Note: On January 13, 2017, the U.S. Department of Education announced a correction to its repayment rate calculations that resulted in changes to the final rate for most institutions. The error in the original rates undercounted the number of students who had failed to pay at least $1 of principal balance, thus inflating the numbers. Because its publication was before the department recognized and publicized the correction, this report uses the original, uncorrected repayment rates.

The word “voluminous” does not even begin to describe the College Scorecard. This new tool to help students and their families choose institutions of higher education, released by the U.S. Department of Education in September 2015, contains 1,700 variables about more than 7,000 colleges across 18 years of data from 1996 to 2013. It is almost certainly the largest release ever of higher education data.

At its heart, the College Scorecard showcases the power of unlocking even a small portion of the data capabilities held by the federal government. It contains important indicators that have never previously been available for all institutions of higher education. This includes the earnings of students who received federal financial aid, multiple years of repayment history for student borrowers, and the typical debt loads by year. Even better, it disaggregates most of these indicators, making it possible to compare the results for students who graduated with the data on those who dropped out, across income bands, and by gender.

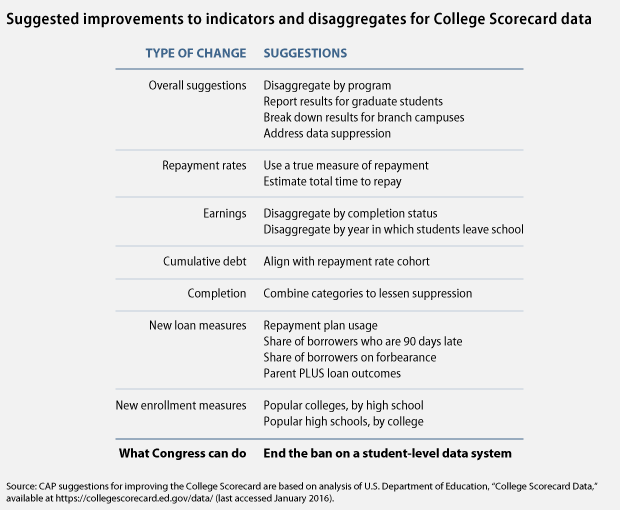

Spending several months analyzing the scorecard, however, reveals several weaknesses and data limitations. Some of the factors underlying these shortcomings are outside the Department of Education’s control. For instance, the agency can report only data on students who received federal aid because of a congressional ban on including all students in the department’s databases. Other issues, such as only reporting results for institutions overall and not by program, will likely get better with time. But the Department of Education could address some problems now. This includes using a true measure of loan repayment, aligning student cohorts across different measures, and fixing data suppression policies. Finally, there are several useful indicators, particularly related to loan performance, that the department could generate off the data that it now holds in order to better inform the public.

With this iteration of the College Scorecard now approaching its six-month anniversary, this report takes a step back to assess the tool’s data. It looks at the scorecard through four sections. First, it highlights the good measures that were important inclusions. For example, the disaggregation of results by type of student, not just institution, is important for identifying places that may be serving certain types of individuals well. Similarly, reporting earnings and loan repayment information provides new measures for rethinking outcomes. And disclosing these data across several cohorts and points in time allows for a better understanding of how results can change.

Second, the report looks at what the Department of Education could do better in the next round in terms of improving the indicators that it already reports and making changes that improve the data’s usability and clarity. For instance, the department could use a better definition of student loan repayment that more accurately captures people who are retiring their debt, as well as better align cohorts for different measures to assist in comparing outcomes.

Third, it suggests additional measures the Department of Education could add. For instance, it could disclose more information about loan outcomes, particularly the use of income-driven repayment plans. It also could break out results for parent borrowers and graduate students to help these individuals better understand their choices.

Finally, this report recommends that Congress improve the College Scorecard by allowing the Department of Education to collect data on all students attending college, not just those receiving federal financial aid. These additional data would make it possible to see how students who are served by the aid programs fare compared with those who are not. It also would provide a complete picture of results for institutions, something that may not be happening now at places where only a small portion of students receive federal assistance.

The hope is that having an honest conversation about the College Scorecard’s data will lay the groundwork for turning it into an even more useful and comprehensive tool in the future. Doing this would help students and their families make sound choices about where to apply and how to pay for college based on clear, understandable, and comparable information. It also would make the data more useful for policymakers to better understand comparisons, and more complete data on earnings should be of particular interest to institutions that currently cannot get such information in a comprehensive way.

Ben Miller is the Senior Director for Postsecondary Education at the Center for American Progress.