In 2015, approximately 3.3 million students are expected to graduate from high schools throughout the United States. Many of them will pursue postsecondary education immediately after receiving their diploma but not nearly enough will complete their degree. Furthermore, high school graduates who do not enroll in a college or a postsecondary education program are more likely to come from lower-income families.

While previous generations of Americans were considered to be among the world’s most educated, gains in postsecondary attainment in competitor countries have outpaced attainment among young people in the United States. U.S. adults between the ages of 55 and 64 are the third-most educated among the 34 Organisation for Economic Co-operation and Development, or OECD, countries—nations that are in competition with the United States. In contrast, U.S. young adults currently rank 10th on OECD’s most-educated list. As the Baby Boomer generation retires from the workforce, these lower levels of postsecondary attainment among the current generation of Americans will become increasingly apparent in global economic performance.

Among the current generation of students, family income plays a significant role in determining who will receive a college degree, which is a key component of the growing inequality in the United States. In 2013, students in the top income quartile were eight times more likely to receive a bachelor’s degree than students in the bottom quartile—up from 1970, when students from high-income families were five times more likely to earn a bachelor’s degree. While income level determines who enrolls in college after high school, it even more significantly determines who completes college and earns a degree. In the context of rising inequality in postsecondary education, it is no wonder that the United States has fallen behind its competitors. If the United States is to make gains in degree attainment and improve its ranking among its competitors, the solution needs to focus on degree attainment in families from the bottom half of the income scale.

Each year, the federal government spends billions of dollars on federal student aid programs to help make college more affordable. In 2015, for example, the federal government spent approximately $28 billion on the Federal Pell Grant Program, which provides grants to low-income students so that they can attend college. But, as currently designed, the process of securing federal financial aid support is a series of mountains instead of open doors. In order to receive federal financial aid, students and families must complete the complex Free Application for Federal Student Aid, or FAFSA. The Advisory Committee on Student Financial Assistance—a working group created by Congress to be an independent source of advice on financial aid policy—has frequently criticized the complexity of student aid and pointed out the barriers the process creates, particularly for the poorest students. The committee called for many simplifications that have since been implemented, including eliminating redundant questions; phasing out the paper FAFSA form; simplifying and streamlining the online application; and instituting a data retrieval tool for easy access to an aid applicant’s tax information from the Internal Revenue Service, or IRS. Despite all of these changes, the FAFSA still serves as a barrier to college access.

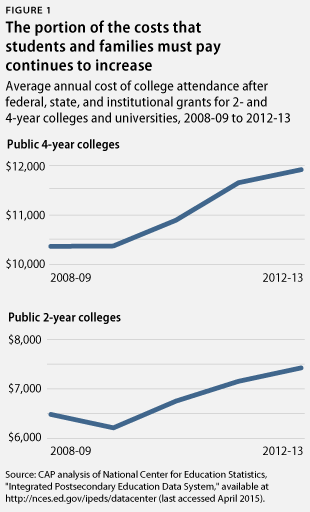

Another barrier yet to be addressed is the inability of students and families to determine their eligibility for federal financial aid and the amount of aid available until after they have already applied to colleges and universities. For prospective first-generation college students and students from families struggling to make ends meet, a public college education with an average annual price tag—after federal, state, and institutional grants—of $12,000 for a four-year college or $7,500 for two-year college is not affordable or accessible and can discourage students from applying at all. For those who do choose to attend college, the lack of financial aid information—as well as the high costs—can lead to poor financial, academic, and college choice decisions.

In 2015, the Center for American Progress announced College for All, a radically student-centric plan that would significantly boost college attainment rates among students from low- and moderate-income families by ensuring that students would be able to attend two- and four-year public institutions without having to incur any tuition or fees while enrolled. In order to remedy financial aid timeline inefficiencies, incentivize more students to earn postsecondary education credentials, and promote future economic success, CAP proposes improving the federal financial aid system by providing an early guarantee of financial aid eligibility through the federal tax system and eliminating the need for students to fill out additional forms in order to receive federal aid. The early guarantee of federal financial aid would increase transparency of both college costs and available aid, as well as incentivize students to enroll in and complete postsecondary education, encourage robust college academic preparation, and spur families to begin saving if possible.

While early aid notification is proposed as a component of College for All, the recommendations in this report can and should be applied to the current financial aid system in order to effectively streamline the aid process and eliminate barriers such as the need for additional forms. This report also details how Congress, under the amended Higher Education Act of 1965, could pilot an early guarantee of aid through the previously authorized demonstration program. The pilot would allow for an early guarantee to be tested for impacts and outcomes on college access and completion rates, as well as troubleshoot delivering aid through the tax system. Through College for All, aid would be guaranteed, delivered, and repaid through the federal tax system in a more rational and organized manner. However, even without the additional reforms proposed under College for All, an early guarantee of aid would increase transparency and incentivize more students to aspire to and achieve postsecondary education.

CAP proposes the following recommendations:

- Provide an early guarantee of federal financial aid: Students and families should receive an early guarantee of available aid when the student is in the eighth grade based on information from their federal income tax return. Receiving federal financial aid should not require students to fill out forms providing income data when this information is already collected and reported through the tax system. The IRS would notify families about their eligibility for federal financial aid before the student starts high school, and the U.S. Department of Education would develop and provide detailed information on the cost of college, net price, types of aid available, and repayment options.

- Build a financial aid calculator that works within the IRS income tax system to determine aid: Currently, financial aid eligibility is determined based on FAFSA information and the formula that determines expected family contribution, or EFC. Under College for All, students would not need to contribute anything upfront for tuition and fees. Instead, students would be guaranteed a mix of grants and loans depending on the family’s income history. Grant aid would target students with the greatest need in order to eliminate the psychological barriers of preparing for college, such as worrying about costs. A new calculator should be created that can work with IRS data points to determine the amount of available grant aid based on multiple years of income data. The balance of the aid would be provided in the form of loans.

- Permit states and institutions to use income data for families to make a more accurate assessment of financial need: Under the new aid system, students and families could elect to share income information with colleges and universities to help institutions make better and more informed decisions regarding what types and amounts of aid to provide students.

- Target and communicate tuition support and grant aid: In order for an early guarantee of federal financial aid to be most effective, tuition support and grant aid needs to be increased. Families need to know that the immediate cost of college is covered. For low- and moderate-income families, it is important to explicitly communicate how much federal aid they will receive in the form of grants that do not have to be repaid. Grant funding should be targeted in a way that incentivizes the most students to attend and complete a postsecondary degree or certificate. The program could be piloted by first targeting the neediest students who are eligible for the maximum Pell Grant award.

- Pilot an early guarantee of aid already granted under current law: The Higher Education Act of 1965, which authorized the federal student aid system, includes an authority for a demonstration program that would allow several states to award Pell Grants in conjunction with an information campaign targeting low-income students in the eighth grade. The Department of Education would then track these students through college and monitor their progress. The Obama administration should work with Congress to have funds appropriated in order to implement a pilot program as quickly as possible to take advantage of state tax and benefit information systems.

The amount of financial aid available to students should be an incentive and make the decision to attend college easier, but the complicated process of applying for aid and a lack of information stand in the way. Together, these recommendations would simplify and streamline the federal aid system and ensure that it fulfills the goal of getting the students most in need to and through college.

David A. Bergeron is the Vice President for Postsecondary Education at the Center for American Progress. Antoinette Flores is a Policy Analyst on the Postsecondary Education team at the Center.