The economic headlines are chock full of soaring corporate profits, booming CEO pay, and record share buybacks.1 Yet, America’s working families and communities are struggling to get by since wages and family wealth have barely budged after decades of stagnation. This is a dangerous situation, as the deep imbalances in how the U.S. economy works—and whom it fails to work well for—increasingly expose America to social and political division.

This issue brief explores why companies share their benefits overwhelmingly with those at the top, leaving little for working families. It discusses why this is the case and what can be done to shift corporate accountability and governance so that economic growth is genuine, lasting, and more equitably shared with working families.

A shift in corporate governance

The boards and managers running companies, especially public companies, respond to the stakeholders who have the power to make demands of them.2 Stakeholders include the consumers who buy their products and services; workers and suppliers who produce them; investors who provide capital and other know-how; and even communities who provide a clean, safe environment and educated workers.3 However, boards and managers have been implementing corporate governance strategies that prioritize Wall Street and corporate executives, over the rest of the stakeholders. Why are America’s companies so responsive to some stakeholders, to the detriment of others?

Corporate governance was not always so one-sided.4 Since the 1980s, relative power within companies shifted away from workers, communities, consumers, and retail investors, and dramatically toward corporate executives and financial sector professionals as a result of several trends:5

- The decline of union power and the increased outsourcing of work greatly diminished workers’ ability to secure wage increases and maintain good health and pension benefits.

- Globalization expanded a pool of low-cost operating options around the world. Without strong and enforceable labor, environmental, and related public interest standards embedded in global trade rules, companies’ newfound mobility empowered managers to level a credible threat against workers and communities to push wages and benefits lower, or work will leave town—or both.

- The decline of strong antitrust enforcement opened the door to rising levels of market concentration, reduced competition, and growing monopoly rents across the economy. The increased importance of intellectual property protection, differential access to valuable big data, and entry barriers created by network effects augmented these trends. As a result, larger, dominant companies are less responsive to stakeholders and able to extract more from consumers and suppliers.

- Share ownership of public companies became more concentrated in the hands of institutional investors. With the rise of short-term-oriented funds and the deployment of extractive, often debt-driven tools such as hedge fund activism and leveraged buyouts—which also handsomely rewarded financial sector professionals—companies became almost obsessively focused on hitting stock price targets in the near term, with stock buybacks as a primary tool for doing so.

- Tax law changes incentivized companies to compensate CEOs and executives with stock options and also cut taxes on the wealthy, most recently in 2017. Corporate managers and financial sector professionals thus enjoyed greater rewards for boosting companies’ short-term returns.

This multidecade rearrangement of power among corporate stakeholders generated strong pressures and plenty of new opportunities to squeeze workers’ wages and benefits. The 2008 financial crisis and subsequent Great Recession created enormous economic dislocations that intensified the stresses on American workers and working-class communities.6 These successive rounds of economic pain have contributed to social division that now poses a serious threat to the United States as a society and polity.7

Who is the economy working for these days?

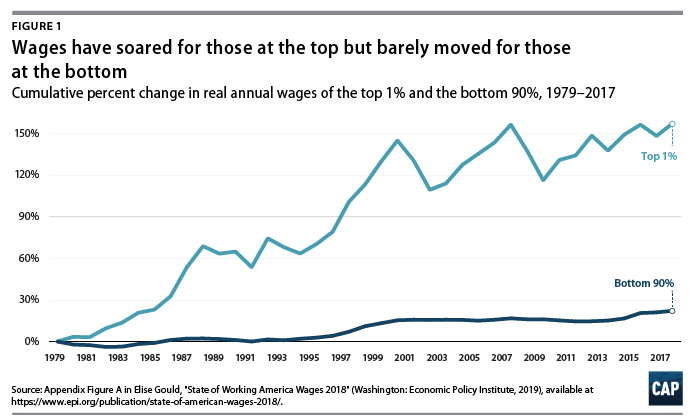

The U.S. economy today is not working for workers and working-class communities. Jobs have been created steadily since late 2010, but the headline jobs numbers have failed to capture the depth of economic pain that working Americans face. Employment opportunities stayed scarce for years after job growth returned; firms only gradually hired more people, and many workers found themselves in jobs that paid only low wages and offered few benefits.8 American workers without four-year college degrees make up roughly 60 percent of the American workforce,9 and yet their real compensation, namely wages and benefits, has been essentially stagnant since the Reagan era.10 What little wage growth has occurred, especially for the bottom 10 percent of workers, is due in no small part to the minimum wage increases passed in certain states rather than at the federal level, where it has been stagnant for more than a decade.11

Wealth levels overall have only recovered to 2007 levels, after falling by 49 percent compared with 2001.12 And among the bottom half of all Americans, who in aggregate own only 1.3 percent of all household wealth in America, the average real wealth is both dangerously low—roughly $20,000—and half of what it was in 1999.13 Moreover, the Black-white wealth gap is larger today than it was before the Great Recession.14 Wealth is an essential aspect of economic security, enabling families to send children to college, afford a retirement with dignity, and meet the unexpected vicissitudes of life. But the millions of Americans whose incomes are barely keeping up with costs and who lack benefits cannot easily accumulate the housing and financial assets needed to generate wealth.15 The challenge is even more pronounced in certain geographic regions as decades of economic decline and a lack of real, meaningful opportunities have hollowed out many working-class communities across America.16

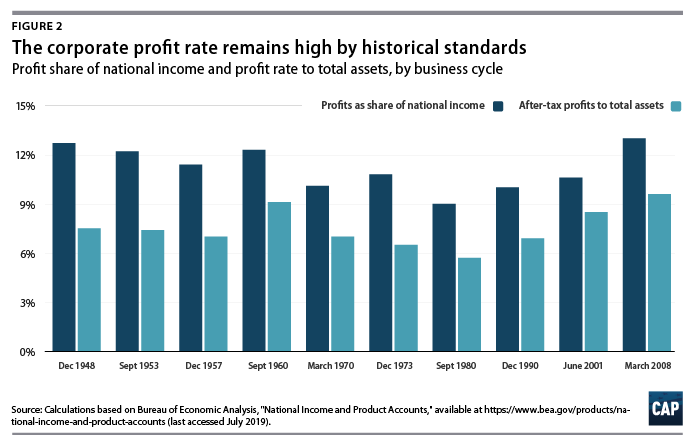

In contrast, the financial crisis and Great Recession barely dented nonfinancial sector corporate profit, which recovered quickly and continued to grow. Since 2017, corporate profit has reached after-tax highs—jumping significantly following the Tax Cuts and Jobs Act of 2017 (TCJA).17 Recently, that growth has slowed, but the corporate profit rate—the ratio of total after-tax corporate profits to total assets—remains above 10 percent, high by historical standards. Indeed, after-tax profits for the current business cycle have reached an average of 9.6 percent of total corporate assets. This is the highest level for any business cycle since World War II. (see Figure 2)

These soaring corporate profits have not translated to broad-based economic prosperity. Rather, by cutting corporate tax rates from 35 percent down to 21 percent; permitting the repatriation of offshore profits at bargain basement rates of 8 percent to 15 percent; and locking in permanent low rates on offshore profits, the TCJA was a corporate giveaway that sent the stock market booming but did little for long-term economic growth or for workers.18 As Warren Buffett aptly noted, nearly half of Berkshire Hathaway’s improved value for the year “was delivered to us in December [2017] when Congress rewrote the U.S. Tax Code.”19

Rewarding those at the top

So, where is all this money that companies are generating, or receiving, going? In large measure, those at the top are receiving it in the form of executive compensation and buybacks. In addition, merger and acquisition activities have continued at a strong pace, which often rewards and further concentrates economic power and wealth at the top.20

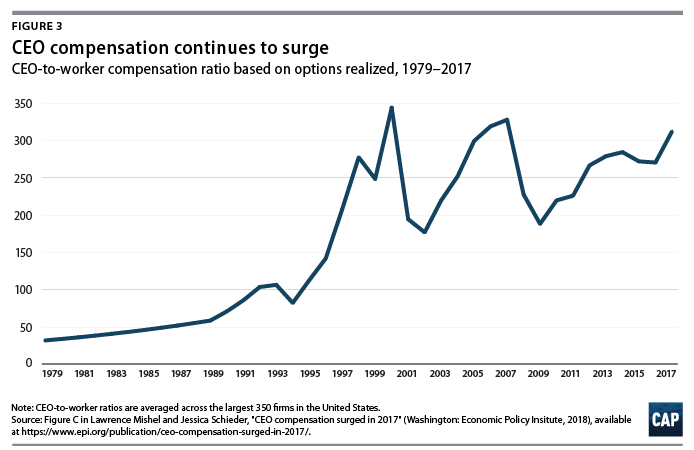

For starters, compensation to CEOs and executives has surged. (see Figure 3) A study by the Economic Policy Institute found a 17.6 percent jump in pay at the very top from 2016 to 2017,21 and the available evidence for CEO compensation this year suggests another robust year.22 Highly compensated financial sector professionals—such as hedge fund and private equity fund managers—also constitute a sizable portion of those at the top who have enjoyed a significant expansion in income.23

Furthermore, share buybacks have exploded. At a record high of more than $800 billion in 2018 for S&P 500 companies, buybacks exceeded capital expenditures.24 With companies’ stock prices increasingly hooked on buybacks, 2019 could be close to these highs—although the chance of a recession in the near future may weigh on returns.25

Share buybacks enable companies to boost their stock prices by buying back their own shares. This can give executives, compensated largely in stock, a handsome windfall.26 Analysis last year by U.S. Securities and Exchange Commission (SEC) Commissioner Robert Jackson found that company executives frequently sell stock during buybacks such that they “personally capture the benefit of the short-term stock-price pop created by the buyback announcement.” Jackson highlights how short-term rewards from buybacks undermine the link between pay and long-term performance.27

In addition, a range of commentators have expressed concerns that excessive buybacks are squeezing out investments in the future and diverting resources from the interests of other company stakeholders.28 Indeed, the growth effects of the TCJA were predicated on the assumption that firms would use the windfall for business investment, which would create the momentum for economic growth. However, domestic corporate investment has barely budged—and contrary to promises, foreign investment by corporations has increased.29 This leaves the bulk of the tax windfall to keep Wall Street and CEOs happy.

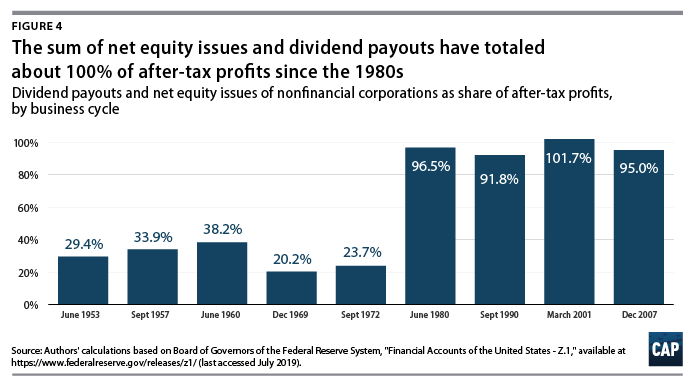

Overall, the data highlight how much corporations reward their shareholders.30 The sum of net equity issues—the difference between new share issuances minus share buybacks and merger and acquisition share retirements—and dividend payouts have totaled about 100 percent of after-tax profits since the 1980s. (see Figure 4) This means that corporations on average spend all the money they make in profits, plus all the money they raise on the stock market, to buy back their own shares and pay out dividends. Typically, the same companies are not simultaneously raising money on the stock market and buying back their own shares. Thus, a lot of companies are spending more than their profits to keep their shareholders happy—a stunning fact, since corporate profits have also gone up at the same time.

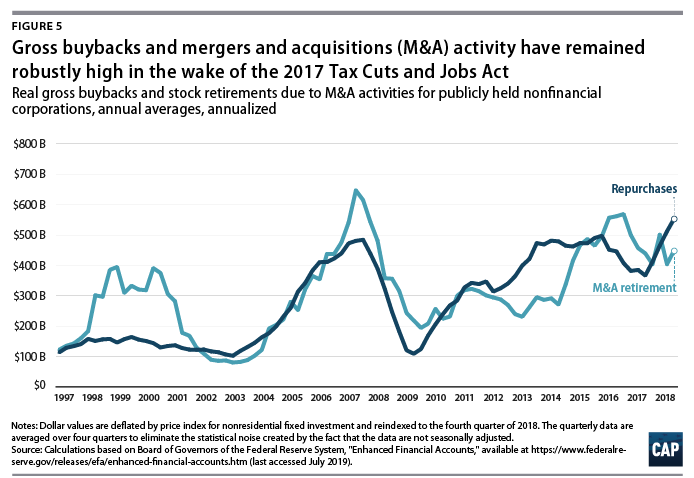

Mergers and acquisitions have also sustained robust levels.31 Frequently, mergers and acquisitions have served to lock out the competition and concentrate market power.32 Recent Center for American Progress analysis reveals the widespread scope of abnormal returns from this trend toward concentration.33 CAP has also highlighted the negative impacts of concentration on farmer incomes, among other groups.34 Golden parachute provisions—agreements that provide significant severance benefits to executives in case of termination—in CEO compensation packages of acquired businesses exemplify the misguided incentive structures built into many mergers and acquisitions.35 Recently, stock retirements due to merger and acquisition activity have come close to the levels observed during the subprime mortgage boom years before the Great Recession and have remained high in the wake of the 2017 tax cuts. (see Figure 5)

Ultimately, the power to divvy up corporate profits looks very different for those sitting at the top versus just about anywhere else.

When workers had power

The 1950s and 1960s were not a golden age of inclusive capitalism for women, people of color, and the environment, to name just a few of the groups and areas affected by the insufficiencies of that era.36 Solely from the perspective of labor’s ability to share in the returns to companies, however, it was a period during which corporate profits were shared more broadly than they are today. That is partly because, coming out of the Great Depression and a war against fascism in Europe and Asia as well as facing the new threat of communism, workers and government demanded that capitalism work better than it had been before.37

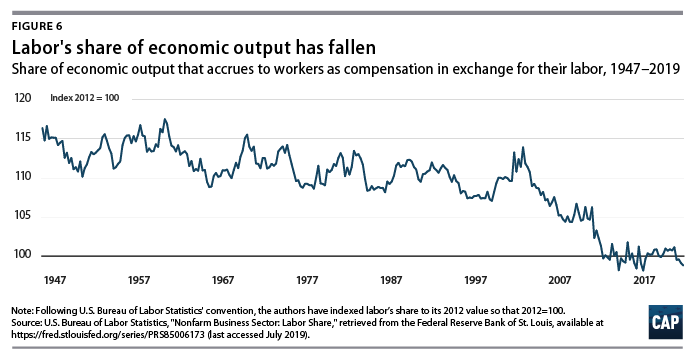

Figure 6 shows the decline in labor’s share of economic output over time.38 Notably, the gap between the 1950s and today may be even starker, as these data do not break out higher-income workers whose wages are growing at a faster pace than mid- and low-wage workers.39

Although a range of policies and broader economic forces were at play, several factors were noteworthy in the context of this issue brief.40

First, with high union density, unions were, in large measure, the most important check on corporate management during that period.41 Union density arose both from hard-fought battles by workers and the concerted efforts of the Roosevelt administration to support unionization through government procurement.42 Workers’ power and willingness to make claims on corporate income are demonstrated by the far greater incidence of worker actions such as strikes. Indeed, strikes were a regular part of bargaining over the economy’s returns but fell dramatically beginning in the early 1980s.43

The international trade environment supported unions’ ability to make those claims, in part because opportunities for companies to seek lower-cost production venues were limited. To begin with, international trade was far less integrated globally.44 Europe and Asia were recovering from the devastation of World War II, while the Soviet bloc, China, as well as much of the developing world were closed to international investment for political, ideological, or other reasons. In addition, there were far greater constraints on communication and transportation than exist today. This meant that outsourcing and offshoring supply chains to low-cost jurisdictions—and the resulting downward pressure on U.S. worker bargaining power—was far less prevalent.45

Notably, the New Deal framers of the postwar international economic order believed strongly in international trade but also recognized the risk that could arise from trade integration without labor standards and protections against other anti-competitive practices.46 Unfortunately, their vision was blocked by American business interests, which eventually won out when the obstacles to international trade noted above fell away.

During the 1950s and 1960s, many industries were also subject to governmental industry-based regulation and vigorous antitrust enforcement. Both exerted a degree of governmental control and public pressure on companies to act more favorably toward workers.47 For example, managers in regulated industries were more acutely aware of the public oversight and reputational risks that regulatory accountability created.48 Vigorous antitrust enforcement had similar effects.49 In addition, regulation and antitrust enforcement resulted in greater distribution of economic power and fairer forms of competition. For example, it was much harder for companies to occupy a dominant position in a supply chain and utilize that position and contractual restraints to pressure other firms and workers in the supply chain.50 A broader distribution of economic opportunity had other salutary effects for workers, such as more effective democratic engagement by workers and other benefits.51

Worker power over corporations was substantially assisted by the relative inability of Wall Street to make demands on a company’s returns.52 Investors overall tended to be far more dispersed, with retail investors a larger percentage of shareholders in companies than today. Those retail shareholders tended to be more passive in their demands on company management than the institutional shareholders of more recent times. Although this was not without costs on corporate performance and executive accountability, it cleared the way for other actors, outlined above, to exert greater demands on boards and management.53

Tax policy also helped. With an average corporate tax rate of 50 percent, individual marginal tax rates on the wealthy upward of 70 percent, and estate tax rates above 70 percent, tax policy throughout the 1950s and 1960s leaned against excessive concentrations of wealth.54 It also generated the revenues needed for government to make robust investments in housing, transportation, education, and communities across the country.

The economy and society of the 1950s and 1960s were far from perfect and cannot—and should not—be recreated. In particular, they often excluded women and people of color from fully participating in the labor market—more so than today. But in developing new proposals to make the economy work better for working families, policymakers can study the lessons of that period to understand the conditions under which worker and governmental power acted to constrain the upward redistributive pull of laissez-faire capitalism.

Toward 21st-century accountable capitalism

For those who believe America can still be a vision of hope for all people, addressing whom the economy is working for is essential. To make capitalism work for working families, America needs to maximize the alignment between the long-term interests of companies with those of the public, in particular working families.

Boost worker bargaining power: The starting point for enabling workers to demand a greater share of the returns to companies has to be rebuilt collective bargaining rights and higher basic wage laws. In “Blueprint for the 21st Century: A Plan for Better Jobs and Stronger Communities” and several other publications, CAP highlights how policymakers can help enable workers to demand their fair share of the fruits of their labor by adopting a $15 national minimum wage; reforming existing labor laws to facilitate sectorwide bargaining; and taking additional steps to ensure that all workers are free to join a union, as well as secure their broader rights in court.55

Workers’ ability to bargain for higher wages is heavily affected by whether trade policy actively counters the downward pressure on wages and standards from globalization by setting higher floors on labor and environmental standards.56 Empowering workers globally to demand a greater share of corporate returns helps workers in America do so as well—especially if the internal opportunities for labor market arbitrage are also closed, such as in so-called right-to-work states. As such, tools such as cross-border collective bargaining; the inclusion of labor and environmental standards in anti-dumping duty calculations; and the exclusion of products made under conditions without sufficient labor rights and environmental standards, among other changes, must be part of the new toolkit in U.S. trade agreements to rebalance capitalism for workers—whether they be in Ohio, Oaxaca, or Anhui.57 Trade agreements must also not unduly limit governments’ ability to enforce the antitrust laws or to regulate in the public interest.58

Keep markets competitive and well regulated: Fair, competitive markets are important for keeping corporations properly responsive to a range of stakeholders, as well investing in the innovation needed to support future economic growth. The growth of concentrated corporate power in recent decades has created unbalanced bargaining dynamics that need to be addressed by the diversity and limits that antitrust enforcement and regulation bring. From digital platforms to agricultural markets, antitrust enforcement, cooperative organizing, and other competition, labor market, and regulatory policy levers should be deployed to boost competition and ensure greater accountability to workers, farmers, consumers, and other stakeholders. CAP has set forth a range of proposals for how to do so.59

Deploy tax policy to counter inequality: Tax policy can help rebalance economic outcomes across the economy not only by securing revenues needed to fund important public investments, but also by affirmatively reducing inequality. In particular, it can help reinforce a better alignment of interests among a company’s management, investors, and workers.

As a starting place, tax policy can help rein in the incentives and ability for executives to extract undue levels of pay. In 1993, Congress attempted to restrain excesses by capping the corporations’ tax deduction for compensation for top executives at $1 million per executive, per year. However, Congress left open a wide loophole: Corporate deductions remained unlimited for “performance-based” pay, including stock options.60 Subsequently, corporations shifted top executives’ compensation into stock incentives, and total pay skyrocketed.61 While cutting taxes on corporations and the wealthy, the 2017 tax law eliminated the performance-based pay loophole, thus subjecting stock options and other incentive-based compensation to the $1 million limit.62 It is too early to tell whether this provision will meaningfully reduce executive compensation.63

A more progressive tax code—with higher tax rates on individuals with extremely high incomes—could address excessive CEO pay in two ways: directly, by imposing higher taxes on CEOs, and indirectly, by changing bargaining incentives. Higher marginal tax rates would reduce the incentive that executives have to use their power to raise their own compensation.64 In recent decades, CEO compensation in the United States has risen while top marginal tax rates have fallen. Using international evidence, Thomas Piketty, Emmanual Saez, and Stefanie Stantcheva find that CEO pay is strongly negatively correlated with top marginal income tax rates, suggesting that higher tax rates reduce CEOs’ incentives to ratchet up their own compensation.65

In addition to higher marginal rates on top earners, policymakers could also consider new, targeted approaches to rein in CEO pay. Progressive localities such as Portland, Oregon, have been experimenting with higher taxes on companies when CEO pay relative to median worker pay is too high, and proposals to do so exist nationally.66 Congress could build on these ideas by considering penalty taxes on executive compensation exceeding a threshold: For example, a threshold set at a historic multiple of CEO pay to typical worker pay would be roughly $1 million, or 20 times the national median wage of $47,000.67 Basing the computation on a national measure of median worker pay, as opposed to a firm-specific measure, would avoid the risk that firms would manipulate their CEO-to-median worker pay ratio by shedding lower-wage workers by outsourcing the functions they provide.

Penalty taxes on excessive CEO compensation would complement tax increases on top earners and address the specific issue of CEOs extracting rents from public companies, but they should not substitute for such increases.68 Only broader approaches to tax top-income earners, including raising income and capital gains taxes, can reliably achieve true tax progressivity; raise the revenue needed to reinvest in the economy and middle class; and check short-term incentives on Wall Street and beyond.

Focus on corporate long-termism: Reining in Wall Street’s short-term influence over corporations does not have to come at the expense of Main Street investor rights and information. Rather, workers, companies, and investors each do better when they all take a more long-term focus.69 And capital markets regulation can do more to maximize the possibilities for genuine alignment of interests. A longer-term corporate focus will mean real increases in investments, strong productivity growth, and, thus, higher wages and living standards for everybody if those gains are equitably shared.

Such an approach may be best encapsulated by the growing movement among investors to take into consideration environmental, social, and governance (ESG) practices and outcomes by companies in their investment and engagement activities. By looking at longer-term risks and opportunities not well reflected in today’s financial disclosures—whether it be climate change, the use of risky tax strategies, human rights, political spending, or how companies’ treat their workers—ESG investing is a market-oriented mechanism that utilizes management’s attentiveness to investors’ concerns to also produce long-term benefits for companies and the public.70

Recent hearings in the U.S. House Committee on Financial Services highlighted how the lack of consistent, comparable, and reliable disclosure standards on the wide range of ESG topics is an obstacle for long-term-minded investors.71 Congress should pass a robust, comprehensive mandate to require ESG narrative and metrics disclosure by public companies in their SEC-filed annual reports and financial statements. Additional attention should also be given to sizable nonpublic companies, where investor protection, efficiency, and capital formation concerns are increasingly present.72 CAP has set out additional recommendations in this area, including how asset managers can better facilitate corporate long-termism, in “Corporate Long-Termism, Transparency, and the Public Interest.”73

The effectiveness of ESG disclosure is, however, closely tied to investor rights and engagement tools, such as say-on-pay votes and shareholder proposals more generally, where investors get to express their views on topics important to a company. Indeed, the ability to tap independent proxy advisers has proven to be a critical tool for checking outsize and unproductive forms of executive compensation.74 Unfortunately, shareholder proposals and independent proxy advisers are under attack.75 Rather than rolling back Main Street investor rights and access to information, a better approach is to enhance accountability.76 ESG metrics could also be better incorporated in CEO pay, possibly in pay versus performance disclosures mandated—but not yet completed—under the Dodd-Frank Wall Street Reform and Consumer Protection Act.77

To empower workers and rein in Wall Street short-termism, the regulation of stock buybacks needs to change. SEC Commissioner Jackson recommended that the SEC make it harder for companies to allow executives to cash out during buybacks.78 A range of proposals in Congress would rein in buybacks, including by tightening the market manipulation rules, requiring companies to raise worker pay to $15 per hour plus certain benefits, and requiring companies to pay workers a bonus before buybacks are permitted.79 CAP has also proposed a series of competition policies, including a monopoly tax, designed to restore competition and rein in abnormally high profits.80 These policies would help check the trend toward greater payouts to Wall Street, with little for workers or other investments in the future.

The regulatory limitations on financial industry and executive compensation, as mandated by the Dodd-Frank Act, remain unfinished business for the SEC and other financial regulators.81 These provisions help check short-term compensation structures and artificial financial engineering by management, as well as improve accountability to shareholders and other stakeholders. Meanwhile, the Sarbanes-Oxley Act’s investors protections have been increasingly weakened.82 Strong accounting and auditing standards help ensure the reliability of financial reporting, which is essential for investors and other stakeholders.83 Greater attention must also be leveled at the high-debt, high-cost financial practices that expose investors and workers to heightened risks.84

A significant obstacle to the completion of the unfinished Dodd-Frank rules, especially at the SEC, was the gridlock created by the courts, and resulting agency timidity, around economic or cost-benefit analyses.85 Were regulators today to ram through weakened versions of these proposals while ignoring those economic analyses and other administrative procedure standards, it would prove that reforms are needed to ensure that both corporations and the regulatory system are more accountable to workers and other stakeholders.86

Conclusion

President Donald Trump’s economic policies have supercharged the underlying trends of an economy that is not working for Main Street Americans. Owing to those broader trends, and especially thanks to Trump’s tax cuts, the rich get richer as working families continue to struggle. But it need not be this way. Economic policy affects how companies respond to their stakeholders. Corporate governance that is more accountable to the demands of workers, communities, and other stakeholders can help ensure that a growing economy’s returns flow to a middle class made up of working families. But much needs to be done to make that happen. Rebuilt unions, sensible regulation, a focus on increasing competition, tax policy that leans against inequality, and corporate long-termism can all help make corporations more responsive to the needs of working families and support more durable and resilient economic growth. Given the precarious nature of American social cohesion today, as well as a growing range of risks to U.S. economic performance, doing better by working families may be one of the smartest investments that America’s companies could make.

Andy Green is managing director of Economic Policy at the Center for American Progress. Christian Weller is senior fellow at the Center and a professor of public policy at the McCormack Graduate School of Policy and Global Studies at the University of Massachusetts, Boston. Malkie Wall is a research assistant for Economic Policy at the Center for American Progress.

The authors would like to thank Seth Hanlon, Will Beaudouin, Shanée Simhoni, and Keenan Alexander for assistance on this brief.