In tandem with increasing individual wealth inequality, growing regional inequality between large “superstar” cities and struggling towns and rural communities has worsened in recent years, prompting interest from lawmakers and citizens alike in place-based economic development policies.1 These policies are narrowly targeted to promote job creation in a particular city or region—often in localities that are perceived as being left behind. Although state and federal governments use a variety of policy tools to promote growth in economically distressed areas, the strategy that has received the most attention in recent years is economic development subsidies. However, as the Center for American Progress found in the 2018 issue brief “The Realities of Economic Development Subsidies,” despite the promises made by prospective employers, these haphazard, secretive, and often rushed incentive packages tend to be of limited effectiveness.2

Several economic development subsidy packages awarded to specific companies have been a fixation of policymakers and national news outlets. For example, shortly after the 2016 election, President-elect Donald Trump claimed credit for brokering a deal in which Indiana gave an air conditioner manufacturer a generous subsidy to dissuade it from offshoring jobs to Mexico—which the company ultimately did anyway.3 Similarly, Wisconsin offered Taiwanese manufacturer Foxconn up to $4.5 billion in various state and local subsidies to build a new factory in the state, based on the company’s claims that it would create 13,000 jobs—a promise Foxconn still has not come close to fulfilling.4 At the federal level, the “opportunity zone” program is purported to bring capital investment to poor census tracts, although the policy seems to be written with the interests of wealthy investors in mind rather than the residents of the depressed regions.5 These deals represent the most egregious examples of giveaways to corporations and the wealthy, but they also illustrate common flaws that characterize economic development subsidies in nearly every state.

When a company is considering relocation or expansion, city, county, and state officials compete by offering various incentives to entice companies to come to their communities. Policymakers who denounce massive subsidies and giveaways are often accused of costing a region jobs; and corporations recognize the leverage that they have over cities, states, and counties when they make credible threats of departure or nonarrival—moves made possible by globally mobile capital.6 The increasing leverage that corporations wield over local, state, and federal governments necessitates dramatic reforms at all levels of government.

In crafting effective economic development policy, federal, state, and local governments must work together to lean against this shift in bargaining power and resist the temptation to compete against each other to drive down standards and bid up giveaways. Specifically, this means instituting a suite of changes designed to generate sustainable, broad-based benefits that are progressively distributed and can be achieved in a cost-effective manner. This report lays out four areas of reform that federal, state and local lawmakers should advance in order to promote economic development that better serves working Americans and represents good stewardship of taxpayer dollars. An equitable economic development policy approach ensures high labor standards, requires transparency and accountability, targets investments toward the people who need it most, and safeguards against cuts to public goods.

The policies and best practices outlined in this report call on federal, state, and local governments to:

- Target genuinely distressed communities through investments that yield higher economic returns, such as workforce training and business services.

- Use economic development to support good jobs by setting high wage and labor standards for any jobs created through subsidy deals.

- Ensure that subsidies do not come at the expense of other services and programs essential to economic growth and prosperity—namely, education, infrastructure, and housing.

- Promote accountability and combat corruption by publicly disclosing the value and content of subsidy deals; conducting annual assessments of investments; adopting clawback stipulations to hold companies accountable for their promises; and requiring site consultants—agents who represent corporations in negotiations—to register as lobbyists.

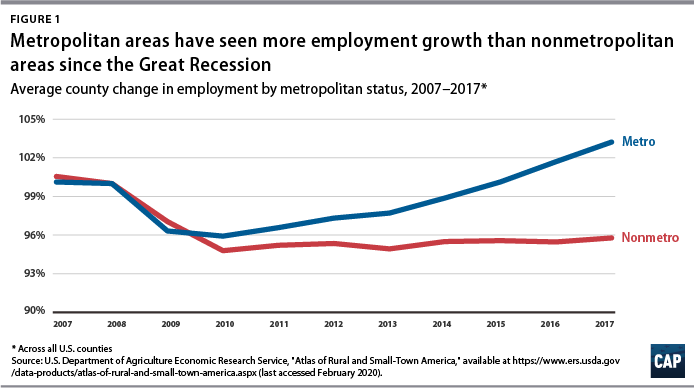

Economic growth has been unevenly distributed across American communities. From 1980 to 2013, the share of the U.S. population living in metropolitan areas that lie on either extreme on the income distribution rose from 12 percent to 30 percent.7 Since the 2008 recession, metropolitan counties overall have seen enormous increases in employment, while nonmetro counties have yet to reach their 2007 employment levels.8 This growing spatial inequality is a pressing concern for policymakers across the country.

Economic development subsidies are one of the most controversial policy tools that local and state policymakers use to create jobs and revitalize community economies. While the short-term political payoff can seem big, a growing body of research suggests that these deals are not nearly as effective as advertised. In fact, one literature review found that the majority of studies on economic development subsidies found mixed effects or no effect on economic growth.9

The most glaring problem with economic development subsidies is that there is no convincing evidence that incentives substantially influence the decision of a firm to locate in a given area.10 Instead, firms are likely swayed by other factors, such as local human capital and infrastructure. For example, Amazon, in its hunt for locations for its second headquarters, reportedly turned down a generous subsidy offer from Detroit due to concerns that the city did not have a large enough skilled workforce or adequate public transit.11 Similarly, the Washington Joint Legislative Audit and Review Committee’s analysis of aerospace industry subsidies was unable to confirm that the $1.1 billion in corporate tax preferences doled out from 2014 to 2017 retained more jobs than if the state had not offered them at all.12 In cases like that of Washington, in which subsidies did not influence a company’s decision, the locality receives no added benefit for its investment—rather, the locality simply pays the company to do what it had always intended.

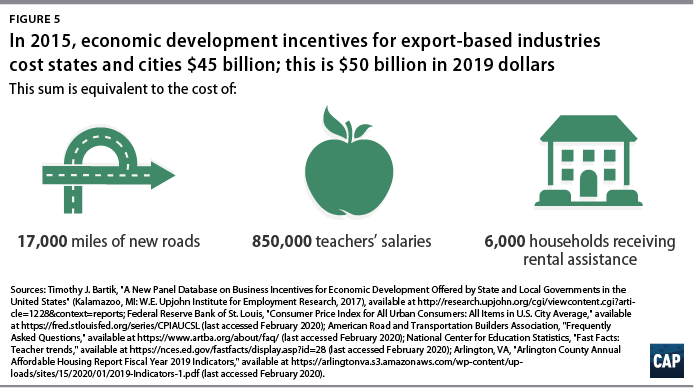

In part due to competition among states to offer companies the sweetest deal, development subsidies are frequently an exceptionally expensive way to create jobs—essentially amounting to a payroll tax in reverse. Although the cost of subsidies varies widely, one study of manufacturing-intensive communities estimated that on average, tax incentives have an annual cost of about $16,000 per job created, compared with $3,000 per job created from investments in customized job training.13 On the extreme end of the spectrum, the deal between Foxconn and Wisconsin could cost as much as $290,000 per job over several years.14 These costly expenditures often come at the expense of public services, such as maintaining infrastructure, that are key to attracting and retaining businesses, which may undercut the benefits of the direct business subsidies.

Despite the dubious effectiveness of providing direct subsidies for specific businesses, states and localities continue to compete against each other in an often ceaseless bidding war for private investments.15 By forcing states and localities to bid against each other for the jobs at stake, mobile corporations force governments to eat into the surplus value of the created jobs to their respective constituents, possibly exceeding the economic value of a company’s presence in the community.

Some states have recognized the economic bidding war as a zero-sum game and have decided to de-escalate or opt out of the race altogether. Neighboring states Kansas and Missouri, after years of poaching each other’s businesses—which often need only to move within the Kansas City commuting zone to receive generous subsidy offers—have brokered an uneasy peace.16 Govs. Mike Parson (R-MO) and Laura Kelly (D-KS) signed an agreement stating that the two states would cease offering tax incentives that poach companies across their shared border without creating new jobs.17 California policymakers recently moved to put an end to competition among local governments for employers by passing a bill banning local tax incentives, although it was ultimately vetoed by Gov. Gavin Newsom (D).18

However, voluntary change on the part of a handful of municipalities and states does not address the perverse incentives operating at the national level, which is why some policy experts have called for a national prohibition of state and local economic development subsidies.19 Art Rolnick, a senior fellow at the University of Minnesota and former economist with the Federal Reserve Bank of Minneapolis, has called for a 100 percent federal tax on the value of state and local incentives received by corporations—effectively banning them.20 Taxing subsidies is not a new idea. In 1999, Rep. David Minge (D-MN) introduced H.R. 1060, which would have taxed any local or state subsidy as income in order to reduce the power of these packages to entice companies.21 These proposals are not without criticism, least of which is the fact that banning subsidies would be of limited effectiveness unless state corporate tax rates—another form of competition among states—were also standardized.

The European Union has pioneered a novel approach to de-escalating intermember competition. The EU’s state aid system requires advanced notification and approval from the European Commission of any development subsidies and puts restrictions on the size of subsidies based on the needs of the region and the scale of the proposed private investment. States are not permitted to subsidize private developments in areas that are not economically distressed, and subsidies may not exceed 50 percent of promised private investment.22

Even short of prohibitions or subsidy caps, federal intervention can play a large role in curbing perverse incentives as long as corporate interests are able to pit state and local governments against each other. Progressive states and municipalities should lead the way by adopting the following best practices in their development strategies. As state and local governments begin to adopt sensible reforms to economic development policy, federal policymakers should design federal economic programs that support states in taking a high-road approach to job creation.

Target policies toward enduring investments that create broadly shared benefits

Economic development incentives have a mixed record for delivering on promised outcomes. However, some investments have proved to yield more effective and equitable results than others. Specifically, prioritizing packages that target distressed areas and invest in job training and business services—rather than tax subsidies—tends to serve communities best.23

State officials should target jobs toward current residents who are unemployed and underemployed. Increasing employment among current residents increases tax revenues and minimizes public costs that increase when new residents take created jobs.24 Moreover, investing in job creation in the most depressed local economies yields larger employment effects than investments targeted in middling or thriving communities.25 Timothy J. Bartik, a senior economist at the W.E. Upjohn Institute for Employment Research, recommends implementing “first-source” requirements in economic development policy and assisting employers in training, hiring, and supporting the existing workforce to ensure that legacy residents see the benefits of economic development.26 Although these measures could make economic development subsidies more effective, few subsidy programs employ them, presumably because they make the offers less appealing to companies.27

State and local governments should also prioritize investments in workforce development to attract employers. These incentives could include publicly funded job training, perhaps offered by a community college, that could be tailored to meet the hiring needs of a specific business.28 In the case that a company shuts its doors, workers would still retain valuable skills and the community could adjust the training programs to meet other needs. Workforce development investments should also center racial and gender equity and be designed in collaboration with local labor organizations, employers, community organizations, and local government officials to ensure a lasting commitment through formal partnerships. The federal government can play an important role in reshaping workforce training programs by establishing a Workforce Equity Trust Fund (WETF) that would provide transportable, wraparound training services to workers.29 These structures can help promote equitable results and stable, quality jobs.

A Workforce Equity Trust Fund

CAP has called for a new approach to workforce policy: establishing a Workforce Equity Trust Fund to deliver quality training through inclusive partnerships to help place people in quality jobs.30 The WETF would be funded by a small tax levied on large corporations and be governed by a tripartite board with representatives from business, labor, and government. The trust would ensure wraparound services and portable benefits to low- and middle-income workers. Federal workforce policy reform would also incentivize the use of targeted hiring, apprenticeship utilization, and job quality requirements for all publicly supported training programs.

In a similar vein, state and federal programs should also prioritize subsidizing enterprises through the provision of services rather than cash giveaways in the form of direct subsidies. The provision of custom services—especially those aimed at local small and medium-sized enterprises—are sounder investments when compared with many recent megadeals. These custom services can include approaches such as the aforementioned WETF that provide customized job training; assistance to help businesses establish the manufacturing or technical infrastructure they need to grow; or readily available support for administrative challenges such as accounting. Bartik estimates that these customized services raise per capita income by 5.8 percent, while the typical subsidy package yields about 0.2 percent growth.31 Another option is to invest in small-business development centers that promote the creation and growth of local businesses by providing training and consultation for aspiring entrepreneurs. One example is Pennsylvania’s Ben Franklin Technology Partners—a public-private partnership that offers startup capital and mentoring services to technology-based businesses.32

The federal government can support these types of efforts through the Small Business Administration and the Economic Development Administration by investing in local resources and programs. As CAP noted in a 2016 report, “A Progressive Agenda for Inclusive and Diverse Entrepreneurship,” reestablishing the U.S. Department of the Treasury’s State Small Business Credit Initiative—which supported state small-business development programs—would be a welcome addition to the current suite of federal programs aimed at promoting entrepreneurship.33

In summary, state and federal economic development subsidies should focus more on how taxpayer money is being invested rather than on the total amount of a cash prize. Focusing on investments in people, infrastructure, and services pays off in the long run much more than a direct subsidy.

Ensure that economic development programs create good jobs

Simply creating jobs is just half the battle: A strong economic development strategy will yield quality, stable jobs with fair pay, benefits, and opportunities for advancement. Unfortunately, subsidized jobs are often substandard, and few incentive programs set requirements that guarantee better pay and benefits. For example, in the years after Nissan opened a plant in Canton, Mississippi—with the help of $1.3 billion in state and local subsidies—workers became concerned with deteriorating workplace safety and the growing reliance on subcontracted laborers who performed the same work for lower pay.34 Charlotte, North Carolina, and Mecklenburg County, North Carolina, subsidized call center jobs paying as little as $30,000 per year—about $20,000 less than the average salary in the area.35 Boeing conditioned its commitment to building the 777X in Washington state on both the extension of the state’s aerospace tax credit for another 16 years and significant concessions by the International Association of Machinists and Aerospace Workers at the bargaining table.36

In fact, although policymakers tend to publicly tout subsidies as job creation programs, other outcomes such as capital formation or growth of the local or state tax base are often the actual goals of the incentives. One survey of manufacturing business incentives found that states’ most commonly cited rationale for tax subsidies was capital formation.37 In a 2014 survey of city and county governments, respondents were just as likely to cite growing the tax base as they were to cite creating jobs as the goal of their governments’ economic development strategies.38 It is no wonder, then, that few economic development packages contain strong job quality requirements.

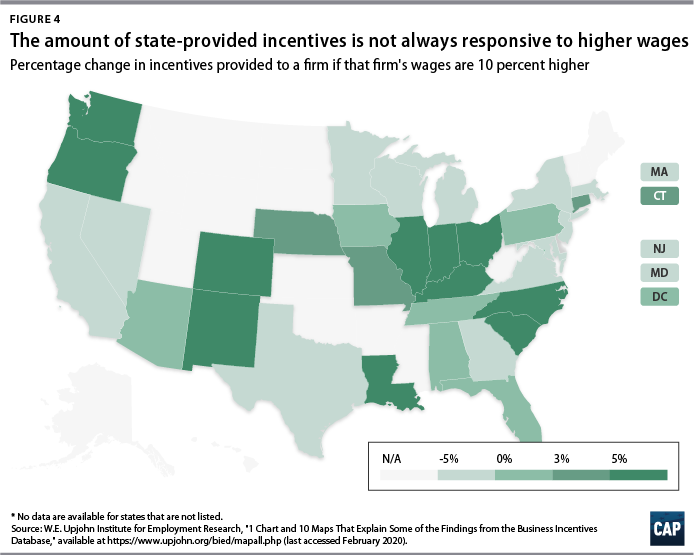

A 2011 audit of state subsidy programs found that fewer than half of all state subsidy programs imposed wage requirements on the supported employers. Of those that did, only about half used the more robust prevailing wage standard, which pegs pay to the typical wage paid to similar workers in a region, so long as it is above a certain floor.39 Moreover, an analysis from the W.E. Upjohn Institute shows a weak relationship in many states between the amount that a state spends on incentives and the wages of the jobs created, suggesting that they do not generally account for job quality in their subsidy deals. (see Figure 4) One exception is Washington state, which does seem to grant higher awards for the creation of higher-wage jobs overall. Some cities have led the way in raising standards for jobs created through taxpayer subsidies. For example, Pittsburgh requires service sector workers employed in large economic development projects to be paid a prevailing wage.40

State and local governments should attach strong labor standards to any jobs that they subsidize through incentive programs, much like the federal government and some states do with certain contracts.41 For example, Maryland adopted a prevailing wage standard requiring contractors who bid on publicly funded projects to submit payroll information proving that they pay their employees an appropriate wage.42 At a minimum, these jobs should pay $15 per hour—or the prevailing wage, depending on which is higher—automatically adjusted for inflation, as well as provide health benefits, protection from discrimination, and enhanced protections to ensure that workers can exercise their rights.43 Previous CAP research found that including wage standards in economic development programs did not slow job growth when compared with control cities.44

States must ensure that any job quality provisions are accompanied by clauses known as clawback provisions, which require companies to return any subsidies received if they break with these provisions.45 Cities, states, relevant nonprofit community organizations, and state attorneys general should have the power to exercise clawback provisions and hold corporations accountable. States and local governments should also, when appropriate, invite labor organizations to participate in the process of negotiating these deals to ensure that the interests of workers are represented.

The federal government, for its part, must institute robust labor standards across the nation, constraining the ability of states to compete with each other through low-road labor practices.46 By raising the minimum wage, abolishing “right-to-work” laws, and guaranteeing the right to organize labor unions in every state, the federal government can put a floor beneath the destructive race to the bottom. For instance, the Protecting the Right to Organize Act would go a long way toward making collective bargaining available to many more Americans.47 Legislation such as the Raise the Wage Act, passed by the House in 2019, would raise the minimum wage to $15 per hour and eliminate the subminimum wage for tipped workers, which would in turn reduce the incentive for companies to hop from state to state in search of cheaper labor pools.48 The federal government should also explore, on a program-by-program basis, ways to make the receipt of federal economic development subsidies by private, for-profit businesses contingent on high-road standards for wages, benefits, and working conditions, similar to existing federal practices for procurement and contracting.

Tie incentives to the preservation of public goods and services

Investments in infrastructure, transportation, housing, schools, parks, and other public services contribute to creating and maintaining communities that are desirable for companies, workers, and their families. Of course, these crucial investments are not possible without an adequate tax base—a burden that should not fall mainly on working families.

Tax incentives and other subsidies are sometimes so large or long term that they compromise the tax base of a community.49 Under a bill passed by the Wisconsin State Legislature, Foxconn can receive payroll tax credits until 2033.50 In an extreme case, Altoona, Iowa, secured a Facebook data center by waiving property taxes on the facilities for 20 years, putting a dent in the school district’s budget to the tune of almost $900,000 in one year.51 Any cost-benefit analysis undertaken by a state must account for the opportunity costs of economic expansion that result when budget cuts undermine public services—as well as the increased costs of services incurred by the proposed development.

Often, the public services on the chopping block in the event of a budget shortfall are crucial to the economic well-being of the entire community. Infrastructure investment, for example, is crucial to the promotion of economic growth across the local economy. Moreover, maintaining affordable and efficient public transportation is critical to attracting employers competing for a sliver of highly skilled workers who may be choosier about where they relocate. Similarly, investment in affordable housing is indispensable to members of low-income communities, who may not be able to pay for housing near their job. In fact, the lack of affordable housing can severely affect the economic competitiveness of a community.52

States and municipalities should adopt best practices that ensure corporate incentive packages do not come at the cost of essential public services. Any cost-benefit analysis commissioned or conducted by state or local governments must contain line items that estimate the opportunity costs that would result from possible cuts to public services. Furthermore, state and local governments can institute contingency and clawback provisions that defer the distribution of some future subsidy payments or benefits until broader-based metrics, such as revenue growth, are met. State and local governments may also consider capping the size of a subsidy at a percentage of its tax base, much like the EU does, to ensure that they can avoid deep cuts to education and transportation.53 Alternatively, state and local governments may choose to cap the total value of an incentive to add some more budgetary certainty.

Hold companies accountable and combat corruption

State and local governments must spend taxpayer money responsibly. Unfortunately, the typical method of disbursing economic development incentives lacks basic accountability measures or transparency. The bidding process for private investment is highly secretive, with constituents and taxpayers often kept in the dark until the deal is already signed. Highly paid location consultants represent companies to state and local officials, effectively serving as lobbyists tasked with facilitating lucrative incentive offers. The process is rife with the potential for favoritism. In fact, a 2019 study found that political contributions from a corporation were closely associated with the likelihood of obtaining a subsidy in a given state.54 After the deal is finalized, there is little to no evaluation or oversight of how the company performs.

Far too often, companies do not live up to their job or investment promises—and if they do, there is little evidence to confirm it. Only 55 percent of municipalities tracked the effectiveness of their economic development policies.55 State and local governments must thoroughly evaluate investment outcomes annually and make these analyses available to the public.56 They should require companies receiving incentives to submit verifiable data based on predetermined metrics, such as the number of jobs created, that allow governments to determine the cost-effectiveness and success of their economic development strategies. Moreover, the continued receipt of subsidies should be contingent on the achievement of certain benchmarks measuring public welfare and economic impact.

In order to ensure that economic development subsidies are going toward meaningful economic investment rather than corrupt giveaways to entrenched corporations, states and municipalities should adopt baseline reporting and accountability measures. At the state level, transparency can be improved by requiring companies to register location consultants as lobbyists under relevant state statutes.57

The federal government should require recipient companies to disclose the value of federal, state, and local incentives and subsidies and create searchable public databases of this information. Additionally, the federal government should make federal grants to state and local economic development programs contingent on states collecting and disclosing the data and metrics described above, as well as additional corporate environmental, social, and governance (ESG) practices through the U.S. Securities and Exchange Commission—even for nonpublic companies larger than a certain size.58 Lastly, the federal government could extend coverage similar to that of the Foreign Corrupt Practices Act to location consultants who operate across state borders in order to limit their lobbying and political donations to state and local officials. Barring federal requirements, state and local governments should build public, searchable databases of agreements and submitted applications that are updated in a timely manner.

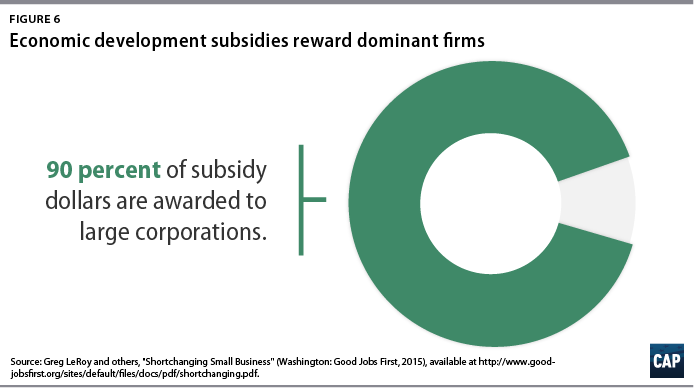

Any decision to provide subsidies to individual companies leads to one of the most frequent criticisms of incentives: that the process means picking winners and losers. An underappreciated concern, however, may be how these decisions further reward existing winners. Keeping or luring an established, big-name company can win flashy headlines, as well as some assurance that the company will exist far into the future. However, household-name corporations already receive the vast share of subsidies for which smaller competitors are not even considered.59 In fact, 90 percent of subsidies go to big businesses, even though small and local businesses often have higher local economic multipliers.60 This dynamic can exacerbate competition issues in the larger economy by protecting incumbents and large corporations over small businesses and startups. Making state, local, and federal incentive programs available to any business that can viably meet the requirements of a subsidy package would reduce the tendency of subsidies to entrench dominant firms and would help promote transparency and fair competition.