Introduction and summary

In September 2017, Puerto Rico’s electricity grid was devastated by Hurricane Maria. Eleven months later, the commonwealth finally reconnected electricity for all of its residents.1 It was the longest, largest blackout in U.S. history and among the largest blackouts in the world.2

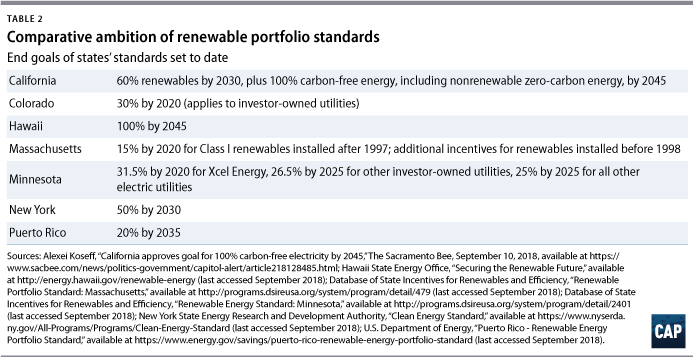

The island’s sole electric utility—the vertically integrated, government-run Puerto Rico Electric Power Authority (PREPA)—faced numerous challenges even before the storm. With most of Puerto Rico’s grid powered by expensive, imported fossil fuels, including 47 percent of electricity generation coming from petroleum,3 the cost of residential electricity in Puerto Rico is higher than it is in most states. At the same time, the median household income on the island is less than half the median household income in Mississippi, the poorest of the 50 states. PREPA has more generation capacity than it needs to power the island today, but it is largely in the form of legacy fossil fuel plants, which are both expensive to maintain and not well-suited to meet the island’s energy needs and goals. Puerto Rico passed a renewable portfolio standard (RPS) in 2010, requiring PREPA to generate 12 percent of its electricity from renewable sources by 2015, 15 percent by 2020, and 20 percent by 20354—goals that the commonwealth has so far failed to meet. Currently, just 4 percent of electricity in Puerto Rico is supplied by renewable energy sources.5

Hurricane Maria, which was a Category 4 storm packing winds of up to 155 mph when it made landfall,6 exposed additional weaknesses in the system, including poorly maintained and overloaded transmission lines. In addition to the issues with PREPA’s physical infrastructure, decades of financial mismanagement and political corruption have taken a toll on the utility’s fiscal health.7 Unable to sustain its $9 billion debt, PREPA has been negotiating with creditors for several years to restructure its obligations; in July 2017, it filed for bankruptcy, and in July 2018, it announced a preliminary deal to restructure part of that debt.8

Even though the lights are finally back on throughout Puerto Rico, serious challenges remain. The grid is still shaky—an accident by a repair crew plunged the entire island back into darkness in April of this year—and experts doubt its ability to weather another serious storm.9 In addition, rather than making the grid more resilient for future storms, restoration to “predisaster condition” is usually the goal.10 Furthermore, it is not clear that PREPA is meeting even this standard: Fredyson Martinez, vice president of the power authority workers’ union, estimates that about 10 percent to 15 percent of the repair work does not meet basic quality standards.11 As a result, even with electricity service restored, there remains significant work to do to prepare Puerto Rico for the next storm.

The commonwealth has taken a variety of steps to reform its electricity sector, and PREPA in particular. In June, Puerto Rico Gov. Ricardo Rosselló signed legislation that allows for the partial privatization of PREPA.12 The governor has championed the privatization plan as a way to lower energy costs, but critics are concerned that the legislation could actually result in higher energy costs for consumers.13 The law lays out the broad strokes of privatization, which would happen in two phases—the first focusing on electricity generation, the second on distribution—but it requires further action. The Puerto Rico Legislature has 180 days to create a new comprehensive energy policy that details the privatization plan. If a new plan is not produced by January 2019, the end of the 180-day period, previous energy laws will supersede the June legislation.14

There have also been efforts to substantially change the role of the Puerto Rico Energy Commission (PREC), Puerto Rico’s independent electricity regulator. Earlier this year, Gov. Rosselló submitted a plan to consolidate PREC with other regulatory bodies, which critics said would remove the regulator’s independence and reduce its authority.15 At this time, it appears that PREC will remain independent, though the legislation passed in June to privatize PREPA does include changes to the structure of PREC. For example, it expands the commission’s membership from three members to five—a change that critics are concerned will allow Gov. Rosselló to create a “lopsided” commission, particularly since he will have the opportunity to appoint four of its members.16 Furthermore, the proposal would require PREC to approve individual proposals for selling off power plants under the privatization plan and to make its decision on these proposals within 15 days of submission17—an incredibly short timeline compared with industry standards. This could interfere with PREC’s ability to do a thorough review.

As Puerto Rico rebuilds its electricity grid and considers the future of PREPA, policymakers should take the opportunity to enact changes to its regulatory system that will better enable the island’s utility to serve residents and businesses while building a cleaner, more affordable, and more reliable energy system.

The good news is that Puerto Rican policymakers don’t have to start entirely from square one: They can and should take lessons from other states’ experiences. This report examines six states—California, Colorado, Hawaii, Massachusetts, Minnesota, and New York—that are at the forefront of grid modernization. First, it explains how these states have set up regulation of their electric utilities. It then examines how these states have pursued broad electricity system modernization, either through regulation or legislation. Next, it looks specifically at how these states have incentivized their electric utilities to simultaneously pursue goals for emissions reduction and for renewable energy deployment, affordability, and reliability.

Finally, based on the author’s review of the policies and regulatory systems in these states, this report makes recommendations for how Puerto Rico can apply these lessons to its own electricity sector. The primary findings and recommendations include maintaining PREC as a strong, independent, and technocratic regulatory commission that is empowered to ensure PREPA meets its energy goals; increasing efforts and investment to integrate low-cost clean energy sources into the island’s electric grid; and transitioning to a performance-based regulation system that will increase accountability at PREPA to prioritize affordability, reliability, and emissions reductions.

Nearly 3,000 people died in Puerto Rico as a result of Hurricane Maria—a number that could still rise.18 In the absence of reliable electricity, kidney disease patients cannot access dialysis, diabetics cannot keep insulin refrigerated, and hospitals and doctors’ offices cannot easily communicate with one another across distances. This is in addition to the multiple challenges people encounter just trying to cook, clean, and bathe without power. It is critical that Puerto Rico take this opportunity to make smart investments in building a 21st-century electric grid and to create the transparent, trustworthy system of utility governance that Puerto Ricans deserve.

Electricity market and regulatory structures

The six states covered in this report represent a variety of electricity systems. Some have deregulated and restructured their electricity sectors to introduce competitive bidding for electricity supply and to allow consumers to choose their electricity supplier; others continue to have vertically integrated utilities that are the sole providers of both electricity generation and distribution. Some have a small handful of large investor-owned utilities, while others have a combination of distribution-only utilities, vertically integrated municipal utilities, rural cooperatives, competitive suppliers, and community choice aggregators. Some have an independent system operator that manages the flow of power for their state or region, while others do not. There is one tool, however, that these six states have in common: a regulatory commission that is responsible for overseeing electricity prices and other utility regulations.

California

California has one of the nation’s more complex electricity markets. It deregulated its electricity market in 1996, becoming the first state to do so.19 However, after the California energy crisis of 2000—when Enron and other companies intentionally took generation offline to artificially inflate electricity prices, causing rolling blackouts throughout the state20—California halted its deregulation process. In 2009, the California Legislature passed S.B. 695, which allows a limited number of nonresidential customers to purchase electricity directly from an electric service provider.21 Today, the program, known as Direct Access, is at capacity, and there is a waiting list of companies and institutions that would like to be able to choose their electricity supplier, either to get a lower electricity rate or to achieve other goals, such as meeting their electricity needs with renewable energy resources.

California has six investor-owned utilities, 46 municipal utilities, four rural electric cooperatives, and three community choice aggregators.22 There are also 15 registered electric service providers that supply electricity to customers that are part of the Direct Access program.23 The California Independent System Operator manages electricity flow for about 80 percent of the state, as well as a small part of Nevada; in the other 20 percent of the state, electricity flow is managed by utilities directly.24

California’s regulatory commission, the California Public Utilities Commission, was initially established through an amendment to the state constitution passed in 1911.25 Today, five commissioners serve on the California Public Utilities Commission. They are appointed by the governor and approved by the state Senate and serve for staggered six-year terms.26

Colorado

In Colorado, natural gas is deregulated, but electricity is not. However, the state has a mix of electric utility models, including some that generate a significant portion of their power and others that purchase power from wholesale power providers or independent power producers.

Colorado has two investor-owned utilities, 29 municipal utilities, and 22 rural electric cooperatives. Two of these utilities—Xcel Energy, an investor-owned utility, and Colorado Springs Utilities, a municipal utility—are vertically integrated. The rest get their power primarily from wholesale power providers and independent power producers.27 These independent power producers must sell to the utilities, rather than directly to retail consumers, because electricity is not deregulated in Colorado.28 The state does not have an independent system operator or regional transmission organization, so utilities are responsible for balancing power flow.

Colorado’s regulatory commission, the Colorado Department of Regulatory Agencies’ Public Utilities Commission, is more than 100 years old, created in 1913. Three commissioners, appointed by the governor and confirmed by the state Senate, serve four-year terms.29 The commission currently regulates only the two investor-owned utilities. Colorado’s rural electric cooperatives asked the Colorado Legislature for commission regulation in 1961 and were awarded it, but then asked for an end to that regulation in 1983 and were also awarded that reversal.30

Hawaii

Hawaii’s regulatory commission actually precedes Hawaiian statehood—the Hawaii Public Utilities Commission was established in 1913.31 However, the structure of the commission has changed many times. In 1959, the new state constitution consolidated the number of departments in the state’s executive branch, and the commission lost some of its previous autonomy.32 However, legislation passed in 2014 gave the commission increased decision-making authority. In 1976, the commission switched to having three full-time commissioners, based at the main office in Oahu, with Hawaii Public Utilities Commission assistant positions in district offices in Kauai, Maui, and Hawaii.33

Hawaii has four electric utilities. There are three investor-owned utilities, which together serve about 95 percent of the state’s population: Hawaii Electric Light Co., which serves the island of Hawaii; Hawaiian Electric Co., serving Oahu; and Maui Electric Co., which serves Maui, Lanai, and Molokai. These three companies are all subsidiaries of a single parent company, Hawaii Electric Industries. The remaining 5 percent of the state’s population is served by a distribution electric cooperative, Kauai Island Utility Cooperative, which serves the island of Kauai. Unlike many states where the regulatory commission only regulates investor-owned utilities, the Hawaii Public Utilities Commission regulates all four of the state’s electric utilities.34

Hawaii’s electricity market is not restructured—meaning customers can only get electricity from their utilities—and the four electric utilities are vertically integrated. In addition to owning their own generation, the three investor-owned utilities also source from independent power producers. Hawaii does not have an independent system operator, and utilities are responsible for balancing power supply and demand.35 Recently, Hawaii has been studying alternative electric utility ownership models. Maui commissioned a report on “alternatives to the investor-owned utility business model,” which concluded that:

The ideal path forward to meet the County’s objectives is to organize, develop and enable a private entity akin to an Independent System Operator (ISO) or Regional Transmission Operator (RTO) to oversee the electric grid and energy market while ensuring a reliable power supply, adequate transmission infrastructure, competitive wholesale prices and fair access for renewable power.36

The rationale for this conclusion was that not many assets would have to change ownership, it could be implemented quickly, and it would provide “clear price signals and market transparency so that power producers of all types can make rational economic decisions.”37 It also concluded that the second-best choice would be to have an electric cooperative take over some or all of Maui Electric Co.’s assets.38 Another study focused on the islands of Oahu and Hawaii did not consider an independent system operator but specifically focused on different utility ownership models. The study discussed some of the benefits and drawbacks of investor-owned, publicly owned, and cooperatively owned utilities; reviewed legal and process considerations for creating a new utility; and recommended additional steps for the state—including financial and legal analyses—as it considers the future of its utilities.39

Massachusetts

Massachusetts has a deregulated electricity market. It has three investor-owned utilities, all of which are distribution-only; two of them—Eversource Energy and National Grid—cover most of the state.40 There are also 41 municipal utilities,41 which are vertically integrated and operate their own municipal light plants.42 Many state regulations that apply to the investor-owned utilities do not apply to the municipal utilities. Massachusetts is part of the territory of New England’s independent system operator, ISO New England, a nonprofit organization that manages electricity flow across the six New England states.43

Massachusetts’ first energy regulator opened its doors in 1885.44 Today, the Massachusetts Department of Public Utilities (DPU) has three commissioners, appointed by the governor and confirmed by the commonwealth Senate, serving four-year terms. Two of the three commissioners serve a term coterminous with the governor, and one of the commissioners serves a four-year term that is not in line with the governor’s term. No more than two of the commissioners can be from the same political party.45

Minnesota

Like Hawaii and Colorado, Minnesota has not deregulated its electricity market. Its five major investor-owned utilities are vertically integrated. Separate from the investor-owned utilities, six municipal power agencies supply 126 distribution municipal utilities with generation and transmission services. The state also has six rural electric associations that handle both generation and transmission and 45 that are distribution-only.46 Minnesota falls under the Midcontinent Independent System Operator, a nonprofit that manages generation and transmission across parts of 15 U.S. states and part of Canada.47

Minnesota’s regulatory commission is the Minnesota Public Utilities Commission. Compared with the other states in this report, the commission’s tenure in the state is relatively short: In 1975, Minnesota became the 48th state to start regulating electric utility company rates. As recently as 2005, the Minnesota Legislature granted additional functions to the commission, including siting, routing, and permitting of large generating plants. 48

New York

New York is a premier example of a deregulated electricity market. Rather than utilities having a monopoly on generating and supplying electricity to their customers, there is a competitive electricity supply market; utilities are required to allow customers to shop for electricity from energy service companies. For customers who do not choose to shop for an electricity provider, utilities continue to offer a default service.49

There are six large investor-owned utilities, one large municipal utility—Long Island Power Authority—and 41 small municipal utilities.50 The New York Independent System Operator (NYISO) is responsible for coordinating the flow of electricity across the state’s transmission system.

The New York Public Service Commission, established in 1907, regulates all of the state’s utilities.51 The commission consists of up to five members, each appointed by the governor and confirmed by the New York Senate for a term of six years and has been bipartisan by law since 1970. The New York State Energy Research and Development Authority and the Power Authority of the State of New York also play critical roles in grid regulation, reliability, and modernization.

Overarching regulatory initiatives: Leading from states’ executive branches

There are a variety of ways that states can approach electricity sector reform. Below are two examples of states that have pursued broad electricity grid reform and modernization primarily through their executive branches: New York’s Reforming the Energy Vision52 and Massachusetts’ grid modernization plan.53 These two cases highlight some of the opportunities and drawbacks of pursuing broad sector reforms through regulation as opposed to through legislation. In particular, reforms driven by regulation have the benefit of removing some of the political concerns of reforms that initiate in a state’s legislature. The state’s executive or regulatory commission has more freedom to pursue a particular vision or set of goals for the electricity sector, without needing to get the votes of a majority of the legislature. This can allow the executive branch to pursue particularly strong and forward-looking reforms, as seen in New York. However, the associated challenge is that this can also make regulations more easily subject to being overturned, as seen in Massachusetts.

New York’s Reforming the Energy Vision

After Superstorm Sandy in 2012 led to 43 deaths, $19 billion in damage, and nearly 2 million people losing power at some point during the storm,54 New York Gov. Andrew Cuomo (D) set out to strengthen and modernize the state’s energy system.55 In 2014, the governor announced his plan: a broad executive branch initiative called Reforming the Energy Vision (REV).56 The chair of the New York State Public Service Commission, Audrey Zibelman, described the ambition of the initiative:

The existing ratemaking structure falls far short of the pace of technology development that defines many parts of our economy. By fundamentally restructuring the way utilities and energy companies sell electricity, New York can maximize the utilization of resources, and reduce the need for new infrastructure through expanded demand management, energy efficiency, renewable energy, distributed generation, and energy storage programs.57

The specific goals of REV are:

Making energy more affordable for all New Yorkers

Building a more resilient energy system

Empowering New Yorkers to make more informed energy choices

Creating new jobs and business opportunities

Improving our existing initiatives and infrastructure

Supporting cleaner transportation

Cutting greenhouse gas emissions 80% by 2050

Protecting New York’s natural resources

Helping clean energy innovation grow58

Gov. Cuomo tasked several New York state agencies with working together to implement REV, including the New York State Public Service Commission, the New York State Energy Research and Development Authority, the New York Power Authority, and the Long Island Power Authority.59 Among these, the role of the commission has been particularly critical.

In conjunction with the governor’s announcement of REV in 2014, the New York State Public Service Commission issued a report, “Reforming the Energy Vision: DPS Staff Report and Proposal,” which described the basic elements of the program that would allow New York to achieve the above goals.60 One of the key elements is the creation of a distributed system platform provider, the goals of which include creating a “flexible platform for new energy products and services”; incorporating distributed energy resources into planning; creating new systems to monetize behind-the-meter resources; and serving as the interface for retail customers.61 The initial commission report also discussed the need for “a more outcome-based approach to ratemaking designed to encourage utility long term planning that optimizes investments and leads to lower customer bills.”62 The commission also issued an order instituting a proceeding on April 25, 2014. The proceeding was separated into two tracks: Track One focused on how to develop distributed resource markets, and Track Two focused on ratemaking.63

In February 2015, the commission issued an “Order Adopting Regulatory Policy Framework and Implementation Plan,”64 which addressed the Track One issues by laying out specific implementation plans for distributed resources markets. Notably, it said that utilities would serve as the distributed system platform providers, with each utility serving as the interface for its customers so that altogether, the utilities across the state would “constitute a statewide platform that will provide uniform market access to customers and DER [distributed energy resource] providers.”65

A few months later, the commission issued an “Order Adopting a Ratemaking and Utility Revenue Model Policy Framework,” detailing Track Two.66 This order laid out a radical reformation of the way utilities are compensated by creating new avenues for utilities to earn revenue beyond the traditional fee-for-service model.67 The new earning opportunities that the commission described include revenues for providing the platform service created by REV; opportunities to earn revenue for meeting specific targets for system efficiency, energy efficiency, customer engagement, interconnection, and affordability; and revenues associated with reducing the cost of reaching clean energy targets.68 As of this writing, New York’s six major investor-owned utilities are implementing several projects intended to demonstrate new business models associated with various aspects of REV.69

Both the goals and process of New York’s REV initiative are instructive. First, the goals of changing the way utilities are compensated in order to better align compensation with desired outcomes and changing the electricity marketplace so as to encourage more distributed energy resources put New York at the forefront of rethinking the role of electric utilities: how they operate, how they are regulated, and how policymakers can ensure they are best serving customers’ interests. The specific regulations laid out by the New York State Public Service Commission are worth closer examination by any policymaker considering these questions.

Second, the process is instructive in that the vision has been set by the governor, with detailed technical regulations and implementation plans provided by the commission and other New York State agencies. As such, REV is a model for those looking at how to drive electricity reform primarily from a state’s executive branch.

Massachusetts DPU’s grid modernization plan

Massachusetts’ grid modernization plan has some similarities, particularly at the outset of the process, to New York’s REV. However, it also demonstrates some of the drawbacks of electricity reform driven solely by the executive branch, rather than through the state legislature, and implemented through regulation—particularly when there is a party change in the executive branch.

In 2012, the Massachusetts DPU initiated a proceeding on grid modernization. The purpose of the proceeding was to investigate policies that would “ensure that electric distribution companies adopt grid modernization technologies and practices to enhance the reliability of electricity service, reduce costs of operating the electric grid, mitigate price increases and volatility for customers, and empower customers to adopt new electricity technologies and better manage their use of electricity.”70 In 2014, the DPU issued several orders that collectively took a significant step toward grid modernization. These orders included: an order requiring Massachusetts’ electric utilities to file 10-year grid modernization plans by August 2015; an order revising how distribution companies can earn incentives for energy efficiency; and an order on time-varying rates that laid out a proposal for default basic service to include peak and off-peak hours.71

The two major utilities, Eversource and National Grid, did submit their modernization plans in 2015. However, their plans were significantly different from one another, posing a challenge for implementation. While the DPU could have picked one of their approaches and chosen to move forward with it, another significant development occurred between the DPU’s 2014 modernization order and the submission of the utilities’ plans: The governor’s office changed hands from Democratic Gov. Deval Patrick to Republican Gov. Charlie Baker in 2015. Under the Baker administration, the DPU has not prioritized the modernization initiative begun under Patrick’s, and implementation of the modernization plan stalled.72

In January 2018, the DPU issued an order that backtracked on some of the modernization plan’s initial goals: It eliminated time-of-use pricing and instituted a new demand charge for residential solar projects.73 Here, the timing of the commissioner’s terms, as described above, may be a relevant factor. Two of the three commissioners serve a term coterminous with the governor;74 thus, these two, including the chair, began their terms in January 2015. The third commissioner, whose term is not coterminous, was appointed in June 2017.75

In designing the structure of the commission, there is necessarily a trade-off between continuity of commissioners and allowing a new administration to appoint people who will implement its vision if it differs from that of the previous administration. The setup of the commission in Massachusetts favors allowing a new administration to appoint its own people but does keep an element of consistency with one offset term. Nonetheless, by halfway through a governor’s term, they will have had the chance to appoint all three commissioners. The policy direction of the DPU can therefore change significantly, which has both advantages and disadvantages. In this case, it has had the effect of slowing, and to some extent reversing, the previous administration’s grid modernization efforts.

Overarching legislative initiatives: Leading from states’ legislatures

One solution to the problem of shifts in policy that accompany a new administration is instituting policies through legislation rather than solely through regulatory measures. While legislation can also be repealed, it tends to be stickier, or less easily overturned. Repealing a piece of legislation requires a larger number of elected officials, while rolling back regulatory decisions can be initiated solely by the governor. Perhaps for this reason, many of the cutting-edge reforms that have been implemented in the six states considered in this report have either begun with or been institutionalized through legislation. There are numerous examples of legislation that have pushed utilities and regulatory commissions to develop broad modernization plans, including Minnesota’s 2015 grid modernization legislation76 and New York’s 2009 legislation requiring a state energy plan.77 Many of these states have also passed legislation on climate change and emissions reduction, which affects the electricity system.78 Below is additional information about how legislation in California has shaped the path the state has taken to date, and how legislation in Hawaii has the potential to shape the path it will take moving forward.

California: A history of proactive legislation

The California Legislature has taken an active role in shaping the state’s electricity grid, particularly with regard to reducing emissions. California’s first legislation that directly dealt with greenhouse gas emissions was passed in 1988.79 It required the California Energy Commission to create an inventory of greenhouse gas emissions and study the effects of those emissions on the state. In 2002, S.B. 1078 created the California Renewables Portfolio Standard Program and required utilities to procure 20 percent of their power from renewable sources by 2017.80 In 2006, California passed several pieces of legislation that have had the effect of making California’s grid one of the cleanest in the country today: A.B. 32, or the California Global Warming Solutions Act of 2006,81 required the California Air Resources Board to reduce statewide greenhouse gas emissions to 1990 levels by 2020—leading to California’s cap-and-trade program, which began in 2012.82 S.B. 1368 directed the California Energy Commission and the California Public Utilities Commission to set emissions performance standards for baseload power plants.83 Finally, S.B. 107 increased the ambition of the state’s RPS, directing the California Public Utilities Commission to hit the target of 20 percent renewable electricity generation by 2010.84

The effects of these pieces of legislation are clear: Since 2006, California has significantly reduced its use of coal for electricity;85 greenhouse gas emissions have been declining since 2007, even while the state’s gross domestic product has increased significantly;86 and in 2017, 41 percent of the state’s electricity generation came from solar, hydro, wind, and geothermal energy.87 In recent years, California has continued to set forward-looking targets. S.B. 32, passed in 2016, set a target of reducing greenhouse gas emissions to 40 percent below 1990 levels by 2030,88 and in 2017, A.B. 398 extended California’s cap-and-trade program.89

While the California Legislature has taken a particularly active role, it is worth noting that it does not operate in a silo: All of the legislation it passed was supported by the executive branch, and the bills above have been signed by both Democratic and Republican governors, including Republican Govs. George Deukmejian and Arnold Schwarzenegger and Democratic Govs. Gray Davis and Jerry Brown. Furthermore, while these pieces of legislation set aggressive goals, they rely on the capability of the California Public Utilities Commission, the California Air Resources Board, the California Energy Commission, and other agencies to execute it effectively.

Hawaii: Shaping the electricity grid of the future

In April of this year, the Hawaii Legislature passed a bill that may serve as an example for the future of utility regulation. Known as the Ratepayer Protection Act, or S.B. 2939, it directs Hawaii’s Public Utilities Commission to establish financial incentives and penalties for utilities based on meeting certain targets—that is, tying utility revenues to performance. While the specific metrics and associated revenues will be determined by the Public Utilities Commission, the legislation lays out performance metrics that the commission should consider in establishing its framework, including affordability, reliability, integration of renewables, data availability, and customer options and satisfaction. Hawaii’s Public Utilities Commission is required to establish the new framework by January 1, 2020.90 While other states have used performance-based regulation of utilities in limited ways, this is the first legislation to require performance-based regulation at this scale. If successful, it could serve as a model for utility regulation in other states.

Hawaii is also one of only a few states to have a climate adaptation policy. In 2012, the Hawaii Legislature passed Act 286,91 which adds 10 climate-change adaptation priority guidelines to the State Planning Act, thus requiring that climate change adaptation be considered in state planning decisions such as budgets and land use.92 While climate adaptation is somewhat tangential to electricity regulation, it is relevant particularly as states look to make their electricity systems more resilient to catastrophic weather that is likely to increase in frequency and severity as the climate changes.

Emissions and renewables

The six states highlighted in this report all share a commitment to reducing emissions from their electricity sectors. Their legislatures, executive branches, and even voters have been looking ahead by recognizing both the need to reduce the carbon emissions that drive climate change and the economic and public health benefits of incorporating more renewable energy into their electricity portfolios. Many of these states also have been the first to take particular steps or set particular goals to reduce emissions. As a result, the emissions profile of several of these states—particularly California, New York, and Massachusetts—is much lower than the national average.

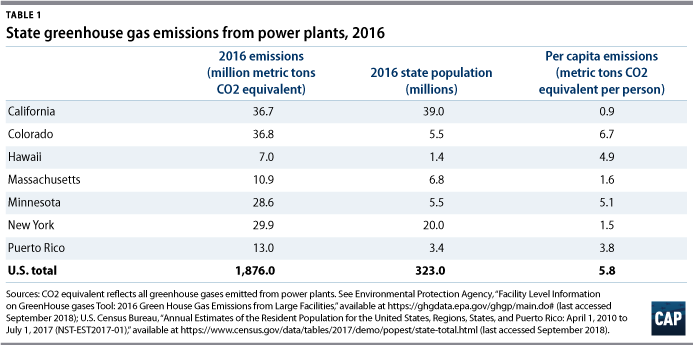

As seen in Table 1, five of the six states discussed in this report have lower per capita emissions than the U.S. average. While Hawaii has lower-than-average emissions and some of the most ambitious goals for renewables in the country, its emissions have historically been higher than states with similarly ambitious goals—such as California and New York—because of its reliance on petroleum for electricity generation.93 Colorado is the one state out of these six with higher-than-average emissions: While it has a strong RPS and ranks 10th nationwide in wind-power generating capacity and 11th in solar generation, it generates a significant amount of its electricity from coal, much of which is mined in the state.94 While Puerto Rico has lower electricity-sector emissions per capita than the average U.S. state, this is primarily driven by its lower per capita electricity consumption, which is about half the U.S. average and lower than Hawaii’s per capita consumption—the lowest of the 50 states.95

Setting standards via legislation, executive action, and voter initiatives

Hawaii, California, New York, Minnesota, and Massachusetts have all set—and frequently updated—their RPS via their state legislatures.

Hawaii was the first state to set a goal of getting 100 percent of its electricity from renewable sources: In 2015, the Hawaii Legislature passed H.B. 623, which set a RPS of 100 percent by 2045.96 This bill was preceded by a series of bills from the Hawaii Legislature that set and gradually increased Hawaii’s targets for renewable electricity generation, beginning with Hawaii’s first legally binding RPS passed by the Legislature in 2004.97

California also has a history of clean energy standards driven by the California Legislature; in fact, the state recently passed one of the most aggressive clean energy standards in the country. S.B. 100, passed in August 2018, requires renewable energy and zero-carbon energy to supply 100 percent of California’s retail electricity sales by 2045. The legislation includes intermediate targets of 50 percent renewables by 2026 and 60 percent renewables by 2030.98 Some electricity in 2045 may be supplied from sources that are carbon-free but not renewable.

By contrast, Colorado had the nation’s first renewable energy standard passed by a voter ballot initiative: The Colorado Renewable Energy Requirement Initiative, or Amendment 37, passed in 2004.99 Since 2004, the Colorado Legislature has increased Colorado’s renewable energy targets; today, investor-owned utilities have a goal of getting 30 percent of their electricity for retail sales from renewable sources by 2020.100

New York has taken yet another approach, with renewable energy goals driven primarily by the state’s executive branch. In 2004, the New York State Public Service Commission approved the state’s first RPS and increased the goal in 2010.101 In 2015, the RPS expired but was replaced with a clean energy standard, which further increased the goal.102 As described above, the governor and the commission have led the state’s REV process to encourage further deployment of renewables.

Meeting emissions and renewable goals: The role of public utilities commissions

These states have generally been successful at achieving their RPS goals. Minnesota’s utilities, for example, have been on track with intermediate steps along the way to reach the goal of 25 percent renewable energy. In fact, Minnesota Power met the requirement of 25 percent renewable energy in 2014, more than 10 years before that level was required.103

When utilities achieve RPS goals sooner than required, the reason is often economics: Wind power is widely available in Minnesota and thus accounts for more than 15 percent of Minnesota’s electricity.104 However, these states’ regulatory commissions have also played a significant role in ensuring that utilities meet RPS goals. By including emissions reduction as a requirement in public utilities commissions’ charters, states help ensure that their utilities achieve goals for renewables deployment. For example, the Hawaii Public Utilities Commission is required by law to consider “the need to reduce the State’s reliance on fossil fuels through energy efficiency and increased renewable energy generation in exercising its authority and duties.”105

A state’s public utilities commission often plays a critical role in requiring utilities to meet the standards that are set by legislatures or voters. Hawaii’s commission can prescribe how much of each type of renewable resource each of the four utilities should be using to meet the goals of the RPS. It can also assess penalties on the electric utilities if they fail to meet these goals and requirements.106

California’s commission is charged with requiring all retail sellers to procure a specified percentage of renewable energy resources, in line with RPS goals; in fact, the commission can even choose to require utilities to procure renewable energy in excess of the RPS goals.107 The commission furthermore has the authority to assess penalties on retail sellers who are not in compliance with renewable procurement requirements.108

Emissions reduction through energy efficiency

One of the ways states can pass on the benefits of emissions reduction to consumers is by incentivizing, or directly investing in, energy efficiency.

Some states do this by instituting energy efficiency targets—either efficiency improvement targets or spending targets—for their utilities. In Minnesota, electric utilities must invest at least 1.5 percent of their gross operating revenues on Conservation Improvement Programs each year.109

Hawaii has an energy efficiency auction where applicants can submit their residential or commercial energy efficiency projects and get paid an incentive from Hawaii Energy, a ratepayer-funded conservation and efficiency program, if they are selected in the auction.110 The applicants are typically companies submitting projects that will have benefits for residents and small businesses.111 California has an Efficiency Savings and Performance Incentive mechanism, which provides performance awards to investor-owned utilities for energy efficiency programs with demonstrated energy savings, and which will also award an incentive for utilities to conduct programs such as energy efficiency marketing and training.112

In 2010, Colorado passed legislation that enabled property-assessed clean energy (PACE) programs. Today, its C-PACE program—Commercial Property Assessed Clean Energy—allows commercial- and multifamily-property owners to finance qualifying clean energy and energy efficiency projects through a special assessment on their property tax bill.113

Regional approaches

New York and Massachusetts are both part of the Regional Greenhouse Gas Initiative (RGGI), a cooperative effort among nine states to reduce greenhouse gas emissions. RGGI is a market-based program in which power generators hold a limited number of allowances to emit carbon dioxide. Power generators can buy these allowances at regional auctions and can resell them on secondary markets. This program—and these allowances—are how RGGI states collectively keep emissions under a specified cap.114 Because the overall cap declines every year, states are encouraged to reduce emissions as the allowances become scarcer.

Affordability

Keeping energy costs low is important for business competitiveness and for families’ and individuals’ quality of life. Low-income households spend on average three times more on their energy bills, as a share of income, than do high-income households.115 There are multiple tools states can use to ensure affordable electricity, including through regulatory commission rate cases, utility incentives, time-of-use pricing, and direct aid to low-income households.

Affordability as part of the regulatory commission mandate

Since the primary function of the regulatory commission in most states is to set the electricity rates that utilities can charge, keeping electricity costs low is a common mandate for these commissions: The regulatory commission must maintain affordability as it pursues any of its other goals. For example, the grid modernization efforts undertaken by Minnesota and Massachusetts explicitly state that they seek to modernize the grid while maintaining affordability.116

Massachusetts provides a good example of how the regulatory commission sets rates, with affordability as a chief concern, in a state with a restructured electricity market. The Massachusetts DPU sets average monthly electricity rates. While customers are able to competitively choose their electricity supplier, the utilities are responsible for establishing default rates for customers who do not choose a supplier. The utilities establish default rates based on competitive bidding, but these rates cannot exceed the average monthly rate set by the DPU. Thus, even in an environment where bidding is supposed to drive down costs, the DPU rates are an additional affordability lever.117

Some states further segment the functions of the regulatory commission so that there is a branch that specifically advocates on behalf of ratepayers. For example, within the California Public Utilities Commission, the Office of Ratepayer Advocates (ORA) is an independent arm with a specific mission to “obtain the lowest possible rate for service consistent with reliable and safe service levels.”118 With this aim, the ORA participates in commission proceedings and other forums that could have a significant financial impact on customers.119

Incentivizing utilities to keep costs down

One of the critiques of the traditional model of cost-of-service regulation of utilities is that if rates are structured such that utilities are paid for their costs plus a return on investment, they have no incentive to keep costs down.120 A regulatory commission can help solve this problem by capping rates, but there is growing interest in other ways to incentivize utilities to reduce their costs and, by extension, consumer electricity prices. Hawaii’s Ratepayer Protection Act of 2018, discussed previously in this report, is a cutting-edge example of changing how utilities are incentivized.

Additionally, some elements of how the California Public Utilities Commission conducts ratemaking give utilities incentives to keep costs down. In California, the general rate cases are on multiyear cycles: Authorized revenue for each year is determined in advance. If a utility has cost overruns, it will earn less than the authorized rate of return; if it is able to reduce costs, it will earn more.121 The utility, rather than customers, keeps these savings in the short run, but in the long run—when rates are being set at the next general rate case—customers can benefit from lower rates because the commission will see these savings when they begin their next rate case and set prices accordingly.

As part of the REV initiative, New York’s Public Service Commission is reconsidering cost-of-service ratemaking, as it says it “inhibits innovation in general, and discourages numerous activities that utilities need to undertake to implement REV.”122

Affordability and time-of-use pricing

Time-of-use pricing is another approach to reducing customer electricity costs, though it is not yet widely used. Under time-of-use pricing, customers pay more for electricity consumed during the times of day with highest demand and less during off-peak hours. It creates the potential for consumers to save money by choosing, for example, to run appliances such as dishwashers and laundry machines outside of peak hours. However, in order to take advantage of it—and not inadvertently end up with even higher electricity bills—customers need to be well-informed and understand how usage hours will affect their bill. Time-of-use pricing also presupposes a level of control over electricity-use scheduling that may be out of reach for some families. Nonetheless, it is worth examination, because in addition to the potential cost savings for consumers, it has other benefits: By incentivizing load shifting, it can reduce the need to build expensive peak-demand plants, which in turn reduces costs for all consumers and can have additional environmental benefits, as those peak-demand plants are usually powered by fossil fuels.123

In New York, utilities offer voluntary time-of-use pricing, though only a small number of customers opt into it.124 There is, however, interest in expanding the program to reduce the impact of electric vehicles on the power grid by making it attractive for electric vehicle owners to start charging their cars later in the evening. Two options for this are encouraging electric vehicle owners to opt in to “whole-house” time-of-use pricing, in which rates charged by utilities for all of the house’s electricity use vary throughout the day—thus allowing electric vehicle owners to charge when rates are lower—or maintaining standard rates that don’t vary by time of day but instead offering rebates for off-peak electric vehicle charging.125

The California Public Utilities Commission has decided to transition residential customers to time-of-use pricing starting in 2019 and has asked utilities to submit their strategies to do so. Some of the state’s major utilities have asked to delay implementation by one or two years,126 while others are moving forward with implementation.127

Programs to assist customers directly

Aside from controlling electricity costs through regulatory commission ratemaking and incentivizing utilities to keep costs down, some states find it necessary or desirable to more directly provide assistance to low-income residents facing a high energy burden. Massachusetts has a special low-income electricity tariff for income-qualified customers.128 Colorado has a bill payment assistance program for customers who are behind on their electricity bills and meet certain income qualifications.129 New York’s Energy Affordability Policy limits energy costs for low-income residents to no more than 6 percent of household income,130 and Minnesota’s Customer Affordability of Residential Electricity program gives low-income households a discount on their monthly electricity bills.131

Programs that incentivize energy efficiency can improve affordability for customers while supporting the state’s emissions reduction goals. For example, Colorado’s Affordable Residual Energy program provides free energy-efficiency upgrades—including equipment replacement—for customers who meet the program’s income qualifications.132

The challenge of island affordability

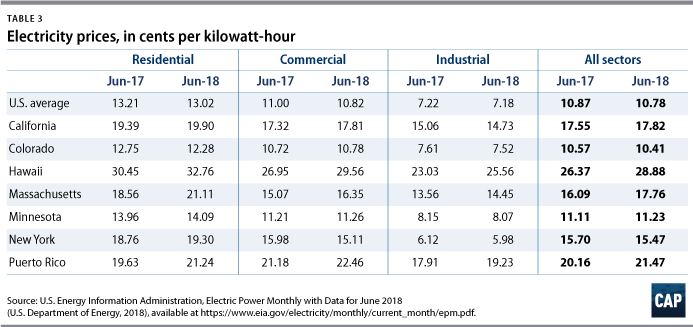

Hawaii faces the highest electricity prices in the country—higher, even, than in Puerto Rico. In both Hawaii and Puerto Rico, the cost of electricity is largely driven by imported fossil energy used to fuel their power plants.133 As described above, Hawaii has a goal of getting to 100 percent renewable electricity generation by 2045, which would drastically reduce its need to import fossil fuels. Currently, however, Hawaii’s largest fuel source for electricity generation is petroleum, followed by coal.134

As Hawaii moves away from imported coal and petroleum and implements its new Ratepayer Protection Act, its electricity costs should decrease. In the meantime, though, Hawaii has a few programs to help residents lower their electricity bills. One of these is the Green Energy Money $aver (GEM$) On-Bill Program, which is an innovative financing program available to both homeowners and renters that combines affordability and renewable energy deployment goals.135 Under the program, customers submit an application to the Hawaii Green Infrastructure Authority (HGIA) to undertake certain energy improvement projects, including a solar photovoltaic system; solar photovoltaic or solar thermal water heating; or a heat pump water heater. If approved, the HGIA will pay a GEM$-approved contractor for the installation, and the customer immediately begins to see bill savings; one of the requirements for project approval is that the energy improvement project provides a minimum of 10 percent utility bill savings for the customer.136 Finally, for customers on life support, Hawaii has a Special Medical Needs program, offering a reduced kilowatt-hour electricity rate.137

Reliability

Reliability is a key performance metric for any utility system: When a customer flips a switch, they should be able to count on the lights turning on. While most states in the Lower 48 look to a national nonprofit corporation, the North American Electric Reliability Corporation (NERC), for their reliability standards, states that have dealt with severe weather, such as New York, have added increased standards on top of NERC’s guidelines, and states outside the continental United States, such as Hawaii, have to chart their own path on reliability.

NERC reliability standards

For most states, NERC is the starting place for reliability standards. NERC standards are enforceable in the continental United States, as well as in parts of Canada and Mexico.138 It is responsible for developing reliability standards and submitting them to the Federal Energy Regulatory Commission (FERC) for approval. Once approved, those standards become mandatory.139

The monitoring and enforcement of NERC standards is carried out by eight regional entities.140 For example, the Midwest Reliability Organization, under which Minnesota falls, is responsible for ensuring compliance with mandatory standards in the states under its jurisdiction. It also conducts assessments to ensure that the grid is able to meet the region’s electricity demands.141

Because of NERC’s broad reach and authority, state agencies with responsibility for reliability will often partner with NERC. For example, the California Public Utilities Commission has worked with NERC and FERC on the mandatory reliability standards process.142

Going beyond NERC

In addition to working with NERC and its regional organizations, a few states also set their own reliability goals. The New York State Reliability Council (NYSRC) has a mission to “promote and preserve the reliability of electric service on the NYS Power System within New York State.”143 To this end, the NYSRC develops and maintains reliability rules with which the NYISO and all entities engaging with the New York state power system must comply.144 NYSRC rules are generally more stringent than NERC standards.145

Independent system operators can also assist with developing and enforcing reliability standards. ISO New England, under which Massachusetts falls, has a dedicated Reliability and Operations Compliance group. The group primarily relies on NERC to set standards but makes sure those standards are implemented and integrated throughout ISO New England.146

California has also experimented with targeted incentives to encourage utilities to improve reliability. As described in a 2015 report on incentive-based ratemaking by the Brattle Group:

In the 2012 rate case for San Diego Gas and Electric, the CPUC [California Public Utilities Commission] adopted performance incentives for the length of interruptions (SAIDI and SAIDET), the number of interruptions (SAIFI) and providing customers with an accurate estimated restoration time (ERT). Under these measures, a target level of performance is set on each of the four reliability measures. If the utility performs better than the target, it is able to collect a ‘reward,’ and if it misses the target, it is penalized. In addition to defining the targets and a formula for calculating the rewards/penalties, the CPUC also determined an overall ‘cap’ on the maximum amount of penalty and reward that could apply in each year.147

Hawaii: Reliability standards outside of NERC

Hawaii is not required to adhere to NERC reliability standards because it lies outside the continental United States. For many years, Hawaii’s utilities operated with internal reliability practices, but without formal standards imposed by its public utilities commission.

In 2010, the commission decided to establish a Reliability Standards Working Group (RSWG),148 and in 2012, the Hawaii Legislature passed S.B. 2787, which authorized the commission to develop and enforce reliability standards.149 In 2013, the RSWG published its recommendations in a report.150 The Reliability Standards Drafting subgroup of the RSWG used NERC reliability standards as a starting point and then developed their own standards that encompass the issues addressed by NERC.151 In 2014, the commission opened a new docket focused on further evaluation and final approval of the recommended standards.152 Currently, adopting the rules and standards recommended by the RSWG is the first step in the Hawaii State Energy Office’s grid modernization strategy.153

Best practices, lessons, and recommendations for Puerto Rico

The current discussions in Puerto Rico about the future of its electric utility, PREPA, and its regulatory commission, PREC, make this an opportune time to examine best practices in other states and use these lessons to create regulatory structures that will enable Puerto Rico to provide clean, reliable, and affordable electricity to its residents. The following recommendations draw lessons from the states reviewed in this report and apply them to Puerto Rico’s situation. A handful of policies—in particular, maintaining an independent and empowered regulatory commission, investing in low-cost clean energy sources, structuring utility incentives to be in line with policy goals, and creating and enforcing reliability standards—have the potential to transform Puerto Rico’s electricity grid to a best-in-class 21st-century system.

Prevent political interference at PREC and strengthen the independent regulatory commission

The six states examined in this report show that having a strong, independent regulatory commission with the authority to make legally binding requirements on a state’s utilities is invaluable for implementing policy goals, regardless of whether those goals originate from the executive branch, the state legislature, or the voters. These states each have a strong regulatory commission that is responsible for approving rates and ensuring that utilities are achieving a variety of goals for emissions reduction and electricity reliability.

In most of these states, the regulatory bodies have a long history, many dating back to the early 20th century; this can be beneficial for creating a culture in the state in which there are clear expectations that the utility will comply with regulatory orders. However, it is not uniformly the case that these regulatory bodies have the benefit of a century of institutionalization: Minnesota provides a counterexample, where the regulatory commission only dates back to 1975. Furthermore, many of these states have made significant changes to their electricity markets in the past 20 to 30 years—most notably the states that have deregulated electricity generation. Thus, a long history of cooperation between the regulatory commission and the utilities may be helpful but not necessary to making market changes.

The role of the commissioners as technical implementers can be somewhat complicated by governors’ appointment of commissioners. As noted previously in this report, some states temper this issue by staggering the terms of the commissioners, requiring confirmation of appointments by the state legislature, and/or requiring political balance in the composition of the commission.

Puerto Rican policymakers should therefore avoid politicizing PREC by combining it with other regulatory agencies or increasing the executive branch’s control over the commission, as Gov. Rosselló’s plan would do, and should instead seek to protect the regulator’s independence. PREC, the regulatory agency, should remain an independent, stand-alone body. The Legislature should additionally consider options to achieve balance among political parties and ways to introduce direct representation of consumers’ interests, such as through a ratepayer advocate within PREC.

Redouble efforts to reach the goals set out in the RPS

While Puerto Rico has an RPS, it has so far fallen far short of the targets. Many success stories identified in this report follow the model of legislators or voters deciding on particular goals for the electricity sector, and the regulatory commission serving as an independent, technocratic body that determines the best way to execute the combination of all goals.

The commonwealth government should take additional steps to require PREPA to hit the 2020 and 2025 benchmarks of the RPS. These steps could include requiring PREPA to procure certain amounts of various electricity sources, such as solar and wind power, and providing performance-based incentive payments for hitting targets. In addition, the Puerto Rico Legislature could also consider augmenting the existing RPS and strengthening reliability by adopting legislation directing PREPA and PREC to implement a system of minigrids, as envisioned by Siemens, the Germany-based energy conglomerate, in a proposal released earlier this year.154

Consider transitioning from a cost-of-service utility model to one that utilizes performance-based regulation

Given the history of corruption and mismanagement at PREPA,155 it’s clear that a business-as-usual approach is unlikely to lead to significant improvements in affordability, reliability, or emissions reductions across Puerto Rico’s grid.156

Many states are interested in performance-based regulation as a way to align utility incentives with policy goals. Several states have started to explore performance-based regulation as an alternative to cost-of-service regulation—paying utilities when they hit designated targets, such as energy efficiency goals, reductions in peak demand, optimizing existing assets, or distributed renewable-energy resource penetration—rather than paying for costs plus a return. The idea is to incentivize the outcomes the state wants to see. Many of the broader electricity-grid modernization efforts, such as New York’s REV, already underway include changing utility revenue models as a core pillar, and other states have gradually begun to implement performance-based regulation in more targeted ways to incentivize utilities to achieve particular goals.

Puerto Rico should consider implementing performance-based regulation in which PREPA’s revenue is tied to hitting targets. Hawaii’s Ratepayer Protection Act could serve as a model for how to initiate this process through legislation, creating guidelines that the regulator could then determine how to implement.

Design and enforce reliability standards that reflect Puerto Rico’s island context

Most states find NERC’s standards sufficient to meet their needs; however, they have different ways of implementing and ensuring compliance with them, and some states choose to go beyond these standards based on their local context. In New York, which has been affected by major weather events, the NYSRC has developed standards that are often more stringent than those of NERC. In Hawaii, where NERC standards do not apply, the regulatory commission has undertaken a process of developing its own standards, based on those of NERC.

Because it does not fall under NERC’s jurisdiction, Puerto Rico should consider taking those standards as a starting point and undergoing a process similar to Hawaii’s to adapt those standards to the local context. Puerto Rico may also want to look to New York as an example, both in terms of strengthening standards even further to prepare for the possibility of future storms and setting up a dedicated agency that is responsible for ensuring utility compliance with those standards.

Prioritize establishing strong governance standards over any particular utility model

The debate over whether PREPA should be privatized in whole or in part has raged in Puerto Rico for years, and this report does not take a position on any of the proposals. Policy initiatives to modernize the grid, reduce emissions, and improve affordability and reliability can work under a variety of electricity market structures and utility models. A variety of electricity market structures are represented here: Some states have deregulated markets while some do not; some have vertically integrated utilities while others have distribution-only utilities; many states have a mix of investor-owned utilities, municipal utilities, and cooperatives; and some are served by an independent system operator while others have utilities manage power flow. Modernization does not necessarily require one particular market model; putting the right requirements and incentives in place is more important.

Conclusion

The extent and severity of the damages caused to Puerto Rico’s electrical grid by Hurricane Maria was unlike anything utility system experts had ever seen.157 Restoring the grid to predisaster condition was a gargantuan task but was nowhere near sufficient to bring Puerto Rico’s energy system into the 21st century or to protect residents from future storms. Policymakers must work swiftly to strengthen the island’s electricity infrastructure—and ensure transparent, trustworthy regulatory and governance mechanisms are in place with regulators who are empowered to do their jobs. As the six states profiled in this report have done for decades, creating a strong governance system for the commonwealth’s electric utilities must be central to that effort if Puerto Rico is to be ready to weather the next hurricane.

About the author

Bonnie Krenz served as a senior policy adviser for energy and climate change policy at the U.S. Domestic Policy Council during the Obama administration. She lives in Washington, D.C.

Acknowledgments

Special thanks to Center for American Progress Senior Fellow Kristina Costa, the Center’s Puerto Rico Relief and Economic Policy Initiative, and the Center’s stalwart Editorial team.