On November 21, Sen. Max Baucus (D-MT), chair of the Senate Finance Committee, unveiled a discussion draft of tax reform legislation that focuses on cost recovery and accounting rules as part of a comprehensive overhaul of the U.S. tax code. This draft package includes the elimination of some longstanding tax breaks for Big Oil companies. The discussion draft proposes to eliminate as much as an estimated $46 billion in unnecessary tax breaks for hugely profitable Big Oil companies over the next decade.

The White House just announced that Sen. Baucus will be nominated to become the next U.S. ambassador to China. If he is confirmed, Sen. Ron Wyden (D-OR) is expected to replace Sen. Baucus as chair of the Senate Finance Committee. Sen. Wyden introduced legislation in previous Congresses that would have eliminated several big oil tax breaks. As chair, Sen. Wyden would have an opportunity to build on Sen. Baucus’s proposal to make the tax code fairer by proposing to repeal additional special oil tax breaks, as proposed by Sen. Bernie Sanders (D-VT) and Rep. Keith Ellison (D-MN).

The oil industry has prospered over the past decade, thanks to high oil and gasoline prices. The five largest companies—BP, Chevron, ConocoPhillips, ExxonMobil, and Shell—earned more than $1 trillion. In the first nine months of 2013, these five companies earned a combined $71 billion in profits. Certainly, these companies and other large oil companies will prosper without $40 billion in special tax breaks over the next decade.

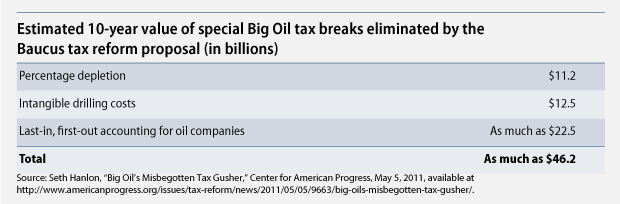

In 2011, the Center for American Progress published an analysis that estimated the dollars lost to the Department of the Treasury from large tax breaks for Big Oil. The Baucus discussion draft would eliminate three of these tax breaks for the mature oil industry, which no longer needs them. This section of the Baucus proposal draws heavily from the Close Big Oil Tax Loopholes Act, S. 307, sponsored by Sen. Robert Menendez (D-NJ) and 17 other senators. The three tax breaks are:

- Percentage depletion rules. These allow oil companies to deduct a flat percentage of the income they derive from investments instead of deducting the costs of oil wells as their value declines. This occasionally eliminates all federal tax responsibility when the price of oil is high.

- Cost recovery for certain taxpayer-created intangible assets. This is often referred to as expensing intangible drilling costs, which allows immediate deductions for drilling oil wells. This essentially provides an interest-free government loan to oil companies. This tax break was established nearly a century ago, in 1916, when the oil industry was new and incentives to drill were necessary to grow the industry.

- Last-in, first-out, or LIFO, accounting. This provision allows oil companies to calculate their profits based on the cost of the oil most recently added to their inventories. The CAP analysis noted that, “Since the most recently acquired inventory costs the most when prices are rising, this method can minimize a company’s taxable income.” Oil companies are the largest beneficiaries of this provision.

Over the past 10 years, these tax code subsidies have provided oil companies with as much as an estimated $46.2 billion in unfair tax breaks.

The elimination of these special tax breaks would increase tax fairness and reduce the deficit. The discussion draft, however, only addresses some of Big Oil’s special tax provisions. There are at least three others that benefit Big Oil that are not addressed in the discussion draft:

- Domestic manufacturing deduction for oil production. This provision was designed to encourage domestic manufacturers to keep their facilities and jobs in the United States. It was amended to allow oil companies to qualify for it too, even though it is impossible to move U.S. oil fields to other nations.

- Dual capacity taxpayer rules for claiming foreign tax credits. Big Oil companies can deduct any amount paid to foreign governments from their American tax bills, including royalties to pay for the oil produced in and taken from other nations.

- The amortization of geological and geophysical expenditures. Companies can write off the costs of searching for oil over an accelerated two-year time period.

![BaucusTable2[1] copy](http://americanprogress.org/wp-content/uploads/sites/2/2013/12/BaucusTable21-copy.png)

In contrast to the Baucus draft’s partial repeal of Big Oil tax breaks, the End Polluter Welfare Act of 2013, S. 1762, would eliminate all permanent tax breaks for oil companies. The bill’s sponsors, Sen. Sanders and Rep. Ellison, recognize that the well-established oil industry no longer needs tax breaks to help it mature and expand. Their bill would remove an estimated total of $77 billion in tax breaks over the next decade. Based on our 2011 estimates, this bill would end the $30.4 billion in oil tax breaks that the Baucus discussion draft would retain.

Despite Sen. Baucus’s modest approach to reducing oil tax breaks, the oil industry strongly opposes his proposal. It claims that eliminating these three tax breaks would hurt its ability to invest in jobs. Big Oil’s recent huge profits, however, do not translate into significantly more jobs. The Washington Post noted:

Oil and gas are industries where a huge portion of the economic output created comes not from the labors of individual oilmen or even the machines they are operating, but from a scarce substance that happens to be located below the ground. You would expect for the great majority of extra [gross domestic product] driven by petroleum exports to translate not into more jobs for people who work in or support oil and gas extraction, but into profits for oil companies and owners of the land that is being tapped.

By comparison, the nascent wind, solar, and geothermal industries announced the creation of 30,000 new jobs in 2012, the same number as the oil industry. This occurred even though the renewable industry is a smaller share of the U.S. energy mix and receives significantly fewer tax breaks.

On December 18, Sen. Baucus proposed to alter the tax breaks received by these renewable and other energy sources. His e nergy tax reform would consolidate tax incentives for these renewable energy sources and other technologies into several broader tax incentives that are designed to stimulate “domestic, clean production of electricity and transportation fuels … to promote energy security and a clean environment.” The elimination of some oil tax breaks would help defray the cost of these changes.

In contrast to the Baucus and Sanders-Ellison proposals, the recently passed Bipartisan Budget Act of 2013 did almost nothing to lower government support for the oil industry to reduce the deficit. The act does include a few favorable and minor budget cuts, including the elimination of research and development funds to help oil companies find and extract resources in hard-to-reach parts of the world. The law would also cap interest payments made by the U.S. government to oil companies on royalty overpayments. These provisions, however, would raise only $750 million, while the aforementioned $76 billion worth of tax breaks are left untouched by the budget bill.

A number of conservative organizations, including Americans for Prosperity and American Energy Alliance—both affiliated with brothers Charles and David Koch—are pressuring Congress to eliminate tax incentives for the deployment of wind power. Yet while they attack wind incentives, these oil-funded organizations ignore the century-old Big Oil tax breaks that cost the Department of the Treasury far more than clean power tax provisions. According to a 2011 Nuclear Energy Institute study, the oil industry has received a whopping 44 percent of the tax incentives provided by the federal government to the energy industry between 1950 and 2010. This includes $194 billion in special tax breaks for Big Oil companies.

As Senate Finance Committee chair, Sen. Wyden would have an unprecedented opportunity to reform the tax code. His previous tax reform legislation addressed some of these oil tax breaks, such as elimination of the percentage depletion provision and the Sec. 199 domestic manufacturing tax break. He should begin his new chairmanship by eliminating these and the other large tax breaks for the oil and gas industry. Sen. Baucus’s proposal is a promising start, but Sen. Wyden could complete the job by emulating Sen. Sanders and Rep. Ellison’s proposal to eliminate all the tax breaks. This would shift some of the burden of deficit reduction from middle- and low-income families to some of the world’s biggest corporations, which can afford it.

Daniel J. Weiss is a Senior Fellow and Director of Climate Strategy at the Center for American Progress. Miranda Peterson is a Special Assistant for the Energy Opportunity team at the Center.