Click here to download a spreadsheet of 2017-18 financial responsibility score results by institution, state, and whether the college is a nonprofit or for-profit institution.

On March 23, the trade association that represents private nonprofit colleges and universities and the largest lobbying group for higher education in the United States sent a joint letter to the U.S. Department of Education, asking the agency to waive the standards it uses to judge the financial health of private colleges for three years.

It’s true that private nonprofit colleges are likely to struggle in the weeks and months, and perhaps even years, ahead; selling a high-priced in-person education when teaching is remote and families are struggling is hard. And while the Education Department’s financial monitoring process is by no means perfect, waiving those tools now would be irresponsible. Because the federal financial assessment lags, colleges whose struggles this spring stem solely from the effects of the coronavirus will not risk federal consequences for years.

Pausing financial oversight of private colleges could increase the odds of unexpected closures, leaving students to transfer to another institution on their own and taxpayers to shoulder the full cost of canceling loans. Already challenged colleges would not have to provide the government with letters of credit or other types of financial guarantees that cover costs in case they suddenly close. They would not be subject to additional monitoring that can help identify the need to create plans for where students will transfer if a college goes under. As new Education Department data analyzed by the Center for American Progress show, the main immediate beneficiaries of relaxing oversight would be troubled private for-profit colleges; this move would give a free pass to colleges that were facing challenges well before the pandemic began.

Rather than abandon financial accountability, Congress should push the Education Department to make it more effective in the short run. This starts with adopting some concepts included in the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act passed by the U.S. House of Representatives on May 15: asking for newer financial data, instead of waiting months for audited financial statements; focusing on immediate liquidity; and requiring institutions that don’t have enough cash on hand to create concrete agreements outlining where their students can transfer in the event of a closure. Such an approach wouldn’t address the necessary long-term reevaluation of the goals of financial monitoring, as well as the measures it uses and consequences associated with it, but it would provide a short-term fix.

How financial responsibility scores work

The accountability standard in question is known as the financial responsibility composite scores. This metric is calculated for all private nonprofit and for-profit colleges by using a combination of three measures—one each to look at a college’s reserves, borrowing power, and profitability. For nonprofit institutions, the profitability measure is more accurately described as operating within their means. The three measures are combined using different weights to produce scores that can range from -1 to 3.

A college’s score dictates whether it faces consequences. Those with a score higher than or equal to 1.5 pass. Those with a score lower than 1 fail and may be terminated or suspended from federal aid programs. The education secretary has discretion to allow schools with failing scores to stay in federal aid programs on a probationary basis, known as provisional certification, but this option cannot be used for more than three consecutive years. Those colleges have to meet certain conditions to keep receiving federal aid, including providing financial protection to the federal government to cover costs of a closure, which can be done by posting a letter of credit from a lender to keep receiving financial aid.

Colleges with scores between 1 and 1.5 are known as zone institutions and face additional reporting requirements. Most consequentially, they can only participate in the federal aid programs under heightened cash monitoring, in which there is a delay in how quickly they receive funds from the federal government. Financial aid payments to students and families are not affected.

The Education Department calculates the scores using audited financial statements that institutions must submit within either six months or nine months after the end of their fiscal year, depending on the type of college. This time frame, on top of the time it takes the Education Department to process the scores, results in a long lag before scores are published. For example, the scores the agency released a few weeks ago are for fiscal years that ended between July 31, 2017, and June 30, 2018, or, depending on the school’s calendar, the 2016-17 or 2017-18 academic years.

This lag means that the scores that reflect the initial effects of the coronavirus in spring 2020 will not be public for two or three more years. Even if the federal government were to levy consequences associated with failing financial responsibility scores before making them public, more than a year would pass before an institution that failed solely due to the crisis faced consequences from the Education Department.

The delayed nature of composite scores also means that if the department does waive its standards, the biggest winners would be colleges that were already struggling years ago. If they were financially unsteady in a relatively strong economy, eliminating consequences for these institutions now, during economically tumultuous times, would only hurt students and taxpayers.

Colleges with failing scores in 2017-18 would be the big winners of a financial accountability rollback

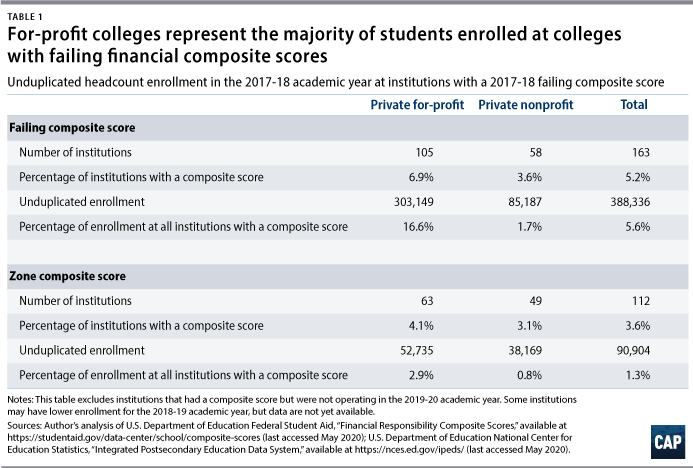

A review of the latest financial responsibility scores shows that troubled private for-profit colleges would be the main beneficiaries of a pause in enforcing financial responsibility— meaning that they would continue to operate with a risk of sudden closure with no plans in place for where students should transfer or financial protection to cover taxpayer losses if a college goes out of business. Only 3.6 percent of U.S. private nonprofit colleges had a failing score in 2017-18, and these 58 institutions represented just 1.7 percent of total enrollment in private nonprofit colleges for that year. (see Table 1)

By contrast, nearly 17 percent of students at private for-profit colleges attended an institution with a failing composite score in the 2017-18 academic year. (see Table 1) Despite accounting for 26 percent of private college enrollment, for-profit colleges represented nearly 80 percent of enrollment in all colleges with failing composite scores. For-profit colleges represent a similar share of student enrollment in colleges that have closed over the last several years.

In fact, 60 percent of students in colleges with a failing composite score based on 2017-18 year data attended just four places, including two corporations that operate multiple college brands: Laureate Education Inc., which operates Walden University; Ashford University; the remnants of what used to be the Education Management Corp. (EDMC), including the Art Institutes and South University;* and Ultimate Medical Academy. Combined, these institutions received $1.8 billion in federal student loans and Pell Grants in the 2018-19 academic year, according to a CAP analysis of federal financial aid data.

In fact, 60 percent of students in colleges with a failing composite score based on 2017-18 year data attended just four places, including two corporations that operate multiple college brands: Laureate Education Inc., which operates Walden University; Ashford University; the remnants of what used to be the Education Management Corp. (EDMC), including the Art Institutes and South University;* and Ultimate Medical Academy. Combined, these institutions received $1.8 billion in federal student loans and Pell Grants in the 2018-19 academic year, according to a CAP analysis of federal financial aid data.

Ashford and its parent company, which used to be known as Bridgepoint Education and now goes by Zovio, have been the subjects of numerous state lawsuits and federal investigations over issues related to recruitment, marketing, and a private loan product it offered. California tried to cut Ashford off from access to GI Bill funds, although the U.S. Department of Veterans Affairs overruled the state. The company has never admitted wrongdoing, including in a more than $7 million settlement with the Iowa attorney general in 2014 over allegations of deceptive recruiting practices as well as a consent order with the Consumer Financial Protection Bureau over its private loan products, in which Ashford forgave $23.5 million in loans and paid an $8 million civil penalty. Ashford has disputed the allegations in the lawsuits and investigations, and an investigation from the Securities and Exchange Commission ended without any enforcement action.

The institutions that used to be owned by the EDMC have a similarly troubled history. In 2015, the EDMC settled with the federal government and several states for nearly $100 million over alleged improper recruiting practices, though it did not admit to any wrongdoing. A nonprofit organization with no experience running colleges purchased the EDMC institutions in 2017 but ran into financial trouble. It sold South University and the Art Institutes in 2019 to a nonprofit whose board members are Wall Street investors.

Ultimate Medical Academy, meanwhile, does not have a major national profile, but its former executive vice president had served as chief operating officer at Trump University. And one of Ultimate Medical’s vice presidents—apparently still in the position—was the director of operations at Trump University.

Pausing the financial responsibility scores process would save each of these institutions millions of dollars, because they would not need to get letters of credit to cover their shaky finances. There would also be follow-on effects for accreditation agencies. Many accrediting organizations use federal financial data to conduct their own oversight; if the Education Department were to stop collecting or publishing this information, it would be harder for these nonfederal actors to do their jobs.

Colleges with zone scores in 2017-18 would also benefit from a pause on financial oversight

Looking at institutions in the middle zone shows a similar story. Less than 1 percent of students at private nonprofit colleges attend institutions with a zone composite score. Overall, nearly 60 percent of students at institutions with these results attended for-profit institutions. Almost 36 percent of students attending colleges with a zone score are enrolled at just two institutions: Lincoln Tech and National American University. The latter is facing a class-action lawsuit over recruiting practices and slightly more than one year ago reported to investors that it had substantial doubts about its ability to stay in business. National American has not issued any comments on the pending lawsuit based on the author’s review of several news articles about the issue.

The consequences of being in the zone are lower, but pausing financial responsibility scores still benefits institutions that fall in this category; they would no longer be subject to the requirement that institutions cannot spend more than three consecutive years in the zone and would be subject to decreased monitoring.

Policymakers should improve, not eliminate, financial monitoring

To be sure, the financial responsibility scores are not perfect. The long lag time to calculate scores means that many more institutions may be in trouble than the outdated picture presents. The accountability regime could stand to place more emphasis on bad outcomes besides just sudden closure, such as excessive growth in enrollment, which can weaken educational quality. But these problems call for better and stronger accountability, not pausing the measures that exist now. The risk to students and the cost to taxpayers resulting from sudden closures because of financial problems are too great to simply ignore the problem.

In an ideal world, the Education Department would overhaul the scores to place a greater emphasis on timely information and rethink their measures to better consider how institutional growth and ownership by outside investors can increase risks for students and taxpayers. But amid the coronavirus crisis, there simply isn’t time to collect the data and run the thoughtful rule-making effort needed to get that right.

Absent long-term solutions, a short-term approach such as the institution stabilization program in the HEROES Act makes sense. Under that program, a private nonprofit institution with a failing composite score for fiscal years that end in 2019 or 2020 or with insufficient liquidity to fund six months of operations at the time of enactment would not have to submit a letter of credit. Instead, it would need to come up with a plan for how it would handle closures, including who would manage records and where students would transfer. Colleges with less than three months of liquidity would have to submit a teach-out agreement, which goes further than a plan for where students would go; it involves binding commitments from other colleges to accept some students. These institutions would also have to more frequently report on enrollment and liquidity levels. While arguably too soft on colleges with almost no liquidity, this approach would at least ensure that stronger monitoring and protections for students are in place in the event that a college shutters.

The institution stabilization program rightfully excludes private for-profit colleges from the additional flexibilities, but all of these institutions should be subject to a liquidity analysis, with strict limitations on enrollment placed on any for-profit institution that lacks sufficient cash reserves.

Conclusion

The current outlook is not good for many private colleges, and it may get worse if family finances keep deteriorating and colleges must stick with mostly virtual instruction for some or all of the next academic year. While it would be a shame if colleges that would otherwise be in fine financial shape—especially those that have a historical mission to serve underrepresented populations—had to close, policymakers cannot turn a blind eye to the possibility that a large number of closures may occur. Doing so puts too many students at risk that their colleges will close with little or no warning, disrupting their education at an already turbulent time. Financial responsibility scores aren’t perfect, but in the current moment of crisis, they are the best measure in place right now to prevent students and taxpayers from paying for problematic institutions’ poor performance.

Ben Miller is the vice president for Postsecondary Education at the Center for American Progress.

* Author’s note: These figures include all locations attributed to that parent company in 2017-18 by the Education Department. Some of these institutions may have since closed, been sold, or had enrollment fall.

To find the latest CAP resources on the coronavirus, visit our coronavirus resource page.