This column was originally published on MarketWatch.

First things first: March’s Employment Situation report from the Bureau of Labor Statistics unveils another month in a growing string of impressive jobs gains. The U.S. economy added 295,000 jobs, and the unemployment rate fell to 5.5 percent in February. Over the past 6 months, the economy has added an average of nearly 300,000 jobs per month. But how long can the economy keep doing this? And how will the Federal Reserve respond?

There are some legitimate questions about whether the economy can keep adding jobs at a rapid clip without setting off inflation. Surely it stops at some point. But since there is so little precedent for recovering from such a steep recession, there will be considerable policy uncertainty for some time. Absent clear precedent, the Fed has to go back to first principles—the ones everyone learned in Econ 101—to figure out what comes next.

If the Fed’s goal is to produce a healthy recovery that puts as many Americans to work as possible without producing inflation, the task is considerably harder than usual. The unemployment rate has fallen dramatically since the end of the Great Recession and is nearing the range of estimates for its long-run level. But both the number of potential workers not included in the unemployment rate and the likelihood that they will return to the labor market are far from their historical norms, so it is not clear what the unemployment rate really shows.

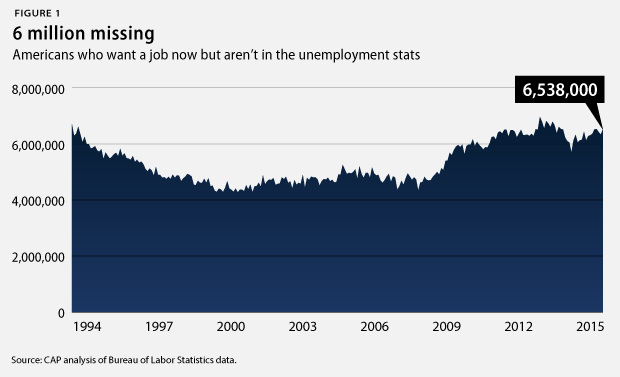

As of Friday, the Bureau of Labor Statistics reported that about 8.7 million people were unemployed, down from 10.4 million people a year ago. At this pace, the U.S. economy should be back down to normal unemployment levels very soon. But there are an additional 6.5 million people who were not counted as unemployed and want a job now. (see Figure 1) Additionally, most broader measures of the labor force suggest that there is a lot more slack before the economy reaches full employment. The rate of change in the simple unemployment rate indicates that the Fed should be contemplating an interest rate increase to slow the economy down. But the levels of unemployed and otherwise idle workers suggest that there is a long way to go.

The real question the Fed must answer is how much it fears inflation. The lesson of monetary policy over the past generation is that because the Fed controls the money supply, it should have little trouble controlling inflation. Inflation expectations are harder to predict, but the best research suggests the Fed merely needs to credibly suggest that it wants to keep future inflation rates low to keep expectations pinned near current levels. Under these circumstances, the Fed can wait until it sees actual signs of inflation before raising interest rates and tightening the money supply in order to stabilize the economy at the same inflation rate but at a lower level of unemployment.

If the economy can get to the same place with more jobs, it seems like the Fed should pursue those policies: The result would be more workers, more stable families, a higher gross domestic product, or GDP, and lower deficits. And yet, here we are. The most hopeful data point in the figure above is still from the mid-1990s, when now Federal Reserve Chair Janet Yellen was first on the Federal Open Market Committee, and the committee kept interest rates low to see if the economy could put more people back to work. It worked then, but the question remains: Will we get to find out if such a policy will work now?

Michael Madowitz is an Economist at the Center for American Progress.