See map “China’s fast-track emission reduction zones” here.

The parties to the U.N. Framework Convention on Climate Change, or UNFCCC, are meeting in Paris to negotiate a new global climate deal. Negotiators are aiming to lock in a new deal that will take effect in 2020, which is when current UNFCCC commitments are set to expire. The prospects for locking in a strong and comprehensive global climate deal are better today than at any other point in history. That is because, this year, both the United States and China are collaborating to bring both developed and developing nations to the bargaining table, and—for the first time—nearly all of those nations are contributing to the global climate effort in some way.

Chinese leadership has been particularly critical in galvanizing action among developing nations. China has committed to double the nonfossil portion of its energy mix, peak its carbon emissions by 2030, and make “best efforts” to hit both targets as soon as possible. Those are significant commitments, and China’s willingness to make those commitments a full year before the Paris talks pressured other developing nations to put their own action plans on the table.

Here in the United States, there are observers who view China’s commitments with a degree of skepticism. Some observers argue that, since China’s target date is 2030, Beijing now has a 15-year grace period to continue with business-as-usual coal consumption and carbon emissions. That argument reflects a fundamental misunderstanding about what it takes to slow, stop, and reduce the emissions of a large economy in order to achieve a 2030 emissions target. It also reflects an outdated understanding of Chinese energy markets. Although recent press reports show that China has upwardly revised some of its previous coal consumption statistics, this issue brief documents significant changes occurring in the Chinese economy to reduce coal use and emissions.

The reality is that major changes are already underway in China, and those changes bode well for a successful conclusion to the climate conference currently underway in Paris. Instead of waiting until 2030—or even waiting until the Paris negotiations conclude—Beijing is already moving full speed ahead to radically rebalance its energy economy. Skeptics often point to Chinese coal consumption as evidence that the nation is failing to address climate emissions. Indeed, coal market patterns are a good indicator of China’s policy progress, and those patterns have shifted dramatically in recent years. For example:

- Chinese coal consumption fell 2.9 percent in 2014, marking the first fall in consumption in 15 years.

- China’s coal imports fell 11 percent in 2014 and are down 37 percent thus far in 2015.

- In 2014, Beijing shut down more than 1,000 coal mines, 5 gigawatts of thermal power capacity, and 55,000 small-scale coal-fired industrial boilers to reduce coal pollution.

- At the regional level, Beijing is rolling out fast-track provincial- and municipal-level coal-control and emission-reduction policies that are putting some Chinese provinces and cities on a path to peak emissions as early as 2020 or 2022. The regions covered under this program account for over 66 percent of the nation’s gross domestic product, or GDP.

- China now has more than 444 gigawatts of renewable energy capacity—which is more than the combined total 2012 electricity generation capacity of Japan, Indonesia, and the United Kingdom—and around 40 percent of total 2012 U.S. generation capacity.

China still has a long way to go to rebalance its energy economy but, as of 2015, the ship is turning. Despite China’s large coal base, the growth rates for coal production, consumption, and imports are rapidly declining. Meanwhile, clean energy capacity is growing at rates that exceed 30 percent to 60 percent per year in some sectors. This bodes well for China’s future emissions trajectory, as well as for China’s ability to play a strong leadership role at the Paris climate summit.

This issue brief will outline China’s recent energy policy developments, new market trends, and how these changes are likely to effect China’s future carbon emissions.

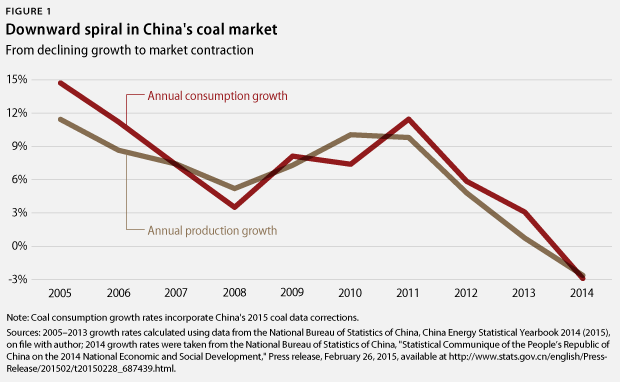

Chinese coal consumption enters downward spiral

Coal-fired power is a major contributor to air pollution in China, and citizen discontent over air pollution is driving a sea change in how the Chinese Communist Party views and regulates coal. Step by step, Chinese regulators are finally dismantling the incentive systems that drove coal consumption growth in previous decades and turned China into the world’s largest coal consumer.

In September 2013, Chinese leaders issued a new “Action Plan on Prevention and Control of Air Pollution” that fast-tracks pollution improvements along China’s eastern seaboard, a region that accounts for more than 60 percent of China’s GDP and more than half of the nation’s total coal consumption. The plan imposes a host of new coal control measures, including regional consumption caps; a ban on new coal-fired power plants in major metropolitan areas along the eastern seaboard; much more stringent emission standards for existing plants; and the forced closure of thousands of inefficient industrial coal boilers. In late 2014 and early 2015, Chinese leaders rolled out another policy package that imposes a new value-added tax on coal production; a new ban on the sale, import, and production of high-emission coal; and a new environmental protection law that gives China’s environmental regulators the authority to impose much higher fines on pollution violators.

These new policies are driving down Chinese coal demand, putting downward pressure on coal prices, and triggering steep losses across China’s coal sector. As of the third quarter of 2015, around half of China’s publicly listed coal companies are reporting losses for the first three quarters of the year. Profits at China Shenhua Energy Company Limited—China’s largest coal producer—fell 45 percent in the first half of 2015. Heilongjiang LongMay Mining Holding Group, one of China’s largest mining conglomerates, recently announced plans to lay off 100,000 workers. China’s coal imports fell 11 percent in 2014 and were down 37 percent in the first three quarters of 2015.

It is important to note that coal is still the biggest driver in China’s energy mix—and that will continue for some time. Coal accounted for 66 percent of China’s total energy mix and 67 percent of the country’s total installed power generation capacity in 2014. However, although China still has a large coal base, the growth rates for production, consumption, and imports are tanking. The market looks big from afar but it is shrinking rapidly.

What confuses many foreign observers is the fact that China is still adding new coal capacity. In 2014, China took hundreds of existing coal plants offline but also added around 39 gigawatts of new coal capacity. The new capacity is coming online for two reasons: First, Chinese leaders are ordering local officials to tear down small emission-intensive power plants and replace them with more efficient plants. So, some of the new capacity is replacement capacity—multiple small plants are shut down and a larger plant is built to replace them.

Second, some local governments are building more plants than they actually need. It takes time to shift construction activity to follow market-demand trends, particularly in China where the financing for these projects is not always market-based. Some local officials are overbuilding simply because they have the capital to do so, and that is creating a massive capacity bubble in China, driving down plant-utilization rates, as well as the generation of profits nationwide. The average utilization rate for China’s thermal-power generations was 54 percent in 2014—the lowest rate since China first began its reform and opening process in the late 1970s.

Overcapacity in coal-fired power mirrors a pattern that is playing out in steel, aluminum, and other heavy-industry sectors: China’s local governments are slow to adjust plant construction to fit reduced market demand. They add more production capacity than the market can absorb and that drives down profits nationwide. In steel, cement, and other heavy-industry sectors, Chinese leaders have issued mandates to curtail new construction and force the closure of existing plants. Similar edicts are likely to come down for coal fired-power as well. In the mining sector, Beijing is already ordering coal mines to reduce production or close down entirely. New power plant projects are already banned along China’s eastern seaboard. A natural next step is to extend the new construction bans westward into China’s central provinces, which is something that is likely to be included in China’s new five-year development plan that will take effect in 2016 and run through 2020. Chinese regulators are already moving in that direction: Last week, Beijing tightened the approval process for new coal-fired power plants and ordered local governments to deny construction permits for coal-fired power projects in regions with excess coal capacity.

As coal contracts, clean energy gains momentum

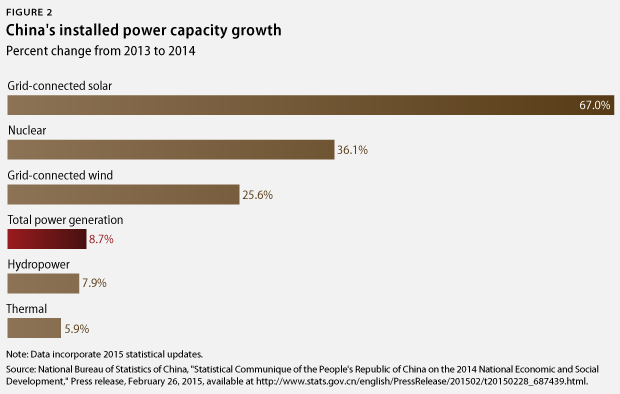

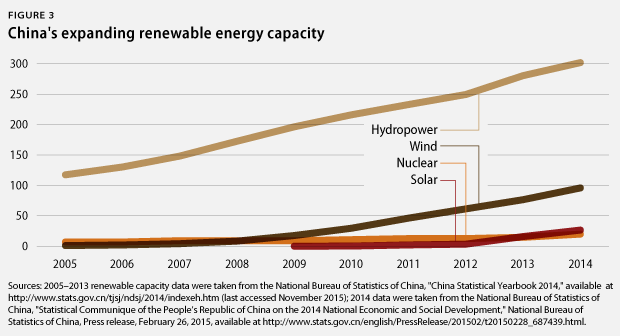

As coal winds down, clean energy is ramping up. As of year-end 2014, China had more than 444 gigawatts of installed renewable energy capacity—which is more than the combined total 2012 electricity generation capacity of Japan, Indonesia, and the United Kingdom—and around 40 percent of total 2012 U.S. generation capacity. China’s growth rates in clean energy capacity are truly staggering. Growth rates for grid-connected solar, wind, and nuclear energy in 2014 were 67 percent, 25.6 percent, and 36.1 percent, respectively. In comparison, China’s thermal capacity grew just 5.9 percent in 2014 despite an overall 8.7 percent expansion in the nation’s total power generation capacity.

Clean energy growth is poised to accelerate further between now and 2020. By the end of 2020, China is aiming to triple its grid-connected solar capacity from 26 gigawatts in 2014 to 100 gigawatts by 2020; double its grid-connected wind capacity from 95 gigawatts to 200 gigawatts; nearly triple its nuclear capacity from 19 gigawatts to 58 gigawatts; and expand hydropower capacity by around 16 percent, from 300 gigawatts to 350 gigawatts.

Hydropower is currently China’s largest renewable energy source—accounting for around 68 percent of China’s total renewable production in 2014—but hydro expansion is limited by geography and growing public resistance to new dam projects. Going forward, China’s biggest energy growth areas will be in nuclear, wind, and solar energy.

Chinese leaders are aiming for price parity between wind generation and coal-fired generation by 2020. To achieve that goal, they will have to raise coal prices, and that is one reason why Chinese leaders are closing down coal mines and imposing new value-added coal production taxes as previously mentioned.

China’s electricity grid overhaul prioritizes low-cost wind and solar over coal

Clean energy growth is not a new story in China—particularly in hydropower and wind energy—but grid connection problems have kept renewable energy sources from posing a true challenge to coal. That is finally changing.

For decades, China’s biggest energy problem was always ensuring adequate supply. Beijing wanted to incentivize coal plant construction, so Chinese leaders ordered utility companies to sign contracts with new coal-fired power plants in which the utility promised to purchase a minimum amount of power on an annual basis from every plant. Those contracts provided guaranteed returns for coal plants but soon clogged China’s electric grid with coal-fired power. Even if utilities wanted to purchase more renewable energy or shift power purchases toward more efficient coal plants, they did not have the ability to do so.

In September 2015, Chinese President Xi Jinping announced that Beijing will finally move the nation toward a so-called “green dispatch” model that prioritizes power sources based on the cost of producing an incremental amount of electricity. The incremental cost for a wind or solar farm is zero, because once the plant is up and running the wind and the sun are the primary inputs. In contrast, coal-fired plants must purchase new coal resources for every unit of energy they produce, so a coal-fired plant will always be more expensive to run incrementally. A green dispatch system would effectively move coal from the front of the priority line to the back—and that would shift investment incentives from coal projects toward renewable projects, thus further accelerating China’s energy transition. Beijing has not yet announced a target date for nation-wide dispatch reform. Implementation details are likely to emerge when Chinese leaders publicize the nation’s 2016-2020 development plan next March.

Chinese regulators are also experimenting with new utility pricing reforms that are expected to lower renewable power integration costs and further improve market incentives for renewable power in China. Under the existing system, China’s two monopoly utility companies—State Grid Corporation of China and China Southern Power Grid—buy and sell power at state-set rates and capture the difference as profits. Both utilities have an incentive to spend as little as possible on renewable power integration and report inflated costs to Beijing. By claiming that renewable integration is prohibitively expensive, the utilities can lobby Chinese authorities to set end-users’ rates as high as possible, widening their profit margins and making renewable energy appear prohibitively expensive. Chinese regulators have long suspected that the utilities are doing exactly that, but it has been hard to prove.

State Grid Corporation of China, the larger of the two utilities, is a vertically integrated behemoth with nontransparent cost structures. State Grid runs 98 subsidiary business units that engage in activities ranging from electricity transmission to equipment manufacturing and aviation. China’s pricing authorities suspect that some of the so-called costs associated with connecting renewable power to the grid are inefficiencies associated with this business model. To address that problem, Beijing is currently piloting a new reform program that will cap utility profits and establish standard grid access fees for transmitting and distributing power. Consumers will be able to negotiate power purchases directly with individual generation companies, thus building in price competition among generators. Once those direct purchase deals are in place, the generator and consumer will simply pay the utility company a grid access fee to send the power from seller to buyer. This regulatory shift will likely be paired with new mandates for quickly linking up new renewable generation sources, addressing one of the largest bottlenecks in China’s renewable energy deployment.

Clean air now a survival issue for the Chinese Communist Party

Some Western observers still assume this progress is a momentary blip—they are still waiting for China to shift back to the old energy model that prioritizes supply over sustainability. What those observers do not realize is that China’s domestic political environment will no longer support the old model. China suffered two massive air pollution incidents—in the fourth quarter of 2011 and the first quarter of 2013—that flipped the political calculus on air pollution. Prior to these recent incidents, Chinese leaders withheld information on local air quality, making it nearly impossible for their citizens to hold the government to account on air pollution issues. After the pollution crises of 2011 and 2013, Chinese citizens demanded greater transparency. Public outrage reached a level that convinced Beijing to change course. Starting in 2012, Beijing switched from withholding air-quality data to installing more than 1,000 air-monitoring devices across the nation that provide citizens with real-time data on a host of major air pollutants. Beijing also rolled out a groundbreaking new air-quality action plan that commits the nation to rapid air-quality improvements, particularly along the eastern seaboard where citizen discontent and pollution levels are highest.

It is important to understand that the Chinese Communist Party has tied its own hands on this issue. Chinese leaders are setting ambitious new air-quality improvement goals and giving their citizens a very accurate yardstick for measuring progress. They are doing so because they believe that, if they fail to address air pollution, they will face a major citizen uprising. Air quality is now a survival issue for the Chinese Communist Party—which was not the case before 2012. Since 2012, Chinese leaders at all levels have made a very public commitment to address this problem. Failure to meet this commitment would threaten regime survival, which is why Beijing is finally getting serious about reigning in coal emissions.

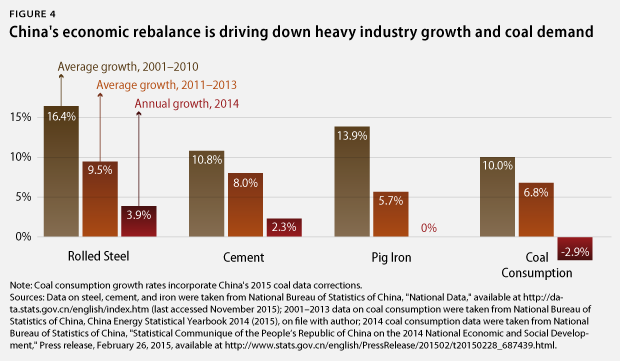

This political shift on air pollution parallels a broader political shift on China’s overall economic growth. China’s old economic growth model—based on fixed infrastructure investment, heavy-industry production, and export manufacturing—is basically defunct. Infrastructure projects are no longer profitable. Two decades ago, turning a dirt road into a two-lane highway brought big economic gains; now the infrastructure is largely in place, and turning a six-lane highway into an eight-lane highway does not bring the same rewards. That means China can no longer absorb large amounts of steel, cement, and other infrastructure inputs—and the export markets for those products are drying up as well. Chinese labor costs are also rising, so it is harder for the nation to compete in global manufacturing markets based on costs alone. With China’s old drivers of economic growth drying up, Beijing desperately needs to push the economy toward a new model—and China’s energy revolution plays a critical role.

In sector after sector, Beijing is working to downshift old growth engines and kick-start new ones. Many of the contracting industries—cement, steel, and iron—are some of China’s biggest coal consumers. As those industries contract, coal demand dries up and the coal sector shrinks as a result. Beijing is also intentionally ratcheting up coal prices to make those energy-intensive sectors less competitive, as well as to make coal less competitive vis-à-vis renewables.

To be sure, there are still uncertainties that bear watching. For example, economists often detect inconsistencies in China’s national economic data—including energy data—so a dose of caution is warranted when assessing Chinese market fluctuations. Earlier this year, the National Bureau of Statistics of China had to adjust the country’s coal consumption statistics in order to address errors that were passed up from the provinces and made their way into the national accounts.

Beijing continually audits the nation’s energy statistics to identify and proactively address these data issues, and Chinese officials generally publicize corrections in a relatively transparent manner. It was the National Bureau of Statistics of China, not foreign observers, who discovered the recent coal data problems and issued revised coal consumption records. Those corrections are helpful, but it can be hard to predict when another such correction is impending.

China’s national statistics are difficult to verify—particularly for foreign observers who lack access to the nation’s internal accounts—but there are verifiable touchstones that analysts can use to triangulate assessments of Chinese economic shifts. For example, as mentioned above, job losses in China’s coal sector, declining profit margins across multiple Chinese coal companies, and rapidly declining coal exports to China from coal-supply nations such as Australia all provide evidence to support the fact that Chinese coal consumption is on the decline. As of 2015, multiple trend lines using data from multiple sources—including sources outside China—are all moving in a stunningly progressive direction, and the recent National Bureau of Statistics of China coal data adjustments did not alter that fact.

Regardless of the angle used to view China’s energy market—whether from coal consumption data, coal import data, coal company profits, or the industries that consume coal—it is clear that coal growth has fallen off a cliff, renewable energy is surging, and, as will be discussed below, China is on track to not only meet the climate commitments its negotiators are putting on the table in Paris but also to potentially do so ahead of schedule.

China’s coming emission peak: Height and downward trajectory is critical for global climate effort

The big question that many international observers are concerned about is what these energy policy changes mean in terms of China’s overall climate emissions. In November 2014, China committed to peak carbon emissions by 2030 and to make “best efforts” to peak earlier. China currently appears on track to beat that goal. Many models suggest that China’s carbon emissions will peak approximately 10 years after coal use peaks. Chinese coal consumption fell in 2014, and if that turns out to be a persistent trend, 2013 may turn out to be China’s peak year for coal consumption. If so, China could be on track to peak carbon emissions around 2025.

Beijing’s economic planners are already plotting what a pre-2030 peak might look like. China’s future emission trajectories are difficult to predict because recent policy shifts are bending the emission curve and making historical trend lines useless for projecting future activity. Along the eastern seaboard, for example, China’s air-quality action plan now bans new coal-fired power plants. Emission trajectories before and after that ban are radically different so planners are being exceedingly cautious about projecting what emissions may look like five, 10, or 15 years down the road.

In a bid to improve understanding about the degree of emission reductions China can achieve on an accelerated policy program, 10 Chinese cities and provinces have taken on pre-2030 carbon-peak commitments. Beijing, Guangzhou, and Zhenjiang City have issued the most ambitious early-peak commitments: All have committed to peak by 2020, 10 years ahead of the official nationwide target. Those cities will serve as trial zones that the rest of the nation can hopefully follow, as well as a statistical laboratory for China’s economic planners.

The big question is how soon China’s more ambitious clean air policies can begin moving westward into the less-developed central and western regions where incomes are still very low. Currently the most stringent policies—such as the ban on new coal-fired power plants—only apply to the three largest metropolitan areas along China’s eastern seaboard. Since those three regions account for around half of the nation’s GDP and coal consumption—and the full action plan covers 66 percent of the nation’s GDP—the policy changes enacted thus far will have a major effect on their own. However, westward reform migration will be a critical issue to watch when China’s new 2016-2020 development plan comes out next spring.

If Beijing can accelerate emission reductions not only along the eastern seaboard, but also in the nation’s heartland, that will substantially bend down China’s future emission curve. Among the 10 pre-2030 carbon-peak cities and provinces, Jinchang, Yan’An, Wuhan, Guiyang, and Sichuan Province will be critical indicators to watch, as all five are in China’s interior. If these interior regions—some of which are in major coal-production zones—succeed in achieving early carbon-emission peaks, that will make it very difficult for other central and western regions to avoid taking on more ambitions action themselves.

The pace at which Beijing extends the nation’s most ambitious climate policies westward will largely determine at what emission level the nation peaks and how quickly Chinese emissions come down after that peak year. If Beijing maintains China’s current east-west policy divide throughout the 2016-2020 planning period, that will give Chinese investors an incentive to build more coal plants and emission-intensive industrial projects in the nation’s heartland, delaying a sharp drop-off in overall Chinese carbon emissions. Overall emissions will still peak by 2030—or even by 2025—but they will peak at a higher level and decrease slowly. If, on the other hand, Beijing can quickly extend the coal caps and other ambitious programs to cover the majority of the nation during the next five-year planning period, high-emission projects will no longer be attractive in China—even in the inland areas—and Chinese emissions will follow a more ambitious downward trajectory. These implementation details will become clear when Beijing releases the new 2016-2020 development plan in March 2016.

Conclusion

Nearly two decades ago, when U.S. policymakers were debating whether to sign on to the Kyoto Protocol, the U.S. Senate passed a “sense of the senate” resolution, often referred to as the Byrd-Hagel Resolution, that called on the United States to avoid taking on international emission reduction commitments unless developing countries were doing the same. At that time, the United States had a large trade imbalance with China, and many U.S. observers feared that if the U.S. reduced emissions and China did not, industrial activity would shift from the United States to China to take advantage of a Chinese cost advantage.

Now the UNFCCC parties are constructing another global deal, and this time the United States and China are moving in lockstep. Both nations are making ambitious emission-reduction commitments, and by doing so, pressuring other nations around the world to do the same. Furthermore, this time, China is not only making strong commitments at the international level but also demonstrating an equally strong pattern of ambitious policy reform at home.

In 1997, when U.S. policymakers were debating the Byrd-Hagel Resolution, it would have been hard to imagine a scenario where China managed to reduce coal use by 2.9 percent in an era of 7 percent GDP growth. It would also have been hard to imagine a Chinese Communist Party that viewed air quality as a red-line issue for regime survival, but 2015 is a new era. Chinese negotiators are showing up in Paris with strong emission-reduction commitments that will serve as the floor rather than the ceiling for Chinese climate action. That bodes well for the future of the planet.

Melanie Hart is the Director for China Policy at the Center for American Progress.

The author would like to thank Yangshengjing (Ub) Qiu, Vivian Wang, Erin Auel, Ben Bovarnick, and Cathleen Kelly for their contributions to this report.