More than half of all Americans will experience at least one year of poverty or near-poverty at some point during their working years. This stark reality makes strengthening our nation’s safety net, including Temporary Assistance for Needy Families, or TANF, more important than ever to help individuals and families weather the ups and downs of life and get back on their feet when they fall on hard times.

To that end, the Center for American Progress has laid out several recommendations for strengthening our nation’s system of work and income supports by, for example, enhancing the Earned Income Tax Credit as a tool for economic stability and mobility and removing counterproductive asset limits that prohibit low-income families from building even modest savings.

For their part, conservative policymakers often propose deep cuts to vital programs that serve struggling families. For example, the fiscal year 2016 House and Senate congressional budgets—which got two-thirds of their cuts from programs serving low- and moderate-income people—suggest that TANF should serve as a model for other assistance programs, including the Supplemental Nutrition Assistance Program, or SNAP—formerly known as food stamps—and Medicaid. However, following this prescription would be a recipe for exacerbating poverty and hardship in America.

Instead of undermining effective income and work supports such as SNAP and Medicaid by modeling them after TANF, policymakers should focus on strengthening TANF by boosting its inadequate funding levels; giving states incentives to target TANF funds to help struggling families—instead of using them for other purposes; improving TANF as a re-employment program; and exploring strategies to make TANF more effectively serve two-parent families.

The TANF block grant, which replaced Aid to Families with Dependent Children, or AFDC, in 1996, was initially hailed as a success during the booming full-employment economy of the late 1990s. But too often, the narrative stops there, ignoring key shortcomings of the program that became apparent once the economy slowed down. While there was broad, bipartisan consensus that AFDC needed to be reformed to focus more on helping parents find steady work and increase their skills and educational attainment, a wealth of evidence now shows that TANF is ineffective in achieving these goals in a number of important ways.

Here are the top five reasons why TANF as it exists today should not serve as a model for other anti-poverty programs.

1. TANF helps very few struggling families with children

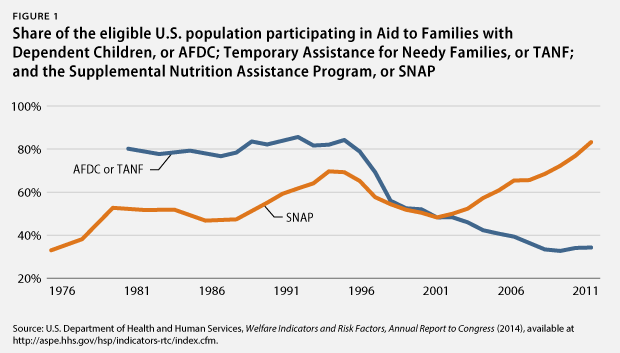

As a flat-funded block grant, TANF’s federal funding has been stuck at $16.5 billion per year for almost two decades, without even routine increases to account for inflation or population growth. Thus, since the program’s establishment, the block grant has lost one-third of its value. As a result, TANF has grown significantly weaker over time as a tool to protect families against poverty and destitution when they fall on hard times. Just one in three families with children living below the austere federal poverty line are helped by TANF today, compared to more than 8 in 10 in 1996. In many states, the situation is even bleaker: Fewer than one in five poor families with children receive TANF in more than half of all states. Wyoming provides a stark example with only 600 people, or 4 percent of children in poor families, receiving TANF in the state.

In comparison, the Supplemental Nutrition Assistance Program is highly effective at reaching struggling individuals and families, with 8 in 10 eligible households receiving needed nutrition assistance.

2.TANF is woefully unresponsive to recessions

During a recession, the number of people who lose steady employment or are unable to find work rises. In response, an effective income assistance program should help more people avoid hardship while they look for jobs or improve their qualifications. This kind of countercyclical response is good not only for the people who are able to avoid hardship and find work as a result, but also for the economy as a whole because it bolsters sagging demand.

Unemployment Insurance and SNAP both responded to the Great Recession in this effective way. TANF, however, has proven essentially unresponsive to recessions, with the recent economic downturn serving as exhibit A. As the number of American families desperate for help skyrocketed during the Great Recession, the number of families helped by TANF hardly budged, rising by just 16 percent between the onset of the recession and December 2010, while the number of unemployed workers rose by 88 percent during the same period. In fact, the number of struggling families that received help from TANF actually dropped in some states despite the tremendous increase in unemployment. TANF is hardly a model for other assistance programs in this respect.

3. TANF is not accountable for results

Although it is often touted as having increased state flexibility and innovation, TANF actually imposes extensive restrictions on states when it comes to designing employment and education paths for parents who receive income assistance from the program. Most of these restrictions relate to which types of education and training activities states may count toward TANF’s “work participation rate.” For example, states cannot provide what is referred to as “job search and job readiness assistance” to a parent for more than four consecutive weeks, even if both the parent looking for work and the TANF job counselor agree it would be useful. Further, and counterintuitively, states do not actually have to help TANF recipients secure paid employment in order to meet the rate. As the Center on Budget and Policy Priorities has pointed out, “TANF is likely the only employment program in which getting participants into paid employment is not a key measure of success.”

Moreover, TANF imposes almost no meaningful accountability provisions on states regarding how they spend federal TANF dollars. This is particularly problematic because just $1 out of every $4 in TANF funds goes to income assistance for struggling families, with states increasingly using TANF dollars for other purposes. Policymakers, the public, and the media lack even the most basic information on where these funds go. Additionally, TANF does not require states to report on which outcomes they achieved. This lack of accountability and transparency leaves the public with little information on how states are spending TANF dollars or whether the program is effective.

In contrast, in programs such as SNAP, approximately 95 percent of program dollars go to helping struggling families purchase food. The error rate for SNAP is among the lowest of all government programs, with fewer than 1 percent of SNAP benefits going to households that do not meet the program’s criteria. Research also shows that SNAP boosts health, educational, and employment outcomes in the long term. Rather than model other programs after TANF, policymakers should be seeking ways to boost the program’s effectiveness and transparency to ensure that dollars are going toward providing income and employment support to struggling families.

4. TANF does not effectively serve two-parent families

One of TANF’s four core purposes is to “encourage the formation and maintenance of two-parent families.” This goal is especially important because there are more married parents living in poverty than never-married parents, and a large body of research underscores that financial stress increases the risk that these families will face marital conflict, violence, and divorce. Yet, TANF does not generally serve two-parent families with children. Approximately 5.2 million children below the poverty line live in two-parent, married households with another 1.4 million children living with cohabiting parents. Only 84,000 of these households, or 1.3 percent, receive basic income support and employment services through TANF.

The conservative narrative often speaks about marriage as an anti-poverty tool, while also promoting as a model the TANF program, which has a dismal record of actually helping struggling two-parent families with children. In contrast, progressive welfare reform policies have a history of promoting family stability. The Minnesota Family Investment Program, or MFIP, a progressive demonstration project evaluated in the 1990s, focused on providing basic assistance while helping struggling families find and keep stable employment. The evaluations showed that this model—which was available to married and cohabitating families in addition to single-parent ones—reduced divorce among two-parent families receiving benefits. The effects were especially powerful among black married couples, who saw a 70 percent drop in their divorce rates.

Unfortunately, current TANF law and funding makes programs such as MFIP all but impossible to run today. In contrast, programs such as SNAP do serve all types of family structures, as long as the household purchases and prepares meals together. Rather than weakening effective programs such as SNAP by modeling them after TANF, Congress should seek out opportunities to ensure that TANF can better serve two-parent households by establishing a national demonstration project that builds off the lessons learned from programs such as MFIP.

5. TANF does a poor job of cutting poverty

The number of families helped by TANF has shrunk by more than one-quarter—from 2.3 million in 2000 to 1.7 million in 2013—while poverty in America has climbed during the same period. For the small share of struggling families that do receive income assistance from TANF, benefit levels are meager at best. In no state does TANF provide benefits of even half the federal poverty level, which was $813 per month in 2013 for a family of three. In 16 states, it provides benefits of less than 20 percent of the federal poverty level—$325 per month for a family of three. Thus, it comes as little surprise that TANF does little to mitigate poverty and hardship. Indeed, reducing poverty is not even one of the program’s four core goals.

Conclusion

With half of Americans at risk of experiencing poverty or near-poverty at some point during their working years, we should all be invested in ensuring that our nation’s safety net provides adequate protection against the ups and downs of life. Instead of undermining effective work and income supports such as SNAP and Medicaid by modeling them after TANF, policymakers should focus on strengthening the TANF program to serve as a more effective tool for helping struggling families get back on their feet.

Moreover, if policymakers are serious about wanting to cut poverty and expand opportunity for struggling families, ensuring an adequate safety net is just one step. Other key policies include creating good jobs; raising the minimum wage; boosting the Earned Income Tax Credit for workers without qualifying children, and making permanent the improvements to the EITC and Child Tax Credit under the American Recovery and Reinvestment Act, which are set to expire in 2017; ensuring paid leave and paid sick days; investing in affordable, high-quality child care and pre-K for all through a partnership with the states; and removing barriers to employment for people with criminal records.

Weakening vital components of our safety net by modeling them after the waning TANF program would be a step backward.

Rebecca Vallas is the Director of Policy for the Poverty to Prosperity Program at the Center for American Progress. Melissa Boteach is the Vice President of the Poverty to Prosperity Program at the Center.