Read the report.

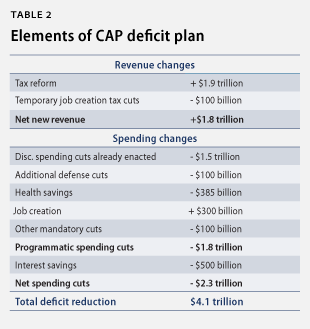

Washington, D.C. — As Americans await a solution to the fiscal showdown, the Center for American Progress today put forward a new comprehensive tax reform and deficit reduction plan. Authored by a team of prominent economic experts under the auspice of CAP, the plan would reduce the federal budget deficit by $4.1 trillion over the next 10 years, accomplishing its deficit reduction through a wide-ranging reform of the personal tax system as well as targeted spending cuts.

“For a tax plan to address our nation’s long-term fiscal challenges, it must be progressive, it must enhance revenue, and it must strengthen the ability of middle-class families to spur economic growth. This plan includes all of those elements,” said Neera Tanden, President of the Center for American Progress.

Throughout the past year, the Center for American Progress convened a group of leading economic experts—including former White House chiefs of staff, former U.S. Treasury secretaries, directors of the National Economic Council, and other top Treasury officials—to develop a plan that would address some of the most serious flaws in the federal tax code and achieve meaningful deficit reduction.

“This is from the team that brought you the last good economy,” added John Podesta, Chair and Counselor of the Center for American Progress. “The tax plan simplifies the filing process and streamlines the code so that everyone can trust that each taxpayer is treated fairly.”

The plan, released today, accomplishes its deficit reduction primarily through a wide-ranging reform of the personal income tax system that raises adequate revenues progressively while making the tax system more efficient, simple, fair, and comprehensible. The key features of the tax plan include:

- A top marginal rate for the personal income tax of 39.6 percent as it was under President Bill Clinton

- Converting tax deductions that tend to favor those in top tax brackets into uniform credits that bestow equal benefits on taxpayers in all brackets

- A top marginal rate of 28 percent on capital gains as it was under President Ronald Reagan and throughout much of the 1990s

- Closing tax loopholes

- Simplifying tax filing

In addition, the plan includes targeted spending cuts, most significantly $358 billion in federal health care savings with harming beneficiaries, as well as $100 billion in further defense savings, and $100 billion from other programs.

All together, the combined plan will reduce the projected federal budget deficits by approximately $4.1 trillion over 10 years. Enactment of the plan would also reduce the publicly held debt from currently projected levels of near 90 percent in 2022, to below 72 percent and falling.

Read the report: Reforming Our Tax System, Reducing Our Deficit by Roger Altman, William Daley, John Podesta, Robert Rubin, Leslie Samuels, Lawrence Summers, Neera Tanden, Antonio Weiss, Michael Ettlinger, Seth Hanlon, and Michael Linden

Read the summary: A Tax Reform and Deficit Reduction Plan

Press call recording: Listen to an audio recording of the report’s authors discussing their proposal on a CAP press call.

Statements from the CAP plan authors:

- Roger Altman, founder and executive chairman, Evercore Partners: “One of the important parts of this plan is that it represents substantial deficit reduction and the United States needs to do that, and needs to do that now.”

- William Daley, former White House chief of staff; former commerce secretary: “This is all about getting our long term house in order for the purpose of getting the economy moving and growing. If we could get this sort of plan done, it would provide certainty, it could aid growth and create enormous opportunity for the American people.”

- Robert Rubin, co-chair, Council on Foreign Relations; former U.S. Treasury secretary: “This is a sound plan that can contribute to recovery in the short term through promoting confidence and an upfront stimulus, and that meets the absolute imperative for longer-term success by addressing our unsustainable long-term fiscal outlook and providing for public investment.”

- Leslie Samuels, former assistant secretary for tax policy, U.S. Department of the Treasury: “Our tax reform plan has specific, pragmatic, and balanced proposals to achieve revenue targets in the Simpson-Bowles plan in a progressive way. Our tax reform makes difficult but necessary choices in a realistic way.”

- Lawrence Summers, former U.S. Treasury secretary: “The fiscal choices the United States makes over the next year will be as important as any in the last half century. The issue is more complex than ever before, with questions of supporting cyclical recovery and maintaining basic fairness being of profound importance along with the central longer-term imperative of controlling unsustainable government borrowing. I believe our plan balances the conflicting imperatives in a sound and desirable way and that its elements deserve serious consideration in the fiscal debates that lie ahead.”

- Antonio Weiss, global head of investment banking, Lazard: “Our plan builds confidence where it matters most—the middle-class consumer—and provides a clear context for business planning, from the equity markets to the corporate boardroom. We also support corporate tax reform that contributes to deficit reduction while also lowering statutory rates, as business leaders advocate.”

To speak with an expert on this topic, contact Katie Peters at [email protected] or 202.741.6285.

###