The holiday season is critical to the bottom lines of millions of small businesses across the country. By one estimate, the holiday season is responsible for at least one-quarter of annual revenue for 73 percent of small- and medium-sized retailers. As the holidays approach, small businesses are facing headwinds because of the Trump administration’s chaotic approach to economic policymaking.

Recent polling makes the stakes clear. A poll conducted by Small Business Majority in the fall found that half of small-businesses owners had increased prices due to tariffs, while roughly one-fifth had delayed expansion plans. According to a survey of small-business owners conducted by Small Business for America’s Future in October and November 2025, 60 percent of businesses affected by tariffs reported that increased tariffs have forced them to make the difficult choice of either raising their prices or absorbing the cost. An additional 59 percent of small-business owners reported the business climate this holiday season as unfavorable, and 74 percent said they are worried about their business surviving over the next 12 months. From rising costs due to tariffs to expiring health care subsidies, this turbulence is slamming entrepreneurs across the country. Main Street is already experiencing a slowdown, with jobs data from payroll provider ADP showing that businesses with fewer than 50 employees laid off 120,000 workers in November, the biggest number of small-business layoffs in five years. New analysis from the Center for American Progress finds that small-business importers paid about $25,000 more per month due to the Trump administration’s tariffs from April 2025 through September 2025, compared with the same period in 2024.

New analysis from the Center for American Progress finds that small-business importers paid about $25,000 more per month due to the Trump administration’s tariffs from April 2025 through September 2025, compared with the same period in 2024.

The Trump administration’s tariffs are an unwelcome, costly gift to small businesses that is wrapped in red tape

Starting with the launch of the Trump administration’s unprecedented trade war in April, tariffs have continued to cost small businesses. Despite President Donald Trump’s claims that foreign nations, such as China, would “eat” the costs of the tariffs, the truth is that a tariff is a tax paid by American importers. CAP estimates that roughly 236,000 small-business importers paid an average of more than $151,000 each in additional tariffs from April through September 2025 compared with the same period in 2024, based on an assumption that small businesses’ share of imports remained constant at the 31.7 percent level it has been at since 2023 and drawing on CNN-reported tariff revenue data. This translates to approximately $25,000 more in added tariff costs per month for the typical small business during that period. (see methodological appendix)

The amount businesses paid in tariffs also varied based on firm size. Mom-and-pop small businesses with fewer than 50 employees paid, on average, more than $86,000 per business from April through September 2025 than they did over the same period in 2024.

Small businesses paid an average of $36,000 in total tariffs per month from April through September 2025. This is more than three times the amount that small-business importers paid during the same period in 2024. Figure 1 illustrates the average monthly tariff costs—across all existing U.S. tariffs—paid by small-business importers from September 2024 through September 2025.

U.S. tariff revenues continued to increase significantly over the course of 2025 since President Trump’s “Liberation Day” announcement and small-business importers are likely to face even higher costs in 2026. CAP estimates that in September 2025, small businesses paid an average of roughly $42,600 in total tariffs. If that monthly amount persists throughout 2026, the typical small business will pay more than $500,000 in tariffs next year under the current tariff regime, potentially resulting in additional layoffs, bankruptcies, and delayed investments.

American businesses are currently bearing the brunt of the tariffs. An analysis from Goldman Sachs finds that as of August, businesses had absorbed 51 percent of the cost of tariffs, passing along 37 percent to consumers in the form of higher prices. This share of tariffs borne by businesses is down from nearly two-thirds this summer, consistent with predictions that businesses will pass these costs to consumers over time. Small-business importers who then sell products to other businesses may also be passing along tariff costs to these businesses, expanding the cost of the tariffs.

Small businesses are facing additional paperwork burdens to comply with the Trump administration’s new tariff regime. These additional burdens are amplified by the administration’s frequent changes to tariff policy. With the administration levying unique tariffs on virtually every country, and specific products such as steel and aluminum subject to their own tariffs as well, small businesses must more carefully account for “tariff stacking” of multiple taxes that could apply to the same product.

For example, a small business importing a ceramic travel coffee mug from China would need to pay multiple tariffs on that product—including tariffs imposed in response to Chinese trade practices under Section 301 of the Trade Act, tariffs imposed as a response to a claimed fentanyl emergency, and so-called reciprocal tariffs—and carefully document everything on customs forms. If that mug had a stainless-steel interior, the business would also need to account for the amount of steel in the product to pay the correct tariff on that component.

Moreover, the Trump administration’s elimination of the de minimis exception to import duty requirements, which allowed shipments under $800 to enter the United States without fees and duties, means that millions of shipments now require the completion of customs forms and prepayment of new tariff rates. This change not only requires the importing business or consumer to complete additional paperwork and raises their costs, but it also disrupted the importation of products into the United States when dozens of postal services temporarily suspended shipping due to confusion about the policy change.

Scott Lincicome of the Cato Institute recently cataloged in The Dispatch how tariff-related complexity is making life difficult for small businesses. As Figure 2 below makes clear, calculating tariff rates on imported products was relatively straightforward prior to the Trump administration’s tariffs. Today, small businesses must confront a complex web of questions about product type, origin, and materials to determine what they owe.

![]()

As this graphic from the Cato Institute shows, small businesses are trapped in a maze of tariff red tape.

To navigate this tariff maze, more small businesses are turning to customs brokers to complete required forms, which can entail paying thousands of dollars in additional fees. With heightened complexity, many brokers are raising fees to account for the additional labor needed.

Small-business stories: CAP conversations in partnership with Small Business for America’s Future and Small Business Majority

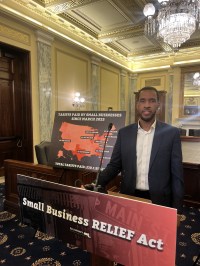

Small-business owner Legrand Lindor is the CEO of LMI Textiles, based in Milton, Massachusetts. His story illustrates the struggle that many entrepreneurs are facing under the Trump administration’s tariffs. LMI distributes medical and harm reduction supplies to public health agencies, nonprofits, and health care providers across the country. Many of LMI’s products include aluminum, and the tariffs have raised the company’s product costs by 20 percent, translating to roughly $80,000 in additional spending. LMI’s contracts do not allow for higher input costs to be passed along to its consumers, so the company has largely absorbed these costs. According to Legrand, LMI went from spending no time on tariff paperwork prior to the administration’s tariffs to spending 4 to 5 hours per import transaction. These costs and the additional uncertainty due to the administration’s turbulent policymaking around tariffs led LMI to scrap plans to open its own warehouse in 2025, which would have reduced operating costs for the company.

Legrand Lindor. (Photo courtesy of communication with LMI Textiles via Small Business for America’s Future and Small Business Majority)

Jyoti Jaiswal is founder and CEO of small business OMSutra, which designs and produces its own handcrafted lifestyle collections in partnership with artisans, women’s groups, and manufacturers across India, offering sustainable fashion, wellness, and home goods to sell in the United States. The recent 50 percent tariff increase on imports from India has forced OMSutra to change how it operates, as it can no longer bring in smaller shipments and must consolidate goods to reduce repeated duty charges. This shift requires blocking much more capital upfront and increases financial risk if inventory moves slowly. These unexpected tariff increases have also raised administrative overhead, from reviewing customs filings to tracking cost changes, and OMSutra cannot pass an extra 50 percent tariff to customers without losing competitiveness. In months when shipments arrive, the company now spends about 10 to 15 hours on tariff-related work—an increase from the 8 to 10 hours it previously spent—which includes preparing documents, looking up product codes, coordinating with its customs broker, and reviewing all duty charges.

Jyoti Jaiswal. (Photo courtesy communication with OMSutra via Small Business for America’s Future and Small Business Majority)

Winter Worryland: Health care premiums are poised to skyrocket

The Trump administration’s indifference to the pending expiration of the enhanced Affordable Care Act (ACA) premium tax credits will be another cost driver for small businesses. More than 20 million Americans who purchase health insurance through the marketplaces are about to see their premium costs more than double in 2026 due to the expiration of the enhanced financial help. About half of adults under age 65 enrolled in the individual market—largely through the ACA exchanges—are either employed by a small business with fewer than 25 workers or self-employed entrepreneurs or small-business owners.

The expiration of the enhanced tax credits means that small-business owners will find themselves paying more for coverage. A previous CAP analysis found that 4.4 million small-business people and self-employed Americans will face an average $1,500 increase in annual premium costs due to the loss of these credits. It’s no surprise that nearly half of the small-business owners polled by Small Business Majority in November reported that rising health care premiums were a “major financial burden” for their business.

Conclusion

The holiday season is critical to the success of the nation’s small businesses. In turn, small businesses are important drivers of the U.S. economy, responsible for 46 percent of private sector jobs and about 44 percent of gross domestic product. The Trump administration’s feckless economic policymaking, including its broad, costly, and frequently changing tariffs and its inaction on the expiration of the enhanced premium tax credits, is on track to cost the average small business that imports products more than $500,000 in 2026. This is a recipe for a decidedly unhappy holiday season and new challenges in the new year.

The authors thank Ryan Mulholland, Emily Gee, and Corey Husak for their reviews, and Kennedy Andara and Amina Khalique for their fact-checking and research assistance, as well as the Production team for preparing figures and supporting the review process. A particular thank you to Scott Lincicome of the Cato Institute for permission to use his chart on tariff commentary. The authors would also like to thank Small Business Majority and Small Business for America’s Future, and business owners Jyoti Jaiswal and Legrand Lindor, for sharing their tariff stories with us.

Appendix: Methodology

According to the 2023 U.S. Census Bureau report “A Profile of U.S. Importing and Exporting Companies, 2022-2023,” the United States has approximately 236,000 small-business importers, defined as importing firms with fewer than 500 employees. Based on the Census Bureau’s “known value”—the portion of U.S. total imports that could be matched to identified companies—small-business importers accounted for 31.7 percent of all identified importer-reported import value, representing more than $868 billion in imported goods in 2023. Very small businesses, defined as firms with 1 to 49 employees, accounted for about 8.96 percent of identified importer-reported import value, or approximately $247 billion, and included an estimated 116,000 importer firms.

Using monthly U.S. tariff-revenue data reported by CNN from the U.S. Treasury Department’s Daily Treasury Statements, the CAP authors calculated the year-over-year change in tariff collections to estimate how much more business are paying in tariff costs than in the year prior. The authors summed the total tariff revenue collected from April through September 2024 and then compared that amount with total revenue collected from April through September 2025. The difference between these two totals represents the additional tariff revenue collected due to the Trump administration’s new tariffs.

To estimate how much of this additional cost fell on small-business importers, the authors multiplied the increase in tariff revenue by 31.7 percent—the small-business share of identified import value in 2023. This amount was then divided by approximately 236,000 small-business importers to produce an estimated average tariff increase of more than $151,000 per small-business importer. The same procedure was applied to very small businesses.

To create Figure 1, the authors applied the share of tariff revenue paid by small businesses, 31.7 percent, to the monthly total tariff revenues as reported by CNN and then divided that amount across the estimated 236,000 small-business importer firms to get the average monthly total tariff costs per small business from September 2024 through September 2025. To project 2026 total tariff costs, the authors assumed the September 2025 monthly total cost of about $42,600 per small-business importer would hold constant. Annualizing this amount produces a 2026 tariff burden exceeding $500,000 per small-business importer.