By Heather Boushey, Adam Hersh | April 6, 2011

The budget put forth by Congressman Paul Ryan (R-WI) for fiscal year 2012 beginning in October makes fantastical claims about its impact on investment, economic growth, and jobs. Rep. Ryan is basing claims of incredible economic benefits from his 2012-2021 budget proposal—that cuts taxes for the rich and lumps burdens onto middle-class families—on forecasts generated by an economic model from the conservative Heritage Foundation. We’ve been down this path before.

And it wasn’t pretty. Nor was it a prosperous path for most American families. Twice before, in 2001 and 2003, the Heritage Foundation provided economic forecasts purporting massive economic gains from President George W. Bush’s tax cuts similarly slanted toward the very rich. To put it mildly, the Heritage economic model is worth less than a broken clock, which can at least be right twice a day. And something doesn’t smell right about their latest predictions either—the ones that Rep. Ryan is trumpeting in support of his “Path to Prosperity.”

If Heritage’s model boasts any track record at all, it is that the opposite of what it predicts will happen, which means Rep. Ryan’s new budget plan would be more aptly named “Path to Prosperity, But Only for the Rich.” Consider the think tank’s most recent predictions for the House Republican budget plan with its past failures.

The Heritage economic model predicts:

- Nearly 1 million additional jobs created in 2012, with the unemployment rate falling to 6.4 percent. Actually, at the pace of job creation they estimate, unemployment will likely be around 8 percent by the end of 2012. Heritage’s job-creation estimate would need to be more than 2.3 million higher between now and 2012—more than 50 percent higher than their estimate—in order to actually reach an unemployment rate of 6.4 percent by the end of 2012; past Heritage predictions overestimated job creation by an average of 6.2 million jobs per year.

- An additional 2.1 million jobs by 2021, which they say will lead to an unemployment rate of 2.8 percent. This rate is below what most economists—and the Federal Reserve—consider inflationary. Well before reaching this rate, the Fed would certainly intervene to create more unemployment and slow the economy. That the Heritage model doesn’t reflect this demonstrates it is not based in reality.

- Average 2.7 percent real annual growth in gross domestic product after accounting for inflation; past Heritage predictions overestimated GDP growth by nearly 1 percentage point, which means they overstated growth by a factor of more than one-third.

- Housing investment will grow, incredibly, at more than double the pace of its peak in the 2000s housing bubble, while business investment will grow at more than double the pace of the business cycle between 2001-2007. Past Heritage predictions for investment overall would grow 5.4 percent annually, while actual investment grew by less than half of that at 2.1 percent a year.

We’ve seen the reliability of Heritage economic modeling before. There’s no reason to believe it now, either.

But this time around, the Heritage model’s economic forecasts touted by Rep. Ryan are not just fantastical, they are wildly fantastical. We now have the data to evaluate the economic policies of tax cutting slanted toward corporations and the wealthy at the expense of middle-class families during the Bush presidency. We also have the data to evaluate the credibility of the Heritage Foundation’s economic model. Both are clear failures that should be rejected by policymakers and the American people. So let’s dig a little deeper into Heritage’s inauspicious record.

Heritage economic model’s inauspicious record

Economists use models to predict how changes in policy or other factors will potentially affect economic outcomes. But, as with any modeling exercise, the real issue is what assumptions about how the economy works go into the mix. And it’s those assumptions that are the fatal flaw of the Heritage model.

The Heritage estimates begin with the Joint Committee on Taxation’s model of the effects of tax changes on the federal budget. They incorporate this into a so-called “dynamic” model of the economy. Heritage’s model incorporates what they believe to be changes in people’s behavior that will occur as a result of the changes in tax policy, thus the moniker “dynamic.” The problem isn’t that Heritage models behavior; it is that their model of behavior is not connected to how people in our economy have been shown to actually behave.

The Heritage model then compares its estimates to the Congressional Budget Office “alternative fiscal scenario,” which include the fixes to the Alternative Minimum Tax and Medicare payments to physicians, both of which Congress repeatedly “fixes” every year. Heritage researchers then claim that the difference between that CBO baseline and their model’s output is what we should expect if Ryan’s budget is implemented. Since their model includes unrealistic models of how people will react to the Ryan policy changes, this leads to fantastical estimates of output and employment growth.

Anyone can make an economic forecasting model. But the true measure of a model’s worth is how accurately it forecasts future economic developments. Before looking at what their model predicts for the Ryan budget proposal, it’s important to understand how well this model has performed in the past. Heritage analyzed the 2001 and 2003 Bush tax cuts using a similar dynamic scoring methodology. In 2001 they predicted that if the Bush tax cuts were implemented, between FY 2002 and FY 2011 income for a family of four would increase by $4,544, investment in our economy would grow 1.9 percent a year, gross domestic product would grow by an average of 3.3 percent per year, more than 1.6 million more jobs would be added, and the unemployment rate would average to 4.7 percent over the 10-year period. But that’s not what happened.

In fact, the period following the Bush tax cuts yielded one of the worst economic performances, as investment growth, employment, and output were slower than in any other economic recovery in the post-World War II era. Further, rather than growing by nearly $5,000, for the first time in any economic recovery since the end of World War II, our nation’s middle-class families saw their incomes fall after factoring for inflation.

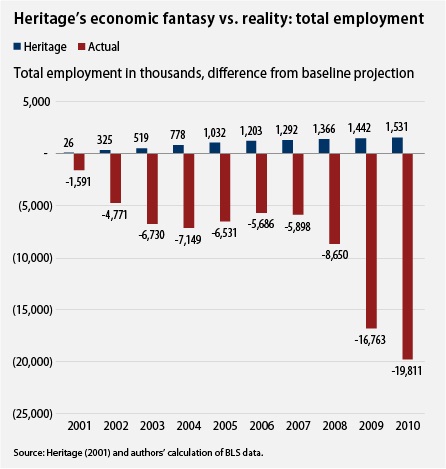

The actual feeble performance of our economy under the Bush-era tax cuts was a far cry from what the Heritage Foundation’s economic model had predicted. Take, for example, Heritage’s 2001 forecasts for job creation and GDP growth effects from the Bush tax cuts. To measure the effect of the Bush tax-cut policies, Heritage’s forecasts and actual economic performance are compared to a baseline scenario of what would have happened in the absence of any policy changes. Heritage’s model did not fare well in predicting the job-creation effect of the Bush tax cuts (see Figure 1).

In every year, the Heritage model simply gets the employment forecasts wrong, even before the start of the Great Recession in December 2007. Between 2001 and 2007, Heritage predicted the economy—spurred by the tax cuts—would add an average of 739,000 new jobs in addition to what would have been created in the baseline scenario. Instead, the Bush tax cuts failed to even maintain job creation at the baseline and job growth fell short of the baseline by 5.5 million jobs per year on average, and 6.2 million fewer per year than predicted by the Heritage model.

Including the years of the Great Recession shows the Heritage job forecasts to be even farther from the mark. But perhaps it is too much to ask their forecasting model to predict the drastic economic consequences of the tax-cutting policies it supported. And as the Bush tax cuts underperformed, the economy also fell farther and farther away from the baseline employment scenario, let alone the egregiously errant Heritage model predictions (to see Figure 2 and for the full article, click here).

Heather Boushey is a Senior Economist at the Center for American Progress. Adam Hersh is an Economist at the Center.

###