Introduction

A bad bill is about to get even worse. Just before recess, in an effort to revive the American Health Care Act, or AHCA, House Speaker Paul Ryan (R-WI) and congressional Republicans proposed a plan for an “invisible risk pool.” And today, word has leaked that the pool is part of a broader plan to allow insurers in the individual market to charge a premium markup for enrollees with pre-existing conditions, with the pool put forth as a way to offset the premium increases resulting from the rest of the plan. Even before these changes, the AHCA would have thrown 24 million people off of their coverage to pay for massive tax cuts for the rich. Ryan’s most recent attempt to alter the bill would be even more harmful. Enrollees could see premium increases of tens of thousands of dollars, and the proposed invisible risk pool would shave only a tiny sliver off these increased costs for the sickest consumers.

The invisible risk pool does little to lower costs

The so-called Federal Invisible Risk Sharing Program would establish a $15 billion fund to help offset insurers’ expenses for patients with high-cost health conditions, similar to the reinsurance program created by the Affordable Care Act, or ACA. But the invisible risk pool is inferior to traditional reinsurance in two key respects.

First, because the fund only covers the costs of certain conditions, consumers and insurers would have to submit paperwork to demonstrate enrollees qualify for the program—putting costly administrative burdens on insurers, enrollees, and doctors alike. By contrast, reinsurance reimburses insurers for any high-cost enrollee, regardless of condition, eliminating the need for time-consuming paperwork.

Second, the invisible risk pool would not cover high costs that are unrelated to any previous health condition, such as a sudden heart attack. While the proposal does provide a means for insurers to “voluntarily qualify” individuals for the pool, this would exponentially increase the administrative burden by requiring insurers to undertake the qualification process for every enrollee. For these reasons, the invisible risk pool is not as efficient or effective as traditional reinsurance.

In addition to its poor design, the funding for the invisible risk pool is a drop in the bucket compared to the massive increase in enrollee health care costs as a result of the ACHA. Spread over nine years and across millions of enrollees, we estimate that the $15 billion fund could lower annual premiums by about 1 to 2 percent each year, or roughly $100 per enrollee annually. Because the AHCA substantially reduces subsidies and shifts costs onto consumers, even without stripping protections for pre-existing conditions the average enrollee would still see their total costs rise by more than $3,000 by 2020.

In an effort to exaggerate the importance of the new fund, Republican sponsors have cited a study they claim shows the invisible risk pool will result in significant premium reductions. However, the study, conducted by the actuarial firm Milliman, does not model anything close to the Republican plan—even though Milliman released the report on the same day the new fund was added to the bill.

First, Milliman did not account for the AHCA’s changes to ACA rules or the planned changes to eliminate protections for pre-existing conditions that would accompany the fund. Second, Milliman did not model the meager $15 billion in funding for nine years—it assumed almost $10 billion annually. Third, Milliman modeled scenarios that involve providers being forced to pay Medicare rates for high-cost enrollees, which accounts for nearly $7 billion of the annual cost savings. Nothing in the legislative language of the AHCA provides legal authority for requiring issuers to pay Medicare rates.

The misleading use of the Milliman report, which was funded by a conservative think tank, is why it is so important for the nonpartisan Congressional Budget Office to carefully evaluate any changes to the AHCA before any vote.

Premiums would skyrocket for pre-existing conditions

Even more concerning than the small savings provided by the fund, the invisible risk pool is now paired with an amendment that would let states eliminate protections for people with pre-existing conditions and minimum standards of coverage if they participate in a federal risk sharing program or create a high risk pool of their own. But the proposed Federal Invisible Risk Sharing Program is woefully underfunded and state high-risk pools have consistently failed. The return of discrimination based on medical history could increase insurance costs by tens of thousands of dollars, as explained below, rendering it unaffordable for millions of Americans with pre-existing conditions.

Before the ACA, insurers would evaluate potential enrollees’ health and medical information, a process known as underwriting, and would raise premiums, exclude conditions, or decline coverage for people with pre-existing conditions. One study found that insurers quoted premiums as much as 50 percent higher for depression and 100 percent for breast cancer. And one underwriting manual showed that simply being overweight resulted in a 25 percent premium increase for some plans. But such examples are not fully representative of the increased premium costs for people with pre-existing conditions, as many of the costliest people were likely to be rejected.

The ACA prohibits insurers from charging higher premiums based on factors like health status, gender, or pre-existing conditions and instead requires community rating. The law also prohibits insurers from denying coverage altogether to applicants with pre-existing conditions—which is called guaranteed issue. The most recent amendment would let states eliminate community rating while maintaining the ACA’s requirement of guaranteed issue. This would mean that while carriers would be forced to offer everyone coverage, they could impose surcharges on premiums based on health status and medical history.

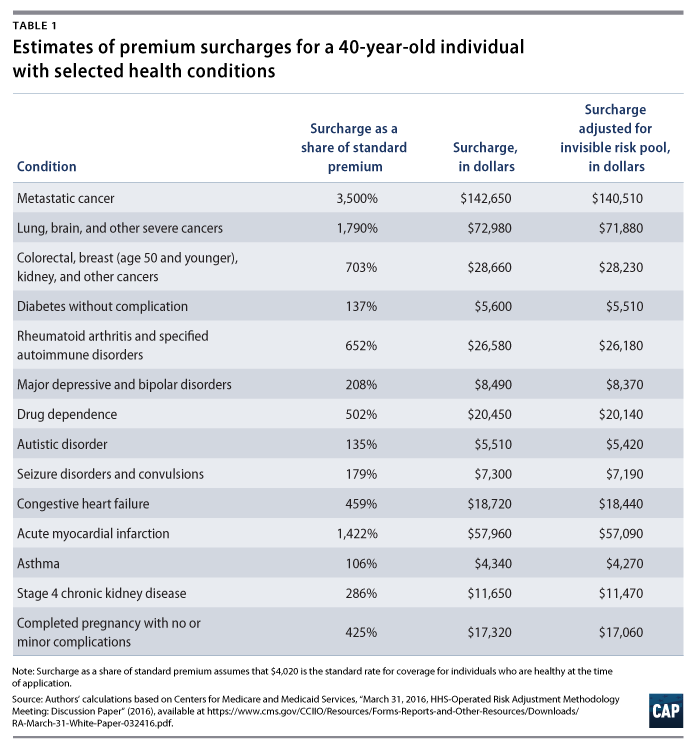

We estimated what surcharges would be for various medical conditions in the absence of community rating. We drew upon data that the Centers for Medicare and Medicaid Services, or CMS, uses to calculate transfers between insurers based on enrollees’ expected costs—this is called the risk adjustment program. We compared the plan liability for total costs for a healthy 40-year-old to the plan liability if that individual had certain medical conditions, as shown in Table 1 below.

Based on our analysis, we estimate that individuals with even relatively mild pre-existing conditions would pay thousands of dollars above standard rates to obtain coverage. For example, because an individual with asthma costs an issuer 106 percent more than a healthy 40-year-old, she would face a premium surcharge of $4,340. The surcharge for diabetes would be $5,600 per year. Coverage could become prohibitively expensive for those in dire need of care: Insurers would charge about $17,320 more in premiums for pregnancy, $26,580 more for rheumatoid arthritis and other autoimmune disorders, and $142,650 more for patients with metastatic cancer.

After accounting for a 1.5 percent reduction in overall premiums from the risk sharing program, the surcharges would still remain astronomically high: $4,270 for asthma, $17,060 for pregnancy, $26,180 for rheumatoid arthritis, and $140,510 for metastatic cancer.

And this analysis does not account for surcharges as a result of individuals’ previous health conditions. Scarce data exists on pre-ACA rate ups, but insurers raised premiums for individuals based on health history, not just current health status. Without pre-existing condition protections, cancer survivors now free of the disease or patients who underwent successful surgery years ago could find themselves facing significant surcharges as well.

Conclusion

Reinsurance programs, whether at the federal or state level, are a means of reducing premium costs that have garnered bipartisan support. But this new fund would do next to nothing to mitigate the harm from stripping away important protections for those with pre-existing conditions, and people could see their premiums increase by thousands or even tens of thousands of dollars. Rather than continue to make a bad bill worse, Trump and House Republicans should stop debating repeal and start considering commonsense ways to build on the ACA’s progress in making affordable health care coverage available to all Americans.

Sam Berger is a Senior Policy Adviser at the Center for American Progress. Emily Gee is a Health Economist at the Center.

Methodology

Under the ACA, insurers can vary premiums according to standard age rating curves but cannot vary them by health status. To estimate how rating up would affect premiums without pre-existing condition protections, we used relative cost factors from the CMS risk adjustment program, which is calibrated to the costs of the individual market population.

Our starting point for our estimate is the Congressional Budget Office, or CBO, score of the AHCA, which projected the premium for an individual of age 40 would be $6,050 per year in 2026. Because the CBO score assumed community rating and because 40 is the average age in the exchanges, we believe that $6,050 is a good approximation of what the average premium would cost in that year for the exchange population. We therefore assume that $6,050 would be the premium for someone with average plan liability risk, or a score of 1.0. This person would be of average health status and therefore not perfectly healthy.

We applied just the CMS risk adjustment factors for age and sex in order to represent the plan liability for a healthy individual. We took the risk factors for a male aged 40 to 44 (score of 0.221) and a female aged 40 to 44 (0.455), to generate a weighted average risk score for a 40-year-old (0.347) using the current male/female proportions in exchange enrollment. Multiplying the risk score by the average premium implies that $2,100 would be the actuarily fair premium for a 40-year-old with no health conditions.

Health plans would set premiums at the time of application and would need to price in unforeseen conditions among apparently healthy people. For example, enrollees may not become pregnant or receive a cancer diagnosis until after enrollment. Because current diagnoses and medical history are not perfect predictors of future health status, we assume the risk score for an enrollee with no conditions at the time of application would be 0.674, halfway between the average among all enrollees (1.0) and that of a person who remains healthy all year (0.374). This equates to a standard rate premium of roughly $4,020 annually for individuals healthy at the time of application.

We then used the CMS risk adjustment factors to estimate the relative cost of selected health conditions relative to the cost of a healthy individual, then converted these into dollar amounts representing premium surcharges. For example, an asthma diagnosis adds 0.717 to an individual’s risk score, increasing it by 106 percent. The asthma patient would pay a surcharge of $4,340 on top of standard rates for coverage because of that condition. Metastatic cancer adds a factor of 23.6 to an enrollee’s risk score, such that a patient with advanced cancer would pay an additional $142,650 for coverage. To simulate the effect of the invisible risk pool, we lowered each amount by 1.5 percent.

Note that because the risk adjustment program calculates scores using each year’s current diagnoses, rather than medical history, we were unable to apply our method to estimate the rate ups individuals would face for prior health conditions. Our method also does not account for the adverse selection that would occur if community rating were repealed. The surcharges for pre-existing conditions would likely deter some relatively healthier sufferers of each condition to forgo insurance. Actual surcharges would, therefore, reflect the cost of treating the more severe cases of each condition and be higher than the amounts we estimate.