In the coming months, President Barack Obama is expected to announce a series of administrative actions on immigration. These actions will come after more than a decade of inaction on immigration reform in Congress, including the House of Representatives’ recent refusal to vote on the bipartisan immigration reform bill, S. 744, passed by the Senate last summer. The Congressional Budget Office estimated that S. 744 would significantly reduce our nation’s deficit and spur economic growth.

Although any executive action adopted by the president will pale in comparison to the economic and fiscal impact of a comprehensive legislative solution such as S. 744, such actions can nonetheless deliver significant fiscal benefits. This report examines the fiscal impact of a variety of scenarios in which undocumented immigrants are temporarily protected from deportation and authorized to work in the interim.

Confronted by a deteriorating immigration system and continued paralysis in Congress, President Obama requested Secretary of Homeland Security Jeh Johnson and Attorney General Eric Holder to identify which administrative actions could be adopted to begin the process of fixing our immigration system. One of the significant administrative steps the president can take is expanding a policy authorizing undocumented immigrants who are deemed to be low enforcement priorities to affirmatively request deferred action. Deferred action is a temporary, discretionary reprieve from deportation that enables the government to focus its limited resources on high-priority enforcement targets while bringing low-priority individuals out of the shadows. In addition to the obvious enforcement and security benefits that flow from expanding the universe of individuals eligible to register and request this exercise of discretion, enabling these individuals to work lawfully, albeit temporarily, also triggers significant fiscal benefits in the form of additional payroll tax revenues.

Deferred action

The president has the legal authority and a great deal of latitude when deciding how to enforce our immigration laws in the most efficient and effective way. Just like a local police chief has the ability to decide whether to focus resources on ticketing people for jay walking or arresting people for driving while intoxicated, the president has the legal authority to determine which individuals are a priority for immigration enforcement. This is known as prosecutorial discretion.

One type of prosecutorial discretion policies in the immigration context is “deferred action,” which was formerly recognized by the Immigration and Naturalization Services in 1975. A deferred action policy identifies low-priority individuals, such as non-criminals, who are not the target of immigration enforcement efforts, and creates a process for them to come forward and affirmatively apply for temporary relief from deportation. Most recently, this form of discretion was utilized in the Deferred Action for Childhood Arrivals, or DACA, program. DACA was announced in June 2012 and extends to undocumented immigrants who have entered the United States before the age of 16 and meet education requirements such as graduating high school. To date, DACA has successfully allowed the U.S. Department of Homeland Security, or DHS, to better focus its resources on higher priorities by granting temporary reprieves from deportation to nearly 600,000 individuals.

Granting deferred action with work permits would increase the amount of payroll tax revenue collected each year. First, by allowing undocumented immigrants to work legally, many workers and employers will be able to emerge from the underground economy and pay payroll taxes for the first time. Today, slightly more than one-third of undocumented workers and their employers are contributing payroll taxes. Providing work permits would create a legal avenue for workers and employers to contribute taxes.

Second, allowing undocumented immigrants to work legally will lead to higher wages. Providing work authorization to eligible undocumented immigrants would equip them with a shield against workplace exploitation and enable them to move freely across the labor market to find jobs that best match their skills. Consequently, undocumented immigrants will observe an increase in their earnings. And as workers’ wages rise, so too will their payroll tax contributions.

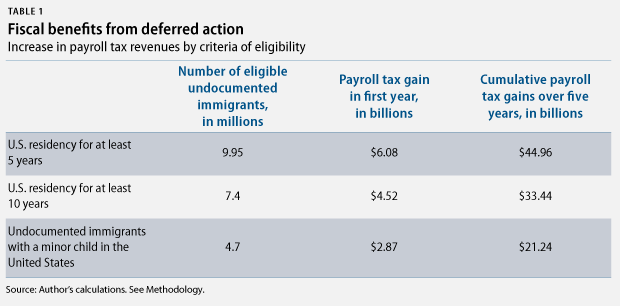

The magnitude of the tax revenue gains, however, varies based on the number of immigrants eligible for deferred action. There are a number of criteria that President Obama could choose from when determining who will be eligible for deferred action. For example, deferred action may only be available to those who have been in the United States for at least 10 years. Alternatively, the president could extend deferred action to those who would have been able to apply for legal status and citizenship under the immigration reform bill, S. 744, passed by the Senate in June 2013.

In the following analysis, the Center for American Progress estimates the fiscal impact of a deferred action program for each of these groups:

- Undocumented immigrants who have lived in the United States for at least five years.

- Undocumented immigrants who have lived in the United States for at least 10 years.

- Undocumented immigrants who have a minor child living in the United States.

The analysis shows that the United States stands to gain a significant amount of new revenue from a deferred action program. Most striking is that the payroll tax revenue gains would be realized immediately—within the first year—and only grow over time as more immigrants apply for relief under the program and receive a work permit. The analysis finds:

- Temporary work permits would increase the earnings of undocumented immigrants by about 8.5 percent as they are able to work legally and find jobs that match their skills.

- A deferred action program that allows undocumented immigrants who have lived in the United States for at least five years to apply for a temporary work permit would increase payroll tax revenues by $6.08 billion in the first year alone and increase revenues by $44.96 billion over five years.*

- If President Obama instead extends deferred action to a smaller number of undocumented immigrants then the payroll tax revenue gains would not be as high.

This report begins with a discussion of why deferred action would trigger an increase in tax revenues. It then presents the findings of the CAP analysis that quantifies the increase in payroll tax revenues that would result from extending deferred action to undocumented immigrants.

Patrick Oakford is a Policy Analyst in the Economic and Immigration Policy departments

* Update: September 5, 2014: The online version of this report has been updated to match the correct PDF.