Read the issue brief.

Washington, D.C. – In light of today’s unemployment report, which verified that job growth in the United States remains volatile, the Center for American Progress released an issue brief detailing five reasons why Congress must persist in extending unemployment benefits. According to the new CAP analysis, failing to do so would be unprecedented in the history of federal responses to high unemployment following economic recessions.

Congress has offered extended emergency unemployment benefits in every major recession since the 1950s, and it has never failed to extend benefits when facing a long-term unemployment crisis as severe as the current one. Today, the percentage of unemployed workers who have been out of work long term, the length of time a typical worker is unemployed, and the share of workers who run out of benefits before finding a new job are all higher than they were each time Congress has let emergency unemployment insurance expire following past recessions.

“Congress has never cut off unemployment insurance when long-term unemployment has been as high as it is today. Unemployment insurance creates jobs, keeps families out of poverty, and helps the unemployed get back to work. Extending these vital benefits should be a no-brainer,” said Sarah Ayres, Economic Policy Analyst at CAP.

The issue brief details the following five key reasons why Congress must extend federal unemployment insurance:

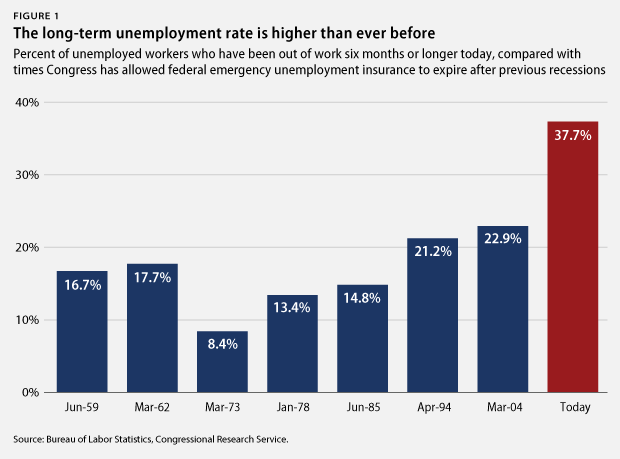

1. The long-term unemployment rate is higher than ever before

The share of unemployed workers who have been unemployed long term is higher than ever before. When Congress has allowed unemployment benefits to expire in the past, the percentage of unemployed workers that were unemployed for six months or more has never been higher than 23 percent. Today, 38 percent of unemployed Americans have been out of work long term. (see Figure 1)

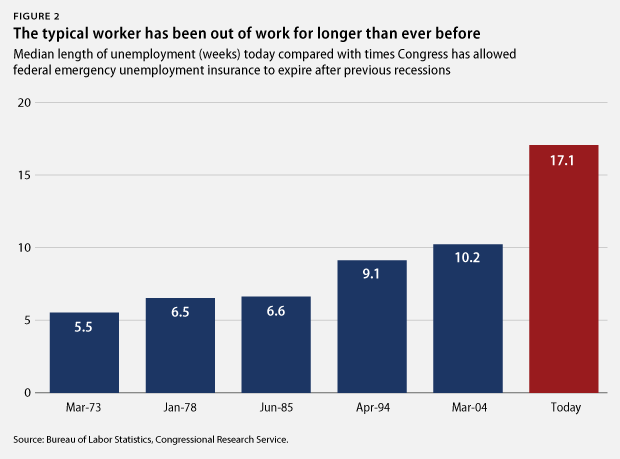

2. The typical unemployed worker has been out of work longer than ever before

Today’s unemployed workers are spending more time looking for work than unemployed workers in previous recessions. The median duration of unemployment today is 17 weeks, but Congress has never allowed unemployment benefits to expire when the median duration of unemployment has been greater than 10.2 weeks. (see Figure 2)

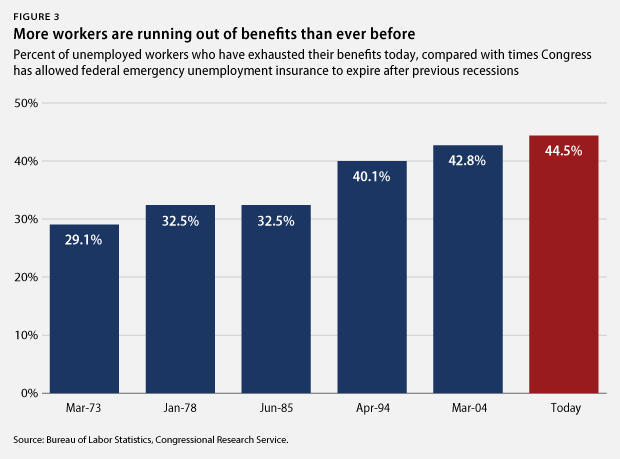

3. More unemployed workers are running out of benefits than ever before

As a result of the long-term unemployment crisis, more and more workers are running out of benefits before they can find a new job. When Congress has previously allowed unemployment insurance to expire, the rate of unemployed workers who have exhausted their benefits has never exceeded 43 percent. Today, 45 percent of unemployed workers have run out of unemployment benefits. (see Figure 3)

4. The unemployment rate remains unacceptably high

The U.S. economy is slowly improving, but the unemployment rate remains unacceptably high. At 6.7 percent, the unemployment rate today is higher than it was six out of the past seven times Congress allowed emergency benefits for the long-term unemployed to expire.

5. There are still three job seekers for every job opening

The ratio of job seekers to job openings has improved since the height of the Great Recession, but there are still three job seekers for every one job opening in America. In a strong labor market, that ratio would be closer to 1-to-1, as it was in 2000 and 2007.

As President Barack Obama recently advised, “voting for unemployment insurance helps people and creates jobs.” Allowing federal unemployment insurance to expire while the country faces a long-term unemployment crisis would be both unprecedented and unwise. Lawmakers should do the right thing for workers and our economy by immediately extending federal unemployment insurance for the long-term unemployed.

###