This article was originally published on MarketWatch.

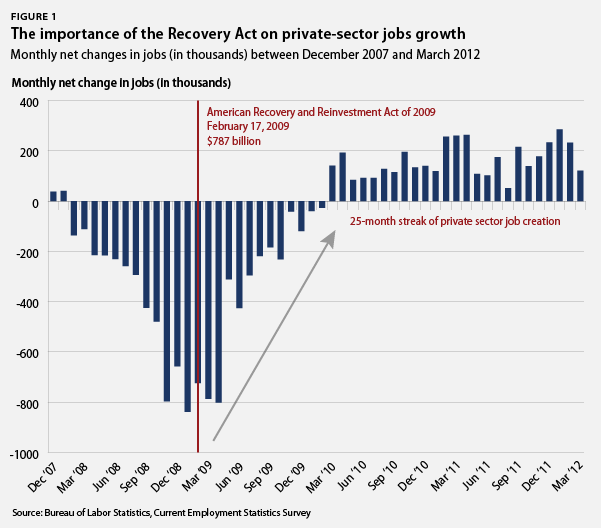

Despite high oil prices, the euro area crises, and obstruction at every turn from conservatives in Congress, the private sector continued its 25-month job growth streak in March thanks to the Recovery Act and other proactive policies. Last month the U.S. economy added 120,000 jobs and the unemployment rate dropped to 8.2 percent.

Some of the moderated growth in March may be due to unseasonably warm winter weather in parts of the country, which could have pulled some economic activity earlier into the year. Overall, though, 2012 registered the strongest first quarter of job growth since the first quarter of 2006—at the peak of the real estate bubble—and stronger than any other first quarter of jobs growth since the 1990s boom economy.

Still, millions of middle-class families continue to struggle uphill due to the hole left in our labor market by the Great Recession that began in December 2007, and the recovery’s moderate pace and unequal distribution mean that growth is not reaching enough people.

Although a number of factors outside the United States are blowing headwinds against our recovery, the conservative budget for fiscal year 2013 passed on a party-line vote in the House of Representatives last week poses a political threat to growth, job creation, and financial security and opportunity for middle-class families.

Not only does this budget seek to change the fundamental structure of the U.S. economy and American society by undermining the popular and successful Medicare program and gifting $3 trillion in tax cuts for the already wealthy, but it also slashes nearly $900 billion from public investments in education, science, and infrastructure critical to growth—all without offering specific policies for job creation or new revenue sources. This budget would threaten the progress we’re making by undermining growth and weakening middle-class families.

The Recovery Act in 2009 and 2010 and other policy actions helped put people back to work in the public and the private sector through a menu of tax cuts and public investments—including in transportation infrastructure and education—thereby driving the sales growth business owners depend on. Slow sales as rising oil prices constrained consumer budgets contributed to the 32,000 retail jobs lost in March at general merchandise stores. Reports from the National Federation of Independent Businesses, an organization of small businesses with 40 or fewer workers, continue to show that sales are the most important concern for small-business owners, as has been the case since July 2008. Poor sales closely track the unemployment rate.

Public spending and investment can help spur the economy by boosting demand for private goods and services at a time when business investment remains hampered by unemployment, and unemployment and household debts constrain consumer spending.

The Recovery Act’s spending and investment helped generate demand in the economy. But since the Recovery Act began winding down in 2010, total government spending and the demand it generated have contracted by 1 percent compared to the beginning of the Obama administration. For comparison, by the end of President Ronald Reagan’s first term, government spending had expanded by 12 percent after inflation, which helps explain the more rapid recovery of jobs from the early-1980s recessions.

Meanwhile, cuts to public-service workers again held back the jobs recovery overall as local governments culled another 3,000 workers last month, including 2,700 teachers and education professionals. Since the start of the recession, state and local governments have shed 450,000 public-service workers. The apparent slowing of public cuts, however, may signal that state and local governments are approaching a stable—albeit likely inadequate—level of employment. But the downward slide could easily resume if policymakers keep trying to squeeze federal, state, and local budgets to the detriment of the labor market and public services that lead to a stronger and more productive economy.

Public-service cuts have weighed especially heavily on women in what is becoming a “man-covery”: Men have gained jobs on net every month but one since March 2010, while women continued to lose jobs month after month through September 2010.

Digging deeper into today’s numbers, the share of Americans with jobs was essentially unchanged at 58.5 percent in March, which is up slightly from the depths of 58.2 percent in December 2009. This is compared to 63.3 percent in 2007 before the recession and 64.4 percent in 2001 at the end of the Clinton administration. More than 5.3 million people have been unemployed for 27 weeks or more, and unemployment remains disproportionately high for African Americans (14 percent) and Latinos (10.3 percent).

Although job prospects are improving, separate data from the Department of Labor show there are 3.7 unemployed workers for every job opening in America. With this jobs shortage remaining, it is not surprising that wages are still lagging behind even modest increases in the cost of living.

Even though the recovery moderated somewhat in March, the labor market still showed a number of bright spots. The manufacturing sector added 37,000 jobs in March and 120,000 jobs through the first quarter of 2012. Propelling gains in American manufacturing is the recovery of the U.S. automotive industry, where employment is up 22 percent since June 2009, the month General Motors filed Chapter 11 bankruptcy and the Obama administration’s actions to restructure the American auto industry really kicked into gear.

The health care and food-services industries also registered large employment gains, adding 26,000 and 37,000 jobs, respectively.

Private employers still remain timid about overall economic conditions and are holding back on a rapid expansion of hiring. Employment in temporary-help services, often a leading indicator of future permanent hiring, fell by 7,500 jobs. Hours in the average work week and for overtime held essentially unchanged in March.

Workers, however, appear to be gaining confidence in labor-market conditions. Last month the number of people re-entering the labor force increased by 41,000 and the number of people voluntarily leaving jobs rose 86,000. Both trends signal more active job searching and switching, signs of growing optimism for job prospects.

In sum, the American economy is still gaining jobs in spite of the factors working against it, and maintaining public spending and investments can keep us on track. The conservative House budget, on the other hand, threatens this progress and could in fact shift the economy into reverse.

Heather Boushey and Adam Hersh are Economists at the Center for American Progress.

This article was originally published on MarketWatch.