House Budget Committee Chairman Paul Ryan’s (R-WI) budget plan for fiscal year 2014 allocates nearly 97 percent of its proposed cuts to the portion of federal spending that is already projected to decline over the next 10 years. To the portion of the federal budget that is expected to rise, Rep. Ryan allocates just 3 percent of his proposed cuts. These simple numbers put the lie to the notion that the Ryan budget is in any way a responsible solution to the legitimate fiscal challenges the country will face in the coming years.

You often hear conservative leaders claim that the United States has a “spending problem.” This isn’t really true, of course. Under current policies, as defined in Rep. Ryan’s latest budget plan, total noninterest spending—that is, all spending except for interest payments on the debt—is already projected to decline from 20.8 percent of U.S. gross domestic product, or GDP, this year to 19 percent of GDP by 2016, and to remain at around 19 percent of GDP through 2023. It is hard to see a “spending problem” in those numbers, especially since noninterest federal spending has averaged 18.7 percent of GDP since 1967.

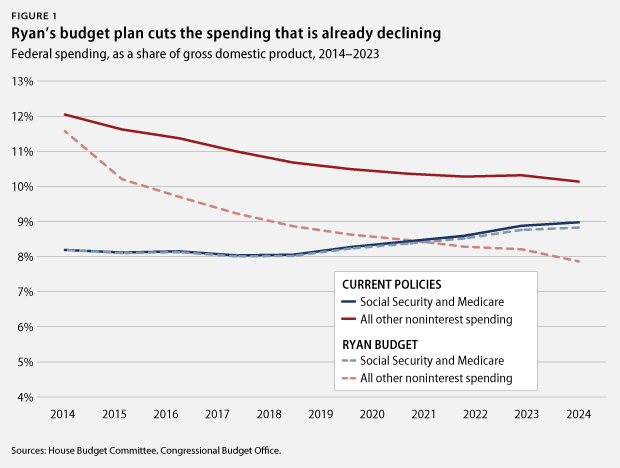

It is true, however, that a certain portion of federal spending is projected to rise somewhat over the next 10 years: retirement-program spending—specifically Social Security and Medicare, which both serve mainly senior citizens. And the country is about to experience a dramatic increase in the number of senior citizens, as the baby boom generation retires. Federal spending on these two programs this year will total about 8.2 percent of GDP and will make up approximately 40 percent of all noninterest federal spending. Under current projections—and again, using the same assumptions that Rep. Ryan does—spending on Social Security and Medicare will rise to 9 percent of GDP by 2023 and will claim 47 percent of all federal noninterest spending.

But if overall spending is projected to decline and then remain stable, while Social Security and Medicare are projected to rise, that must mean that all other programmatic spending is actually projected to decline. And, in fact, that is exactly the case. All federal spending aside from Social Security, Medicare, and interest payments on the debt will total 12.6 percent of GDP this fiscal year. Under current policies, that total is expected to decline to 10.1 percent of GDP by 2023. In other words, if we have a “spending problem” at all, it’s certainly nowhere to be found in the half of the budget that is actually getting smaller.

Why, then, does Rep. Ryan’s budget plan allocate nearly all of its massive spending cuts to the portion of the federal budget that is shrinking and nearly none to the portion of the budget that is growing? Rep. Ryan’s budget calls for a total of more than $3.9 trillion in noninterest spending cuts over the next 10 years relative to current policies, as defined by Rep. Ryan himself. About 97 percent of those cuts—more than $3.8 trillion—are apportioned to programs other than Social Security and Medicare. As a result, all federal programmatic spending other than Social Security and Medicare would decline from 12.6 percent of GDP today to just 7.9 percent of GDP by 2023 under the Ryan budget. By contrast, spending on Social Security and Medicare would still rise from 8.2 percent of GDP today to 8.8 percent of GDP by 2023. In fact, Rep. Ryan’s cuts to the “all else” category are so deep that by 2021 the federal government will be spending more on Medicare and Social Security than on every other program in the budget combined.

Defenders of the House Republican budget claim that their draconian spending cuts are necessary to solve a “spending problem.” But nearly all of those cuts would be applied to a chunk of the federal budget that is already expected to decline substantially, while the parts of the budget that are expected to see a modest rise in costs are left mostly untouched. Perhaps the Ryan budget isn’t actually designed to solve a “spending problem” after all.

Michael Linden is the Director for Tax and Budget Policy at the Center for American Progress.