Later this week, the House of Representatives will vote on a second round of tax cuts once again favoring the rich. This new tax plan is a sequel to the tax law that the Republican-led Congress enacted in December, which is informally known as the Tax Cuts and Jobs Act (TCJA). The TCJA was badly skewed to wealthy Americans, exacerbating the decades-long trend toward greater inequality of income and wealth. The law created new loopholes for well-heeled taxpayers to exploit. Moreover, its massive cost was financed by higher budget deficits that will put even more pressure on vital programs that serve all Americans. The newly proposed tax plan shares each of these failings. Congress should reject it. Instead, federal lawmakers should work toward real tax reform, beginning with undoing the damage caused by the TCJA.

Tax Scam 2 is just more of the same

During the week of September 24, Republican leaders plan to bring up a package of three bills that they call “Tax Reform 2.0”—that critics rightly call Tax Scam 2—for a vote in the House. The centerpiece of this package is H.R. 6760, a bill to permanently extend the individual and estate tax provisions of the TCJA beyond their scheduled expiration at the end of 2025. The reason these provisions were made temporary was that congressional leaders chose to move the TCJA through Congress using the process known as budget reconciliation, which enables bills to pass the Senate with a simple majority but only if they are not estimated to increase deficits over the long term. Under these procedural constraints, the TCJA’s authors chose to make the legislation’s corporate tax provisions permanent and its individual and estate tax provisions temporary (with some exceptions). H.R. 6760 would permanently extend both the provisions of the TCJA that cut individual taxes, including the reductions in individual tax rates and higher standard deduction, and the TCJA’s tax increasing provisions, including the elimination of personal exemptions and the cap on the deduction for state and local taxes (the SALT deduction).

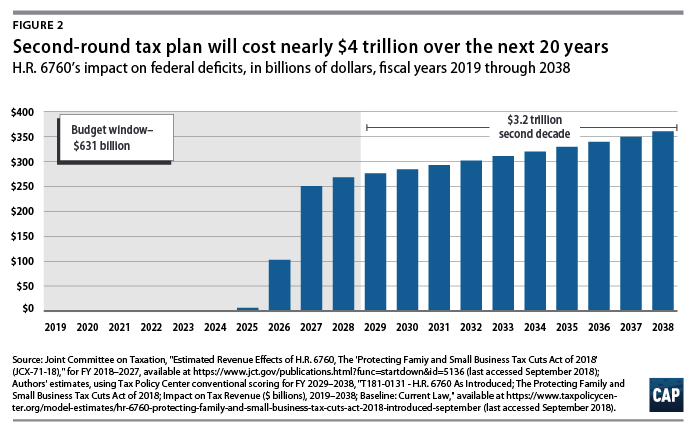

The House Ways and Means Committee reported H.R. 6760 along straight party lines on September 13. The bill has been scored by the Joint Committee on Taxation (JCT) to increase deficits by $631 billion over 10 years. As discussed below, the cost over a longer time horizon would be much greater.

The other two components of Tax Scam 2 are H.R. 6756, the American Innovation Act of 2018, and H.R. 6757, the Family Savings Act of 2018. In addition to various other retirement- and savings-related tax changes, the most significant provision of H.R. 6756 would create a new type of savings account that would mainly serve as a new tax shelter for wealthy Americans while doing nothing for the Americans who actually need help preparing for retirement. These tax changes are not paid for and would increase deficits by $21 billion over 10 years, according to JCT. H.R. 6756 provides tax cuts for startup businesses and businesses that acquire startups. It, too, is not paid for and would cost $5.4 billion over 10 years, according to JCT. All told, the three Tax Scam 2 bills would add $657 billion to deficits over the next 10 years.

Tax Scam 2, like the TCJA, is badly skewed to upper-income Americans

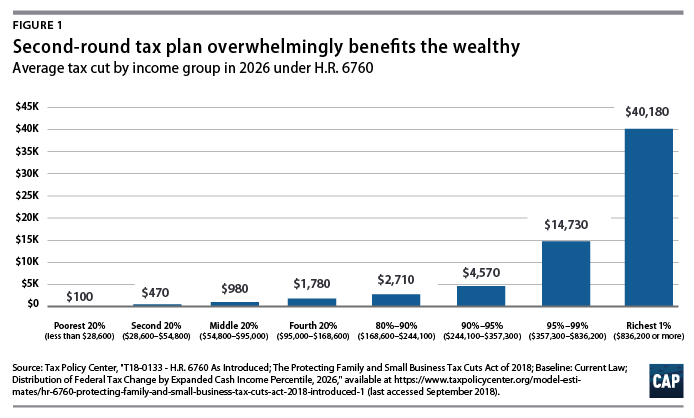

In the TCJA, the congressional leadership chose to respond to decades of growing income inequality with tax cuts that exacerbate that fundamental problem. The TCJA was badly skewed to the rich, providing much greater tax cuts to the wealthy than people with modest incomes, and raised taxes on about 8 million Americans with incomes under $200,000. Tax Scam 2 is more of the same. While the centerpiece, H.R. 6760, does not include corporate tax cuts—since those were already made permanent in the TCJA—it nonetheless favors high-income people over middle- and working-class Americans. The individual and estate tax provisions of the TCJA, if extended as part of a second round, would provide a $40,000 annual windfall for the average household in the top 1 percent—more than 80 times greater than the average tax cut for a household in the bottom 60 percent, according to estimates from the Tax Policy Center (TPC) of the legislation’s impact in 2026. Forty percent of the tax benefits would go to Americans with incomes in the top 5 percent—above $357,300—while only 20 percent of the benefits would go to Americans with incomes in the bottom 60 percent—those making less than $95,000.

The reason that people at the top of the income ladder get such a big windfall is that H.R. 6760 would make permanent four major tax cuts enacted in the TCJA that benefit high-income Americans either predominantly or exclusively: the reduction in the top ordinary tax rate; the increased exemption from the tax on wealthy estates; the new tax loophole for pass-through businesses; and the reductions in the alternative minimum tax (AMT). (see text box)

The TCJA’s individual provisions: 4 big tax cuts for the rich

The individual tax titles of the TCJA include four major tax cuts for high-income Americans that are in effect from 2018 through the end of 2025. Tax Scam 2’s H.R. 6760 would make permanent these four major tax cuts for the rich.

- Top tax rate: The TCJA cuts the top-bracket tax rate—the rate paid on income exceeding $500,000 for singles and $600,000 for couples—from 39.6 percent to 37 percent. H.R. 6760 would permanently lock in that lower top rate, perpetuating a wasteful giveaway for millionaires and other very high-income individuals. Notably, 39.6 percent was the top tax rate in effect before the Bush tax cuts of 2001, and it was restored in the fiscal cliff agreement at the end of 2012.

- Estate tax: The TCJA gave large tax cuts to wealthy estates. H.R. 6760 would make the estate tax cuts permanent. Before the TCJA, the estate tax was paid only by the wealthiest 0.24 percent of estates in the country—about 1 in every 400 estates—because up to $11.2 million in wealth for couples and $5.6 million in wealth for singles was exempted. The TJCA doubled that already generous exemption to $22.4 million for couples and $11.2 million for singles, so that now only the wealthiest 0.07 percent of estates in the country—the wealthiest 1 in every 1,400—pay any estate tax. By raising the exemption, the TCJA not only reduced the already-tiny number of wealthy estates subject to the estate tax, but also conferred a windfall for America’s wealthiest estates—those valued at more than $22.4 million—of $4.5 million each. The benefit will accrue to the heirs of those estates.

- Pass-through loophole: The TCJA carved out a new tax loophole that predominantly benefits wealthy owners of partnerships, limited liability companies (LLCs), and other pass-through business entities. As New York University School of Law professor and tax scholar Daniel Shaviro explained, the new pass-through deduction “achieved a rare and unenviable trifecta, by making the tax system less efficient, less fair, and more complicated.” That is because the new pass-through deduction creates a byzantine set of new eligibility rules that allows those with high-priced tax advisers to game the system in their favor, all while causing headaches for regular taxpayers and disadvantaging regular employees who are not eligible for the deduction. The richest 1 percent of Americans receive 61 percent of the tax cut from the pass-through deduction, while Americans in the bottom two-thirds of the income distribution receive only 4 percent of the benefit. Extending the TCJA individual provisions would make this egregious new loophole permanent, benefitting wealthy Americans, including real estate developers, bankers, owners of very large businesses, and even many members of Congress.

- Alternative minimum tax: The TCJA also dramatically cut back the AMT, providing another tax cut for high-income households. Since Congress permanently patched it at the end of 2012, the AMT applied almost exclusively to taxpayers with incomes of more than $200,000, with most of the tax falling on those with incomes of more than $500,000. The TCJA cuts back the AMT by increasing the exemption amount and indicating that the exemption does not begin to phase out until a taxpayer reaches $1 million in income.

Tax Scam 2 increases deficits by nearly $4 trillion over the next two decades

According to the Congressional Budget Office (CBO), the TCJA will cost nearly $2 trillion over the next decade. Already, its deleterious fiscal effects are being felt with revenue significantly lower this year than pre-enactment projections. Unsurprisingly, corporate tax revenues are down sharply—$71 billion (30 percent) lower this fiscal year than during the same period last fiscal year.

Tax Scam 2 would compound the damage. It is a fiscal time bomb whose costs truly explode over the long term. H.R. 6760, the centerpiece, is officially estimated to cost $631 billion over the first decade, fiscal years 2019–2028. But since the individual and estate tax cuts are already in place through 2025, the costs of H.R. 6760 only begin to materialize after that. In 2028, for example, H.R. 6760 would cost $268 billion, which, to put it in perspective, is nearly four times what the federal government is projected to spend on the Supplemental Nutrition Assistance Program (SNAP) that year.

The true cost of H.R. 6760 is reflected in revenue estimates for the following decade. The bill will reduce revenue by $3.2 trillion over fiscal years 2029-2038, according to the nonpartisan TPC. (Other outside estimates place the cost in a similar range.)

None of these cost estimates include debt service—the additional interest that the United States will need to pay due to higher deficits. According to the Penn-Wharton Budget Model, when accounting for debt service, extending the individual tax provisions of TCJA would add more than $5 trillion to the nation’s debt by 2040.

Congressional Republicans and White House officials have made clear their intention to pay for the tax cuts by cutting critical services such as Social Security, Medicare, and Medicaid. Thus, Americans have strong reason to believe that every dollar given away in wasteful tax cuts as part of Tax Scam 2 could be taken out of these programs.

Congress should undo the damage from TCJA instead of making it permanent

Rather than prioritize the working-class families who have struggled economically in recent decades, the TCJA showered massive tax cuts on the wealthy individuals and corporations that were already receiving an outsized share of the economy’s gains. In so doing, the TCJA widened the chasm between the fortunate few and everyone else. By draining revenue, the law is inflating budget deficits, increasing the pressure on middle-class priorities such as Social Security, Medicare, and Medicaid. Worse, the TCJA was part of the larger effort by the Trump administration and conservatives to sabotage Americans’ health care. By repealing part of the Affordable Care Act (ACA), the tax law will increase health care premiums and harm Medicare’s solvency.

The TCJA has also failed to make the tax code any fairer or simpler for regular Americans. In fact, the much ballyhooed promise that taxes would be so simple that people could file on a postcard fell flat when the new IRS form was revealed to be a double-sided form with six additional worksheets.

While proponents claimed, based on corporate press releases, that corporations were using their new tax breaks to increase worker pay and bonuses, actual economic data has shown that real wages continue to be flat and bonuses have been unexceptional compared to previous years. Rather than raising worker pay, corporations appear to be using their tax cut to distribute more cash to shareholders in the form of stock buybacks, which are on pace to reach a record $1 trillion this year. Thus far, there is little or no evidence of a boom in business investment, let alone the kind of spectacular boom that would be necessary to bear out many of the outlandish claims about the bill.

These are all reasons why the American people continue to disapprove of the TCJA and believe, correctly, that it favors the wealthy and large corporations.

Instead of engraving this deeply unfair and flawed tax scheme into permanent law, Congress should work toward a tax code that is fair for American workers and the middle class. That work starts by undoing the damage from the TCJA rather than prolonging it. Real tax reform would be based on principles that are the opposite of what guided TCJA and its sequel, Tax Scam 2. Those principles include:

- Reversing every penny of the tax cuts for the wealthy and corporations, as a step toward making the wealthy pay their fair share. Public opinion polls have consistently showed that Americans’ top priority when it comes to taxes is ensuring that the wealthy and large corporations pay more, not less. TCJA provided hundreds of billions of dollars in tax cuts for the wealthiest and for corporations already enjoying record-high profits. Real tax reform would undo all of the tax cuts for upper-income Americans and corporations, which would raise much needed additional revenue. A fundamental priority of real tax reform must be improving the taxation of income derived from wealth so that gains do not go untaxed and that income from wealth is not favored in relation to income from work.

- Ending unfair and inefficient loopholes such as the pass-through deduction and other loopholes that enrich the wealthy and well-connected. Real tax reform would be aimed at closing loopholes that arbitrarily benefit certain taxpayers over others and allow wealthy individuals and corporations with high-priced tax advisors to shrink their tax bill. But the TCJA failed to close infamous tax breaks, including the carried interest loophole for Wall Street fund managers and special tax breaks for the fossil fuel industry. Worse, it created egregious new loopholes such as the pass-through deduction. Real tax reform would close these loopholes and many others.

- Leveling the playing field for American workers by ending the tax code’s perverse incentives for investment overseas. As part of his campaign platform, President Donald Trump promised to equalize the tax rates on U.S. corporations’ foreign and domestic earnings. But the TCJA went in the opposite direction, enacting a permanently lower tax rate for foreign profits (in some cases, zero) than for profits earned domestically. The TCJA’s complex international tax rules also create incentives for U.S. firms to lower their tax bills by locating physical assets—such as manufacturing facilities—outside of the United States. These incentives run counter to the promises that were made and the interests of American workers. Real tax reform would level the playing field for American workers by equalizing the rates on foreign and domestic investment. Rep. Lloyd Doggett (D-TX) and Sen. Sheldon Whitehouse (D-RI) have recently introduced legislation proposing a way to accomplish this.

- Strengthening tax credits for working families is yet another area where the TCJA missed a major opportunity to enhance tax credits that boost the incomes of low-wage workers, reward work, and improve the well-being and long-term prospects of children in low-income families. Low-wage workers were only made eligible for a fraction of the TCJA’s increased Child Tax Credit (CTC)—with the families of 11 million children receiving nothing or an increase of $75 or less and another 15 million receiving more than that but still less than the full credit. The TCJA actually reduced the Earned Income Tax Credit (EITC) by slowing how it is adjusted for inflation. Real tax reform would dedicate some of the revenue from repealing tax breaks for the wealthy and corporations toward strengthening these vital tax credits. For example, by increasing the refundability of the CTC, providing an additional benefit to families with young children, and boosting the EITC, especially for low-income workers without dependent children, who currently receive very little.

With our economic and fiscal challenges, the last thing that Congress should do is give away more tax cuts for the rich. Congress should reject Tax Scam 2 and begin the work of undoing the damage from the TCJA.

Seth Hanlon is a senior fellow at the Center for American Progress. Galen Hendricks is a special assistant on the Economic Policy team at the Center.