On September 12, the Census Bureau will release its annual data on income, poverty, and health insurance coverage in the United States. These data, collected from the Current Population Survey for calendar year 2017, are expected to show that the national poverty rate continued the downward trajectory it has followed since 2014, measured by both the official poverty measure and researchers’ preferred Supplemental Poverty Measure (SPM), which also counts tax credits and certain in-kind assistance as income. Yet despite this expected decrease, experts anticipate that the typical American family experienced only modest income gains in 2017—if any—and that health insurance coverage rates flatlined.

Although any decrease in the share of people facing poverty and hardship is good news, it is important to put that decrease in context. In the Trump economy, corporate profits are soaring in the aftermath of the recent tax law, while working families are being squeezed by stagnant wages and rising health care costs. The 2017 Census Bureau data will fail to capture the effects of recent policy changes—including the historically unpopular tax law, enacted in December 2017—as well as the Trump administration’s many ongoing threats to Americans’ financial security. These include proposed cuts to programs that help Americans meet a basic standard of living, as well as the nomination of Brett Kavanaugh to the U.S. Supreme Court, whose confirmation would be devastating for working-class people, including those living in poverty. Indeed, any good news for working- and middle-class Americans is due in large part to the Trump administration’s failure to impose much of its damaging policy agenda. Center for American Progress analysis showed that if just three of Trump’s proposed budget cuts had been in place in 2015, 2.3 million more Americans would have been in poverty.

This column sets the stage for the Census Bureau’s data release—and provides timely information for fall policy debates—by detailing how working families are faring in the Trump economy, the attack on access to health care, and the continuing assault on important supports that families need to make ends meet.

The Trump economy is squeezing everyday Americans while further enriching the wealthy

While the Census Bureau’s release will offer several important data points on how American families fared in 2017, these data do not tell the full story of the economy under President Donald Trump. In the Trump economy, everyday workers are increasingly squeezed—stuck between stagnant or declining wages and the rising costs of basic necessities such as medical expenses, child care, and housing. This July marked nine years since the nation’s poverty-level minimum wage was last increased; low pay and unstable work mean that 4 in 10 adults cannot cover an unexpected expense of $400. In 2017, nearly one-third of households in which at least one adult is working reported facing economic hardship.

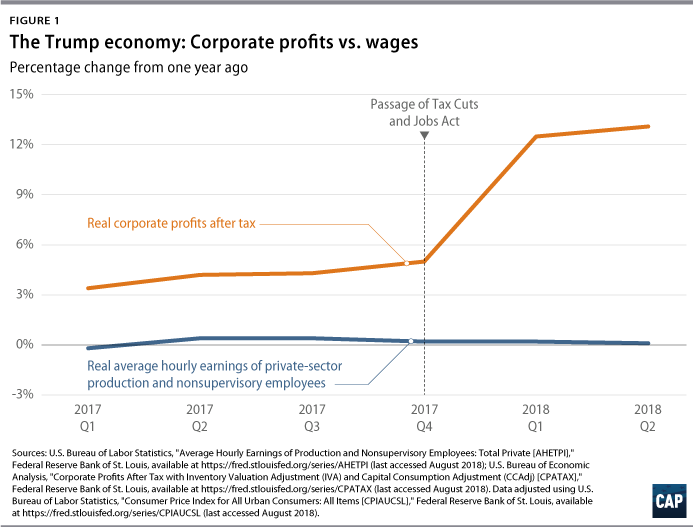

Meanwhile, wealthy corporations and individuals are making out like bandits, thanks in large part to congressional Republicans’ deeply unpopular tax law. Corporate profits are near an all-time high. And companies are using their tax cut windfalls to deliver cash to executives and wealthy shareholders, many of whom don’t even live in the United States, through stock buybacks. A record $1 trillion in such buybacks are expected this year. That’s money that could be used to increase worker pay.

The 2017 Census Bureau data will not capture it, but evidence suggests that the recent tax law has exacerbated the divide between the wealthy and everyone else. As the law takes effect, funneling 83 percent of its benefits to the top 1 percent in 2027, measures of inequality can be expected to accelerate in future census data. Yet even as the wealthy are set to receive this windfall, real wages for rank-and-file American workers actually fell by 0.2 percent from June 2017 to June 2018—a far cry from the $4,000 pay raise that Trump claimed American households would see. Coupled with the administration’s repeated attacks on workers and labor rights, the economic security of working Americans is being threatened.

Beyond highlighting the gaps between the rich and those in the middle and working classes, the Census Bureau data underscore that people of color and women consistently face higher rates of poverty, diminished earnings, and lower family incomes. Recent research identifying “hidden rules of race” in the tax law suggests that racial disparities in income and wealth may be widening in the Trump economy.

The uninsurance rate is holding steady, but health care sabotage is poised to drive it up

Next week’s Census Bureau release will reinforce recent evidence from the National Center for Health Statistics that progress toward expanding insurance coverage has stalled and that racial disparities in health insurance coverage have ceased to narrow. About 28 million Americans lack health insurance, yet the administration is working to push that number up, not bring it down. The Trump administration and its allies in Congress have repeatedly tried to sabotage the Affordable Care Act (ACA), undermining enrollment efforts and driving up premiums for middle-class families. Furthermore, the repeal of the individual mandate through the recent tax law will raise the share of Americans who are uninsured in coming years, as well as cause premiums to rise.

In addition, the state-level data that the Census Bureau will also release next week are likely to serve as a reminder of how conservative governors and legislatures have left millions of Americans stranded in the coverage gap. Data from the American Community Survey will make clear that states that have failed to expand Medicaid have dramatically higher uninsurance rates than states that have expanded coverage. Disparities between states could grow larger still if states go along with the administration’s latest attempt to strip Medicaid coverage from millions of people who are not able to find work for a certain number of hours per week.

Administration policies threaten families’ basic living standards as the tax bill funnels money to the wealthy

The Census Bureau’s Supplemental Poverty Measure—a more comprehensive measure of poverty that takes into account several federal programs as well as expenses such as child care and out-of-pocket medical costs—will make clear the importance of programs such as Social Security, nutrition assistance, housing assistance, and others to ensuring economic security. Each year, Census Bureau data show that these critical programs help tens of millions of Americans avoid poverty and hardship, yet attacks on them have formed the foundation of the Trump administration and the congressional majority’s platform, all to finance tax cuts for the ultrawealthy.

The president’s first budget took two-thirds of its draconian cuts from programs designed to support low- and moderate-income Americans. The administration has since proposed cuts to SNAP, Medicaid, affordable housing, Social Security’s disability programs, and more. While fortunately the administration has so far failed to make these damaging and unpopular cuts a reality, many families are already suffering due to the administration’s ACA sabotage and the damaging Medicaid cuts that some states have already put into place. Some U.S. residents have been particularly targeted for harm: The Trump administration is on the verge of releasing an unprecedentedly harsh “public charge” rule that would impose radical income and health tests on legal immigrants seeking to obtain a green card, resulting in a chilling effect on families’ willingness to access needed services and laying the groundwork for a public health crisis.

Conclusion

Any economic progress for working- and middle-class Americans revealed in next week’s data release must be understood in the context of the broader Trump economy and policy agenda. Positive headlines highlighting modest progress on income, poverty, or health insurance in 2017 will hide a troubling bigger picture of an economy in which huge swaths of everyday Americans are increasingly squeezed, as well as fail to capture the damage from the recent tax law and the administration’s health care sabotage.

Instead of policies that favor corporations and millionaires over working people, Americans deserve a policy agenda that improves economic security for working families. If Trump and his allies were serious about helping the “forgotten men and women,” they would offer solutions to boost workers’ pay and improve job quality, including raising the minimum wage, strengthening collective bargaining, and instituting a job guarantee in hard-hit communities. Their solutions would help rein in families’ costs to allow them to reach and remain in the middle class, by making child care more affordable and expanding the Child Tax Credit for families with young children. And their solutions would ensure that families can meet basic needs, including by investing in affordable housing and making health care available to all.

Unfortunately, President Trump and his allies in Congress have instead opted for an agenda that has led to flat wages and rising health care premiums even as corporate profits soar. While they may attempt to claim credit for any moderate gains for working families during the Trump administration’s first 11 months, these gains have occurred despite, not due to, their efforts.

Rachel West is the director of research for the Poverty to Prosperity Program at the Center for American Progress. Katherine Gallagher Robbins is the director of policy for the Poverty to Prosperity Program. Melissa Boteach is the senior vice president of the Poverty to Prosperity Program.

The authors would like to thank Daniella Zessoules, special assistant for Economic Policy at the Center, for her analysis in Figure 1.