This issue brief contains a correction.

On December 20, 2017, the U.S. House of Representatives and Senate passed a new tax law, commonly known as the Tax Cuts and Jobs Act (TCJA).1 Since the fall of 2017, the legislation, which provides huge tax cuts for the wealthy and corporations, has been consistently unpopular with voters.2 Its proponents, however, frequently pushed claims and promises that ranged from aggressive puffery to outright lies. A year after the law’s passage, the major promises made by the TCJA’s proponents have been exposed as hollow.3 Here is the reality of the TCJA’s impact thus far.

Tax cuts primarily benefit the wealthy

Promise: “Any reductions we have in upper-income taxes will be offset by less deductions, so there will be no absolute tax cut for the upper class.” – Treasury Secretary Steven Mnuchin, November 20164

Reality: The TCJA showered massive tax cuts on the richest Americans. The highest-earning 1 percent can expect tax cuts averaging more than $51,000 in 2018 alone—more than what the median American worker makes in a year.5 Even when considering the tax cuts as a percentage of income, the benefits for the richest far exceed those for the middle class. (see Figure 1) American voters have overwhelmingly recognized the tax bill as primarily a giveaway to the wealthy. President Donald Trump essentially admitted as much when he floated the idea of a 10 percent tax cut for the middle class only weeks before the 2018 midterm elections.6 The Administration has since dropped the idea.7

The law’s bonanza for the rich comes in the form of several tax cuts. It doubled the estate tax exemption to $22.4 million for a couple—giving heirs to multimillion-dollar estates a windfall of tax cuts of up to $4.5 million per estate. Massive tax cuts for the owners of pass-through businesses and corporations translated into further tax breaks for the rich. The top 1 percent—who own nearly 40 percent of the country’s wealth, largely in the form of stock and other equity—receive 61 percent of the tax benefits from the reduction in the pass-through rate.8 The tax law even provides giveaways to wealthy people in foreign countries, since foreigners own 35 percent of U.S. corporate stock.9 This year alone, foreign investors will receive a $47 billion tax windfall as a result of the TCJA.10

Existing employment and wage trends persist as corporate profits skyrocket

Promise: “This huge tax cut … will be rocket fuel for our economy. … The biggest winners from this transformation will be everyday families, from all backgrounds, from all walks of life, and our great companies, which will produce the jobs. They are going to produce jobs like you’ve never seen before.” – President Trump, December 201711

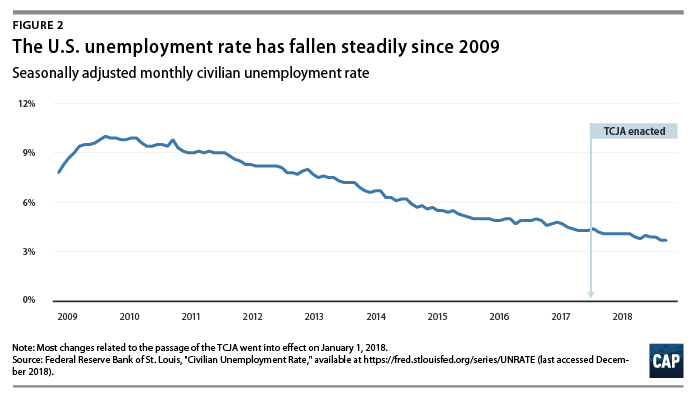

Reality: The TCJA has not produced any economic miracles. Despite massive federal borrowing, job creation continues at the same rate as it did before Congress passed the lax law.12 Figure 2 illustrates how the unemployment rate has continued its decadelong decline since peaking in 2009, suggesting that the TCJA’s employment effects are, at best, minimal. Gross domestic product (GDP) growth has been strong in 2018—owing partly to significant increases in federal government spending—but analysts do not expect this pace of expansion to continue much longer.13

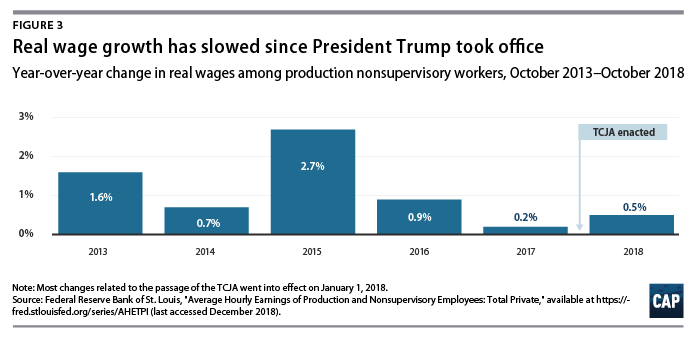

More importantly, the economy’s overall growth has not translated into gains for workers. Real wages have barely budged, continuing a pattern that goes back to 1980 in which paychecks have barely kept pace with the rising costs of living.14 As of October 2018, rank-and-file, or production nonsupervisory, workers saw less than a 0.5 percent year-over-year increase in real median hourly earnings—a rate of wage growth slower than what occurred from 2013 to 2016. (see Figure 3) There are systemic reasons for this wage stagnation, such as the erosion of bargaining power, but the TCJA did nothing to address them.15 As Sen. Marco Rubio (R-FL) put it, “there’s no evidence whatsoever that the money’s been massively poured back into the American worker.”16

After-tax corporate profits—which were already at record highs before the tax bill—soared following the law’s passage, increasing more than 19 percent since the third quarter of 2017.17 Former chief economic adviser Gary Cohn and other proponents of the bill argued that corporations would invest their windfall in their workers —but that has not happened.18 Shortly after the tax bill’s passage, many large corporations, including some that had lobbied heavily for the tax bill, attributed year-end bonuses or other worker benefits to the bill’s passage.19 But there is little reason to believe that the tax bill led to these bonuses or that they signaled an economywide trend.20 Indeed, only 4 percent of firms credited bonuses or other worker benefits to the tax bill, constituting a tiny fraction of their overall payroll.21 Since the tax bill’s passage, bonuses for private sector workers have only increased by $0.02 per hour.22 Most importantly, real wages, the true test of whether workers are getting ahead, grew very slowly.23

Federal deficit soars as corporate tax receipts plummet

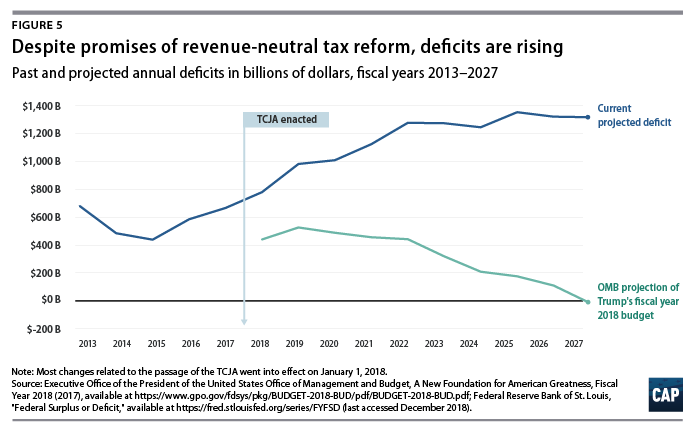

Promise: “I not only don’t think it will increase the deficit, I think it will be beyond revenue neutral. In other words, I think it will produce more than enough to fill that gap.” – Senate Majority Leader Mitch McConnell, December 201724

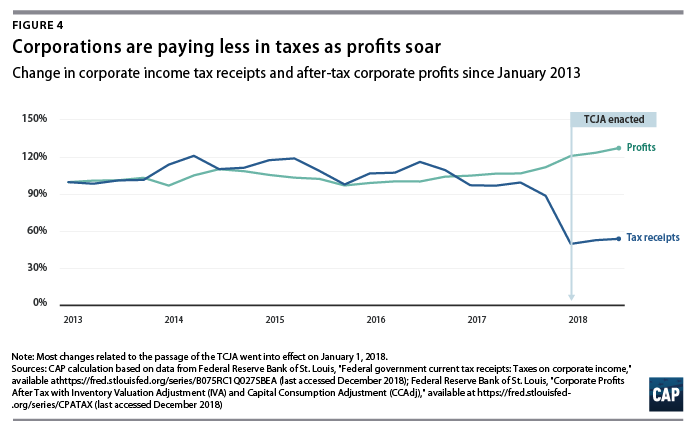

Reality: Every credible analysis predicted that the TCJA would considerably increase federal deficits and the debt.25 The Congressional Budget Office estimated that the law would result in $1.9 trillion of additional debt over the next 10 years, excluding interest, and that the budget deficit would exceed $1 trillion in 2020 and every year thereafter.26 This directly contradicts the promises of revenue-neutral tax reform and deficit reduction outlined in President Trump’s budget for fiscal year 2018.27 Deficits are not inherently harmful, but timing and purpose matter. The decision to implement an unpaid-for, long-term tax cut for the wealthy and corporations several years into an economic recovery was unwise. The resulting rising debt offers congressional leaders a convenient excuse to cut Social Security, Medicare, and Medicaid.28

The budget shortfall results partially from cuts to the corporate tax rate. Corporate tax revenues fell more than 30 percent in fiscal year 2018, with corporations paying $92 billion less in taxes than the year before.29 When measuring based on what corporate tax revenues would have been under pre-TCJA law, the drop is even larger—$119 billion, or 37 percent, for fiscal year 2018.30

Low repatriation rate of offshore corporate profits

Promise: “Over $4 [trillion], but close to $5 trillion, will be brought back into our country. This is money that would never, ever be seen again by the workers and the people of our country.” – President Trump, August 201831

Reality: The TCJA provided a windfall for large multinational corporations that have hoarded profits offshore for decades to avoid U.S. taxes. Under the new law, these companies must now pay tax on about $2.6 trillion of pre-TCJA offshore profits regardless of whether those profits are returned to the United States.32 But the one-time repatriation tax is dramatically lower than even the new lower rate for new corporate profits, and the companies have up to eight years to pay. Proponents of the legislation argued that companies would bring back trillions of dollars to invest in the United States. But in the first six months of 2018, corporations moved only about a third of the cash and other liquid investments that they are believed to hold offshore—and in any event, far less than the $4 trillion to $5 trillion that President Trump claimed.33

TCJA proponents should have known better. When Congress enacted a tax holiday in 2004 for offshore corporate profits, the tax cut failed to produce any of the promised economic benefits and resulted in significantly reduced federal revenues.34 The congressional Joint Committee on Taxation found that a large portion of the profits that were repatriated during the holiday would have been repatriated anyway and taxed at the normal rate.35 Moreover, instead of investing in workers or boosting investments, corporations funneled nearly all of their tax holiday repatriation dollars into shareholder payouts.36 More broadly, the notion that tax cuts will motivate corporations to bring money back into the country is flawed.37 In reality, repatriation usually amounts to an accounting change—rather than an operational change—for these corporations as they shift money on the books from a subsidiary to the parent company. On paper, this technical change appears as a decrease in overseas investments but does not necessarily reveal actual corporate behavior. Moreover, prior to the TCJA’s passage, corporations were awash in cash and had access to plenty of low-cost financing, making it even less likely that an enormous cut in the corporate tax rate would change their investment behavior.

Corporations use profits for buybacks, not capital investment

Promise: “More assets like machines let workers produce more, and when workers can produce more, businesses can afford to pay their workers more.” – Council of Economic Advisers Chairman Kevin Hassett, October 201738

Reality: Instead of investing more or increasing wages, corporations have largely spent their tax windfalls on stock buybacks. S&P 500 companies spent $194 billion on buybacks during the third quarter of 2018, and buybacks are expected to top a record $1 trillion by the end of 2018.39 Meanwhile, there is no sign of an investment boom. After two strong but hardly exceptional quarters, nonresidential fixed investment slumped badly in the third quarter of this year, increasing by a measly 2.5 percent annualized rate.40 Sen. Rubio recently wrote about the implications of this corporate decision-making: “When a corporation uses its profits to buy back stock, it is actively deciding that returning capital to shareholders is a better activity for business than investing in the company’s product or workforce.”41

The TCJA adds new complexities and loopholes to the tax code

Promise: “So yes, we are throwing out the special-interest loopholes that riddle the code.” – House Speaker Paul Ryan, October 201742

“Our plan will enable Americans to file their taxes on a form so straightforward it would fit on a postcard.” – House Speaker Ryan, August 201743

Reality: On several levels, the TCJA represents a missed opportunity to simplify and reform the tax code. For individuals, House Speaker Ryan’s promised postcard did not materialize. The IRS did produce a new 1040 form with fewer lines—but there is a catch:44 Filers claiming certain deductions, such as for student loan interest, will be forced to use additional worksheets. Meanwhile, the hurried and partisan process of the bill’s passage resulted in several new and continued loopholes.45 For example, the wealthy continue to benefit from stepped-up basis—where gains in asset values are exempted from income taxes when passed to heirs—and have a whole new way to avoid taxes through the TCJA’s new deduction for pass-through businesses.46 Certain industries, such as private equity, oil and gas, and real estate developers, maintained and, in some cases, expanded their ability to use special interest tax breaks.47

The TCJA failed to meet its proponents’ promises to the American people, but it lives up to lobbyists’ and special interests’ wildest dreams. Rep. Chris Collins (R-NY) told the press, “My donors are basically saying, ‘Get it done or don’t ever call me again.’”48 Congressional Republicans did indeed get it done by giving their donors huge tax cuts; those donors rewarded them by using some of their new tax savings for political contributions to help re-elect the bill’s supporters.49 Sen. Lindsey Graham (R-SC) admitted that this would be the case when he told a report that “financial contributions” would stop if congressional Republicans did not pass a tax bill.50 Donors did not get all of the windfall, however—several members of Congress also benefited considerably. According to their financial disclosures, some members on tax-writing committees could see tax cuts worth hundreds of thousands of dollars due to changes in pass-through provisions.51

Despite the current strength of the macroeconomy, the fiscal damage52 from the TCJA is already extensive. The 116th Congress should pursue real tax reform that eliminates the law’s costly and ineffective provisions and instead prioritizes a fairer tax code that benefits workers rather than corporations and the wealthy.

Andrew Schwartz is a policy analyst of Economic Policy at the Center for American Progress. Galen Hendricks is a special assistant for Economic Policy at the Center.