View data on Big Oil’s fourth-quarter profits (.xls)

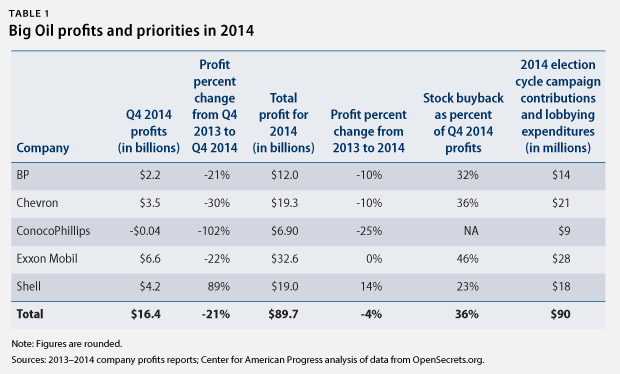

Oil industry prices continued to dip steeply in the fourth quarter of 2014, but the big five oil companies—BP, Chevron, ConocoPhillips, Exxon Mobil, and Shell—remained profitable, making $16.4 billion in the last quarter of 2014 and $89.7 billion for the entire year.

These lower oil prices were reflected at the pump. Gas prices slid for a record 123 days before rebounding last week and hitting a national average of $2.03 per gallon of unleaded gasoline. The four-month slide was a boon for American consumers, who saved nearly $14 billion more at the pump last year than they did in 2013.

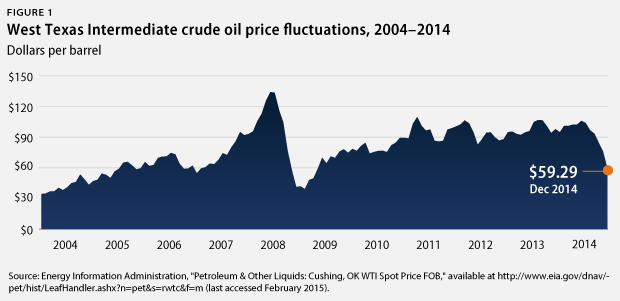

These lower gas prices, due in part to an oversupply of crude oil, resulted in 21 percent less profit for the big five companies compared with the fourth quarter of 2013 and 4 percent less than last year. Fluctuations in oil prices are nothing new; given the past decade of oil prices, 2014 was not a devastating year for oil companies—it was just average. Prior to 2009, crude oil below $60 per barrel was common on the West Texas Intermediate, or WTI, a benchmark of oil pricing. (see Figure 1)

Several companies have announced plans to cut investment spending and jobs in the wake of lower profits. But if history is a teacher, these companies will still be spending big bucks on elections and lobbying. In 2014, Big Oil spent nearly $40 million on lobbying politicians. Over the two-year 2014 federal election cycle, Big Oil gave $5.3 million in campaign contributions and spent an additional $84.6 million on lobbying. These five companies alone averaged a budget of $126,149 per day to influence federal law and support their protectors—a $90 million total.

With increased talk of modernizing the tax code, Big Oil wants to make sure its $2.4 billion in annual federal tax breaks stays right where it is—in annuity. Some of these tax breaks, including the deduction for intangible drilling costs, have been on the books for 99 years—meaning that they date back to when the nation’s oil industry was nascent.

Having withstood a century of market fluctuations, petroleum has matured into one of the most profitable industries in economic history. The industry has hung its hat on the tax code for so long that advocates for tax fairness often refer to these breaks as loopholes—loopholes that allow Big Oil approximately $76.6 billion in federal tax avoidance over a decade. President Barack Obama’s 2016 budget would eliminate many of these loopholes, which would raise $4 billion in 2016 alone. Yet congressional support for this provision is highly doubtful.

While there is a range of views predicting a return to high prices or a continuation of current pricing, one thing is clear: Oil companies have made money, lots of it, for a very long time. And they spent it to influence politicians in the hope of maintaining the status quo for the industry’s next century.

Danielle Baussan is Managing Director of Energy Policy at the Center for American Progress. Miranda Peterson is a Research Assistant for the Energy Policy team at the Center.