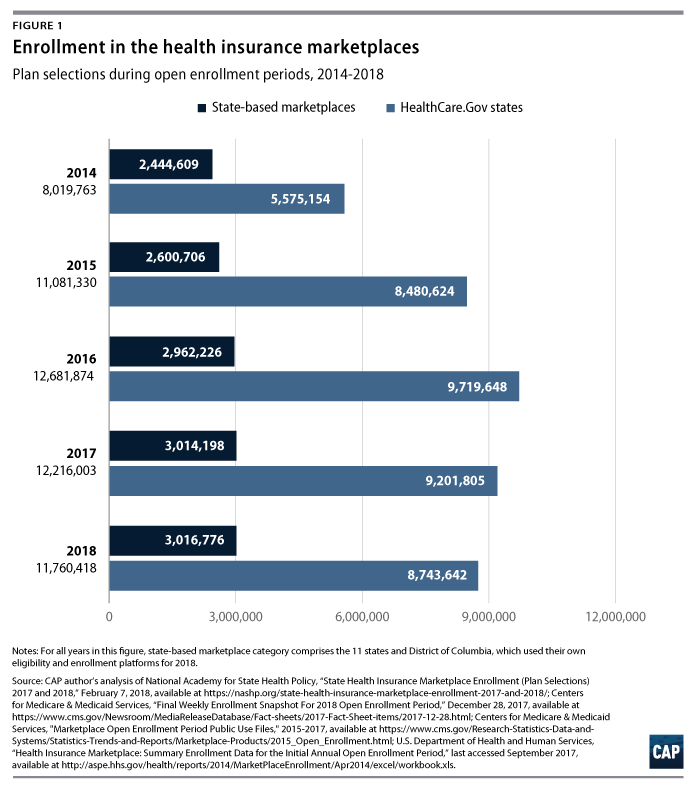

Ahead of this year’s health insurance marketplace open enrollment, a variety of analysts had projected marketplace enrollment would decline due to a much shorter open enrollment period; less outreach and advertising aimed at potential enrollees; and political wrangling over repeal of the Affordable Care Act (ACA). A total 11.8 million people signed up for 2018 individual coverage in the ACA marketplaces, fewer than the 2017’s 12.2 million or 2016’s high of 12.7 million. This 4 percent drop in enrollment, however, was not nearly as steep as some had predicted. In fact, the marketplaces appear remarkably stable despite challenges this year.

Recent data on both enrollment numbers and financial performance demonstrate that the marketplaces are resilient against these headwinds. Financial data suggest the individual market has continued to stabilize. Health insurance companies Anthem and Cigna both reported their individual market business had been profitable in 2017, and Wellmark announced it would re-enter Iowa’s market in 2019.

Nevertheless, marketplace enrollment remains below its potential. As one approach to approximating how much higher 2018 enrollment could have been absent the Trump administration’s cuts to outreach and shortened enrollment period, the Center for American Progress applied the 2017-2018 enrollment growth rate of the District of Columbia and 11 states with their own enrollment platforms to the 39 that rely on the federal government’s HealthCare.gov platform. If conditions in the states using HealthCare.gov been similar to those in the state-based marketplaces, a total 12.2 million people would have enrolled for 2018 coverage. The state-based marketplaces, however, also faced setbacks ahead of 2018 open enrollment. If the Trump administration had not attempted to sabotage the individual market in all states over the past year, 2018 enrollment could have even exceeded last year’s.

Challenges in the fifth open enrollment period

Marketplace enrollees in the 39 states on the federal HealthCare.gov platform received less time and less information about open enrollment this year. HealthCare.gov’s open enrollment period was just 45 days, half the length of the previous year’s sign-up window. The U.S. Department of Health and Human Services (HHS) also slashed its advertising budget by 90 percent and cut enrollment assistance programs for federally supported marketplaces. While the tighter deadline did appear to drive higher volumes of weekly enrollment activity, HealthCare.gov enrollment fell to 8.7 million for 2018, down from 9.2 million the year before, a drop of 5.3 percent.

Other Trump administration actions ahead of open enrollment sowed uncertainty across all states. Throughout the year, congressional Republicans made multiple attempts to repeal the law and ultimately ended the individual coverage mandate.

Just days before open enrollment began, the administration followed through on its threats to end reimbursements to issuers for cost-sharing reductions (CSRs), subsidies that lower deductibles and other out-of-pocket costs for low-income enrollees. States responses to this disruption affected the affordability of exchange coverage. Many states directed plans to make up for the lost reimbursements by raising silver plan premiums, thereby increasing the price of the benchmark plan for premium subsidies relative to other metal tier plans. This so-called silver-loading strategy protected subsidized consumers from rate increases and lowered their net premiums for bronze, gold, and platinum plans. As a result, plans with $0 premiums after tax credits were more widely available than ever before.

What if all states had the same growth as the state-based marketplaces?

In contrast to the enrollment decline for HealthCare.gov, 2018 enrollment was up slightly among the state-based marketplaces (SBMs). Total enrollment in the 11 states and District of Columbia grew by 0.1 percent, with 3.02 million people selecting plans for 2018 coverage compared with 3.01 million in 2017.

Conditions in the SBMs were more favorable for enrollment growth. All but three SBMs declared last fall they would offer open enrollment periods longer than those on HealthCare.gov. Notably, Maryland set a December 15 deadline but later gave consumers a one-week extension. SBMs were not directly affected by the federal decisions to cut advertising and outreach for the marketplaces.

In the case the HealthCare.gov states also had slight enrollment growth of 0.1 percent, 9.2 million people would have signed up for 2018 coverage, bringing the total marketplace enrollment to 12.2 million across all enrollment platforms.* This represents a relatively conservative estimate of 2018 potential enrollment; uncertainty about the ACA and the status of the individual mandate, reduced national advertising by HHS, and premium increases for unsubsidized enrollees likely dampened enrollment growth in all states.

Challenges ahead of the marketplaces

While robust 2018 marketplace enrollment is a good sign, sign-up numbers alone don’t paint a full picture of the state of the individual market. Another still-unknown aspect of the individual market is enrollment outside the marketplaces. In a handful of states, unsubsidized consumers and those who purchased insurance outside the marketplaces were not insulated from the premium increases resulting from cancellation of CSRs. Unsubsidized consumers will likely to see large premium increases again in 2019 due to repeal of the individual mandate.

Who signs up for coverage also matters: A sustainable individual market requires a stable risk mix of enrollees, including young and healthy people. If the decline in 2018 enrollment contributes to an unexpectedly less healthy ACA risk pool, consumers may face extraordinary premium increases again next year.

Despite the fact that more than 12 million Americans are signed up for marketplace coverage this year, the Trump administration continues to push forward with attempts to sabotage the individual market, including encouraging the proliferation of substandard, limited-duration coverage plans and proposing ACA repeal in its annual budget. Going forward, a stable individual market will depend on states and the federal lawmakers taking decisive action to ensure Americans have access to comprehensive, affordable health coverage.

Emily Gee is the health economist for Health Policy at the Center for American Progress.

*Author’s note: The Trump administration’s cancellation of marketplace outreach activities in the final weeks of the 2017 open enrollment period may have suppressed 2017 sign-ups as well. One former federal marketplace official estimates 2017 enrollment would have been 350,000 greater if full outreach had continued.

** The HealthCare.gov state with the greatest drop in enrollment was Louisiana, which began its expansion of Medicaid under the ACA in June 2016. As a result, some individuals who would have otherwise qualified for marketplace financial assistance instead became eligible for Medicaid coverage. Even if we allow Louisiana’s 2018 level to drop in our potential enrollment estimate, however, 0.1 percent growth among HealthCare.gov states would have resulted in total marketplace enrollment close to 12.2 million.