Opponents of carbon pricing argue that any requirement on businesses to pay for their pollution will destroy the economy. In order to begin to deconstruct this hyperbolic argument, this issue brief examines carbon pricing within the context of the nation’s budgetary situation. In fact, if the federal government were to collect a carbon tax of $25 per ton of carbon dioxide emitted, that revenue would amount to less than 3 percent of the current budget.

Background

Top economic advisers to Democratic and Republican presidents have expressed their support for putting a price on carbon dioxide emissions, describing this as an effective and efficient approach for both reducing pollution and encouraging the adoption of cleaner sources of energy. However, past policy proposals have faced concerted opposition, and opponents of carbon pricing have argued that such policies “would devastate our economy,” have “a huge impact” on states, and “wreak major economic damage.” One pressure group, Americans for Prosperity, has convinced hundreds of policymakers to take a pledge opposing legislation to establish a so-called “climate tax” because of the burden of higher taxes.

These predictions of disaster are exaggerated and are often detached from any specific policy detail. For example, many predictions imply that pricing carbon would have a disastrous effect on the economy, regardless of the amount of value assigned to each ton of pollution; the sources to which the pricing policy applies; the timeline on which the policy is established; the use of any collected revenue; and the ability to adjust or reduce less desirable taxes due to the increased revenue collected. A policy that prices carbon can be crafted in any number of ways—with a wide range of potential effects. Depending on the policy details selected, a price on carbon could either trigger rapid transitions in the energy sector or none at all. It could also raise significant revenue for the federal government or, alternatively, raise none at all.

Indeed, during a recent debate in the House of Representatives regarding a resolution denouncing the concept of a carbon tax, Rep. Steve Scalise (R-LA) said a carbon tax would have a “devastating impact” on the U.S. economy and would cost the U.S. “more than a million jobs.” Rep. Doug LaMalfa (R-CA) called a carbon tax a “job-killing scheme.” However, the House resolution in question contained no specific policy details on which to base these harsh critiques.

What is carbon pricing?

Pollution from carbon dioxide results in significant costs to society through the damage caused by climate change, particularly in terms of the harm to public health, agriculture, regional security, economies, livelihoods, and ecosystems. To price carbon means to implement a policy tool that helps transfer those costs from society to the carbon polluter, which, in turn, drives emissions reductions.

The primary approaches to carbon pricing are carbon taxes and emissions trading systems, otherwise known as cap and trade. Carbon taxes can be applied to the amount of carbon contained in fuels burned or to the tons of greenhouse gases emitted. Emissions trading systems establish a cap on emissions and allocate a certain number of emissions permits according to the cap—permits that participating countries can then buy and sell. In either system, polluters have the option of reducing emissions or paying the associated costs.

These policy specifications matter a great deal. Increasingly, as governments develop and adopt carbon pricing policies, they are finding acceptable approaches that internalize the costs of pollution. In fact, carbon pollution is already priced in a significant portion of the world without yielding dramatic harm to national economies. In total, about 40 national jurisdictions and over 20 cities, states, and regions on five continents—representing almost one-quarter of global greenhouse gas emissions—have placed a price on carbon. In 2014, 25 percent of the U.S. population lived in a jurisdiction where carbon pollution is currently priced and where nearly 30 percent of the country’s economic activity took place. The price on carbon in California is the highest of any state in the country at almost $13 per ton of carbon dioxide equivalent, and yet the California economy is projected to grow at a faster pace than the rest of the United States over the next two years.

In recent years, momentum to expand the adoption of carbon pricing policies has been growing. More than 400 investors with more than $24 trillion in assets have called on governments to establish “stable, economically meaningful carbon pricing.” Already, more than 1,000 businesses use a price on carbon or plan to do so in the next two years. In addition, at the United Nations climate talks in Paris last December, governments, businesses, and nongovernmental organizations announced the new Carbon Pricing Leadership Coalition as a means to accelerate and expand the adoption of carbon pricing worldwide.

As a first step in explaining how pricing carbon might affect the national economy, it is important to understand how such a price on carbon relates to the nation’s tax and budget priorities. It is beyond the scope of this brief to explain and detail the macroeconomic effects of putting a price on carbon.

Pricing carbon and the federal budget

A carbon tax does not have to be high for it to yield significant revenue. For example, the nine states that participate in the Regional Greenhouse Gas Initiative, or RGGI, have cooperatively put a price on carbon emissions by auctioning permits to the power sector at a price of just $2 to $5.41 per ton. This small fee has generated more than $2.4 billion in revenue since 2008. The state of California has levied a more significant price of at least $10 per ton and has collected more than $2.2 billion since the program began in 2012. Due to the size of the national emissions inventory, the amount of revenue raised by pricing carbon at a federal level would be substantially higher.

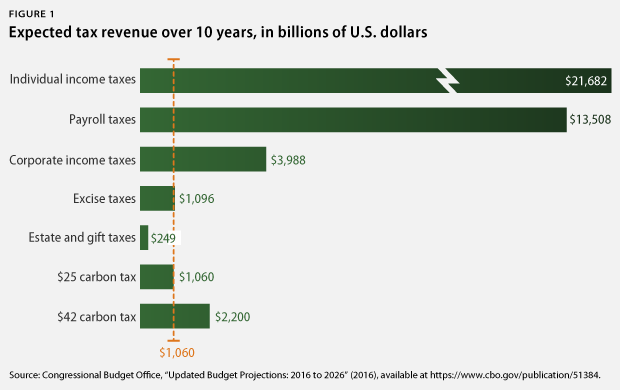

The Congressional Budget Office’s, or CBO’s, baseline budget projections show that, over a 10-year period, annual federal revenues are expected to remain flat as a percentage of the nation’s gross domestic product. In absolute terms, the revenue totals will grow from $3.250 trillion to $5.042 trillion between 2015 and 2020. Against this baseline, the CBO evaluated the hypothetical impact of a carbon tax with a base price of $25 per ton with an annual 2 percent increase and found that such a tax would raise $1.06 trillion over 10 years.

While $1.06 trillion is clearly a substantial amount of revenue, it is better understood when placed in context with other federal taxes and expenditures. This carbon tax is discussed in further detail below as it compares with current sources of federal revenue, federal program expenditures, and new policy proposals. However, similar analyses would apply if the revenue was generated through a cap-and-trade program, such as those adopted by the state of California and the states participating in RGGI.

Carbon tax revenue compared with current sources of federal revenue

The federal government is currently projected to collect $42 trillion in tax revenue from 2017 to 2026. The majority of this is from income and payroll taxes, totaling $35,190 trillion. Another 9.4 percent of the total is collected from corporate income taxes, and 2.8 percent of the total is from excise taxes. A $1.06 trillion increase in revenue would amount to an increase in aggregate revenue of approximately 2.6 percent between 2016 and 2025. Over that 10-year period, such a tax would bring in only the equivalent of 5 percent of the revenue generated from income taxes. The revenue increase would be approximately equal in scale to excise taxes currently levied at the federal level, which includes the combined taxes on gasoline, alcohol, tobacco, firearms, airline tickets, shipping, and environmentally hazardous chemicals. A $42 per ton tax, as has been proposed in the Senate, would correspondingly generate more revenue—amounting to a 5 percent increase over the projected total revenue.

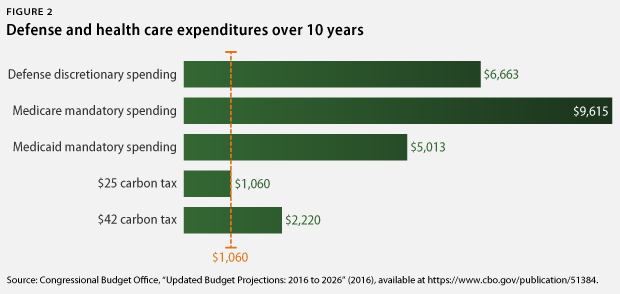

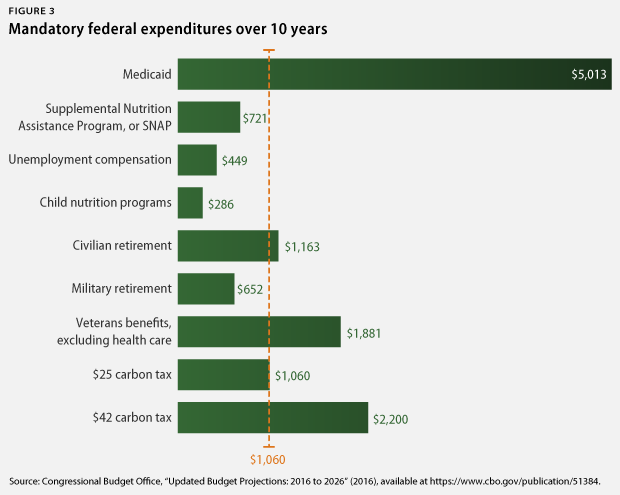

Carbon tax revenue compared with federal program expenditures

Similarly, comparing the revenue from a $25 per ton carbon tax to projected federal expenditures can also provide important context. Veterans benefits, excluding health care costs, are currently projected to cost $1.881 trillion over 10 years, slightly more than the amount of revenue generated from such a carbon tax. Medicare payments are more than eight times greater than the revenue that the CBO carbon tax would produce, and Medicaid payments are more than four times as large. Defense spending is projected to cost more than six times the amount of the CBO modeled carbon tax. Over 10 years, the full cost of mandatory expenditures is expected to be $32.6 trillion—more than 30 times the scale of the CBO carbon tax.

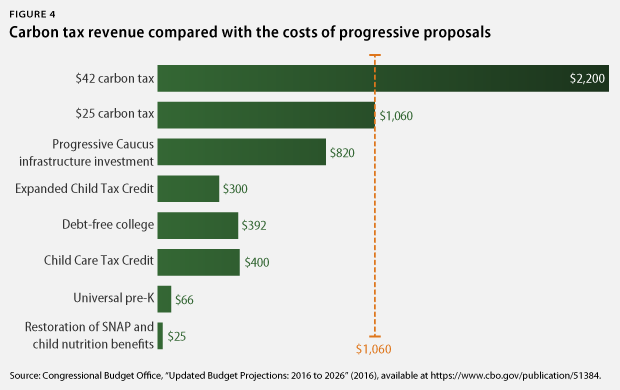

Carbon tax revenue compared with new policy proposals

While a carbon tax would be a relatively small source of revenue, it would compare favorably to some of the budget proposals that have been made in recent years. For instance, its value would be more than 16 times the cost of universal pre-K. It could also more than pay for the $820 billion the Congressional Progressive Caucus in the House of Representatives recommends for infrastructure investments in the coming decade. That proposal would fund reconstruction and refurbishment of roads, bridges, transit, energy, and water infrastructure around the country, thereby supporting job growth and enhancing economic productivity. Although the Center for American Progress is not proposing at this time that a carbon tax be used to fund these specific programs, the costs of these programs are useful for conceptualizing the magnitude of the revenue a carbon tax could produce.

Conclusion

Putting a price on carbon pollution would create an opportunity to generate new sources of revenue. This revenue, while substantial in absolute terms, would be relatively small compared to current federal revenue collection and budget priorities. An examination of the economic policy underlying a carbon tax in the context of the nation’s current fiscal situation helps dispel the hyperbole clouding the debate over market-based approaches to reducing carbon emissions.

Greg Dotson is the Vice President for Energy Policy at the Center for American Progress.

Ben Bovarnick is a Research Assistant with the Energy Policy team at the Center.

Special thanks to Alexandra Thornton, Harry Stein, and Alison Cassady for their

contributions to this issue brief.