the responsiveness of increased employment to additional child care spending might diminish, because most mothers who would have joined the labor market with an effective decreased cost to their families for child care have become employed, which would likely occur in the initial years.

A 300 percent increase or quadrupling of spending, maternal employment would increase for eligible families with very young children (under age 3) and incomes below 75 percent of state median income (SMI) by 20.4 percent (using elasticity of 0.068 from the recent study by Enchautegui and others; for families with children ages 3 to kindergarten entry with incomes below 75 percent of SMI, maternal employment would increase by 15 percent (using elasticity of 0.05); for families with school-age children from kindergarten through age 12 with incomes below 75 percent of SMI by 10.2 percent (using an elasticity of 0.034). These are consistent with the most common range of elasticities found in the recent literature review conducted by Morrissey and in several other analyses.

For the upper-bound effects on maternal employment, we estimated what the increase in maternal employment for children with children under age 6 required to reach the higher level of overall maternal employment for mothers with children ages 6 through 17 (with none younger than 6 years old). The assumption for this estimate is that with far greater access to high-quality child care at an affordable cost, mothers with young children would increase their employment to the levels of mothers without young children for whom child care costs and availability of high-quality care is less of a limiting factor on mothers’ employment relative to when they have younger children. Maternal employment is estimated to increase by 2.0 million or nearly 12.5 percent from current levels, with increases similarly varying by child age, family income, and family structure.

The range for the increase in employed mothers estimated here is likely very conservative for several reasons. First, and most significantly, the scale of the expansion envisioned relative to current investments in financial assistance for families’ child care costs is so large, it goes beyond the empirical range of changes in child care cost or subsidies in the research literature. As such, we might expect the elasticity from increasing levels of child care spending on parental employment to potentially diminish at higher levels of investment as there were fewer women left to potentially enter the labor force. As such, the upper bound of the range may be conservatively low. If we used the same elasticity measures for the entire increase in projected child care spending—that we apply to determine the lower-bound estimate of the increase in employment for the first 300 percent—this would result in an increase of roughly 6 million newly employed mothers and nearly 92 percent of all mothers employed. This estimate seems beyond what is conceivable given other constraints and preferences that shape employment. Even at the more conservative lower- and upper-bound estimates for newly employed parents that we project for this analysis—the 5 percent to 8 percent increase of all mothers with children under 13 becoming newly employed—the rate of mothers employed in the United States would surpass the prior peak of 70 percent in 2000.

Second, this estimate includes just the projected increased employment among families with incomes below 75 percent of SMI, for whom the literature indicates most of the response in terms of increased employment occurs. While there would likely be much less change in the number of mothers in families with incomes above 75 percent of SMI that would go from not being employed to becoming employed due to the changes in child care spending, there would likely be some small marginal increase among families with incomes between 75 percent and 150 percent of SMI, particularly in two-parent families in which only one parent is currently employed. If one estimated that the employment elasticity from child care expenditures for more moderate and middle-class families in this income range was even one-fifth what it is for the lower-income families below 75 percent of SMI, this would further increase employment levels by 200,000 more newly employed parents.

Third, this analysis only measured the increase from the proposed expansion in child care subsidies for working parents, which is the largest early childhood program expansion being proposed and is designed with working parents’ child care needs in mind. There would likely be further marginal impact of the proposed policy changes to support preschool program expansions in the states and for the federal Head Start program that would further spur some further increase in parental employment.

Finally, this is not a dynamic analysis and factors only the effects of the initial large boost in child care spending and not the iterative impacts of increased child care spending that lead to further increases in employment until a dynamic equilibrium is reached.

Estimations of increased employment and earnings in the child care and education workforce

To estimate the size of the current child care and early education workforce to determine how much of the total workforce that would be expected with the expansion in child care, and which portion of that would represent an increase in the workforce, we identified and aggregated the current number of workers in several occupational codes (for example, “child care workers,” “preschool teachers,” and others) in the May 2016 BLS State Occupational Employment and Wage Estimates, and compared those with figures found in prior studies that have estimated the size of the workforce. We found these estimates to be roughly comparable for the center-based child care and early education workforce. For example, Gould identifies 1.2 million child care workers in the economy that she notes are primarily center-based caregivers and teachers, as well as that these data exclude self-employed child care workers, such as family child care providers and other self-employed workers providing child care in their homes.25

The child care workforce in general is difficult to count, and especially the home-based caregiving workforce. Data from NSECE found that there were 1,000,000 teachers and caregivers working in centers providing care to children birth to age 5 and approximately 1,000,000 paid home-based caregivers, which included 118,000 that were categorized as “listed” providers and 919,000 that were “unlisted” home-based providers who indicated they were paid caregivers in the survey. (An additional estimated 2.7 million were unpaid home-based caregivers.)26

To determine what the change in earnings would be for the workforce of center- and home-based teachers and caregivers, we determined whether in each state current per-child maximum base payment rates for subsidized child care were the current average child care wage levels in the state (from BLS data) and/or the earnings level needed to support state minimum self-sufficiency income standard for individuals working full-time. The self-sufficiency standard calculates the income needed for individuals or families to adequately meet their basic needs, taking account of costs associated with employment and the significant differences in costs across places. The Center for Women’s Welfare at the University of Washington has developed and published state self-sufficiency standards for 37 states and the District of Columbia, and we grouped and imputed self-sufficiency standards for the 13 states for which the self-sufficiency standard using the average self-sufficiency standard for costs with similar cost of living.27

In states for which state these base payment rates were below the higher of the current average child care wage levels and the state minimum self-sufficiency income standard for individuals, we calculated how much the child care payment rates would need to be increased to the higher of those two levels. This leads to increases in base payment rates in 45 states and the District of Columbia to support higher compensation provisions.

Ajay Chaudry is a senior fellow and visiting scholar at the New York University Robert F. Wagner Graduate School of Public Service. From 2012 until 2015, he was the deputy assistant secretary for human services policy at the U.S. Department of Health and Human Services. Katie Hamm is the vice president for early childhood policy at the Center for American Progress.