Note: Newer data on DACA recipients can be found in “What We Know About the Demographic and Economic Impacts of DACA Recipients: Spring 2020 Edition” by Nicole Prchal Svajlenka and Philip E. Wolgin.

In the first half of 2020, the Supreme Court is expected to decide the future of Deferred Action for Childhood Arrivals (DACA). As CAP detailed last week, the nearly 700,000 DACA recipients are deeply rooted community members whose fiscal and economic contributions are felt broadly. Nearly 1.5 million individuals live in households with a DACA recipient, including more than a quarter million U.S.-born children of DACA recipients. DACA recipients pay $613.8 million in mortgage payments and $2.3 billion in rental payments each year. Annually, their households pay $5.7 billion in federal taxes and $3.1 billion in state and local taxes. DACA recipients are making a societal and economic difference in every state.

Many states have been vocal in their support of DACA, while others have made their opposition known. Twenty-one states and the District of Columbia—representing more than half of all DACA recipients—are parties to litigation efforts supporting DACA and opposing the Trump administration’s efforts to end the initiative. These states include California, Colorado, Connecticut, Delaware, the District of Columbia, Hawaii, Illinois, Iowa, Maine, Maryland, Massachusetts, Minnesota, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, Virginia, and Washington. While New Jersey has not joined any of the cases now heading to the Supreme Court, the state did intervene as a party to defend DACA in the litigation brought by Texas to end the initiative. This litigation is current pending in the Southern District of Texas, and New Jersey filed an amicus brief in support of DACA in connection with litigation that the Supreme Court will consider.

On the other hand, eight states are suing the federal government in an effort to end the initiative. These states—Alabama, Arkansas, Kansas, Louisiana, Nebraska, South Carolina, Texas, and West Virginia—represent just 20 percent of DACA recipients, with the vast majority of this population living in Texas. An additional four states—Alaska, Arizona, Florida, and South Dakota—filed an amicus brief in opposition to DACA before the Supreme Court, but have not joined litigation to end DACA. Although Mississippi Gov. Phil Bryant (R) appears as a plaintiff in the Texas litigation, Mississippi’s attorney general declined to add the state as an official party to the action. And even in Texas—the state leading the litigation challenging DACA—the four largest cities, Houston, San Antonio, Dallas, and Austin, joined a city-led amicus brief in support of DACA while the case was before the 2nd U.S. Circuit Court of Appeals.

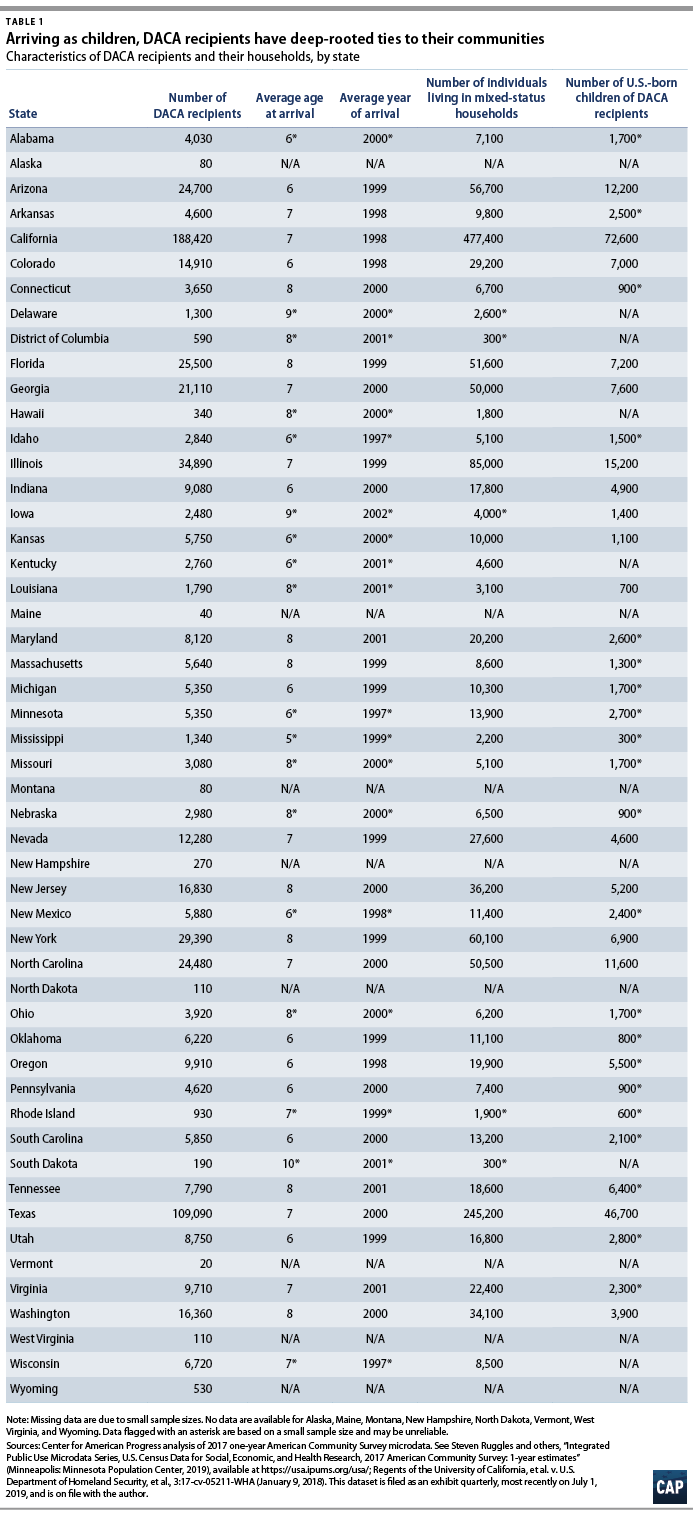

DACA recipients have long-term and familial ties to their communities

In states across the country, there are large numbers of residents living in mixed-status families. For example, there are 12 states where more than 5,000 U.S.-born children have a parent who is a DACA recipient. This is not surprising in states such as California, Texas, Illinois, Arizona, Florida, and New York. But it’s also true for North Carolina, Georgia, Colorado, Tennessee, Oregon, and New Jersey.

On a state-by-state basis, the average DACA recipient came to the United States between 1997 and 2002. Unexpectedly, the states with the earliest arrival date for DACA recipients—1997—are Idaho, Minnesota, and Wisconsin.

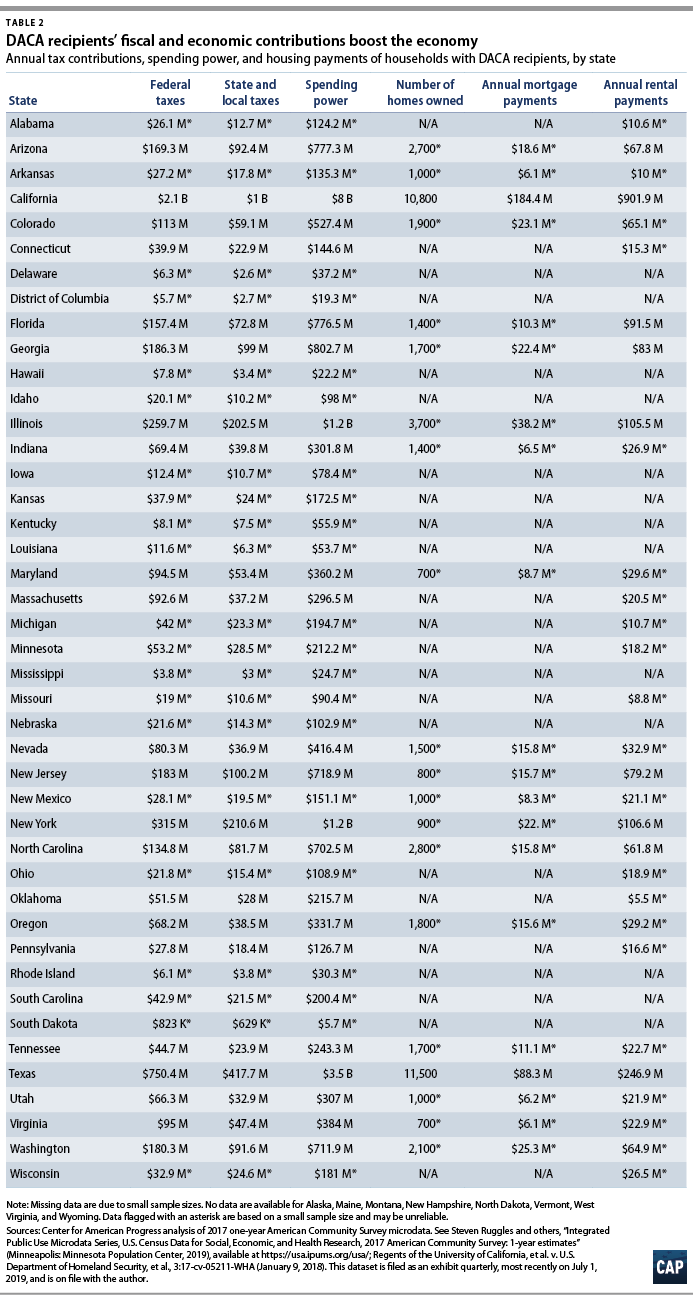

DACA recipients are economic contributors

In addition to their roots in their communities, DACA recipients make important economic and fiscal contributions in the form of tax revenue. DACA recipients and their households pay tens of millions in taxes to the federal government each year. They also pay state and local taxes: In 41 states and the District of Columbia, DACA recipients and their households pay more than $1 million annually per state in state and local taxes. In 35 states, that tax revenue is more than $10 million each year per state, and in 12 states, it is more than $50 million per state. These state and local tax dollars are sent right back into the community, funding local schools, health insurance for low income residents, and infrastructure investments.

DACA recipients also make substantial rental or mortgage payments. In 20 states, DACA recipients pay more than $6 million each year per state in mortgage payments—payments that would be in jeopardy if DACA recipients lost their protections and were forced to leave their homes. DACA recipients also make major, and oftentimes local, economic contributions in the form of rental payments.

DACA recipients in California and Texas

Data on DACA recipients, their families, and their economic contributions are largest in California and Texas, where nearly half of DACA recipients—29 percent and 17 percent, respectively—live. In California, nearly half a million (477,000) individuals live in homes with the state’s 188,000 DACA recipients. California DACA recipients are parents to 73,000 U.S.-born children. Their households pay $2.1 billion in federal taxes and $1 billion in state and local taxes annually. They own nearly 11,000 homes in the state and pay $184.4 million in mortgage payments and $901.9 million in rental payments each year.

More than 109,000 DACA recipients call Texas home. They are parents to 47,000 U.S.-born children; 245,000 individuals in the state live with a DACA recipient. Each year, Texas DACA-recipient households pay $750.4 million in federal taxes and $417.7 million in state and local taxes.

Conclusion

DACA recipients make countless positive contributions to their states. If the protections of DACA were terminated, DACA recipients and their families would face potential separation and their economic contributions would be thrown into jeopardy. The Supreme Court should ensure that DACA and its positive outcomes continue.

Nicole Prchal Svajlenka is a senior policy analyst of Immigration Policy at the Center for American Progress.

Methodology

The findings presented in this column are based on CAP analysis of 2017 1-year American Community Survey (ACS) microdata, accessed via the University of Minnesota’s IPUMS USA. For the purpose of measuring the overall number of DACA recipients, this column uses the latest data filed as evidence in Regents of the University of California, et al. v. U.S. Department of Homeland Security, et al.; the data are on file with the author. The data show 660,880 active DACA recipients as of June 30, 2019.

Household tax contributions and spending power estimates are based on methodology developed by New American Economy and include all households that contain a DACA recipient. The tax rates applied to the microdata come from the Congressional Budget Office and the Institute on Taxation and Economic Policy. Spending power is measured as household income after federal, state, and local tax contributions; these data are based on household incomes, which are available in the ACS microdata.

The analysis calculates mortgage and rental payments for households in which a DACA recipient is the head of household or the spouse or unmarried partner of a head of household. Monthly payment information is aggregated from the ACS microdata.