The combination of flat or declining wages and rising costs over recent decades has hit working families hard. According to an analysis from the Center for American Progress, incomes remained flat between 2000 and 2012 even as the real costs associated with the pillars of joining or staying in the middle class—health care, retirement savings, child care, college savings, and housing—increased by $10,600 for a typical married family with two children. While this middle-class squeeze has hit families across the board, communities of color have been disproportionately affected. For example, while real income for a typical household fell by 5.7 percent between 2002 and 2012,* in comparison, the typical African American household saw a 10.1 percent drop in real income during this same period of time, and the typical Hispanic household saw a 7.7 percent drop.**

On average, children of color begin life at a more disadvantaged starting point than their white peers, hindering their chances of eventually reaching the middle class. While child poverty is too high across all races and ethnicities, the poverty rates for black children, at 38.3 percent, and Hispanic children, at 30.4 percent, are about three times as high as the rate for white children, at 10.7 percent. Asian children have the lowest poverty rate overall, at 10.1 percent. But disaggregated data reveal that ethnic sub-groups, such as Hmong Americans, Bangladeshi Americans, and Pacific Islander, tend to experience much higher rates of poverty than white children.

These gaps in poverty not only represent a great moral challenge to the United States, they also threaten to undermine the country’s long-term economic competitiveness. New CAP analysis shows that, even under conservative estimates, child poverty costs the United States $672 billion in lost economic output due to lower educational attainment, worse health outcomes, and increased spending on criminal justice.

Nearly half of all children born in the United States today are children of color, and by 2043, the United States will have no clear racial or ethnic majority. Absent investments and reforms in order to level the playing field for children of color, the costs of child poverty to the U.S. economy will continue to mount.

Fortunately, there are policy solutions to tackle child poverty and boost economic opportunity. Research has shown that family income is an important ingredient in improving outcomes for children. In fact, seminal research by Greg Duncan of University of California, Irvine, and his colleagues found that a $3,000 increase in annual family income for low-income children from the prenatal period to age 5 led to a 17 percent earnings increase in adulthood.

Recognizing this connection, Congress must in the near term make permanent the 2009 improvements to the Child Tax Credit, or CTC, and Earned Income Tax Credit, or EITC. The improvements—which made these policies more widely available to low-income families—are set to expire in 2017; if Congress fails to act, 16 million people—including 8 million children—would be pushed into or deeper into poverty.

Building off of these important improvements, the Center for American Progress has proposed reforms to further strengthen the CTC; these reforms would help alleviate the middle-class squeeze and cut child poverty for all families, with disproportionate effects for families of color. Specifically, CAP proposes that Congress:

- Make the existing CTC available to nearly all families with children by eliminating the minimum earnings requirement and making the credit fully refundable. These reforms would ensure more equitable access to the CTC for families facing unemployment or with lower earnings. Given that black and Hispanic families face higher rates of poverty and unemployment than white Americans, there are significant racial and ethnic disparities in who is excluded from the current CTC due to low income. A 2011 study from Columbia University found that nearly 30 percent of Hispanic children and 38 percent of African American children lived in families that would not be eligible for the full CTC, compared to 20.5 percent of children overall.

- Index the value of the CTC to inflation so that it retains its value as the costs associated with raising children continue to rise.

- Enhance the CTC with a supplemental Young Child Tax Credit of $125 per month, totaling $1,500 a year, for children under the age of 3 in order to reflect the elevated costs of raising young children and the important role of family income during these early years in a child’s long-term outcomes. Given that a growing share of young children are children of color, this recommendation will also help address racial and ethnic disparities among America’s youngest children.

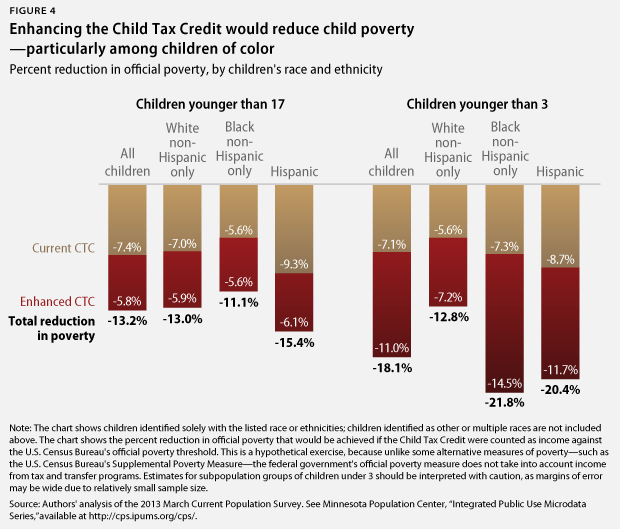

Together, these policies would more than double the anti-poverty power of the existing CTC, and the additional $1,500 per year provided by the monthly Young Child Tax Credit would alleviate a significant share of the rising costs of the middle-class squeeze for families with young children. The reforms have the added benefit of helping level the playing field for children of color, particularly children under the age of 3.

These reforms would decrease poverty for children across the board and reduce the number of children younger than 3 who live in poverty by 7.2 percent among white children, 14.5 percent among black children, and 11.7 percent among Hispanic children. Additionally, previous CAP analysis shows that eliminating racial and ethnic disparities would raise incomes for all Americans and boost U.S. economic growth. CAP’s recommended reforms to strengthen the child tax credit would bolster the nation’s economic competitiveness and bring the United States one step closer to the goal of ensuring that all kids have a shot at the American dream.

Melissa Boteach is the Vice President of the Poverty to Prosperity Program at the Center for American Progress.

*Author’s note: From 2000 to 2012, incomes were flat for a typical two-parent, two-child family. For the typical household, however, income actually declined by 8 percent. The Census Bureau only provides detailed data broken down by race and ethnicity from 2002 onward. But between 2002 and 2012, real income reductions were much larger for African American and Hispanic households than for the typical household.

**Author’s note: Median income is adjusted to 2013 dollars using the CPI-U-RS. Author’s calculations from Bureau of the Census, Current Population Survey, Annual Social and Economic Supplements, Table H-5: “Race and Hispanic Origin of Householder — Households by Median and Mean Income, 1967 to 2013,” available at http://www.census.gov/hhes/www/income/data/historical/household/.