The U.S. economy bounced back in the second quarter of 2014, growing at a 4 percent annualized rate and brushing off the 2.1 percent contraction in the first quarter, according to new data from the Bureau of Economic Analysis, or BEA, released this morning. U.S. gross domestic product, or GDP—the sum total of goods and services produced by workers and equipment in the United States—expanded to $17.3 trillion, 0.4 percent above the level before last quarter’s anomalous shrinkage.

With the second-quarter rebound, we can all enjoy a sigh of relief before contemplating the longer-term trend of U.S. economic growth five years after the end of the Great Recession. Annual revisions by the BEA in today’s report show that since the economy’s trough in June 2009, the U.S. economy has grown at a 2.2 percent rate on average. However, that is well below average on a historical basis and much lower than the economy should be growing in order to fully recover from the ongoing shock of the bursting real estate and financial bubbles.

While growth in the second quarter reverted back to the post-recession trend rate, the United States appears stuck in a low-growth groove that former Treasury Secretary Lawrence Summers and other economists describe as a “secular stagnation” trap. Secular stagnation is a condition where rising inequality combined with private markets, despite historically low interest rates, are unwilling to supply enough investment to make up the shortfall in aggregate demand in the economy that stands between our present situation and one with full employment. In such a situation, Summers’ hypothesis goes: adequate growth can only be achieved through asset bubbles, or a more substantial role for public investment—in the infrastructure, education, and scientific research needed to drive future productivity and economic growth.

Today’s BEA report underscores the secular stagnation diagnosis. Conventions for measuring GDP divide economic activity into several categories; personal consumption by households, private investment, exports and imports, and government consumption and investment. Below headline growth, a look at these categories reveals the underlying conditions in different sectors and their contributions to overall economic health. Here, two items stand out as straying far from the norms of prior economic experience and practice: the recovery of personal consumption and the downward path of public-sector spending and investment.

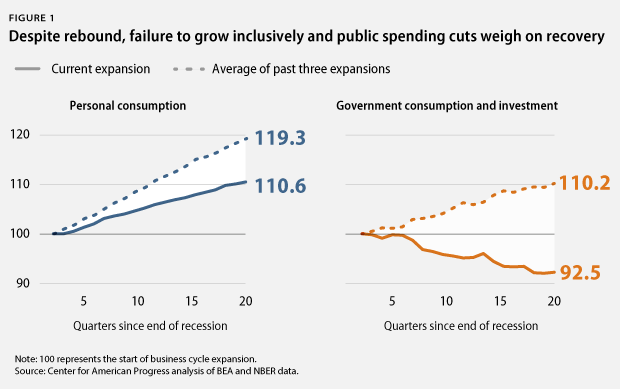

Household consumption spending, typically amounting to more than two-thirds of total GDP, grew 2.5 percent in the second quarter and accounted for two-fifths of overall growth in the quarter. But through the recovery, high personal debt levels and households financially squeezed by stagnant incomes conspired to depress the recovery of consumption overall relative to past experience. Since June 2009, total personal consumption by households increased 10.6 percent after adjusting for inflation (see Figure 1). But compared to the trend over the same period in the prior three expansions, consumption grew by 19.3 percent. While total personal income continues growing, today’s report shows that the growth in income has been led by investment income and salary bonuses—things that at best comprise a minor share of most people’s total income.

Government spending on public service provision and investment also shows a marked departure from past policy choices to support economic recoveries. Figure 1 also shows that in the prior three recoveries—in the 1980s, 1990s, and 2000s—spending at all levels of government grew an average of 10.2 percent over the first five years of expansion, adjusting for inflation. However, in the current recovery, public spending not only failed to keep pace with prior practice, but it actually fell by 7.5 percent. As a share of the overall economy, the public sector shrank to 18.3 percent of GDP from 21.5 percent at the start of the expansion, according to today’s data.

The congressional crusade to cut spending is unnecessary given the rapidly improving federal fiscal outlook. But the failure to reinvest in the economy’s public goods and to provide emergency unemployment insurance and basic safety nets to those still enduring the ravages of secular stagnation is weighing on current and future overall growth. These factors can be seen in today’s report in the sluggish growth of final domestic sales—purchases of goods and services in the United States—that, at 2.3 percent, lagged well behind overall GDP growth.

Private investment rebounded in the second quarter of 2014, growing 17 percent. Through the current recovery, private investment in productive equipment, intellectual properties, and residential buildings on average has followed the trajectories of previous recoveries. However, volatility in one component of investment—private inventory adjustments—is contributing to overall vicissitudes of quarter-to-quarter GDP growth.

Inventory investment measures are seen as a “plus” when businesses produce inventory to hold in stock for later sales. That same measure is seen as a “minus” when businesses sell off existing inventory stocks and don’t replenish them. In the 20 quarters since the U.S. economy began expanding again in July 2009, changes in inventories swayed overall GDP by an average of -1.1 percentage points to +1.3 percentage points, depending on the inventory cycle—or a little more than half of the overall growth registered in a given quarter.

In America’s international economy, exports increased 10 percent in the second quarter, although already disproportionately larger imports to the United States expanded by 12 percent. The resulting net increase in the U.S. trade deficit shaved 0.6 percentage points off the second quarter’s overall growth rate.

While today’s GDP data put to rest the anxieties over the first quarter’s contraction and show GDP securely on a path to growth, this path is one that is not leading to broadly shared prosperity for many in the U.S. economy. Without more policy action to boost investment and expand employment and incomes, the specter of secular stagnation will continue casting a pall over the economy.

Adam S. Hersh is a Senior Economist at the Center for American Progress.