Appalachian coal producers recently announced a new round of layoffs, eliciting a flurry of press releases from politicians that blamed the Environmental Protection Agency, or EPA, for the coal industry’s problems. While Appalachian coal production is falling, the EPA’s rules to cut carbon pollution and improve air quality are not the driving force behind the coal industry’s decline in Appalachia.

In September 2014, Alpha Natural Resources announced that it had laid off hundreds of workers in the company’s West Virginia coal mines, with the potential for more layoffs later this year. Earlier in the month, Patriot Coal also announced layoffs at its operations in Boone County, West Virginia. In their press releases, both companies acknowledged the challenging market conditions but placed an equal amount of blame on the EPA and its rules to clean up fossil-fuel-fired power plant pollution. Rep. David McKinley (R-WV) quickly blamed the EPA as well, saying these layoffs were “another example of how the lives of thousands of men, women, and children are being ripped apart by the actions of the EPA and its callous disregard for hardworking Americans.” West Virginia Gov. Earl Ray Tomblin (D) promised to “continue our efforts against the federal regulations that devastate our state, our communities and our families by forcing power plants in America and around the world to use a less attractive fuel source.”

The reality is much more complex than these sound bites portray. Appalachia’s coal communities are confronting a confluence of market factors that are years in the making. Alpha Natural Resources Chairman and CEO Kevin Crutchfield acknowledged as much in a document for investors, describing the coal market as “extremely challenging.” He cited numerous market factors, including low domestic and international prices for both thermal and metallurgical coal, soft natural gas prices, and increased imports—primarily from Colombia.

Many coal mines in Appalachia are closing or idling, with potentially significant effects on communities across the region. In order to mitigate these effects, it is important to understand the compounding market conditions contributing to the decline of Appalachian coal. Those who point fingers at environmental regulations are obscuring a more intractable reality about the market challenges confronting the Appalachian coal industry. Placing the blame on the EPA’s efforts to reduce pollution, mitigate climate change, and protect human health may provide an attractive political argument, but it simply clouds the discussion and slows progress toward meaningful solutions.

This issue brief discusses some of the market challenges Alpha Natural Resources and other companies in the Appalachian coal industry face.

Cheap and abundant natural gas

The sudden abundance of natural gas from shale deposits in the United States has put significant pressure on the coal industry nationwide. Between 2007 and 2012, natural gas production from shale increased fivefold in the United States, driving natural gas prices down from a 10-year high of $8.86 per million British thermal units, or BTUs, in 2008 to an average of $2.75 per million BTUs in 2012 and $3.73 per million BTUs in 2013.

These low prices—combined with the air-quality benefits that come with burning gas rather than coal for electricity—have eroded coal’s position as the go-to energy source for power generation. Coal accounted for half of the country’s net generation of electricity in 2004, compared with the 18 percent provided by natural gas. Coal’s share dropped to 39 percent by 2013, with natural gas accounting for 27 percent of the nation’s electricity generation. During the first half of 2014, natural gas power plants accounted for more than half of the new electricity-generating capacity that utility companies placed into service.

This trend is likely to continue well into the future. The Energy Information Administration, or EIA, estimates that natural gas production will increase 56 percent between 2012 and 2040 under a business-as-usual scenario. Given these ample supplies of cleaner-burning natural gas, the EIA anticipates that electric power producers will choose gas rather than coal when adding new fossil-fuel-fired generation capacity in the coming decades. The EIA projects that natural gas-fired plants will account for 73 percent of capacity additions through 2040, compared with just 1 percent for coal.

Competition with other U.S. coal

Appalachian coal is not only losing market share to natural gas but also to other U.S. coal basins.

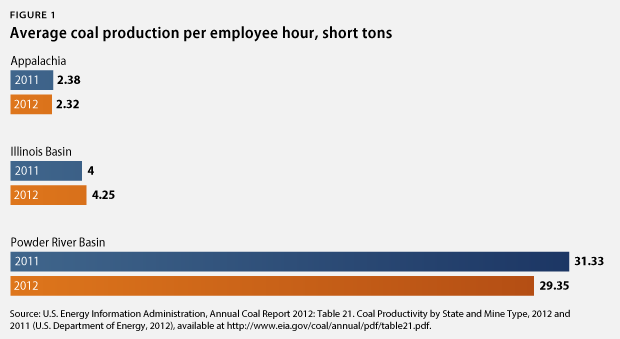

The largest, easiest-to-access coal seams in Appalachia have already been mined, forcing coal companies to spend more resources to extract coal from lower-profit seams. Coal companies in the Powder River Basin in Montana and Wyoming can extract more than 10 times as much coal per employee hour as coal companies operating in the Appalachian Basin. (see Figure 1)

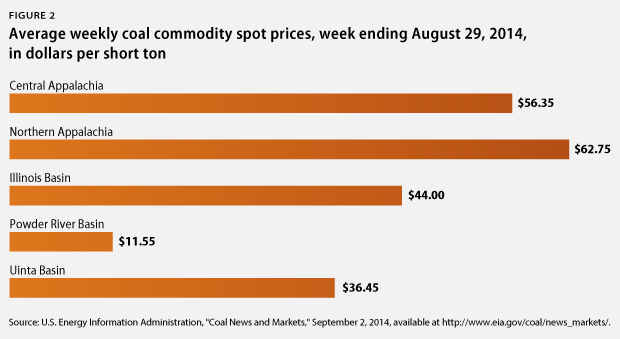

As labor productivity in a mine declines, coal prices often must rise in order to make the mine economically viable. Consequently, Appalachian coal is more expensive than coal from other parts of the United States. For example, the spot price for Northern Appalachian coal averaged almost $63 per ton for the week ending August 29, 2014. In contrast, the spot price was less than $12 per ton for Powder River Basin coal and $44 per ton for Illinois Basin coal. (see Figure 2) Although not as cheap to produce as Powder River Basin coal, Illinois Basin coal costs less to mine than Appalachian coal because the coal seams are thicker and closer to the surface.

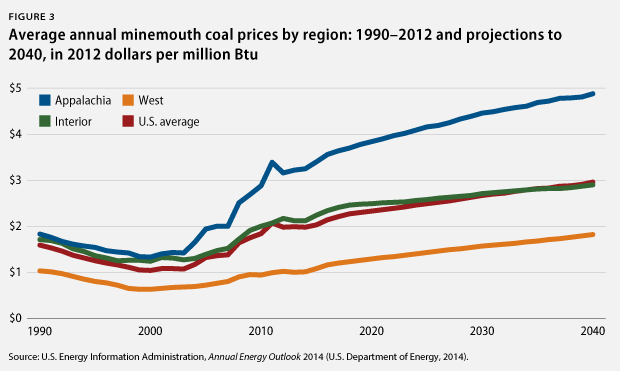

The high cost of Appalachian coal acts as a significant market barrier. The average mine-mouth price—the price of coal before factoring in transportation costs—for Appalachian coal began climbing in 2004, and the Energy Information Administration predicts it will continue to increase by 1.6 percent each year through 2040 due to declining mine productivity. (see Figure 3) Accordingly, the EIA projects that Appalachian coal production will continue to decline in the coming years “as coal produced from the extensively mined, higher-cost reserves of Central Appalachia is supplanted by lower-cost coal from other regions.”

Appalachian coal’s declining competitive advantage

The price differential shown in Figures 2 and 3 makes it difficult for Appalachian coal to compete. Until recently, Appalachian coal’s saving grace was its relative proximity to the East Coast power plant fleet and its comparably low-sulfur, high-energy content. Generally, low-sulfur coal makes it easier for power plants to control their emissions of sulfur dioxide and meet Clean Air Act requirements.

However, Illinois Basin coal continues to make inroads in markets formerly cornered by the Appalachian coal producers. With the advent of effective scrubbers, the relatively low-sulfur content of the Appalachian coal no longer offers the same competitive advantage over higher-sulfur coals. The Energy Information Administration predicts that that coal production from the Interior Coal Region, including the Illinois Basin, will increase in the coming years, reaching “new highs as scrubbers installed at existing coal-fired generating units allow them to burn the region’s higher-sulfur coals with lower delivered costs.”

Recent announcements from electric utilities demonstrate the reality of these predictions. In 2013, the Tennessee Valley Authority, or TVA, and Southern Company, which operates power plants throughout the southeast, announced that they would no longer purchase coal from Central Appalachia. The TVA indicated that it decided to switch coal sources “mostly because of price.” Southern Company said that switching to cheaper coal from the Illinois Basin would result in savings that “translate … into hundreds of millions of dollars a year for our customers.” For both companies, scrubbers installed on smokestacks negate the need to pay a premium for lower-sulfur coal.

Consequently, the West Virginia Coal Association has called the Illinois Basin the Appalachian coal industry’s “biggest challenger.”19 Similarly, in its second quarter financial announcement, Alpha Natural Resources noted that competition from the Illinois Basin “intensified” in 2014.

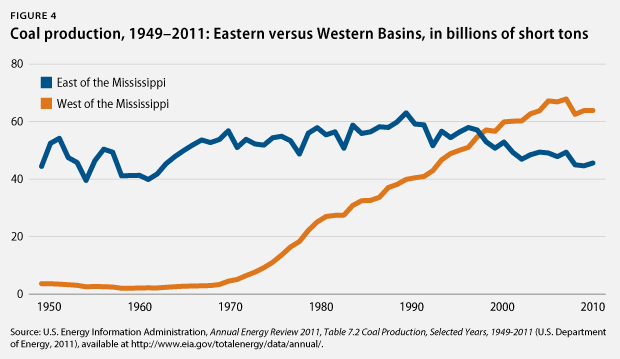

Even before the Illinois Basin emerged as a major competitor, Appalachian coal faced stiff competition from the less labor-intensive Powder River Basin coal from west of the Mississippi River. In 1999, coal production west of the Mississippi surpassed the eastern coal basins for the first time, a trend that is unlikely to reverse. (see Figure 4) Between 2001 and 2012, coal production from the Powder River Basin grew from 35 percent of total U.S. production to 41 percent. During the same time period, Appalachia’s share of U.S. coal production fell from 38 percent to 29 percent.

Competition from foreign coal imports

Appalachian coal also faces competition from abroad. Coal imports for the first six months of 2014 increased 43 percent compared with the same time period last year. Imported coal has become particularly attractive to power plants along the East Coast due to congestion in the U.S. rail system, the high cost of transporting goods by rail, and falling global coal prices. The National Mining Association has noted that “U.S. power plants on or near Eastern or Gulf ports can access coal much more cheaply from … traditional offshore exporting countries than they can from the U.S. interior.”

In its second-quarter financial announcement, Alpha Natural Resources noted that increased imports, primarily from Colombia, were putting pressure on the U.S. coal market. The United States imported 1.6 million short tons of coal from Colombia during the first quarter of 2014, a 50 percent increase from the same period the previous year. A spokesman for Alpha Natural Resources noted, “Colombia produces a high quality thermal coal” that is “inexpensive to mine” and “relatively inexpensive to ship” to power plants along the East Coast of the United States.

As a result, Colombian coal is simply cheaper than coal from Appalachia. Power plants in the eastern United States can buy Colombian coal for $75 to $82 per ton compared with $79 to $86 per ton for Central Appalachian coal. In addition to lower labor costs, Colombia has the advantage of being able to transport the coal by ship, which is cheaper and more efficient than rail. It is approximately $11 cheaper per ton to ship coal from Colombia to Florida power plants than it is to transport coal from Central Appalachia.

Falling international coal prices

Appalachian coal companies exported 31 percent of the coal they produced in 2012, up from 25 percent in 2011 and 19 percent in 2010. As a result, the region’s coal industry is increasingly dependent on foreign markets.

Recently, global coal prices have fallen due to a confluence of factors, including slower than- expected global coal demand and rising coal output. On September 25, European coal futures hit a five-year low due to concerns about oversupply. With the current unfavorable state of the global coal market, U.S. coal producers are exporting less: U.S. coal exports fell 17 percent in the first half of 2014 compared with the first half of last year.

The international picture could change as the world’s leading producers respond to falling coal prices and cut production. Nevertheless, the recent dynamics of the global coal market had a measureable effect on Alpha Natural Resources and Arch Coal, another major coal producer in Appalachia.

Alpha Natural Resources generated 45 percent of its revenue from the export market in 2013, primarily from the sale of metallurgical coal. In August, the company alerted investors to the challenges posed by the “oversupplied” global metallurgical coal market and noted that global prices for thermal coal were “below the break-even point for most U.S. producers.” When announcing potential layoffs, Alpha Natural Resources again raised the global supply glut as a key concern, stating that the “international price of coal shipped to power plants in Europe has been hovering at a four-year low, while prices for metallurgical coal used to make steel have declined more than 20 percent in less than a year, reflective of oversupplied markets.”

Similarly, Arch Coal announced in July that it was going to idle the Cumberland River Coal Company complex, which spans counties in Virginia and Kentucky. Arch Coal said it was “actively responding to currently challenged metallurgical coal markets.” In its second-quarter financial statement, Arch Coal noted that “prevailing soft seaborne thermal and metallurgical prices are likely to limit U.S. coal exports this year.” Arch Coal also acknowledged the cyclical nature of the global market—and the extent to which Appalachian coal producers are vulnerable to these cycles—by expressing some optimism that an increase in global steel production and planned cutbacks in global supply will “bring better balance to global metallurgical markets over time.”

The decline in coal jobs began long ago

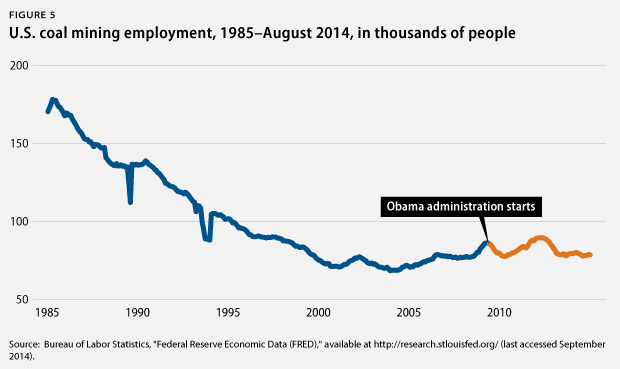

The coal industry and other critics are keen to point to the Obama administration’s environmental and climate initiatives as the precipitating factor in the decline of Appalachia’s coal industry. But employment in the nation’s coal mines has been falling for decades as production has shifted from underground mining to surface mining, which is more mechanized and less labor intensive. Figure 5 displays the national picture of coal-mining employment since 1985, showing a steep downward trend until leveling off around 2001. Notably, nationwide coal employment under President Barack Obama has been higher than or equal to the levels seen under the George W. Bush administration.

In Central Appalachia, the shift from underground mining to surface mining has had a tremendous impact on employment. Direct coal employment in the region fell from 70,000 miners in 1985 to 35,600 miners in 1997—a 50 percent decline in only 12 years. This occurred even though Central Appalachian coal production was on the rise during that time.

Conclusion

All of these market forces have put pressure on Appalachian coal companies, resulting in the recent layoffs. When a coal company decides to close a mine or lay off workers, the effects on local communities are significant. However, it is both disingenuous and counterproductive to blame the Environmental Protection Agency for these layoffs. Ignoring the complex market forces and structural barriers only delays meaningful discussion about ways to reinvigorate coal communities across Appalachia.

Alison Cassady is the Director of Domestic Energy Policy at the Center for American Progress.