Last December, the House Committee on Education and the Workforce rushed through a partisan rewrite of the Higher Education Act less than two weeks after introducing it. Since then, the bill has languished without a vote scheduled in the House.

Yet, there are signs that might be changing. Last week the House majority whip convened a meeting to discuss the bill as rumors swirl about a potential vote coming in June.

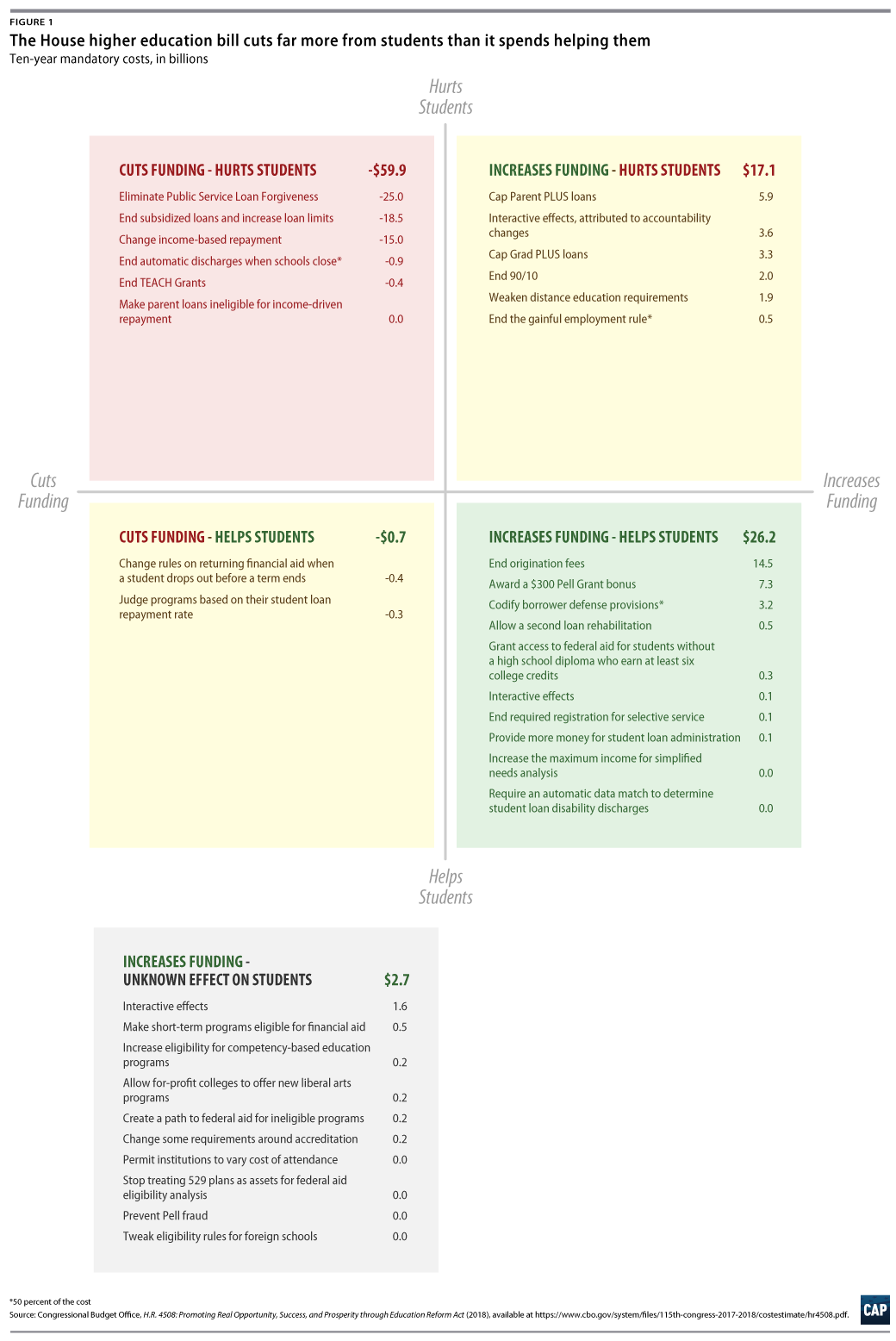

One of the most common critiques of the legislation is that, over the next decade, it cuts almost $15 billion from higher education. A closer look at that Congressional Budget Office (CBO) cost estimate, however, shows the story for students is much worse than that net-cost figure. The bill includes $60 billion in cuts over a decade. It then spends $26.2 billion in benefits that are clearly good for students, while the usefulness to students of another $2.7 billion in changes will depend on whether there is sufficient accountability to ensure quality. As a result, CAP estimates the net loss to students is about $31 billion.

Our estimate is more than two times larger than the CBO’s because the House legislation spends billions of dollars on changes whose effects, ultimately, would harm students. For instance, the bill spends more than $4 billion to decimate the higher education accountability system; the CBO estimates that providers that would have otherwise lost eligibility or shrunk under the old system will instead get more financial aid, thus increasing federal spending.

The best way to understand the House legislation is to break the components up based on whether they save or cost money and if they hurt, help, or have an unknown effect on students. Table 1 shows that breakdown based upon 10-year mandatory cost estimates.

The rest of this analysis breaks down each of these areas in greater detail.

Provisions that reduce funding and hurt students

The House legislation has three big changes that cut a combined $58.5 billion by taking away student benefits. It also includes three other small changes that cut another $1.4 billion for a total loss of $59.9 billion. These are in top-left corner of Table 1. The legislation:

- Ends loan forgiveness for public service workers—a $25 billion cut

- Gets rid of loans that do not accumulate interest while borrowers are in school—an $18.5 billion cut*

- Changes income-driven repayment plans—a $15 billion cut

- Changes smaller elements, such as half the cost of ending automatic loan discharges for borrowers whose schools close (the estimate includes half the cost of this policy) or the full cost of ending the TEACH Grant Program—a $1.4 billion cut

Provisions that increase spending and help students

In exchange for these massive cuts, students would get three clear benefits that cost a combined $25.1 billion—plus a few smaller changes that cost $1.1 billion—for a total of $26.2 billion. These are in the bottom-right corner of Table 1. The legislation:

- Ends student loan origination fees, which are 1.066 percent of the balance for Stafford Loans and 4.264 percent for PLUS loans—a $14.5 billion cost

- Provides a $300 bonus for Pell Grant recipients who take more courses—a $7.3 billion cost

- Codifies processes for receiving loan forgiveness for borrowers whose schools took advantage of them—a $3.2 billion cost, which represents half of the full cost of this change

- Changes smaller items, such as the ability to rehabilitate a defaulted loan a second time; making it easier for borrowers who are totally and permanently disabled to get their loans discharged; a path for students who do not have a high school diploma to get financial aid after earning six credits; and a portion of interactive effects—a $1.1 billion cost

Provisions that increase spending and hurt students

The House bill is much worse than just looking at the net-cost figure. There’s $17.1 billion in this category—shown in the top-right corner of Table 1—included in this legislation:

- Eliminates accountability requirements, such as caps on how much revenue for-profit colleges can receive from the Department of Education; it also includes half the cost of eliminating the gainful employment rule, which removes aid eligibility for career training programs where graduates’ debt levels are too high compared to their incomes; and it weakens rules protecting students from low-quality distance education programs—a $7.9 billion cost, including $3.6 billion in interactive effects that reflect how eliminating multiple accountability requirements costs more than getting rid of each requirement on its own**

- Caps PLUS loans for parents and graduate students—a $9.2 billion cost

The PLUS loans change is less clearly negative than the accountability decimation. These products have worse fees and interest rates compared to other federal student loans and also raise worries about intergenerational debt. However, the legislation pays for capping the loans by taking away loan forgiveness options for other students, which is a worrisome trade. That said, even including this spending would mean the bill still spends nearly $8 billion a year to weaken the accountability system.

Provisions that reduce spending and help students

There are two things in the bill that combine to save nearly $700 million and might theoretically help students by increasing accountability. They are in the bottom-left quadrant of Table 1. The legislation:

- Changes rules on how schools return money when a student drops out before a term ends—which saves $419 million

- Judges programs’ eligibility for financial aid on a repayment rate—which saves $267 million

Just comparing the size of the savings from the new accountability provisions with the cost of getting rid of the existing ones clearly shows how much worse the bill is in protecting students compared to current law. On net, the bill’s accountability changes generate a cost of $7.2 billion—meaning that it will result in an oversight system that grants financial aid to more institutions and programs than current requirements. That’s a concern given that the existing accountability system already does not do enough to protect students from subpar options.

Provisions that increase spending and may or may not help students

Finally, there are some parts of the bill that clearly cost money, but it is unclear whether the changes would help students. In most cases, this lack of clarity is because the bill expands access to a new type of training or program, which might either be good or awful if there is insufficient accountability. All told, these items cost $2.7 billion. They are the very bottom section on the right of Table 1. The legislation:

- Allows students to use financial aid at short-term programs—a $451 million cost

- Expands access to competency-based education programs—a $194 million cost

- Permits for-profit colleges to offer new programs in the liberal arts—a $192 million cost

- Has interactive effects, such as when two policies together generate a greater cost than either alone—a $1.6 billion cost**

What about discretionary spending?

Some of the provisions in this bill would also raise the amount of required discretionary spending. According to one analysis, the bill’s added discretionary costs are $16.8 billion over 10 years. However, these two types of spending are fundamentally different. The mandatory money in the bill would be spent if it becomes law. By contrast, appropriators have no obligation to increase discretionary spending. Congress would have to enact and the president sign additional legislation each year to achieve such additional spending. It’s entirely possible that instead of increasing spending, appropriators could choose to cut federal grants or other education programs.

Including discretionary spending, however, would not make the story meaningfully different. The provisions that cost money and help students are less than $500 million over five years. That’s five times less than the $2.5 billion in provisions that cost money and hurt students and about half the spending for changes with unknown effects.

Adding it up

Counting all the unknown provisions as good for students and not subtracting the savings that help them yields a net loss of $31 billion. For context, that’s roughly the same amount of money spent each year on the Pell Grant program. Even adding in spending to cap PLUS loans to this calculation still yields a net loss to students of $21.8 billion.

The country is overdue for a reauthorization of the Higher Education Act. But it’s hard to look at this House bill and conclude that massive cuts combined with spending a substantial chunk of money on weakening accountability is a good way to solve major national challenges around access, completion, and equity. It’s simply not a good way for America to prosper.

Ben Miller is the senior director for postsecondary education at the Center for American Progress.

*Author’s note: This provision also includes an increase in loan limits, but the CBO estimates this change has a very small spending effect.

**Author’s note: The CBO reports that overall interactive costs for the House bill are $5.3 billion—$2.2 billion for Pell Grants and $3.1 billion for loans. But it does not break down which provisions interact with each other. This analysis proportionally assigns the interactive costs based upon each category’s share of spending. In other words, we estimate that changes to loans that cost money and hurt students are 65 percent of the mandatory spending on loans, so that category gets the same share of the interactive effects for loans, or $2 billion. The calculation for this apportionment does not include any changes that cause net savings, the Pell bonus, ending of origination fees, borrower defense codification, or PLUS loan caps.