This column was originally published on MarketWatch.

We got two important signals about the economy today, and they tell a story that we are all too familiar with: The economy continues to grow, but workers aren’t seeing enough of the gains. The initial gross domestic product, or GDP, growth estimate for the last quarter of 2014 came in at 2.6 percent, a solid number. At the same time, the Bureau of Labor Statistics, or BLS, released the Employment Cost Index, arguably the most comprehensive measure of income growth in the U.S. economy, showing compensation growing only 2.2 percent over the past year.

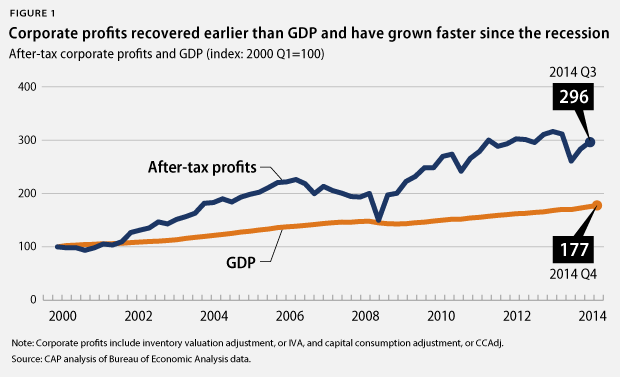

What this says about the economy looking back is different than what it means going forward. Slow wage growth is a sign that we still have too much slack in our economy, and the GDP number—at least the first estimate of it—is just fast enough to keep an economy humming along but not fast enough to take back much of the ground that workers lost over the past 15 years. In other words, while corporate profits seem healthy, when looking at all the data we have, it seems like the economy is still growing steadily, but not impressively.

Looking forward, today’s slow wage growth can be seen as a virtue, assuming the Federal Reserve is still in the evidence-based monetary policy game. Slow wage growth combined with falling oil prices mean the Fed faces little risk in keeping rates low for longer than markets currently expect. At the same time, deflation in the Eurozone and falling oil prices continue to point to a lack of global demand and a world in which the United States will be the lynchpin of the global economy in 2015. In other words, external events suggest the consequences of hiking rates too early have grown more severe over the past six months, while the data suggest the risks from keeping rates low are less than they may have appeared.

This is good news for American consumers, who are driving U.S. GDP growth at the moment—with the government becoming less of a drag on the economy, but continuing to underinvest, and businesses understandably remaining reluctant to commit to major expenditures. Auto sales remained brisk in the fourth quarter, capping off the industry’s best year since the recession. And this quarter capped a decent year for housing investment, which has become less of a drag in the past couple years.

However, the question is how much longer consumers can support the U.S. economy and, increasingly, the global economy. With the dollar strengthening, we can expect net exports to lower GDP as the year goes on. Headwinds in Europe and Asia are strong, but the U.S. economy has been stronger so far. The question is whether American households can keep the ball moving until the rest of the world can recover. Or at least that’s what it looks like today; if today’s GDP growth number also gets revised upward to 5 percent, we’ll all be humming a different tune. Remember this isn’t the last word—the first pass at GDP growth in the third quarter of 2014 was pretty mediocre, but by the time revisions were done, we were all pretty pleased with the number. This is important to keep in mind as we opine on what you can know based on an advanced estimate.

Michael Madowitz is an Economist at the Center for American Progress.