Supportive state and national policies for solar power, coupled with more available and affordable technology, have spurred a strong solar market. Residential photovoltaic solar installations increased 60 percent from 2012 to 2013, reaching 792 megawatts of electricity. Market projections of solar panel investments for the first quarter of 2014 anticipate another 60 percent increase in solar installations. Moreover, some analyses project that more than 1 million residential solar installations could be installed by 2017—triple the current market. Over the past year, prices for residential photovoltaic systems fell 7 percent, and installation prices declined in major residential markets, including California, New York, Massachusetts, and Arizona. These factors have resulted in an expansion of solar deployment to middle- and upper-income households. However, the same benefits have not yet accrued for low-income households on a large scale.

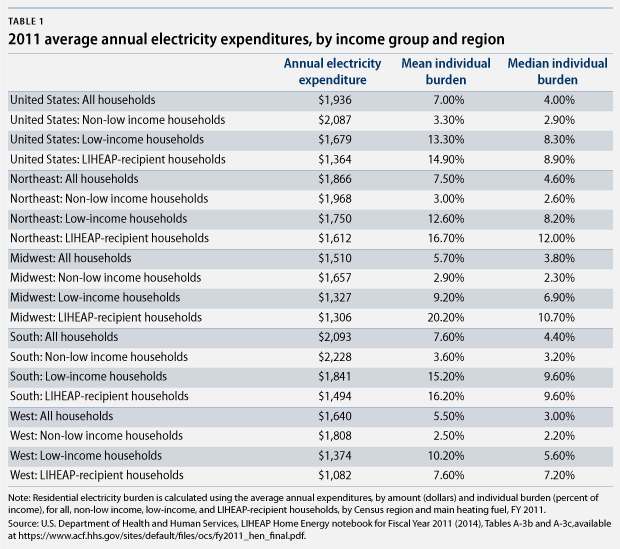

Low-income households in the United States spend a higher percentage of household income on energy costs than their higher-income peers: Their energy spending is more than twice the average for non-low-income households—8.3 percent compared to 2.9 percent—and four times the median national household energy cost burden—a median of 13.3 percent compared to 3.3 percent. Access to solar power could significantly reduce the energy burden of low-income households by providing electricity below local utility rates. Furthermore, as residential solar systems become increasingly common and significant sources of renewable energy, policies that increase low-income solar adoption will help alleviate the risk of a so-called electrical divide in which low-income consumers who do not have access to renewable energy sources increasingly carry the burden of financing antiquated utility systems.

However, low- and middle-income households face several barriers to rooftop solar access:

- Difficulty meeting credit requirements to obtain long-term, low-cost financing or affordable leases for solar systems

- Not being able to benefit from tax credit or other incentive programs because of insufficient income or inability to claim benefits

- Status as tenants rather than homeowners, which means households do not control the roof-space necessary for installation of solar systems

In order to ease the energy burden experienced by low-income households and take advantage of the ever-strengthening solar market, states and local governments should embrace policies that can help low-income families access residential solar power. These policies will provide families with a clean, stable, and renewable source of energy that could help reduce household electric bills and enhance grid resilience. Although several states have begun to explore this potential, there is still much to be done.

State programs that are expanding solar adoption among low-income households

States are well positioned to support innovative strategies of solar power deployment to low-income communities and households. They can enact legislative support expediently and tailor policies to match their specific geographic and economic features. California, Louisiana, and Colorado are three states that feature particularly innovative and income-specific solutions to affordable financing for solar power.

California

California has aggressively pursued strategies to support deployment of solar power with a special emphasis on programs that serve low-income families. California launched the Go Solar California campaign in 2007 with a goal of deploying 3 gigawatts of photovoltaic power to homes and businesses by 2016 and financed with a total budget of $3.3 billion over 10 years, collected through a charge on electricity distribution. The largest component of the program, the California Solar Initiative, or CSI, reserved 10 percent of its budget, or $216 million, to support the adoption of solar power by low-income families. This budget is divided between the Single-Family Affordable Solar Housing, or SASH, and Multifamily Affordable Housing, or MASH, programs.

SASH—managed by the nonprofit Grid Alternatives with a total budget of $108 million—subsidizes 1 kilowatt photovoltaic systems for very low-income households—partially for those that are 50 percent to 80 percent below the median household income and fully for those that are more than 80 percent below the median. To date, Grid Alternatives has installed 4,489 systems across California. Although the program relies on incentives between $4.75 and $7.00 per watt installed in the form of upfront rebates, Grid Alternatives has successfully reduced installation costs through a volunteer-based installation model and has trained more than 16,000 volunteers. Installation labor costs can represent around 10 percent of the full cost of a residential system, and this model not only allows Grid Alternatives to reduce costs, but also to educate potential consumers and community members.

Partnered with SASH, California employs the MASH program to deploy solar systems for multifamily buildings—either in their common areas or for use by specific tenants—at incentive rates of $1.90 to $2.80 per watt. The program has resulted in 347 completed projects totaling 23.6 megawatts—with another 48 projects totaling 6.7 megawatts in the pipeline—costing an average of $6.61 per watt. PG&E and Southern California Edison have installed a total of 20.7 megawatts, and the Center for Sustainable Energy has installed 2.6 megawatts.

In addition to CSI, the state launched the Solar for All California program in 2010, which directly invested a portion of its annual Low income Heating and Energy Assistance Program, or LIHEAP, funding to support solar deployment for LIHEAP-eligible homeowners. In all, the program financed photovoltaic systems for 1,482 low-income households using $14.7 million in LIHEAP funds and an additional $3.5 million leveraged through outside partners. The program is distinct from CSI due to its use of LIHEAP funding, rather than a consumer-financed budget. Since LIHEAP funding is distributed nationally, the success of this pilot could be replicated in other states with approval of the U.S. Department of Health and Human Services.

Louisiana

In contrast to California, Louisiana lacks a robust system of public support and financing for low-income solar deployment or any income-specific state energy programs. However, PosiGen, a solar leasing company, has developed a low-income solar system leasing model that has successfully installed more than 4,000 systems since 2011. PosiGen has leveraged Louisiana’s 50 percent tax credit on purchased solar systems, 38 percent tax credit on leased systems, and the federal 30 percent Residential Renewable Energy Tax Credit to reduce the costs of financing photovoltaic systems.

In order to capture the full value of the credit, PosiGen leases the systems from U.S. Bank, which owns the panels. To further reduce costs, PosiGen has secured financing on community redevelopment terms, which can be more favorable than standard agreements. Such terms allow banks to earn redevelopment points, which are necessary to comply with the Community Reinvestment Act. Although Louisiana has succeeded with this financing model, it is not based on characteristics that are exclusive to the state. In fact, 16 states currently offer residential renewable energy tax credits to offset a portion of solar system costs that could lay a foundation to replicate this program.

Colorado

Colorado passed the Community Solar Gardens Act in 2010, which allows Colorado homeowners to purchase shares of centralized solar installations. Community solar gardens, or CSGs, allow homeowners who would not otherwise have the necessary rooftop space to purchase solar power. Colorado’s legislation is unique in that it targets low-income households by requiring that 5 percent of the electricity from each CSG be reserved for subscription by low-income households in order for the CSG to qualify for state Renewable Energy Credits.

The Clean Energy Collective, a community solar company, has also partnered with the Denver Housing Authority, or DHA, to earmark 5 percent of solar power produced for DHA housing residents and offset the electric bills of 35 low-income families. The program is expected to generate $7,700 in bill credits in the first year and more than $230,000 over the 20-year lifetime of the program.

Policy recommendations

Elements of these innovative state-based programs can serve as models that can be implemented across the nation. Colorado’s experience with community solar and the combination of state and federal tax credits and community development programs in Louisiana through a private company, for example, are policy ideas that could be replicated nationally, particularly in states that have already enacted tax incentives for solar power and community solar legislation. To further build on these ideas, states should consider additional policies—such as using brownfield redevelopment as part of community solar programs, incorporating solar into rehabilitation programs for existing housing, and developing green banks similar to those now underway in Connecticut, New York, and Hawaii—as opportunities to further advance low-income household solar adoption.

Expand community solar programs

Community solar programs are centralized solar arrays with electricity divided between residential subscribers in the form of a credit on their monthly utility bills. Because the arrays can be placed anywhere with grid access, homeowners who lack the necessary space for a photovoltaic installation can still access solar power and accrue the associated benefits. Shares of community solar installations are typically sold on a per-panel basis and maintained by a central entity—either a company such as the Clean Energy Collective in Colorado or a utility such as Central Hudson Gas & Electric. Community solar programs allow renters and homeowners with shaded roofs to invest in the benefits of solar power—without the restrictions of traditional rooftop solar systems.

The scale and investment requirements of community solar programs depend heavily on the states in which they are located, since state legislation typically sets qualifications for each project. Colorado’s Community Solar Gardens Act, for example, limits installations to a maximum of 2 megawatts and requires a minimum of 10 subscribers to own at least 1 kilowatt each of the total capacity. Subscribers also must live in the same county as the community solar garden. In 2011, Colorado Springs Utility developed four 500 kilowatt— totaling 2 megawatts—community solar gardens, which customers could lease for 20 years. Colorado Springs Utility required a minimum purchase of 400 watts, about two panels worth, for a minimum initial investment of $1,100. However, the scale of the Colorado Springs case is large relative to other programs. A CSG could range in size from 10 panels to 2,500 panels. In California, community solar garden legislation allows installations to grow up to 20 megawatts, which would require 160 acres.

Community solar power has unique potential to benefit low-income communities for a variety of reasons. First, low-income families are more likely to rent or live in apartments than the average American household. Second, community solar power can be purchased in discrete amounts that are smaller than most multi-kilowatt rooftop solar systems, making the cost to entry more accessible. Furthermore, because community solar programs are constructed on larger scales than most rooftop units, they can secure cheaper prices through bulk panel purchases. Finally, community solar programs can be installed on land that is otherwise unusable or has low property value, as long as it is within reach of a centralized grid and receives adequate sun. This can reduce the property costs necessary for initial investment and support community redevelopment by increasing the productivity of unused land.

Use brownfield properties for solar projects

Across the United States, there are brownfield properties that are considered unusable due to past industrial or commercial use. The U.S. Environmental Protection Agency, or EPA, defines brownfields as property where expansion, redevelopment, or reuse “may be complicated by the presence or potential presence of a hazardous substance, pollutant, or contaminant.” The EPA estimates that there are more than 450,000 such sites in the United States, and solar developers are already demonstrating a growing interest in using brownfield and landfill properties for development of commercial solar plants. The EPA and National Renewable Energy Laboratory, or NREL, have also invested $1 million to evaluate the feasibility of developing renewable energy on Superfund sites—or those undergoing cleanup of hazardous wastes—brownfields, and former landfill and mining sites. The EPA and NREL mapped renewable energy potential on brownfield sites around the country, produced reports on best practices, and developed feasibility studies for the reuse of 27 contaminated sites for solar installations.

Although the development of solar projects on brownfields is not a new concept, these sites have primarily been redeveloped for commercial solar projects in the past. In order to facilitate the development of cost-effective community solar programs on these properties, Community Development Finance Institutions, or CDFIs, and other community organizations coordinate their efforts. These projects would face low-siting and permitting barriers and facilitate cleanup and use of sites that are blights on the communities they inhabit. Furthermore, the EPA coordinates a series of grant and loan programs to facilitate environmentally sound cleanup and redevelopment of brownfields, which could be marshaled by CDFIs and community solar programs to further reduce investment costs. By investing in brownfield redevelopment through solar power, low-income communities could repurpose wasted land for positive economic growth.

Finance low-cost solar power through community development organizations

As described above, Louisiana has succeeded in leveraging state and federal tax credits in partnership with banks and community development programs to increase the affordability of solar power. Today, many CDFIs could replicate Louisiana’s success elsewhere. CDFIs are nongovernmental organizations engaged in lending and development projects in low-income neighborhoods. They can secure low-cost capital from banks looking to comply with the Community Reinvestment Act and can leverage New Market Tax Credits and Community Development Block Grants to attract private financing. CDFIs such as Craft 3 in Oregon have already successfully financed energy efficiency projects. In another example, Bank of America invested $55 million in CDFI energy efficiency projects in 2011. The Solar and Energy Loan Fund, which received CDFI accreditation in 2012, has also financed $2.4 million in residential energy improvements in Florida, including low-income rooftop solar systems. There are currently 896 CDFIs functioning around the country, and many of these institutions are well positioned to support deployment of solar power to low-income communities in states that do not currently offer income-specific programs to reduce household energy consumption.

Incorporate solar power into housing stock rehabilitation

One of the substantial costs homeowners and businesses face in installing rooftop solar systems is the cost to physically connect solar panels to the roof. This process takes time and expertise and is more expensive when done on a case-by-case basis. California has taken steps to address some of these challenges by requiring all new buildings to be constructed in a “solar ready” fashion that would support a solar photovoltaic system in unshaded areas, if possible. Although this policy will offer homeowners increased opportunity for future investment in solar panels, this policy does not address the houses throughout the United States that are already built.

In order to better deploy solar power to low-income communities, solar providers should partner with states, municipalities, and nonprofits to incorporate rooftop solar systems into redevelopment and rehabilitation projects. This could be done by engaging Neighborhood Stabilization Program, or NSP, grant recipients and leveraging this low-cost financing for solar system installation. NSP financing is allocated for purchasing and rehabilitating homes and residential properties that have been foreclosed, redeveloping land with blighted or vacant properties, and establishing financing mechanisms to further these programs.

Congress allocated three rounds of Neighborhood Stabilization Program grants under the Community Development Block Grant program between 2008 and 2010—$7 billion in total. These funds were made available to states, local governments, and nonprofits on a formula basis to benefit individuals whose incomes do not exceed 120 percent of the area’s median income. These funds are projected to support 88,000 jobs, rehabilitate 75,000 affordable housing units, and demolish 25,000 blighted properties over the life of the program.

President Barack Obama’s fiscal year 2015 budget seeks to build on the success of the NSP through the $15 billion Project Rebuild program. These funds would further support neighborhood stabilization efforts. A coordinated approach to incorporate solar panels into the rehabilitation of low-income housing—similar to California’s solar ready policy—could offer states and community development organizations an efficient and cost-effective means to deploy solar power to low-income families. By working with communities that receive NSP grants and similarly administered community development block grants, states and local communities can pursue a program to provide solar power to low-income, first-time homeowners.

Community development organizations can also partner with housing rehabilitation corporations to leverage economies of scale and secure lower cost solar panels. Working with rehabilitation projects that are already retrofitting roofs, solar companies and nonprofits could incorporate the installation of solar systems into the construction of low-income housing units. Financing for these panels could come from the housing rehabilitation corporations, which could purchase them outright or from solar companies that could secure long-term lease agreements to collect a portion of each utility bill, while supplementing this income with Renewable Energy Credits, tax credits, and favorable rates associated with community development financing. This strategy would circumvent the issue of customer acquisition, providing better financing rates and offering residents energy at a further reduced cost.

Leverage state green banks

Green banks, which are publicly funded clean energy finance institutions, can support low-cost, income-specific solar programs in a number of ways, including by offering low-cost loan funds or loan guarantees to CDFIs, other community organizations, and nonprofits for low-income solar programs. They can also establish loan-loss reserves that can reduce the credit requirements necessary for consumers to access solar lease programs. Furthermore, green banks can support residential property assessed clean energy, or PACE, programs that help homeowners finance solar systems for little upfront cost. Although residential PACE programs have encountered setbacks in recent years, California has established a loan-loss reserve fund designed to act as a backstop against potential defaults, and other state green banks could establish similar programs.

Connecticut’s Clean Energy Finance and Investment Authority, or CEFIA, has significant potential to leverage low-cost capital for low-income solar deployment. CEFIA is working to reduce the barriers faced by homeowners to obtain rooftop solar through the Solarize Connecticut program, which offers per-watt incentives and subsidized leases for solar systems. The program has reduced minimum credit score requirements for solar leases to 640, although this credit barrier is still too high for many low-income families. Similarly, the recently launched NY Green Bank represents a significant potential source of financing that could be leveraged to reduce the cost of capital and increase the viability of low-income solar deployment programs.

Hawaii is also is working to reduce the upfront costs of solar power through the state’s Green Market Securitization program. The program operates through mechanisms that are similar to CEFIA, underwriting the upfront costs of solar investments through a state bond program. It achieves affordability by merging low-cost financing from bond sales with on-bill financing charges over the life of projects. This financing structure allows residents to pay for solar power over time through savings on their electric bills. The program is specifically designed to reach low- to moderate-income homeowners and renters. As green banks develop new ways to creatively finance clean energy, these programs represent an important opportunity to support low-income solar deployment strategies.

Conclusion

Rooftop solar systems offer access to an energy resource that is clean and renewable, provides generally stable generating costs, and advances decentralized energy generation. Greater availability of financing and lowered costs have resulted in a strong, growing residential solar market. Unfortunately, the majority of low-income households have not enjoyed these benefits because they face challenges ranging from a lack of information to the inability to benefit from tax credits and difficulty obtaining low-cost financing. There are initiatives underway in several states to address these barriers to low-income household solar adoption. Replicating the best elements of these programs and adapting them to a larger array of states and communities could help increase low-income household solar power usage. Additionally, states could utilize existing programs such as brownfields redevelopment and housing rehabilitation under the Community Development Block Grants program to expand low-income solar power adoption. Expanding solar deployment would deliver significant benefits to many of the nation’s most vulnerable communities.

R. Darryl Banks is a Senior Fellow at the Center for American Progress. Ben Bovarnick is a Special Assistant for the Energy Policy team at the Center.