Introduction and summary

Florida—with its vibrant cities, vast coastlines, diversity, and thriving agriculture and tourism industries—draws high numbers of visitors and new residents who help to drive the state’s gross domestic product, which topped $1 trillion in July. If Florida were a nation, it would be the 17th-largest economy in the world.1 Florida is the nation’s third-most populous state and is fast approaching 21 million people; yet its growth and economic vitality offer only a partial picture of life in the Sunshine State.2

Income inequality is rising as Florida’s population swells. The burdens of extreme weather events and sea level rise, driven by a changing climate, are only getting worse for communities, aging infrastructure, and government and household budgets. More intense hurricanes and flooding damage homes and roads, knock out electricity, threaten public health, and take a bite out of paychecks as well as businesses’ bottom lines. Rising temperatures force families trying to make ends meet to choose between necessities like food or air conditioning. These consequences are hard on Florida residents, the majority of whom live without the financial stability to get by when wages drop, when flooded streets prevent them from getting to work and when medical, home repair, and electricity bills climb in the wake of dangerous hurricanes, floods, and heat waves.3

State leaders will increasingly be confronted with the need to support future-ready communities and infrastructure that is designed to withstand 21st century threats while improving families’ economic stability and protecting the air, water, and natural areas that voters deeply value.4 In order to alleviate the pressures of rapid population growth and more extreme weather, state leaders need a comprehensive and sustainable long-term strategy to close the state’s future-ready infrastructure investment gap.

To safeguard Floridians against the impacts of sea level rise and extreme weather, the Center for American Progress and the CLEO Institute recommend that state leaders create a “Florida Future Fund.”5 This state fund would use a blend of public and private investment—as well as financing products—to support innovative transportation and energy infrastructure projects and flood protections in areas that need them the most. The fund would provide low-interest or interest-free loans, loan guarantees, and other financing products. It would also leverage philanthropic and private capital in order to expand investment in future-ready infrastructure, including community solar projects, energy efficiency improvements, regional transportation services, public transit upgrades, electric vehicle charging stations, parks, and other community flood protections. These investments would improve Florida’s resilience and quality of life, creating good jobs; lowering energy bills; reducing costly flood damage to homes and businesses; and efficiently connecting people to employment opportunities, child care, schools, and other critical community services.

In sum, the Florida Future Fund offers state leaders a forward-thinking and equitable approach to modernizing the critical infrastructure needed to support the state’s economy, and help communities prepare for the future as extreme weather risks increase and the sea rises.

Sea level rise and extreme weather threaten communities and infrastructure

Floridians are on the front lines of sea level rise, which, when coupled with high tides, more intense downpours, and stronger hurricanes, causes more frequent flooding and higher storm surges.6

Florida cities are often named among the most vulnerable to sea level rise globally.7 Between 1985 and 2016, the sea level rose six inches around Florida.8 This rise has had a measurable impact on communities. From 2006 to 2016, flooding from high tides in Miami Beach has increased by roughly 400 percent.9 Some residents in low-lying Florida communities are already starting to change their behavior in order to adapt to more frequent flooding, which is only expected to get worse.10

Currently, the rate of global sea level rise is four inches or more per decade—a rate that has tripled over the past 10 years.11 Based on this rate, scientists project that over the next 30 years, Florida’s sea level will rise approximately an additional 13 inches.12 If this rate continues to accelerate, by the end of the century, the sea level around Florida could potentially rise more than six feet.13 At this level, numerous Florida communities, like Miami and St. Petersburg, will face chronic flooding and inundation.14

Floridians also face climbing temperatures and extreme heat waves, making it impossible to depend solely on sea breezes for cooling.15 This means higher costs for homes and businesses that will now have to install and more frequently use air conditioning systems.

Sea level rise and extreme weather threats increase the strain on Florida’s aging energy, transportation, and water systems as well as on other infrastructure that supports the state’s economy and the daily lives of residents.16 In the face of a changing climate and growing population, without a massive modernization investment in Florida’s infrastructure, state residents’ prosperity and quality of life will suffer.

Despite the state’s strong gross domestic product and growing economy, Florida has the fifth-highest income inequality among states in the nation and financial instability is commonplace among Florida households.17 More than 57 percent of Florida residents do not have money set aside in case of an emergency, which ranks them last in the nation for emergency savings.18 This lack of an emergency cushion means that in the wake of an extreme weather disaster, nearly six out of 10 Floridians may not be able to pay for food, critical health care services, child care, emergency housing, or home repairs without going into debt or falling deeper into poverty.

Without a massive modernization investment in Florida’s infrastructure, state residents’ prosperity and quality of life will suffer.

To make matters worse, nearly 15 percent of Floridians live in poverty.19 According to the Prosperity Now Scorecard, Florida ranks 42nd among states and the District of Columbia in resident prosperity.20 In other words, many Floridians are liquid asset poor, are unable to pay bills, and cannot afford higher education, health care, or transportation to and from work.21

Major storms—like Hurricane Irma—can put even more strain on communities by rendering services and basic infrastructure unavailable. This puts Floridians in tenuous economic, health, and safety situations. In 2017, Irma took 87 lives in Florida, and the storm’s damage cost state agencies and county governments roughly $1.7 billion.22 While some of these expenses will be covered by federal disaster aid, the state and local governments will shoulder a portion of the storm’s financial burden. When hurricanes knock out the power or damage roads, businesses and residents lose money because many workers are unable to get to work, and businesses often must remain closed.23 Based on insured value, Florida’s coast is the second-most vulnerable to hurricanes among U.S. coastal states.24

Irma caused harmful flooding from north to south, affecting cities such as Jacksonville, Tampa, and Miami.25 Statewide, 3.8 million customers lost power, including in areas that were spared the worst of Irma’s damage—like Tallahassee.26 Power outages in Florida’s subtropical heat can be deadly. In South Florida, 14 nursing home residents died when caretakers left them for 62 hours in rooms that reached 99 degrees after a loss of power caused air conditioning to cut out.27

Unfortunately, blackouts are now more common in the southeastern United States. More frequent and powerful storms damage powerlines, and more customers overburden the grid by turning on air conditioners in order to escape rising temperatures and intense heat waves.28 By as early as 2041, the majority of Florida is expected to see at least 75 more days per year of 95 degrees or higher, compared with its historical climate.29

This high heat will make energy burdens heavier, meaning that the percentage of income households devote to energy bills will increase. Families who live paycheck to paycheck are likely to feel the weightiest increase. According to a study by the American Council for an Energy-Efficient Economy, 50 percent of low-income households in major Florida cities have, on average, an energy burden of up to three times the national average.30 This is often because families struggling to make ends meet in Florida live in homes that are old, energy-inefficient, and in need of substantial repairs.31

Extreme temperatures can spike energy bills, especially for households living in heat islands—urban neighborhoods where concrete and asphalt surfaces absorb and radiate heat, producing temperatures that are warmer than in surrounding areas.32 Given Florida’s temperature trends, air conditioning can be a lifesaver for children, the elderly, and people with disabilities. Yet, for low-income households, paying higher energy bills to run air conditioning units means having less money available for groceries, rent, health care, and other expenses.33

In addition, climbing temperatures worsen outdoor air quality and public health, as common air pollutants like ozone concentrate in hot areas.34 Rising temperature trends put pressure on thousands of Floridians living in urban areas that consistently fail air quality standards, such as Tampa, Miami-Dade, Orlando, and St. Petersburg. These failing air quality grades are primarily due to traffic congestion, and they threaten those with respiratory and cardiac conditions.35

Insufficient transportation planning can also exacerbate poor air quality and create significant costs and inconvenience for residents. For example, traffic congestion and delays cost each commuter in Miami and Orlando at least $1,000 annually.36 While modern and efficient public transit can substantially reduce traffic jams and pollution, 98 percent of commuters in Florida do not use public transit because they lack access to reliable, linked, and safe transit services.37 In rural areas, transportation is mainly limited to driving personal vehicles. Therefore, mobility is a major challenge in rural areas where not everyone can afford to own and maintain a vehicle.38

When extreme storms strike, such a lack of mobility options can be a safety issue. Rural communities are sometimes located far from first responders and other key community services. Additionally, due to the legacies of disinvestment and segregation, communities of color in both rural and urban areas can find it particularly difficult to evacuate. If main roads are flooded, individuals from these communities must overcome a lack of safe transportation options and/or a lack of route alternatives with which to evacuate by car.39 For those that can reach transportation, affordability can be a major issue. During the evacuation of Florida ahead of Hurricane Irma, the cost of airline tickets skyrocketed due to high demand.40

State leaders can reduce the public health and economic threats of more extreme weather and sea level rise by expanding investment in future-ready energy and transportation systems, flood protections, and other neighborhood improvements.41

Florida must lead on 21st century infrastructure solutions

The risks of sea level rise and more intense extreme weather in Florida are exacerbated by aging infrastructure, rapid population growth, and pervasive economic instability. As such, these challenges demand an effective and long-term response from state and local leaders. Currently, state leaders are not investing in deployable technologies and forward-looking solutions to improve Florida’s infrastructure at the pace and level needed to address the state’s challenges.

For example, clean energy and energy efficiency projects can improve energy security and indoor living conditions; transportation upgrades can enhance mobility and reduce local pollution; and tree, wetland, and coastal restoration projects can reduce flooding. Yet public and private investments are often directed toward other priorities rather than cleaner and more innovative projects that reduce climate change threats. As a result, the state has a future-ready infrastructure funding gap, particularly in low-income areas, communities of color, and tribal communities, all of which are already placed at risk and at a severe disadvantage by discriminatory and neglectful past and present public policies and planning decisions.

The state has taken some small first steps to improve the sea level rise and extreme weather readiness of Florida infrastructure. For example, in 2017, Florida leaders approved a spending package with $4 billion devoted to protecting Florida’s beaches, parks, springs, and the iconic Everglades, which can buffer communities from flood waters and storm surges.42 This amount included $62 million for beach and coastal restoration statewide; however, only $3.6 million of these funds were devoted to coastal resilience.43 Additionally, state leaders set aside $151 million for bike and pedestrian pathways.44

Other successful initiatives in Florida include Florida Forever, the Coastal Partnership Initiative grant program, Resiliency Florida, the Solar and Energy Loan Fund, and the state’s transportation infrastructure bank.45 While these efforts make critical investments in land conservation, coastal protections, and water, energy, and transportation resilience, more resources are needed. Though $101 million is allocated in the budget for the Florida Forever conservation program, conservation advocates allege that state leaders have underinvested in the program, putting Florida’s government in noncompliance with a voter-approved 2014 constitutional amendment requiring a specific allotment of annual funding.46

In July 2017, the Miami Beach City Commission approved a law that, for the first time in Florida, required new and some remodeled homes to install solar panels.47 Increased solar capacity can improve electricity reliability when power lines are damaged during hurricanes and other extreme weather events.48 In addition, in April 2018, the PSC issued a ruling that removed a roadblock to rooftop solar leasing programs when it approved a lease by Sunrun.49 The ruling is expected to spark growth in the residential solar industry. At the end of 2017, state leaders updated commercial building codes to require more energy-efficient lighting and started several new energy efficiency programs for farming communities.50 While these are small steps in the right direction, they will not fill the energy efficiency and solar energy gaps created by a 2014 PSC ruling to reduce statewide energy efficiency goals by 90 percent and end the state solar rebate program.51 In addition, Florida neither has a comprehensive energy policy nor a renewable portfolio standard (RPS), which requires a specific amount of electricity sold by utilities to come from renewable energy sources. Since 2000, RPSs in 29 states, the District of Columbia, and three U.S. territories have fueled about half of the country’s renewable energy growth.52

Among U.S. states, Florida has the third-highest potential for rooftop solar.53 In 2017, it ranked third among states in solar energy growth.54 Despite high demand for solar power, solar makes up less than 1 percent of Florida’s total electricity generation capacity, placing the state 12th nationally in cumulative solar capacity installed, according to the Solar Energy Industries Association.55 For these reasons, in 2016, Florida voters blocked a utility-sponsored amendment to Florida’s constitution that would have limited rooftop solar expansion.56

To address the above opportunities and challenges, state leaders must move quickly to develop a forward-thinking, equitable, and sustainable infrastructure investment strategy that accelerates the clean energy transition and prepares both communities and the economy for long-term extreme weather, sea level rise, and population growth trends. In 2017, the American Society of Civil Engineers gave Florida infrastructure a C grade, and the condition of Florida’s transit system ranks 19th out of all states—just behind Georgia.57 State leaders’ current approach may be enough to maintain a passing grade for Florida infrastructure, but it places too much dependency on direct appropriations and the whims of state House politics. For this reason, the state is at risk of continually falling behind in the years to come.

Instead of relying on temporary fixes, Florida leaders must use a long-term strategy to jumpstart future-ready infrastructure solutions that will support a strong, clean, and inclusive economy; improve neighborhood livability; and protect the air, water, and natural areas that voters deeply value.58 The majority of Floridians demand a smarter and more forward-thinking response to the state’s pressing infrastructure, sea level rise, and extreme weather challenges.59 Florida policymakers have a responsibility to meet this demand.

By building future-ready energy systems, transportation infrastructure, and neighborhood flood protections that can better withstand climate change threats and the demands of a growing population, state leaders can strengthen economic security, improve equity, and protect statewide public health and safety.

Recommendation: Create a Florida Future Fund

Upgrading aging infrastructure that puts communities and local economies at risk in a changing climate must be a top priority for Florida. By creating a Florida Future Fund, state leaders would open up new and innovative financing pathways to modernize Florida’s infrastructure while reducing flooding and extreme weather threats.

The Florida Future Fund would complement ongoing successful initiatives such a. Coastal Partnership Initiative, Resiliency Florida, and others mentioned above. Upon establishing a Florida Future Fund, state leadership could also propose that U.S. Congress pass legislation to help capitalize State Future Funds in every state using federal funds to help modernize infrastructure in Florida and across the nation.60 The Federal Green Bank Act of 2017 could provide such a funding source.61

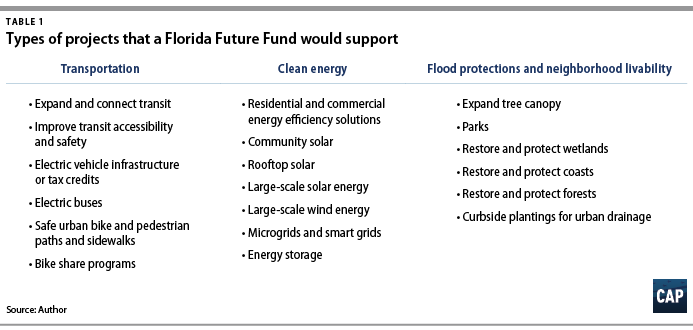

The Florida Future Fund would improve the mobility of Floridians and reduce local pollution, for example, by making needed investments in transportation sector improvements—including:

- Upgrading and linking regional transportation services

- Modernizing public transit systems

- Installing electric vehicle charging stations

- Deploying electric buses, electric vehicles, and bike-share systems

- Building safe bike and pedestrian paths

To strengthen energy security and affordability in homes, businesses, and communities, the Florida Future Fund would also invest in energy and building sector improvements, for example, by:

- Deploying community solar, rooftop solar, and large-scale renewable energy generation facilities

- Upgrading the power grid

- Building community microgrids and smart grids that incorporate energy storage technologies

- Updating municipal building codes for solar and energy efficiency

- Supporting energy efficiency improvements that will keep more dollars in Floridians’ wallets

Lastly, to improve neighborhood livability and shield residents, businesses, farms, and community services from floods and storm surges, the Florida Future Fund would support community improvement projects, for example, by:

- Building new parks

- Installing curbside plantings to improve drainage

- Expanding urban and rural tree canopy

- Updating municipal planning and development codes for flood reduction.

- Protecting coasts and natural areas—such as forests, wetlands, and the Everglades

The Florida Future Fund would prioritize project investments in communities that need it the most, including low-income areas, communities of color, and tribes. To support local job creation, the fund could pair investments made in these communities with job training programs. As shown in Table 1 below, the Florida Future Fund would support ready-to-deploy solutions that embrace best practices as well as more innovative project designs that would reduce future threats.

Smart infrastructure investments pay back dividends to communities and taxpayers

The infrastructure projects supported by the Florida Future Fund would strengthen Florida’s economy and improve residents’ daily lives, for example, by creating jobs, cutting energy bills, and reducing time wasted sitting in heavy traffic.62 Fund investments would also lower public health risks and economic losses tied to extreme weather damage to homes, businesses, and industrial and hazardous waste sites.63

Florida could offset 47 percent of its total electricity consumption through rooftop solar alone.

As electricity demand in Florida rises due to a growing population and increased use of air conditioning, the Florida Future Fund would help the state use solar energy to meet a greater portion of its electricity consumption by supporting community solar projects that use school and other public building rooftops. The Florida Future Fund could also provide financing in order to improve the affordability of rooftop solar for households and business owners. According to an analysis by the National Renewable Energy Laboratory, Florida could offset 47 percent of its total electricity consumption through rooftop solar alone.64 These Florida Future Fund projects would improve the state’s energy security by reducing strain on the grid and lowering energy bills for households. They could also create thousands of jobs and support small businesses in the solar industry. While, in 2017, Florida ranked fifth among states in solar jobs, with more than 8,500, it is ranked 35th in the nation for solar jobs on a per capita basis, with significant potential for growth.65

State leaders could also create jobs by investing in Florida Future Fund projects that modernize transportation systems. According to the U.S. Department of Transportation, over 10 years, every $1 billion invested in modernizing infrastructure creates roughly 13,000 direct and indirect jobs.66 Based on this analysis, if Florida state leaders dedicated the $1.3 billion needed to improve and connect the state’s existing transit systems, they could create approximately 16,900 direct and indirect jobs.67

According to an analysis of publicly available information, after Hurricane Sandy, $3.2 billion in federal funds for rebuilding infrastructure and communities created 81,000 jobs in New York City.68 Similarly, the Florida Future Fund would invest in infrastructure that would create jobs and be designed to withstand future sea level rise and extreme weather threats.

The Florida Future Fund would also help Floridians lower future flooding and extreme weather damages and costs. Risk management experts estimate that for every $1 invested in building resilient communities and infrastructure, $6 are saved in future costs—including economic disruptions, property damage, public health crises, and deaths caused by extreme weather disasters.69 Based on this estimate, if state leaders invested $283 million across the state in infrastructure to prepare areas vulnerable to sea level rise and extreme weather, Florida taxpayers could save nearly the same amount that they paid to repair damage from Hurricane Irma—approximately $1.7 billion.

The economic benefits of Florida Future Fund investments could be distributed across urban and rural areas by expanding economic opportunities in the communities where projects are located; by reducing the costs of future flooding and disaster damage; and by helping business owners and residents save money on their energy bills. For example, the fund could support flood protections and future-ready public transit projects to help safeguard city centers from future threats while improving economic mobility and air quality. In addition, by reducing certain flood risks, the fund could bolster the state’s agricultural, outdoor recreation, and tourism economies, on which rural and urban residents alike depend.

To design a Florida Future Fund that will drive smart investments into future-ready projects, state leaders can draw lessons from similar funds in other states. For example, infrastructure funds in states such as New York, Michigan, and California have used innovative capitalization and finance options, sound and equitable project criteria, and strong community engagement and oversight processes. Taken together, they can inform Florida state leaders on how to design a Florida Future Fund. These and other fund design options are described below.

A blueprint for creating a Florida Future Fund

A Florida Future Fund would give state leaders an opportunity to efficiently and effectively channel new investments into future-ready infrastructure that would better support Florida’s communities and economy. This section discusses options for state leaders to establish and design a Florida Future Fund and to ensure that the fund makes wise project investments guided by good governance measures, strong project criteria, transparency, and meaningful public engagement, all aimed to deliver clear benefits to Floridians. In a state where city streets flood even on sunny days, state leaders must recognize that there is little time to waste and begin investing and innovating in order to save what makes Florida home.70

A Florida Future Fund could be established either by the governor through executive action or through legislative action, as New York and Connecticut have done, respectively, to create their green banks.71 A fund could also be created as a program within an existing agency or organization. For example, the Florida State Infrastructure Bank was established as a program of the Florida Department of Transportation.72 State green banks have also been created as programs within the state public utility commissions, as stand-alone state agencies, and as private and independent nonprofit corporations with state oversight.

Green banks that are established as programs and state agencies have experienced a mix of successes and challenges. For example, housing a financial entity within state government can increase the risk that funds will be diverted to cover other government expenses, and it creates bureaucratic hurdles that slow the flow of capital to private and public project developers. To avoid funding delays or diversions, Nevada lawmakers are considering making the state’s green bank, established in 2017, a private nonprofit corporation.73 The independent nonprofit model is appealing to state leaders because it would efficiently channel investments to support Nevada’s budding clean energy market, creating new jobs and improving public health and safety, all while reducing air and carbon pollution.

Ideally, Florida policymakers would establish a Florida Future Fund as an independent nonprofit entity with strong rules that would protect the fund’s resources from being diverted for other purposes. These protections could be included in the executive action or legislation that establishes the fund, or they could be secured later through a ballot initiative. For example, in 2014, voters approved a constitutional amendment to the Land Acquisition Trust Fund, which ensured that, going forward, the same amount of documentary stamps tax revenue used to pay off Florida Forever’s original capitalization bonds would be devoted to the program.74 Without such protective measures in place, Florida Future Fund revenue could be cut or diverted to other initiatives, which would slow progress toward bringing future-ready infrastructure and neighborhood improvements to Floridians.

Ensuring good governance

The Florida Future Fund should be structured to meet high governance standards. Policymakers can do this by establishing a fair and transparent project review process; metrics to meet social, environmental, and economic measures; and a strong investment plan informed by input from local government and community leaders. If state leaders create a strong and credible governance structure, they can avoid the potential for funds to be diverted for other purposes, misused on projects that do not deliver clear benefits, or awarded based on political favoritism. For example, to guarantee that funds are spent wisely, the Connecticut Green Bank bylaws require its board to use specific project review, award, and transparency processes. This includes conducting annual private audits, posting project information online, and collecting annual statements from project developers awarded funds for projects other than for small residences.75

The Florida Future Fund’s charter can be designed to create a fund board that will ensure public accountability and effective fiscal oversight. In Connecticut, for example, the green bank has a board that is composed of the secretaries of the different state departments as well as community and private sector representatives. Michigan’s green bank is governed by 18 people representing government, the private sector, and community interests.76 In contrast, New York’s green bank is advised by four people with banking and reinsurance credentials.77 In Miami, projects funded through the Miami Forever bond program, which include flood protections and neighborhood improvements, will be governed by the city commission and monitored by a revolving seven-person citizens oversight board and public hearings.78 The board will consist of seven community residents and activists appointed by Miami’s commissioners and mayor.79

To ensure a good mix of public, private, and community leadership, Florida state leaders should consider including the following representation on a Florida Future Fund board:

- Two private sector representatives from Florida’s community banks, development sector, and investment sector who can speak to encouraging a nimble flow of capital

- At least two community advocates from low-income rural and urban areas who can ensure the equitable design and implementation of projects

- One clean energy and one transportation expert, both of whom can knowledgeably speak to the pace and change of innovation in each sector

- One expert on sea level rise and extreme weather threats to Florida’s communities and infrastructure

By creating a transparent project review process with equitable criteria, fair metrics, and balanced Florida Future Fund leadership, state leaders will ensure that the fund invests in projects that will improve the quality of life and future readiness of all Floridians.

Capitalizing the Florida Future Fund with public and private dollars

At its inception, the Florida Future Fund should be capitalized with a combination of different public funding streams, thereby allowing Florida leaders to tap into a flexible and diversified source of capital to support the future readiness of infrastructure and communities. The scope and growth rate of the Florida Future Fund is dependent on the amount of seed money raised and whether initial funding will be augmented with a continuous revenue stream. Therefore, to launch an effective fund, state leaders would need to determine the right mix of local, state, and federal public resources.

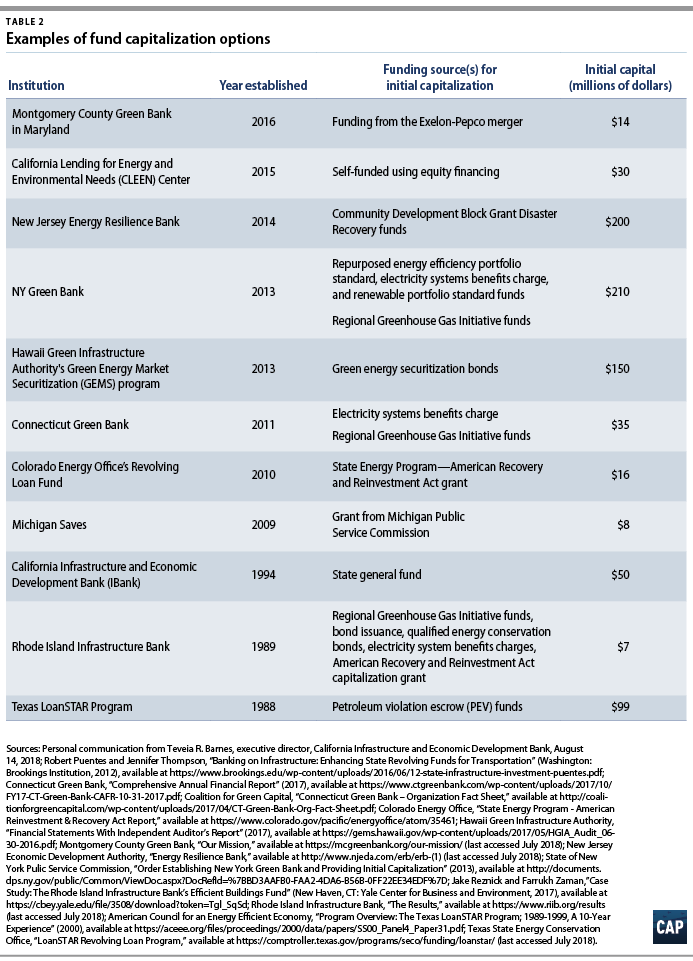

They could also structure the Florida Future Fund to help fill the future-ready infrastructure spending gap by leveraging private dollars. Philanthropies, utilities, and investment banks are all potential partners for state leaders to augment public spending for Florida Future Fund capitalization and implementation. Options for Florida leaders to create a blend of public and private dollars are described below, and examples of how various state infrastructure funds were initially capitalized are included in Table 2.

Bonds

Given the sophistication of the U.S. municipal bond market, state leaders should consider issuing state bonds to capitalize the Florida Future Fund. Known for their beneficial tax treatment, nontaxable bonds would allow the Florida Future Fund to attract private capital from investors to supplement public resources, enhancing the operations and capabilities of the Florida Future Fund in the process. Bond issuance is a common method used by local, state, and federal governments to fund infrastructure projects. For example, in November 2017, voters in Miami approved the Miami Forever Bond, a $400 million general obligation bond that will pay for infrastructure projects that address climate change impacts, increase affordable housing, and encourage economic development.80

Appropriations

State leaders should also consider identifying a constant, dedicated revenue stream to ensure the long-term viability of the Florida Future Fund. The most direct method of public investment in the Florida Future Fund would be appropriations from the state’s annual budgeting process. This method would allow state leaders to take an active role in ensuring that the Florida Future Fund has sufficient resources to address the economic, social, and political realities of the state. However, while direct appropriations would be the simplest way of capitalizing the Florida Future Fund, this approach is susceptible to potential budget shortfalls, changes in the political landscape, and competing funding priorities—especially if the fund is primarily composed of public capital.

Tax revenue

Other streams of capital could be collected by expanding sources of tax revenue, for example, by slightly increasing the existing documentary stamps tax on commercial and residential real estate transactions. In 2017, there were $113.7 billion in residential real estate transactions across the state, so a documentary stamps tax increase of just 5 cents for every $100 of real estate sold could generate roughly $57 million in new annual revenue for the Florida Future Fund, counting just Florida’s residential transactions.81

Electricity system benefits charge

In addition, Florida could implement a small charge on consumers’ electricity bills—known as a system benefits charge—to secure a constant revenue stream for the Florida Future Fund. In New York, state leaders determined that a system benefits charge that had been devoted to existing clean energy programs would be put to better use if it created and funded a green bank. Established with a 2013 executive action, the NY Green Bank was initially capitalized at $210 million, which included a combination of reallocated energy efficiency portfolio standard, renewable portfolio standard, and system benefits charge funds.82 As of 2016, Florida had more than 9 million residential ratepayers, each of whom consumed, on average, 1,123 kilowatt-hours (kWh) per month and paid about 10.98 cents per kWh, resulting in a monthly electricity bill of $123.37.83 If Florida were to implement a fixed system benefits charge of between $10 to $20 per year on all residential ratepayers, the state could raise anywhere between $91.4 million and $180.2 million annually for the Florida Future Fund. Montana took a similar approach in 1997 when it established its universal system benefits program, which requires all electric utilities to place a surcharge on customers’ electricity consumption based on 2.4 percent of electric utilities’ 1995 revenues.84

The systems benefits charge could also be collected on a volumetric basis—based on the amount of electricity a household uses, usually in the form of a charge per kWh. For example, New Hampshire adds a 0.348 cents per kWh systems benefit charge to consumers’ electricity bills, whereas Eversource Energy in Connecticut charges 1.02 cents per kWh and Orange and Rockland Utilities in New York charges 0.587 cents per kWh.85 The volumetric approach is often seen as more equitable than a fixed charge since consumers with the lowest electricity demand pay less to support energy system improvements than high demand users. State policymakers should strongly consider equity and seek public feedback when deciding between a fixed or volumetric-based system benefits charge.

Philanthropy

Foundation grants or private giving could also serve as potential sources of capital for the Florida Future Fund. To curb pollution and climate change, foundations all over the world are funding local, regional, national, and global entities. For example, in 2016, The Kresge Foundation invested $3 million in the Connecticut Green Bank to support clean energy in affordable housing.86 In 2017, Washington, D.C., received a $60,000 Partners for Places Equity Pilot Initiative grant to equitably implement the city’s resilience and clean energy plans through meaningful community engagement.87 During its 50th anniversary year, the Miami Foundation, which focuses on community philanthropy, supported the Miami Forever Fund by raising more than $1.5 million from individuals and organizations.88

Given Florida’s vulnerability to powerful hurricanes, sea level rise, flash flooding, and extreme heat waves, state leaders could invite grants or donations from private foundations to support the Florida Future Fund. Foundation grants offer the Florida Future Fund the opportunity to secure resources that are not subject to the politics surrounding tax revenue, appropriations, or bond issuance. However, grant funding from foundations or donations can be intermittent, so it may not serve as a stable source of financing for the Florida Future Fund over time. Also, state leaders would need to focus on foundations with goals that matched those of the fund.

Utility partnerships

Given that Florida utilities contribute nearly half of all energy-related carbon pollution in the state, Floridians would substantially benefit from an expansion of the state’s utility investments in energy efficiency and renewable energy generation.89 Apart from Tampa Electric, which spends roughly $6.30 per customer on low-income energy efficiency programs—more than twice the national median—Florida’s other electric utilities devote between 2 cents and $2.12 per low-income customer to make efficiency improvements.90

To take advantage of Florida’s clean energy market potential, state leaders could explore meaningful partnerships with electric utilities in an effort to deliver direct and measurable benefits to the state’s electricity consumers. Under these partnerships, utilities could, for example, commit to investing at least 6 percent of revenue in energy efficiency programs—in line with the nation’s top energy-efficient utilities and tripling their current investments in renewable energy generation capacity by 2030 through contributions to the Florida Future Fund.91 These investments would benefit utility customers by lowering electricity bills, mitigating local air and carbon pollution, and improving electricity system reliability.

Leveraging private investment

By learning from the experience of successful state green banks and conservation financing initiatives—and by partnering with community development banks—Florida state leaders can design the Florida Future Fund to attract the private capital needed to scale up investments in future-ready infrastructure.

After the Connecticut Green Bank was established, every public dollar invested by the bank in clean energy projects drove $6 of private investment.

In 2017, Connecticut’s green bank won the prestigious Innovations in American Government award from the Ash Center for Democratic Governance and Innovation at Harvard University.92 The award was in recognition of Connecticut state leaders’ forward-leaning approach of leveraging private dollars to invest in projects that paid dividends back to taxpayers.

In the 11 years prior to the creation of the Connecticut Green Bank, the state provided subsidies to rooftop solar customers in the form of rebates in order to help meet the state’s greenhouse gas reduction goals. This approach matched private dollars with public dollars at a rate of 1-to-1.93 After the Connecticut Green Bank was established, every public dollar invested by the bank in clean energy projects drove $6 of private investment, as recorded through fiscal year 2016.94 Although the Connecticut Green Bank began in 2011 with only a $35 million capitalization, it has now leveraged nearly $800 million in private capital to generate small-scale clean energy and transportation system investments of more than a billion dollars.95 As a result, Connecticut’s green bank has created more than 12,000 clean energy jobs within the state and has deployed nearly 200 megawatts of renewable capacity. Connecticut’s green bank success has inspired at least eight other states to launch their own green banks.

In Michigan, the state green bank, Michigan Saves, has generated more than $100 million in small-scale energy efficiency and renewable energy solutions for homes and businesses—such as geothermal, battery storage, solar photovoltaic, and thermal systems—saving residential customers and businesses nearly $9 million.96 In 2018, state leaders embraced the Michigan Saves green bank program’s success and set the lofty goal of turning $100 million in project investments into $1 billion in total investments by 2023.97

In New York, which is comparable in population to Florida, state leaders started with a $210 million public capitalization of the NY Green Bank. To date, the bank has invested $458 million in various clean energy and energy efficiency projects while achieving financial self-sustainability.98 Likewise, the California Infrastructure and Economic Development Bank (IBank) has financed more than $38 billion in infrastructure and economic development projects with an initial capitalization of $50 million from the state’s general fund.99

Like some clean energy and mobility projects funded by green banks, natural infrastructure—such as wetlands—has historically been supported by public investment due to its perceived lack of value in the private investment market. In reality, natural infrastructure provides vast benefits, from improving community flood protections to supporting tourism and the outdoor economy. Most natural infrastructure projects supported by the Florida Future Fund would likely require public funding. However, state officials and private sector groups in Louisiana, Maryland, and Nevada have begun to successfully leverage private investment to fund the conservation of important natural infrastructure. By monetizing natural infrastructure as eco-assets and giving it a market rate, state leaders can provide property owners and developers with financial incentives to restore natural infrastructure, thereby supporting conservation efforts and community flood mitigation.100

In addition to learning from successful state green banks and conservation financing models, Florida state leaders could design a Florida Future Fund that would work with community banks to drive investments in future-ready infrastructure that meets community needs. The fund could also work with larger investment banks from Florida’s financial sector or investors outside of Florida to back innovative infrastructure and neighborhood improvement projects that benefit Floridians.

Florida leaders could also leverage private investments pooled by other state infrastructure banks, such as the NY Green Bank. New York is in the process of creating a stable clean energy and small-scale transportation infrastructure funding portfolio that will attract $1 billion in investment from banks, pension funds, and other groups. One could argue that, given the large economic potential of renewable energy and the need for energy efficiency solutions in homes and businesses across Florida, private investors in the NY Green Bank could be drawn to invest in Florida’s clean energy market via a Florida Future Fund.

Depending on the will of state policymakers, the potential public and private revenue streams described above could support the Florida Future Fund for a set period or indefinitely. By securing continuous revenue streams, the Florida Future Fund would be able to maintain liquid assets and could allocate resources to projects that may take longer to earn a return. Additionally, if designed with a recurring revenue source, the Florida Future Fund could become self-sufficient, enabling it to address critical infrastructure and environmental challenges for years to come.

Since each capitalization option can alter the Florida Future Fund’s operations and capabilities, state leaders should consider what combination of funding sources is most suitable for establishing and sustaining a fund that will support 21st century energy and transportation infrastructure as well as the flood protections that Florida needs.

Setting smart and equitable project criteria

Florida leaders should instruct the board of the Florida Future Fund to set project criteria that will channel new and equitable investment in innovative transportation solutions, energy systems, and flood protections, all of which support extreme weather preparedness, economic development, and public health and safety. For example, the New York Green Bank has investment criteria that are designed to more efficiently accelerate clean energy development in the state; these include ensuring that financial transactions happen at market rate, contribute to market growth, and support the state’s greenhouse gas reduction policies.101 Florida could set similar criteria to support a rapid increase in energy efficiency improvements and renewable energy use.

Given the affordable and workforce housing shortages, coupled with the rising cost of living in Florida, the Florida Future Fund should also include criteria to ensure that project developers work with local officials and community leaders to design and implement strategies to reduce the risk of long-time residents being displaced from their communities as neighborhood improvements drive up rents.102 These strategies could include an expansion of affordable housing; more inclusionary zoning that breaks down long-standing structural barriers and allows for greater housing density; community land trusts to support locally owned housing and business assets; and job training programs to support access to good careers and jobs.103

The Florida Future Fund should include the following project criteria to meet social, environmental, and economic measures:

- Support socio-economic mobility and affordable access to good jobs, schools, child care, and community services

- Lower energy use and costs for residents

- Reduce local air pollution and greenhouse gas emissions

- Reduce the risks of damage from hurricanes, flooding, heat waves, other extreme weather, and sea level rise for residents and businesses

- Support equitable and gainful economic opportunities for low-income households, communities of color, tribal communities, women, and/or the disabled

- Reduce the risks that low-income residents are displaced from their communities by climate change threats and neighborhood improvements that drive up rents

- Create good jobs with fair wages and support the local economy

Lastly, state leaders should require that between 25 to 50 percent of Florida Future Fund capital is invested in communities with the greatest need. This includes low-income areas and communities of color, both of which have historically been situated in or near precarious environments highly exposed to sea level rise, flooding, and heat waves, among other environmental hazards.

By setting strong project criteria for the Florida Future Fund and designating a substantial portion of the funds to communities that most need future-ready infrastructure, state leaders can maximize economic, public health, and quality of life benefits for Floridians.

Financing options for future-ready projects

Since different future-ready infrastructure solutions have varying financing challenges, a Florida Future Fund could offer an array of financial services and products matched to overcome the specific deployment barriers of projects, from home energy efficiency improvements to city electric buses.

As only 45 percent of Florida credit users are currently able to access prime credit, state leaders should design the Florida Future Fund to increase access to energy efficiency, renewable energy, and other community, business, and household improvements throughout the state—including in rural areas and urban communities often left behind.104 For example, the Florida Future Fund could offer favorable financing options and incentives for projects in economically disadvantaged areas, including zero- or low-interest loans or loan guarantees for municipal projects such as public transportation upgrades or smart grid improvements. The Florida Future Fund could also reduce risks for private investors on needed clean energy and other projects by underwriting up to 100 percent of the loans for applicants in financially “risky” communities or municipalities and then grouping and warehousing the loans to create a scale large enough to be palatable for a private investment sale. Some green banks have securitized loans to help small clean energy projects that were formerly cut off from low-cost capital to access publicly traded debt markets. In Florida, the multistate Warehouse for Energy Efficiency Loans program for rural electricity customers uses this approach to securitize loans to reduce household energy use and lower electric bills.105

The Florida Future Fund could also provide credit enhancements, rebates, and grants to individuals and municipalities, depending on the type of project and scale. For example, while individuals may use credit enhancements, rebates, and grants to purchase solar home systems, municipalities could also use them to fund neighborhood improvements and flood reduction strategies, including tree canopy expansion or curbside plantings to absorb storm water.

Lastly, the fund could require municipalities to contribute at least 20 percent in matching funds to support projects, with arrangements to reduce the match for more economically disadvantaged areas.

By using a mix of the financing options described above, the Florida Future Fund could increase access to clean, affordable energy and transportation options; build communities and infrastructure that can withstand extreme weather and other threats; and improve economic security and quality of life for Floridians.

Supporting meaningful community engagement

Even when strong criteria for social, environmental, and economic projects and financing tools are available to fill gaps in community infrastructure, lack of community relationships, language barriers, and racism can all play a role in denying communities needed investments.106 To avoid poorly designed projects with harmful community impacts, the Florida Future Fund should also establish a meaningful, equitable public and stakeholder engagement process. This process should ensure that project developers build strong community relationships and work closely with local or tribal government officials and community members, from start to finish, on project designs and throughout implementation in order to ensure that projects reflect community priorities and deliver real, lasting benefits.107

The Florida Future Fund could also provide toolkits and guidance on designing equitable projects that meet and prioritize community needs, such as those used by planners in King County, Washington, or the toolkits developed by the equity research institute PolicyLink.108 These equity toolkits act as checklists and step-by-step guides for planners to promote meaningful inclusivity. Furthermore, they ensure that residents receive the benefits of projects by not displacing them from their communities due to rising costs of housing, child care, or other services.

To support strong community engagement and remove barriers to participation, project developers should hold public meetings in community gathering spaces at times when the most community members are available to meet. Project developers should provide food, transportation, child care, and translators to ensure maximum participation from community members who live paycheck to paycheck, do not have personal transportation, have young children, or do not speak English.

By establishing a strong public engagement process, the Florida Future Fund can ensure that projects are thoughtfully designed and deliver clear community benefits.

Conclusion

The demand in Florida is high for future-ready community development and infrastructure projects that will reduce extreme weather and flooding damages, lower local air pollution, cut energy bills for households and business, and improve economic mobility. Yet Florida still faces a wide infrastructure investment gap that has left much of this demand unmet. In the absence of an effective federal infrastructure plan, Florida policymakers will need to lead the way to mobilize the investments needed to support resilient and clean energy systems, transportation options, flood protections, and other neighborhood improvements. Florida state leaders can do this by establishing a Florida Future Fund to leverage private sector capital with public dollars and to exponentially expand investment in needed infrastructure solutions. Florida’s leadership could also propose that Congress pass legislation to help capitalize State Future Funds in every state using federal funds in order to help modernize infrastructure in Florida and across the nation.109

With the cost of living increasing across the state and the majority of Floridians living without emergency savings, projects supported by the Florida Future Fund would expand economic opportunities for all Floridians and help people keep more of their hard-earned money in their wallets. By creating a Florida Future Fund to support new, long-term, and 21st century infrastructure solutions, state leaders will improve the lives of every Floridian in ways that count: protecting public health and safety, communities, and businesses from future threats.

About the authors

Cathleen Kelly is a senior fellow for Energy and Environment at the Center for American Progress.

Miranda Peterson is a research associate for Energy and Environment at the Center.

Guillermo Ortiz is a research assistant for Energy and Environment at the Center.

Yoca Arditi-Rocha is the executive director of the CLEO Institute.

Acknowledgements

The authors would like to thank the following experts for their contributions to this report: Alison Cassady, Kevin DeGood, Luke Bassett, Ryan Richards, Mary Ellen Kustin, Rejane Frederick, Shiva Polefka, Emily Haynes, Steve Bonitatibus, and Keenan Alexander from the Center for American Progress; Caroline Lewis from the CLEO Institute; Maribel Balbin from the CLEO Institute’s Expert Advisory Council; Susan Glickman from the Southern Alliance for Clean Energy; Zelalem Adefris and Mayra Cruz from Catalyst Miami; former Mayor of Pinecrest, Florida, Cindy Lerner; Alec Bogdanoff from Brizaga; Alex Kragie from the Coalition for Green Capital; Kim Ross from Rethink Energy Florida; Aliki Moncrief from Florida Conservation Voters; and Lauren Ordway from the Institute for Sustainable Communities.