Education has been called the passport to the future. It has been defined as the great equalizer and lauded as being a key to unlocking the American Dream. Yet too many children—often low-income and minority children—are denied access to high-quality education because they attend schools that are underfunded and under-resourced. The sad reality is that gross funding inequities continue to exist in this country, and too often the schools serving students with the greatest needs receive the fewest resources.

In the education world, the existence of funding inequities has long been a known fact, but the sources of these inequities have not always been obvious. Typically, we have blamed local property tax variation as the sole, or at least primary, cause of inequalities and called for greater state funding as the solution. In practice, however, we see that states providing a large share of state aid are not necessarily more equitable in their distribution of school funding.

There must therefore be more to the story behind funding inequities. This report tries to provide a fuller picture of the problem so that we know more about what stands in the way of equity. The two chapters that follow explore stealth inequities in school finance, which are defined as often-overlooked features of school funding systems that tend to exacerbate inequities in per-pupil spending rather than reduce them, and that do so in a way that favors communities with the least need.

This report begins by identifying those states where combined state and local revenues are systematically lower in higher-poverty districts—that is, states with “regressive” school funding distributions. Based on this analysis, the authors focus on six states—Illinois, Texas, New York, Pennsylvania, Missouri, and North Carolina—where children attending school in higher-poverty districts still have substantially less access to state and local revenue than children attending school in lower-poverty districts. With these states in mind, the authors then go beyond recent reports on school funding inequities to uncover some nontraditional causes of these imbalances.

The first chapter, “How State Aid Formulas Undermine Educational Equity in States,” written by Rutgers University professor Bruce Baker, explores how state aid formulas—often designed to promote equity and adequacy—can work against their own stated objectives.

What makes these patterns more offensive is that each of these states is taking billions of statewide taxpayer dollars and channeling them back to lower-poverty districts, which are much less in need of state funding support. Baker points out that each of these states could achieve far more equitable distribution of resources and far more adequate educational opportunities in high-poverty settings if these resources were allocated based on student need.

In the second chapter, “The Role of Local Revenues in Funding Disparities Across School Districts,” written by New York University associate professor Sean P. Corcoran, takes a closer look at the role local revenues play in resource disparities across low- and high-poverty school districts. The main storyline is not a new one: Local revenues are primarily determined by a district’s ability and willingness to raise tax dollars for its schools. To the extent that taxable wealth—for example, property or income—is lower in high-poverty districts, poor districts will tend to raise fewer education dollars than wealthier ones for any given level of tax effort. But that is far from the complete story, as Corcoran points out.

For example, nonproperty sources of revenues—such as income taxes, fees, and revenues from intermediate sources—are typically higher in low-poverty districts than high-poverty ones and are rarely equalized through the state aid formula. Additionally, newly legislated restrictions on the growth of local property taxes are likely to constrain poorer districts more than wealthier ones if these districts are less able to obtain the political support needed to obtain an override. At a time when state budget woes have placed more of the burden on local districts, these new constraints on local finance are particularly worrisome.

Suffice it to say, there are a number of ways in which school finance programs can create opportunities for stealth inequities in state and local revenues—inequities not solely due to differences in available resources. The origins of these inequities are not always obvious to lawmakers or education advocates. In order to understand how stealth inequities undermine the intentions of school finance systems, however, you must first understand the systems themselves. Let’s explore the system of funding public education in greater detail.

A primer on state school finance systems

A “state school finance system” is the set of rules, regulations, and policies, which combine state aid with local resources to fund schools so they can meet a given educational goal—usually having at least something to do with improving equity and adequacy of resources for the children of the state. Within that system are various streams of state aid, as well as policies regulating local property taxation. Further, there may be additional local income taxes or county-level tax revenues distributed to school systems. State aid formulas are typically very complex, with many moving parts, each the product of political deliberation and a determinant of who wins or loses when it comes to state aid. The authors refer to each of these formula elements as a “policy lever.” Similarly, local and intermediate tax policies include their own policy levers such as tax limits, definitions of property types, valuation methods, and exemptions. In short, there are a multitude of policy levers that influence both the distribution of state aid, county-level intermediate resources, and the raising of revenues from local taxes and fees.

In general, modern state school finance formulas—aid distribution formulas—strive to achieve two simultaneous objectives:

- Accounting for differences in the costs of achieving equal educational opportunity across schools and districts

- Accounting for differences in the ability of local public school districts to cover those costs

A local district’s ability to raise revenues often is a function of local taxable property wealth and sometimes of the incomes of local residents.

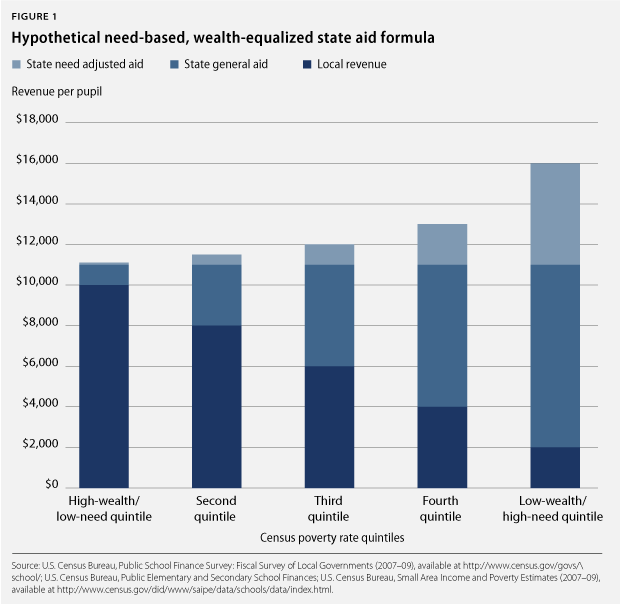

Figure 1 provides an illustration of how state and local revenues combine in an “ideal” finance system to fund per-pupil spending. In this system, state aid compensates for differences in local capacity to raise revenues and provides more revenues to districts with greater educational needs, which may be directly and indirectly related to poverty. Thus revenues differ by poverty concentration in predictable ways, with high-poverty districts typically raising less in local revenues and receiving more state aid, and low-poverty districts raising more in local revenues and relying less on state assistance. In this example, the typical low-poverty district raises most of its revenues from local taxes. To the extent that state aid depends on local fiscal capacity, this illustration makes the simplified assumption that districts with weaker revenue-raising capacity also tend to be higher-poverty districts. While this is not uniformly true—consider a high-poverty urban district with a large commercial property tax base, for example—there is generally a correlation between the two. Districts may receive a small share of general state aid if the total cost of providing educational opportunity exceeds the local resources raised with a fair tax rate.

Overall, the balance of state and local revenue in this hypothetical case is progressive. In Figure 1, general state aid is used to achieve equality of dollar inputs across districts with varying fiscal capacity, and need-based aid is used to adjust for varying costs of achieving equal educational opportunity. In practice, the ways that general and need-based aid are integrated into school funding systems vary. Many states use multipliers or weights in their general aid formula in order to target more aid to children with greater needs. Other states use separate categorical allocations for specific programs, services, or student populations, while still others use a combination of weights and categorical funding. Yet despite the progressive aspirations or intentions of many funding formulas, things don’t always turn out as one might expect or how the state aid formulas intend.

States that get it mostly right

The hypothetical case presented in Figure 1 represents how school funding systems are supposed to look. These state systems provide state aid to offset differences

in local capacity to raise revenues, while also providing more support to those districts with greater educational needs. Of course, no state funding system looks exactly the same as Figure 1. But two states—New Jersey and Ohio—come closer than most.

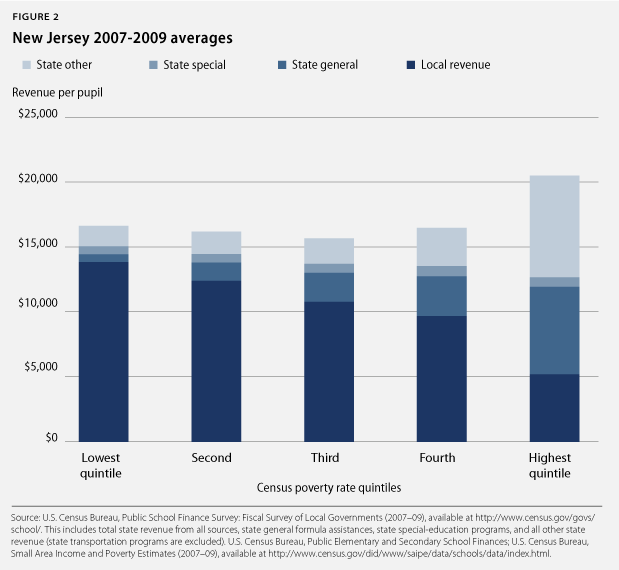

New Jersey is pictured in Figure 2, with revenue components based on a three-year average from the Census Fiscal Survey data (F–33). For New Jersey this three-year average bridges a formula change that moved some funding, which was previously outside of the general aid formula, into a weighting system that is part of the general aid formula—going from the lightest blue into the third lightest. New Jersey’s combination of general and special state aid driven to high-poverty districts creates a significant progressive tilt. Even in New Jersey, however, the lowest-poverty districts continue to receive substantial aid outside of the general formula—the lightest two blue regions. Notably, this additional aid to the lowest-poverty districts keeps those districts ahead of moderately high-poverty districts and thus undermines the formula’s progressive tilt toward equity. As states such as New Jersey make a greater effort to drive resources into higher-poverty districts, districts in the middle are often “squeezed out”—a pattern observed in a number of other states.

Figure 3 shows Ohio over the same three-year period. Similar to New Jersey, Ohio succeeds at driving resources to the highest-poverty districts. At the same time, Ohio also drives significant portions of general aid into low-poverty districts. Similar to New Jersey, districts caught in the middle in Ohio remain somewhat left out.

Again, New Jersey and Ohio are among the states that do the best job of achieving a progressive distribution of resources across districts in accordance with local fiscal capacity and student needs. Let’s now turn to states that do much worse than New Jersey and Ohio.

Identifying the least equitable states

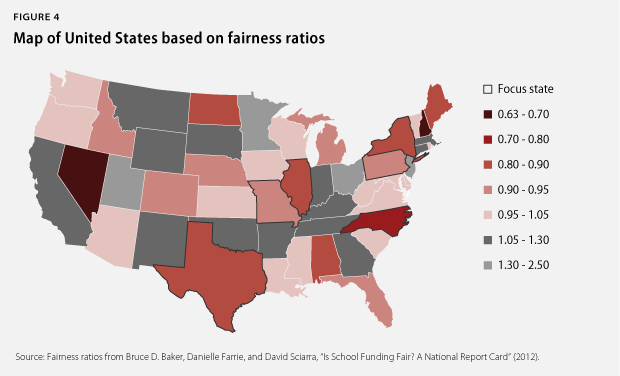

To identify the least equitable states in the country, the authors adopt a version of the School Funding Fairness model used in an annual report produced by the Education Law Center of New Jersey. This model enables identification of the states that generally have more regressive state school finance systems—or systems where higher-poverty districts have systematically lower state and local revenues per pupil than lower-poverty districts. The first step is to identify the most regressive state school finance systems—that is, states with the greatest imbalance in revenues available to both low- and high-need school districts. The model uses data from the years 2006–07, 2007–08, and 2008–09, and determines the relationship between state and local revenues available to districts and their enrollment (size), population density (which is also interacted with size), teacher-wage cost, and the percent of children in poverty. In other words, variation in state and local revenues is first examined with respect to basic measures of educational cost. Then the states where, holding constant other cost factors, revenues have the weakest relationship to poverty are identified.

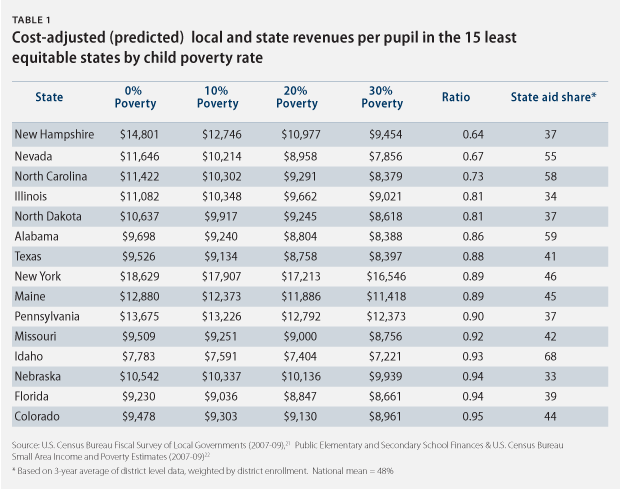

Table 1 summarizes the bottom 15 states by this measure: those states which have the largest gaps in funding between the highest-poverty districts and lowest-poverty districts after correcting for the other cost factors in our model. In New Hampshire, for example, a district with 30 percent of children in poverty receives only 64 percent of the state and local revenue per pupil of a district with no—0 percent—children in poverty, after adjusting for cost factors. New Hampshire, however, is a relatively small state that maintains a very high local share of school funding (63 percent), making it a less interesting case in a study of stealth inequities. Likewise, Nevada fares poorly in terms of progressivity, but it too is an unusual case, with only 17 school districts and the majority of children situated in a single district (Clark County). The remaining candidates in Table 1 include a number of large and geographically diverse states.

Table 1 relies on a statistical model to adjust for differences in district cost characteristics such as size, population density, and average wage costs, but, as it turns out, a simple unadjusted comparison of mean revenues between districts in the lowest and highest quintiles of poverty produces a very similar list of inequitable states (see Table 1a). To put it another way, the selection of inequitable states does not strongly hinge on the methods adopted from the School Funding Fairness report. State and local revenues are sufficiently unequal in these cases that many of the same states—including the six selected as focus states—appear on this list.

A comment on the role of federal revenues is in order at this point. The largest share of federal revenues to local public school districts are Title I revenues, which are targeted on the basis of poverty. But the influence of these revenues on the overall progressive or regressive nature of state school finance systems is small. Federal Title I revenues, for example, when included in the funding fairness model, tend to raise the revenue estimates for the highest-poverty districts (more than 30 percent, based on U.S. Census poverty data) by about 5 percentage points.

As noted earlier, the goal of this report is to uncover stealth inequities to explain why these states exhibit such regressive patterns in school spending. Is it the case that in the most regressive states, there is simply not sufficient state revenue in the system to target low-wealth districts in order to improve equity? Or are other factors at play?

Choosing our focus states

This report does not explore the causes of disparities for every state in Table 1. Rather, it starts from the most regressive and chooses a number of states that are:

- Geographically dispersed across regions

- Sufficiently large and diverse

- Exemplars of the variation in state education systems in the United States

Notably, there are few states from the West and Southwest regions in our analyses. While these states may have their own set of school finance problems—such as low overall spending on public education—with the exception of Nevada, they are not systematically regressive as defined here.

This report focuses on six states with regressive distributions of state and local revenues in Table 1—Illinois, Texas, New York, Pennsylvania, Missouri, and North Carolina. (Note: North Carolina, Florida, and Alabama operate in county-level systems, with state aid flowing to counties. Because North Carolina is the least equitable among these, the authors chose to explore the causes of inequities there.) These six states are geographically and demographically diverse and round out the sample for the exploration of stealth inequities.

States must scrutinize regressive funding systems and implement progressive funding formulas and approaches that use financial resources in ways that will most effectively level the educational playing fields between their districts. Nationwide, school finance disparities continue to seriously undermine the mission of this country’s public schools. Eliminating these disparities must be a priority if our goal is to successfully educate this generation of children to compete and win in the global marketplace.

Bruce D. Baker is a professor in the department of educational theory, policy and administration at Rutgers, the State University of New Jersey. Sean P. Corcoran is an associate professor of educational economics at New York University’s Steinhardt School of Culture, Education, and Human Development, and an affiliated faculty member of the Robert F. Wagner School of Public Service.