View data on Big Oil’s third-quarter profits (.xls)

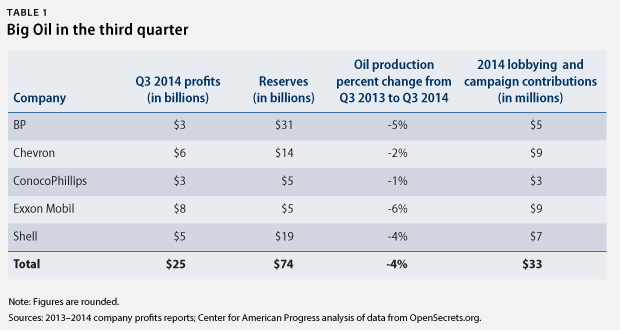

The big five oil companies—BP, Chevron, ConocoPhillips, Exxon Mobil, and Royal Dutch Shell—have enjoyed another quarter of sizable profits, totaling $25 billion. They earned these profits even as the average global oil price dropped 7 percent from this time last year.

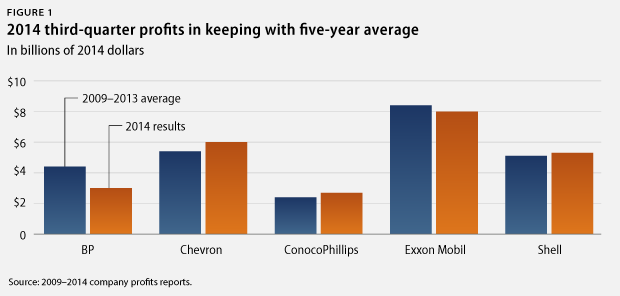

The oil industry appears to be taking these price fluctuations in stride. David Lesar, chairman and CEO of Halliburton Co., noted that price swings are a common occurrence in the industry. In a recent interview, he said, “If [the price of oil] floats between US$80 and US$100, our sector will be fine.” In the same article, Oklahoma oil billionaire Harold Hamm noted that his company “can produce down to US$50 a barrel,” a more than $30 drop from today’s price. While this quarter’s profits are a 2 percent dip from the previous one, profits are up 6 percent from a year ago and consistent with a five-year average.

As Big Oil enjoys $25 billion in profits, the oil industry continues to receive decades-long tax breaks that sweeten its ledgers. These tax breaks, often referred to as tax loopholes, save Big Oil $2.4 billion in taxes to the federal government annually. Over the course of a decade, this amounts to nearly $76.6 billion in avoided taxes.

How has the oil industry held onto such a sweet deal? It spends millions of dollars on campaign contributions and lobbyists in an effort to avoid paying even more in federal taxes. So far this year, Big Oil has spent $33 million on lobbyists and politicians. Some of these tax exemptions are nearly 100 years old, but Big Oil manages to protect them year after year.

Sen. Ron Wyden (D-OR) has made purging tax breaks and loopholes from the energy tax code a priority of his Senate Finance Committee chairmanship. Congress should act on this increasingly popular bipartisan issue and reform the tax code for Big Oil regardless of which party controls Congress in the next session.

Danielle Baussan is the Managing Director of Energy Policy at the Center for American Progress. Miranda Peterson is a Special Assistant for the Energy Policy team at the Center. Ashley Olmeda is an intern at the Center.