This column was originally published on MarketWatch.

U.S. job growth rebounded in March as employers added 192,000 new jobs to the economy, according to new data released by the Bureau of Labor Statistics. Combined with February’s revised job creation numbers—which were increased to 197,000 based on better data—the labor-market expansion appears to be strengthening. Questions remain, however, about whether the quality and quantity of jobs being created are adequate to deliver middle-class standards of living to U.S. workers.

The national unemployment rate remained unchanged at 6.7 percent in March with 10.5 million people unemployed, according to today’s report. Among major worker groups, the unemployment rate increased 0.2 percentage points to 6.6 percent for women and increased 0.4 points to 12.4 percent for African Americans, but decreased 0.2 percent to 7.9 percent for Latinos.

To make sense of the falling national unemployment rate, down 3.3 percentage points since the labor market’s recession peak, it is important also to look at the labor-force participation rate—the share of the civilian population that is either working or actively seeking work—which is a key factor in calculating the unemployment rate. The civilian force participation rate ticked up 0.2 percentage points over the previous month to 63.2 percent in March. But this is a sharp overall decrease in participation from 66 percent in December 2007, at the economy’s peak prior to the Great Recession. This decline in labor-force participation represents almost 7 million people who are no longer working or looking for work.

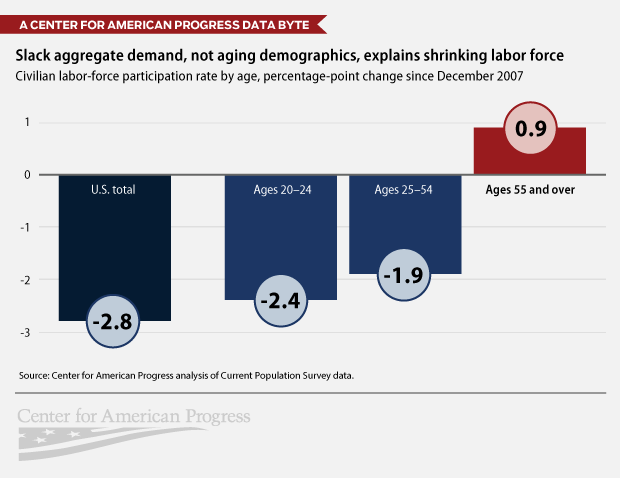

The significance of this shrinking workforce depends a lot on its causes. A number of analysts, including Federal Reserve Bank of St. Louis President James Bullard, argue that declining participation is a result of aging demographics—an increase in the amount of people near or over retirement age who are choosing to exit the labor force. In this case, the measured decline in labor-force participation supports the notion that a declining unemployment rate reflects substantial improvement in labor-market conditions.

However, data provided in today’s report contradict this hypothesis. In fact, while the overall U.S. labor participation rate declined and then failed to recover from the recession, workers ages 55 and over actually increased their labor-force participation by nearly 1 percentage point, and participation for traditional working-age people has slipped substantially. Workers ages 25 to 54 saw labor-force participation fall 1.9 percentage points since the start of the Great Recession, while participation for young workers, ages 20 to 24, fell 2.4 percentage points.

To be sure, the demographic shift in the U.S. labor force is real, but we have not yet started to feel the effects on labor-market indicators. The loss of working-age people rather than older workers shows that slack labor-market demand, not an aging population, is driving exits from the labor force. This renders the overall unemployment rate lower than it would otherwise be if we counted as unemployed the nearly 6 million workers who were identified in today’s data as not in the labor force but wanting to work. If these people were still counted in the labor force, the unemployment rate would be 10.5 percent rather than today’s 6.7 percent. Thus, it is reassuring that Federal Reserve Chairwoman Janet Yellen indicates that the Fed will look beyond the unemployment rate in assessing how monetary policy can help maintain maximum employment.

Private sector employment finally recovered in March to its pre-recession peak level—although this remains below what is needed for full employment due to population growth in the intervening time. The 192,000 new jobs seen today were dispersed widely across the U.S. economy, with no one industry really leading the pack. Fully half of job gains in March, or 96,000 jobs, came from the retail trade, employment services, and accommodation and food services industries that are notorious for providing low wages with few benefits, paid leave, or prospects for career mobility. Employment grew 27,000 in health care services, an industry that has seen uninterrupted growth for several years, revealing more about structural changes in the economy than the current labor-market situation.

While it is clear that the U.S. labor market continues on a path to recovery, a return to full employment—when wage increases are typically seen widely across the job market—remains far from the business-as-usual pace seen in recent months’ jobs data. Bipartisan Senate action this week to extend emergency unemployment insurance for the long-term unemployed took one step toward relief for a still underpowered labor market. This effort, however, may wreck on the shoals of the Republican-controlled House of Representatives.

Failing to extend unemployment insurance would harm unemployed job seekers, their families, and the businesses whose sales depend on people’s income security. But if the House does not act, it would be another reminder that, at this point in our economy, this state of affairs is a choice made by political leaders and not our economic fate.

Adam S. Hersh is Senior Economist at the Center for American Progress.